Table of Contents

What is Chartered accountants?

An internationally recognised financial expert who manages client budgets, audits, taxes, and business plans is a chartered accountant. You can work for organisations, the government, and people as a CA. Your role is to assist clients with money management and offer knowledgeable financial advise. A person with the title of chartered accountant is qualified to provide financial advice and maintain financial records.

A CA can offer assistance at various phases of business establishment in addition to planning taxes and other compliances. When developing strategies, applying for business loans, keeping accounts, installing software, asking for grants and subsidies, etc., their knowledge of important business-related topics like legislation, finance and taxes, agreements, and so forth.

A Chartered Accountant can help the nation's economy expand. Each chartered accountant has specialised understanding in the stock market, foreign exchange, legal issues, and financial taxation. They assist everyone in comprehending the laws and regulations. Although Indian CAs are technically considerably superior, modern accounting is more than simply technicality. It also involves figuring out and fixing issues. Clients search for and value CPAs that they can rely on as consultants and who comprehend business dynamics.

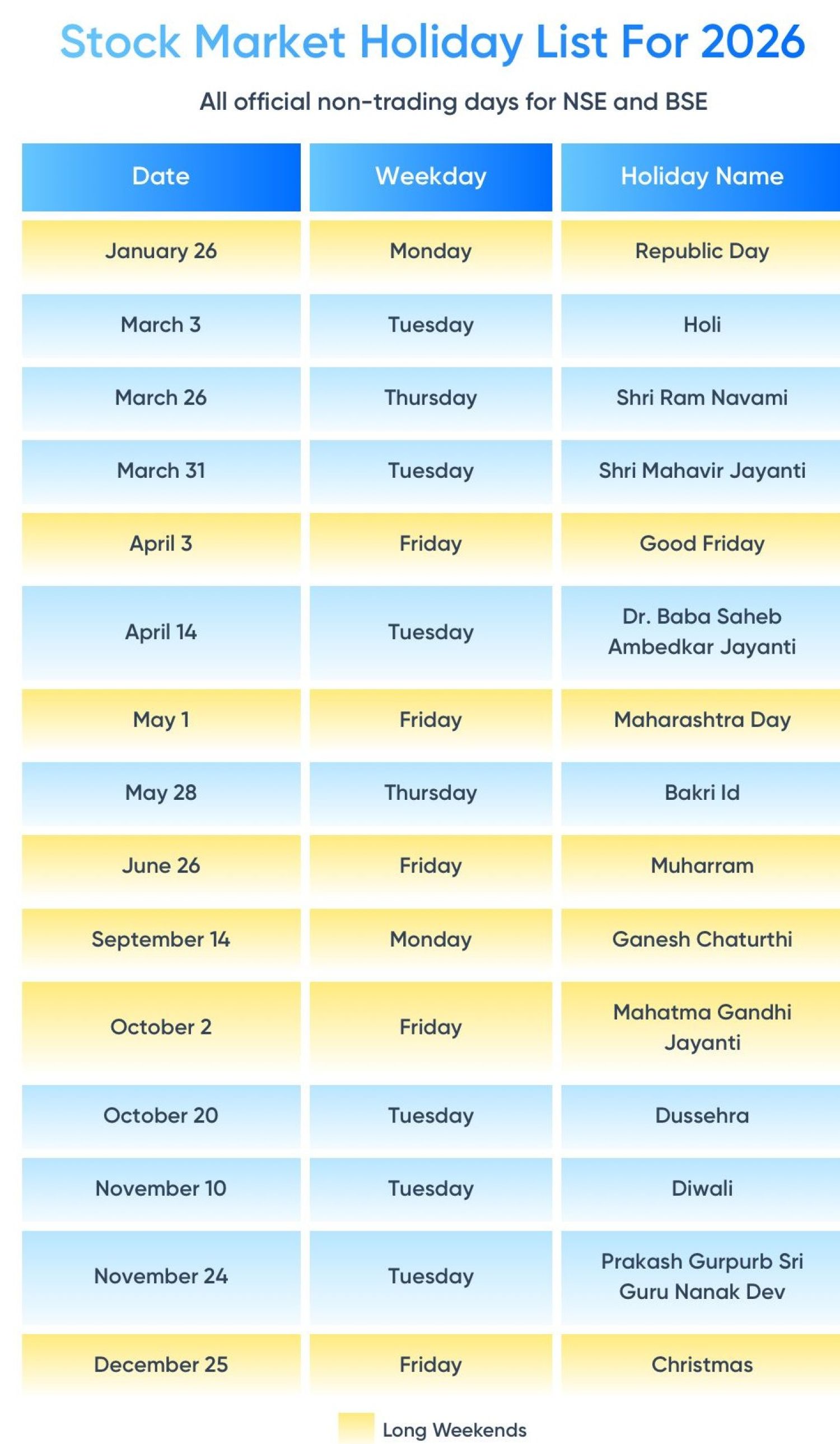

The market demands a CA with expertise in equities, IPOs, insolvencies, mergers of businesses, and acquisition analyses. The CA must comprehend the reports and change the business scenarios in addition to providing advice, plans, and audits to the company.

Role of Chartered accountants

“Remember the meaning and dignity of word Chartered to keep our Business Guide and Protector role with compliance a tool to support our above two roles. “

In order to avoid getting caught later, engaging a CA while building a company can be quite helpful because it allows one to gain early insight on key issues. Indian CA experts can assist you in creating the ideal accounting structure for your business.

Many people are drawn to the profession of chartered accounting because of the lucrative salaries and reputation attached to it. You might be interested in becoming a chartered accountant if you are comfortable working with numbers and have excellent analytical abilities (CA).

Professional CA firms can assist you with dealing with the complicated tax regulations that, if disregarded, could result in severe penalties. Additionally, they fight on your side before tax officers and authorities. They can also provide you with any information you require on such paperwork and documentation. Additionally, they support you in a number of other business-related areas, such as obtaining a digital signature, assisting you with an external audit of your business, raising a red flag before any discrepancies are discovered by the auditor or tax official, receiving government subsidies and penalties, etc.

He examines financial planning and processes to ensure that resources are used effectively. provides legal counsel on corporate concerns and secretarial services. He serves as the management's top adviser on merger, reconstruction, takeover, and expansion plans.

Now we can discuss in brief a Chatered Accountants’s role in a business:

- Company Audit

- Direct, Excise, And Goods and Service Tax

- Conventionally the services offered by CAs are:

- Assist you in applying the business loan or overdraft

- International Tax

- GST Compliance, Audit, And Training

- Business plan,

- Company registration and legal structure

- Company Secretarial Services

- Cost Accountancy

We wish you A Very Happy CA Day.

“May God bless us with better professional fraternity and strong bonding “

The Chartered Accountant Act and the creation of an independent body were proposed by an expert committee in 1948. ICAI was consequently founded on July 1st, 1949. The experts that assist us in better understanding our accounts are Chartered Accountant/CAs.

CA may help your business grow, thus speaking with him is essential for your firm's long-term success.God Bless All of us !