TDS

CBDT issue Circular on Section 194R of the Income-tax Act

RJA 21 Jun, 2022

Section 194R of the Income-tax Act of 1961 What is 194R TDS? In the Budget 2022 New section 194R, which was introduced by the central government would apply a 10% TDS (tax deducted at source) to benefits earned by professionals or businesspeople in the course of their profession or business beginning July 1. ...

COMPANY LAW

Appointment Auditor or Resignation, Intimation & Related Formalities

RJA 18 Jun, 2022

Appointment Auditor or Resignation, Intimation & Related Formalities in Company Act 2013 All registered companies, whether they are a one-person corporation, or a limited company or a private limited company are required to keep a proper book of accounts and have them audited. As a result, following the incorporation of ...

INCOME TAX

CBDT issue guidelines for removal of difficulties U/s 194R of I. Tax Act.

RJA 17 Jun, 2022

CBDT issue guidelines for removal of difficulties U/s 194R(2) of I. Tax Act. Guidelines for removal of difficulties U/s 194R(2) of the Income-tax Act w. e. f. July 1, 2022, The Finance Act 2022, New section 194R of the Income-tax Act was inserted under the Income-tax Act. Before providing any benefit ...

GST Filling

CBIC published Instructions on Sanction, Post-Audit, & Review of Refund Claims

RJA 16 Jun, 2022

CBIC published Instructions on Sanction, Post-Audit, & Review of GST Refund Claims The CBIC published guidelines for sanction, post-audit, and refund claim review. While the field officers were pursuing varied processes involving discipline, review, and post-audit of refund requests, the Board issued these directions. The Central Board of Indirect Taxes ...

OTHERS

Private aviation industry is started adopting cryptocurrency payments

RJA 11 Jun, 2022

Why the private aviation business is started adopting cryptocurrency payments? Despite the rise in the popularity of the cryptocurrency in current years, even the most popular Bitcoin supporters would have to admit that few peoples use their digital coins to buy their necessities used on regular basis. Along with many ...

ROC filling

Highlights: MCA Amends New Strike-off Rules and forms

RJA 11 Jun, 2022

Key Highlights: MCA Amends Strike-off Rules Strike off is refers to the removal of the Company's name from the Registrar of Companies. It's more like a company closure, as the company will cease to exist after being Struck Off and will be unable to execute any activities thereafter. ...

COMPANY LAW

MHA Clearance required for Chinese nationals' appointment as directors

RJA 10 Jun, 2022

MHA's latest notification aims to restrict the backdoor entry of Chinese companies or investors into India The Govt of India has issued a notification requiring nationals of land border-sharing nations who are appointed as directors on boards of corporations to receive a security clearance in order to prevent Chinese ...

COMPANY LAW

GST Compliance Calendar for the Month of June 2022

RJA 01 Jun, 2022

Key Dates for GST compliance in the month of June 2022. A lot of responsibilities and duties come while we are running and operating a successful business. As a law-abiding citizen, we must observe the government's rules and regulations in India, there are a slew of regulations that a ...

Goods and Services Tax

Input Tax credit can not be denied on Genuine transaction with suppliers

RJA 01 Jun, 2022

Input Tax credit can not be denied on Genunine transation with suppliers In the matter of Sanchita Kundu & Anr. Vs Assistant Commissioner of State Tax If the supplier is later discovered to be a fake, ITC cannot be denied to the buyer for a genuine transaction: The High ...

INCOME TAX

TAXABILITY OF VIRTUAL DIGITAL ASSETS U/S 115 BBH

RJA 01 Jun, 2022

TAXABILITY OF VIRTUAL DIGITAL ASSETS/ CRYPTOCURRENCY U/S 115 BBH Applicability of TDS & Tax Rate on Virtual Digital assets/ cryptocurrency Any Kind of Income received from the transfer of any Virtual Digital Assets/ cryptocurrency will be taxed @ 30%. Slab rate 1% tax deducted at source will be deducted on such transfers of ...

IBC

CBIC issues SOPs for recovering GST dues from liquidation- IBC companies

RJA 28 May, 2022

SOP of the CBIC issued for recovering GST dues from companies in liquidation under IBC. SOP of the CBIC for recovering GST dues from entities that are in the process of being liquidated under the Insolvency and Bankruptcy Code (IBC). GST and Customs authorities have been designated as operational creditors, ...

GST Compliance

LATE FEE FOR DELAY IN GST FILING FORM GSTR-4 FOR FY 2021-22 WAIVED

RJA 28 May, 2022

New E-Advance Rulings Scheme 2022 - CBDT Notification No. 07/2022 The Ministry of Finance announced the E-Advance Rulings Scheme 2022 in a notification dated January 18, 2022. Taxpayers can now ask for advance rulings by e-mail under the new e-advance rulings scheme. Notably, the case's personal hearing will be held via video conference as ...

INCOME TAX

Benefits & Drawbacks of Tax saving by Formation of HUF

RJA 16 May, 2022

Benefits & Drawbacks of Tax saving by Formation of HUF. What is a Hindu Undivided Family (HUF)? HUF stands for Hindu Undivided Family. This is a legal practice of reduction of taxes and assets pooling by forming HUF which comes under the Hindu Undivided Family Act. All the members of ...

