Table of Contents

- Minimum Wages Revision By The Govt Of National Capital Territory Of Delhi

- Revision Of Minimum Wages In Delhi

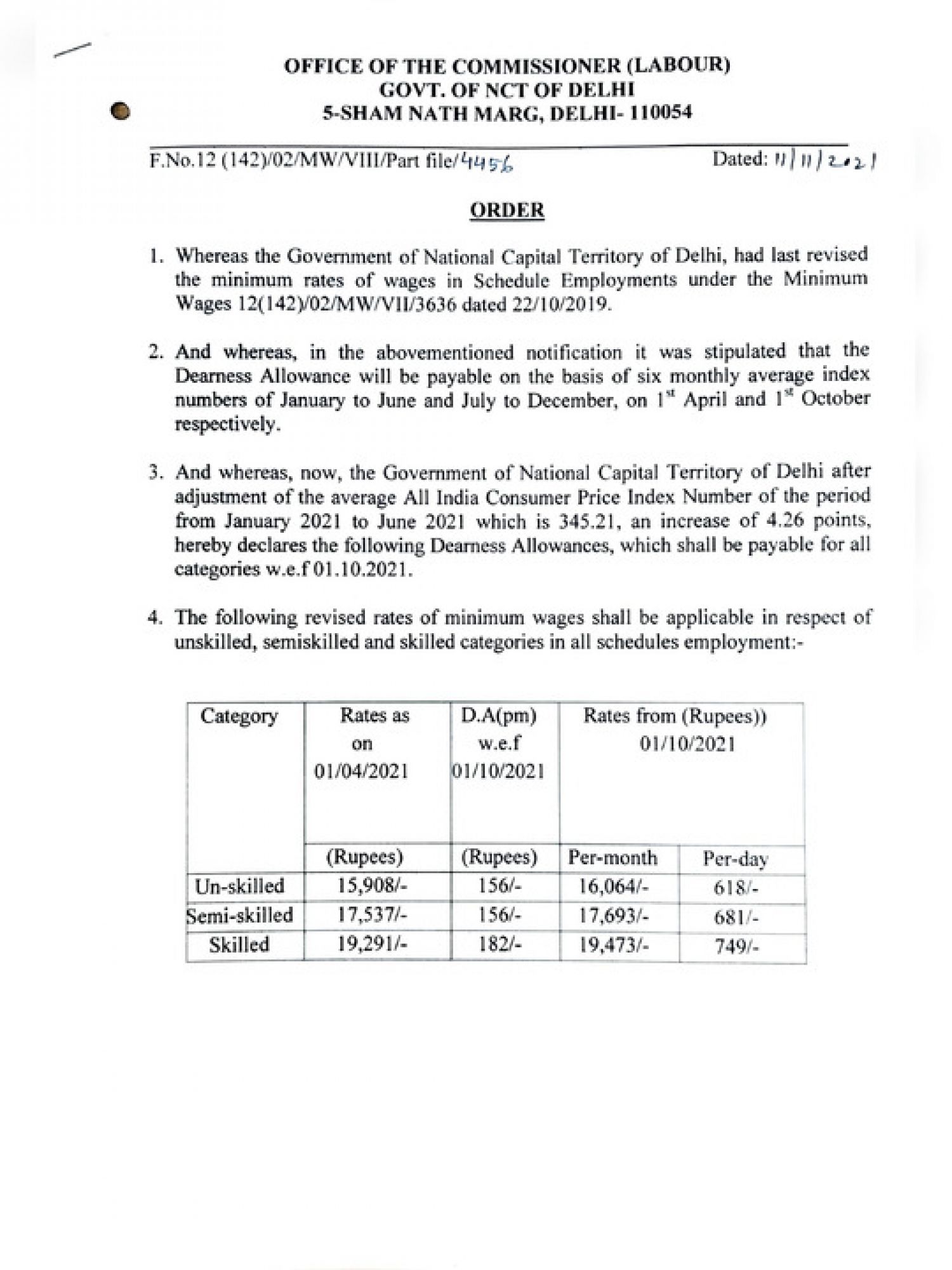

- So Finally Monthly Salary Of Skilled Workers Has Been Increased From Inr 19,291 To Rs 19,473, Increase Takes Monthly Wages Of The Unskilled Workers From Inr 15,908 To Rs 16,064 while Monthly Wages Of Semi-skilled Workers Will Hikes From Inr 17,537 To Rs 17,693, A Delhi Govt Statement Said.

- Punishment For Contravention

Minimum Wages Revision by the Govt of National Capital Territory of Delhi

The minimum wage is the amount paid to workers in order to maintain their standard of living. It also tries to protect workers from exploitation. The Minimum Wages Act of 1948 ('the Act') now oversees the determination of the minimum wage in certain designated occupations.

The appropriate state government establishes minimum wages for the state that no firm can pay to its employees in regular employment.

Wage rates in scheduled employment vary depending on a variety of factors, including states, industries, talents, and vocations. As a result, there is no single national minimum wage rate, and each state's revision cycle is different.

On August 8, 2019, parliament has enacted the Code on Wages Act, 2019 ('the Code') to replace four labour laws: the Minimum Wages Act of 1948, the Payment of Wages Act of 1936, the Payment of Bonus Act of 1965, and the Equal Remuneration Act of 1976. But, the Govt has yet to announce the effective date for the Code's implementation, thus the Act will continue to govern minimum wages till then.

Revision of minimum wages in Delhi

Govt of NCR of Delhi had revised rates of minimum wages which shall be applicable w.e.f 1st October 2021. (On 11th November 2021, vide F.No.12 (142)/02/MW/VIII/Part file 4456)

Revised rates in respect of skilled, semiskilled, unskilled, & clerical and supervisory staff categories in all schedules employment are:

|

Class of employment |

Category of workers |

Basic rates per month |

Dearness allowance per month |

|

Unskilled |

Not applicable |

16,064 |

618 |

|

Semi-skilled |

Not applicable |

17,693 |

681 |

|

Skilled |

Not applicable |

19,473 |

749 |

|

Clerical and supervisory staff |

Non matriculates |

17,693 |

681 |

|

Clerical and supervisory staff |

Matriculate but not graduate |

19,473 |

749 |

|

Clerical and supervisory staff |

Graduate and above |

21,184 |

815 |

So finally monthly salary of skilled workers has been increased from INR 19,291 to Rs 19,473, Increase takes monthly wages of the unskilled workers from INR 15,908 to Rs 16,064 while monthly wages of semi-skilled workers will hikes from INR 17,537 to Rs 17,693, a Delhi govt statement said.

Punishment for contravention

Any employer who-

(a) pays any employee less than the minimum wage rate set for his or her type of work, or less than the amount payable to him or her under the provisions of this Act; or

(b) violates any regulation or order issued under section 13 related to the establishment of working hours during the regular working day;

can be punished with a period of imprisonment of up to 6 months, a fine of up to Rs. 500, or both:

When imposing a fine for an offence, the court must take into account the amount of any compensation already imposed against the offender in any actions brought u/s 20.