Table of Contents

- What Is Means Of Recovery Of Shares?

- In Case Of Share Transmission.

- Differences Between Transmission Of Shares & Transfer Of Shares Are Mentions Here:

- In Case Of Share Transfer

- In Case Of Unclaimed Dividend

- Inadequate Or Non-execution Of A Transfer Or Transmission Of Share :

- What Is The Process For Claiming Back Shares From Iepf Suspense Account?

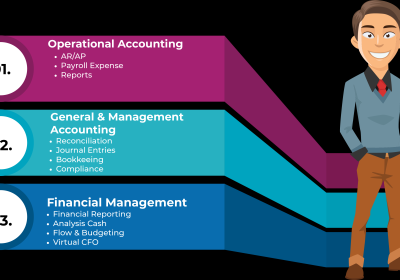

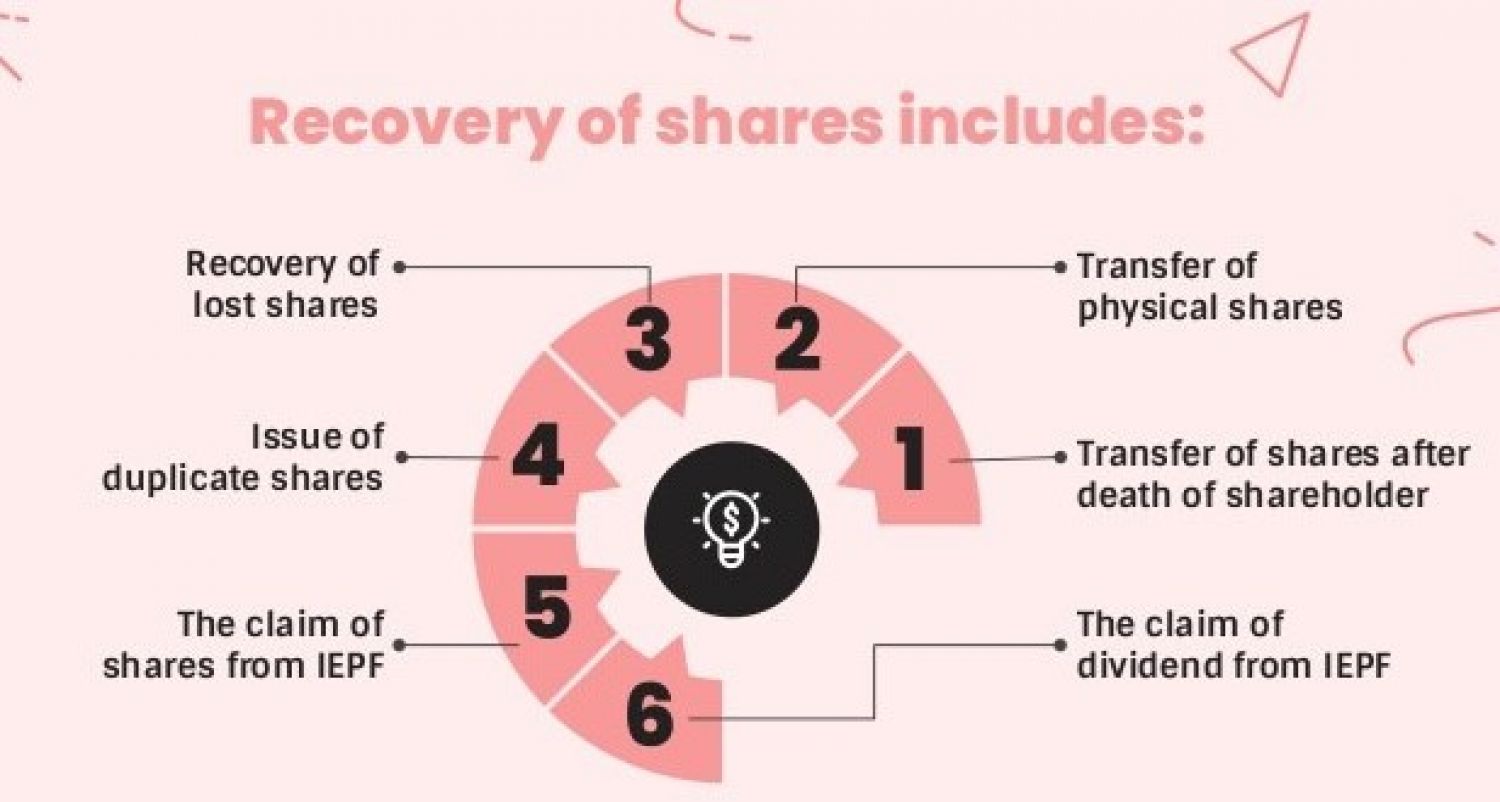

What is means of recovery of Shares?

Physical share certificates were used in the early days of investing in stocks. Investors' investments in a corporation, whether in the form of shares or debentures, were allotted in physical form.