FEMA

Legitimate Foreign Currency while Person Travelling Foreign

RJA 14 May, 2022

What is legitimate Foreign Currency while person travelling foreign. Manny countries have slowly & steadily opened their doors to foreign tourists after a long period of closure. The last two years have been particular worst for domestic and international travel, whether for education or business. But now that restriction is ...

IBC

IBC - INSOLVENCY CODE ON MCA MENU

RJA 08 May, 2022

INSOLVENCY CODE ON MCA MENU Bid to confirm errant promoters don’t regain control, usher in simpler framework for individual insolvencies. The Ministry corporate affairsis proposing to undertake multiple changes under the IBC 2016, and the same is expected to include the ways of ensuring ...

OTHERS

CA's can check C&AG Provisional Empanelment Status for FY 2022-2023

RJA 06 May, 2022

CA Empanelment with the Office of the C&AG for FY 2022-23 From 06.05.2022 to 17.05.2022, the status of provisional Empanelment, as well as provisional score points, for LLPs and Chartered Accountant firms that have applied for empanelment with the Office of the C&AG of India for the FY 2022...

COMPANY LAW

Tax Compliance & Statutory Calendar for May 2022

RJA 02 May, 2022

Statutory and Tax Compliance Calendar for May 2022 S. No. Statue Purpose Compliance Period Due Date Compliance Details 1 Labour Law PF/ ESI Apr-22 15-May-22 Timeline for payment of PF & ESI contribution for the previous month. 2 Goods and Services Tax GSTR -7 TDS return under GST Apr-22 11-May-22 GSTR 7 is a ...

IBC

Is IBC 2016 is a the right step ?

RJA 02 May, 2022

Is IBC 2016 is a the right step ? Before this IBC legislation, the debt recovery system in our country took an average of four years to resolve insolvency. That's far too long and inexcusable, especially given the Prime Minister's and our country's efforts to improve the ease ...

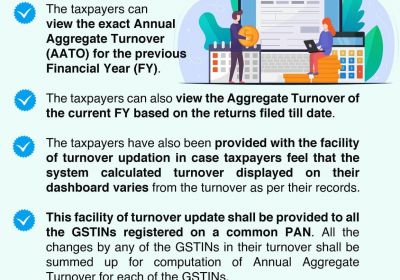

GST Consultancy

How to compute AATO (annual Aggregate Turnover) computation for FY 2021-22.

RJA 01 May, 2022

GSTN Enables Functionality Of AATO (annual Aggregate Turnover) For The FY 2021-22 On GST Taxpayers' Dashboards Functionality of Annual Aggregate Turnover for the Financial Year 2021-22 has now been made live on GST Taxpayers’ GST Dashboards with the below characteristic mentioned here under: The GST taxpayers can view the ...

INCOME TAX

CBDT Notifies Manner & Form for filing Updated ITR Returns U/s 139(8A)

RJA 30 Apr, 2022

CBDT through Notification No. 48/2022 Dated 29th April 2022 notifies Form and Manner for filing Updated ITR Returns under section 139(8A). On April 29, 2022, the CBDT has issued the New income tax rules i.e Income-tax (Eleventh Amendment) Rules, 2022 to amend the OLD income rule i.e Income-tax Rules, 1962 & introduces manner for ...

Goods and Services Tax

Modification/Change to GSTR 1 & GSTR Filling Process

RJA 30 Apr, 2022

Change to GSTR 1 and GSTR Filling Process GSTR 1 is a monthly return form for regular taxpayers who have a yearly turnover of more than 1.5 crores and must provide information of outward supply on the 11th of the next month. Taxpayers with income under 1.5 crores will be required to submit ...

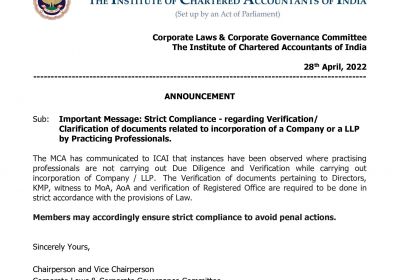

COMPANY LAW

Strict Compliance - Documents Related to formation of Company or LLP

RJA 28 Apr, 2022

Strict Compliance - about the Verification/ Clarification of Documents Related to the Incorporation of a Company or an LLP by Practicing Professionals. - ICAI made and warn for Strict Compliance - about the Verification/ Clarification of Documents Related to the Incorporation of a Company or an LLP by Practicing Professionals ...

COMPANY LAW

Compulsory audit trail in company accounting postponed to FY on 01.04.2023.onwards

RJA 28 Apr, 2022

The requirement for a compulsory audit trail in company accounting software has been postponed to the financial year commencing April 1, 2023. The requirement for a mandatory audit trail in corporate accounting system has been postponed until the fiscal year that begins on or after April 1, 2023. MCA Notifications should be read. The ...

INCOME TAX

ICAI issue FAQs.: CAs are not allowed to certify an ITR as a true copy

RJA 28 Apr, 2022

CAs are not allowed to certify an ITR as a true copy: ICAI provides Frequently Asked Questions. In a set of FAQs about issuing the UDIN, the ICAI said that "Chartered Accountants have no authority to qualify an Income Tax Return as a valid document." Chartered ...