Table of Contents

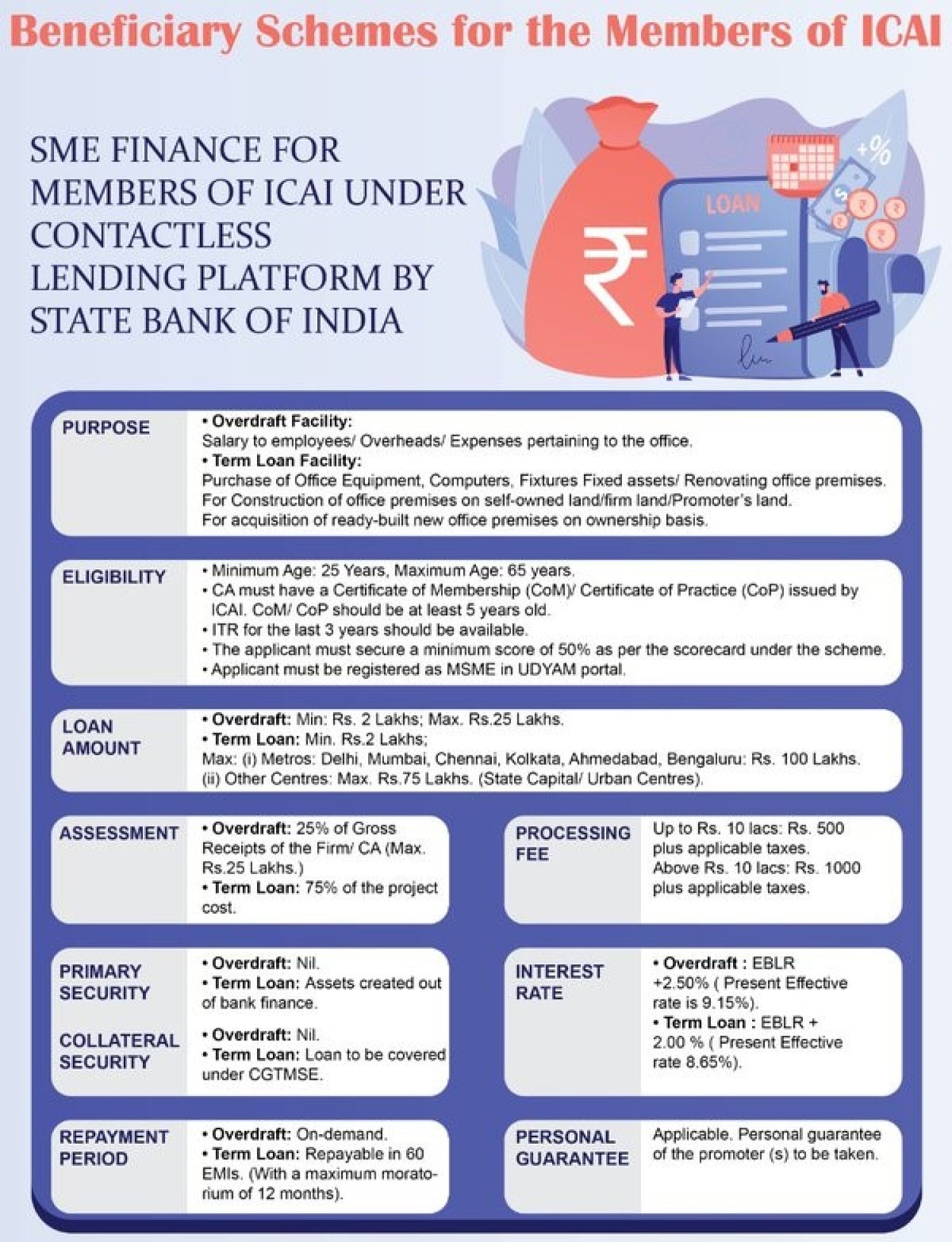

Beneficiary Schemes for the Chartered Accountants Members of ICAI:

The chartered accountancy profession is regulated in India by the Institute of Chartered Accountants of India (ICAI), which also establishes accounting standards and provides professional development courses.

he Institute of Chartered Accountants of India have come up with new mediclaim scheme with ICICI Lombard for new as well as Super TOP UP option with extra advantage for Chartered Accountants, Institute of Chartered Accountants of India Releases 4 Insurance Products : CA Members Beneficiary Schemes

- ICICI Lombard – Super Top Up

- ICICI Lombard – Retail Cyber Policy

- HDFC Group- Poorna Suraksha

- ICICI Lombard – Health Insurance

Professional indemnity insurance, LIC term insurance, auto insurance, homeowners insurance, medical insurance, etc. are some of the additional insurance options. For details reference you may go through the following link: ICAI Beneficiary Schemes

Attention all Institute of Chartered Accountants of India members

Timeline to Submit the Know Your Member (KYM ) Form & pay Chartered Accountants members annual ICAI membership fees is Fastly coming —30th Sept 2024.This is a useful reminder for all The Institute of Chartered Accountants of India members! Timely filing of the Know Your Member form and payment of the annual membership fees is crucial to avoid any compliance issues. Here’s a recap of the steps mentioned:

- Login: Visit the Institute of Chartered Accountants of India SSP and log in.

- Member Functions: Head to the ‘Member Functions section.

- KYM Form: Select ‘Know Your Member (KYM ) Form’ under the ‘Member Module’.

- Complete the Form: Provide personal, professional, and contact details.

- Document Uploads: Upload necessary documents like permanent account number, Goods and Services Tax details, and photographs.

- Submit: After reviewing the form, submit it online.

- Fee Payment: Pay your Chartered Accountants annual membership fees through the Self Service Portal, even before form approval.

Make sure to file early and avoid any last-minute rush! Feel free to reach out if anyone faces issues or needs assistance.