Table of Contents

DEDUCTIONS UNDER SECTION 80CCD OF INCOME TAX ACT

Income Tax Act, 1961 provides various tax deductions under Chapter VI-A for contribution to pension plans. Such deductions are available u/s 80C, 80CCC, and 80CCD. This guide talks about section 80CCD.

This section provides tax deductions for contribution to the pension schemes notified by Central Government, i.e., National Pension Scheme (NPS) & Atal Pension Yojana (APY). There are two parts or sub-sections of this section namely – section 80CCD(1) & section 80CCD(2).

Section 80CCD(1)

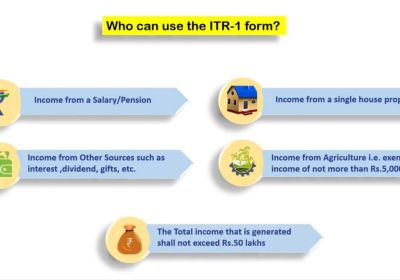

This part applies to all the individual taxpayers who are employed by the Central Government/any other employer or any other individual assessee. All citizens of India between the ages of 18 and 60 years can contribute to NPS on a voluntary basis. An NRI can also contribute to NPS. This Scheme can participate in addition to PPF and EPF.

Under this section, the maximum deduction allowed is:

- up to 10% of salary for salaried employee

- and 10% of gross income for another taxpayer who is not under salaried employment

Part (1B) provides an additional deduction of Rs. 50,000 for the contribution made by an assessee under NPS.

Note: The maximum deduction as an aggregate of section 80C,80CCC & 80CCD(1) should not exceed Rs. 1,50,000 but after including section 80 CCD(1B), total deduction limit becomes Rs. 2,00,000.

Here salary means (basic pay + dearness allowance)

Section 80CCD(2):

The deduction is also allowed to an employee if his employer makes a contribution to the employee’s accounts in the pension scheme of the Central Government. The deduction allowed here for the employer’s contribution is up to 10% of the salary of the individual.

Taxability of amount received back from the National Pension Scheme & Atal Pension Yojana

40% of the payment received from the National Pension System Trust to an employee on the closure of his account or on his opting out of the pension scheme referred to in section 80CCD shall be exempt u/s 10(12A).

Balance 60% will be taxable, but if the same is used to purchase an annuity plan, then it shall not be considered as income of an individual at the time of closure of the account.

Further, the periodic pension/annuity received from such an annuity plan will be includible in the taxable income in the year of receipt and taxable accordingly. So in a sense by purchasing an annuity plan one can defer the tax liability or avoid/reduce the tax if he is not expected to have significant taxable income post-retirement in the future.

In case of the death of the account holder, the amount received by a nominee of departed on the closure of the account is exempt from tax. Tax professionals expect in In Budget 2021 that the Govt to correct a few of the National Pension Scheme anomalies with respect to income tax advantages(In Budget 2021). They say that this will help to increase the attractiveness of the NPS. 'In the case of contributions to Tier I, up to 14 percent of the employer's contribution is allowed for central government employees but, in the case of all other employees, up to 10% of the employer's contribution is eligible for deduction under Section 80CCD (2).

Deduction claim by Individual and HUF under section 80C-80U

“Time to submit proof of investment” – by now you may have got the communication from your HR to submit proof of investments for FY 20 – 21.

For those who have opted for the old Regime Tax rate, this means you need to invest Rs 1.5 Lakhs under Sec 80C. In this regard, pls note that the majority of people invest in LIC, because it is the best option when it comes to safety, saving, investing and Returns. In the past few days, I have shared multiple posts on LIC’s performance on LinkedIn and why LIC is the first choice amongst its peer group.

Even amidst the COVID -19 crisis, LIC has ensured that customers don’t have to move from their doorstep to avail of services through contactless documentation.

You can invest in the Equity Linked Savings Scheme (ELSS) of your choice which also gives tax benefits under Sec 80C.

https://carajput.com/blog/quick-overview-on-income-tax-deduction-u-s-80c-80u/