Table of Contents

- What Is Financial Literacy?

- What Do You Mean By Financial Freedom?

- Why Is Financial Literacy Awareness So Important?

- What Are The Three Components Of Financial Literacy Concept ?

- Effects Of Financial Illiteracy

- Invest Your Money For The Long Term.

- Rule Of 50/30/20

- Do We Need To Diversify Our Savings?

- Following Are Examples Of Some Investment Options Available With Us :

- Let's End With A Conclusion-

WHAT IS FINANCIAL LITERACY?

- To be financially literate, you must be able to avoid allowing money – or a lack thereof – get in the way of your happiness as you work hard and achieve, including a long and satisfying retirement.

- A strong financial literacy foundation can help us achieve a variety of life goals, such as saving for college or retirement, managing debt responsibly, and running a company.

- People who are financially literate are less susceptible to financial deceptions.

- Financial literacy is a term that refers to a set of important financial capabilities and principles.

- Financial literacy is the comfortable knowledge of concepts such as saving, investing, and debt management that leads to a sense of overall financial well-being and self-confidence.

- It all involves developing a basic understanding of financial matters, and while Americans could certainly do better in this area, they've made progress in recent years.

WHAT DO YOU MEAN BY FINANCIAL FREEDOM?

- Financial freedom is defined as having sufficient savings, investments, and cash on hand to live the life one wants for himself and his family without relying on others.

- Making timely investments is the best way to achieve financial freedom. As it has been rightly said,

- "THE EARLIER YOU START YOUR RETIREMENT PLANNING, THE GREATER THE POTENTIAL RATE OF RETURN ON YOUR INVESTMENT,"

WHY IS FINANCIAL LITERACY AWARENESS SO IMPORTANT?

- Financial literacy is an important indicator of people's ability to make sound financial decisions.

- The Financial literacy includes not only the knowledge and understanding of financial concepts and risks, but also the skills, motivation, and courage to apply that knowledge and understanding to make effective decisions in a variety of financial contexts, to improve one's own and society's financial well-being, and to enable participation in economic life. In today's continually changing environment, effective and efficient financial planning has become a necessary aspect of living a peaceful life.

- Financial literacy is as important as any other basic for each individual since it will help you manage all of your hard-earned resources effectively for a safe and secure future. It aids in the development of self-sufficiency and self-government. The same shortage will leave you with no strong foundation for your savings and investment decisions.

What are the three components of financial literacy concept ?

3 Key part of Financial Literacy

- An update Budget. word “budget” as tantamount to the word “diet,” but at its most basic, a budget is just a spending plan

- ID Theft Prevention

- Dedicated Savings (Saving to Spend)

EFFECTS OF FINANCIAL ILLITERACY

- Financial illiteracy affects people of all ages and socioeconomic backgrounds.

- Without it, a person may make poor financial decisions, resulting in substantial debts. Being financially uneducated has played a significant role in lowering living standards.

- The rate of retirement planning will be lower if there is a high prevalence of fiscal illiteracy. To live a peaceful retirement, one must begin planning for the future at an early age.

- Those that are unable to handle their finances are the ones who suffer the most during difficult times. They only have one choice: borrow money at exorbitant interest rates.

- Poor financial decisions have a long-term impact on people's lives; a single bad financial decision can lead to a slew of negative consequences, forcing a person to compromise on his desires.

INVEST YOUR MONEY FOR THE LONG TERM.

- The quickest strategy to maximise the growth potential of your savings is to make the long investment.

- Long-term investments offer more capital gain tax benefits than short-term investments.

- Moreover, it reduces the risk of market volatility. The benefit of compounding is the best reason to invest for a long time.

RULE OF 50/30/20

- In real world situations, Rules 50/30/20 RULE is very manageable in real-life practice. As recommended by the rule, we should diversify our income into three parts.

- Our needs and necessary expenses should be covered by 50% of our earnings.

- Our wants should count for 30% of our earnings, while the remaining 20% should be earmarked for savings and investments.

- Most of us spend the majority of our earnings and save only a little part.

- So, the 50/30/20 RULE helps us to limit overspending and contribute to healthy financial habits.

DO WE NEED TO DIVERSIFY OUR SAVINGS?

- One of the most popular questions is whether we should put all of our savings into one investment option or diversify.

- As a consequence, diversification is the most straightforward strategy to enhance your returns while reducing the risk of asset price volatility.

- It's one of the most important aspects of achieving long-term financial goals of reducing risk.

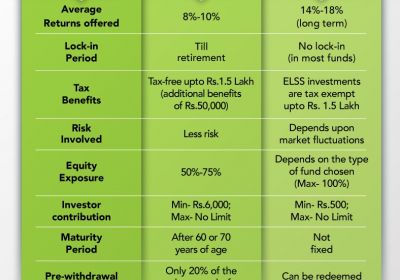

Following are examples of some investment options available with us :

- Mutual Funds

- Public Provident Fund(PPF)

- Bonds

- Fixed Deposit

- Real Estate

- Sukanya Samridhi Yojana

- Stock Market

- Gold

LET'S END WITH A CONCLUSION-

- Financial literacy is essential for preventing financial mistakes and ensuring a strong, safe, and secure future. So, instead of seeing saving as a punishment, think of it as an investment opportunity your money properly and at the correct time.

- Financial literacy will assist in making better financial decisions and will reduce the financial stress and anxiety.

- So, your stress-free future is contingent on the financial decisions you make now; to do so, everyone of us must appreciate the importance of financial literacy.