Due to the fact that these shares/debentures were in paper form, they were difficult to keep and readily destroyed or lost. It was difficult to keep them secure in paper form because investors would eventually lose or dismantle them for a variety of reasons, including relocation, wear and tear on the share/Debenture certificate, and so on.

There could be a number of situation where you are facing following problem related to share or dividend unclaimed as described below.

- Shares that have been lost or missing of share certificate.

- When you have not receive dividends/ bonus / rights.

- Shares that have been Dematerializing physical shares

- Torned Stocks.

- dividends, Shares, transferred to IEPF

- Shares That Were Forgotten.

- Original Shareholder's Death/deceased

-

In case of Share Transmission.

What Does the Term "Share Transmission" Mean?

- It refers to the transfer of shares through operation of law, that is, following the death of the original shareholder, the transfer of shares to the legal heir.

- Death, insolvency, marriage, lunacy, inheritance, bankruptcy, or any other "statutory" reason other than natural transfer can cause complications for the legal successor with the transference of shares.

- You are not only the shareholder but also the owner of all rights once you have registered for share transfer with a firm.

Possible Issues and Support:

- Share Transmission can be clumsy at times, and it can take a toll on you if you don't seek adequate professional advice.

- We at provide support to our valued clients on a variety of Share Transmission difficulties. Take a look at some of the issues you can face during the share transmission process.

"Transfer of Shares" and "Transmission of Shares" are used interchangeably:

- It has been discovered to be one of the most common issues encountered by shareholders. The Companies Act of India's Constitution distinguishes between "Transfer of Shares" and "Transmission of Shares."

- The "Transfer of Share" is entirely dependent on the shareholder's action and decision, whereas the "Transmission of Share" is entirely dependent on the operation of laws. Shares are only transmitted by inheritance or will in the case of "Transmission of Shares," whereas "Transfer of Shares" is not always done with specific consideration.

Jointly Held Securities:

- If you are a joint holder, you may experience issues with share transmission. In the case of jointly held securities, we can assist you in removing the name of the other shareholder either by operation of law (in the event of the death of a joint holder) or voluntarily.

Documents Needed for Share Transmission

- Letter of Administration, Succession Certificate, or Will Probate

- The successor's specimen signature (s).

- A certified copy of the death certificate is required.

- Request a transmission application from the legal heir(s) or representatives.

Differences between transmission of shares & transfer of shares are mentions here:

- A transfer is the act of moving an asset from one location to another. The movement can be physical, or it can be the ownership of the asset's title, or it can be both. This movement can be voluntary or compelled by legislation in the case of securities.

- The transfer of shares is a voluntary act done by the shareholder and is performed through a contract.

- The transmission of shares, on the other hand, occurs as a result of the operation of law, that is, when the holder of shares dies or becomes insolvent/lunatic.

|

Particular |

Transmission of Shares |

Transfer of Shares |

|

What is it? |

Operational by law |

Voluntary Act |

|

How is it affected? |

Insolvency, death, lunacy or inheritance |

A deliberate act of parties |

|

Is there a consideration? |

No |

Yes |

|

Who can initiate? |

Legal heir or receiver |

Transferor or Transferee |

|

Who is liable? |

Original liability of shares continues to exist |

Liability of transferor ceases to exist post the transfer |

|

Is stamp duty compulsory? |

No |

Yes. Payable on the market value of shares |

|

Is a transfer deed compulsory? |

No |

Yes |

-

In case of Share Transfer

-

What does it imply Share Transfer?

Transferring the title of the certificate of share from the transferor to the transferee is referred to as a "transfer of shares" in marketing terms. When you have shares in physical form and are the legal heir of the said shares, and you want to transfer such shares in your name, you can contact RJA for all transfer-related solutions.

-

How Can We Assist You with Share Transfers?

When attempting to transfer the shares of multiple companies to your name, it is natural to encounter some common issues. If you are experiencing any of the problems listed below, RJA can provide you with satisfactory assistance.

-

Share Certificates Can Be Lost:

Share certificates can be lost due to unforeseen circumstances. If you've misplaced your share certificates, there's a good chance you won't be able to recoup the value of those shares. At Muds, we can assist you in recovering those duplicate certificates in your or your company's name and make your efforts to reclaim your possessions simple and painless.

-

Mismatch of Signatures:

It is common for your signatures to change over time, especially if you are signing documents after a long period of time and your current signatures do not match the signatures in the previous records. RJA can assist you in synchronizing your signatures with the Company's records.

-

Mutilated Share Certificates:

Improper care of share certificates can cause wear and tear, which can cause major issues when transferring shares. So, if you have shares that have been torn, dismantled, or mutilated, you can seek a solution to recover those shares at RJA.

-

Non-Submission of Transfer Deed:

This occurs when a buyer has paid the consideration amount in full but is unable to submit the transfer deed for any reason. Inevitably, the shares are still registered in the name of the sellers. At RJA, we can assist you in transferring those shares to the buyer while the shares remain in the seller's name.

If you are experiencing any of the issues listed above in "Transfer of Shares," don't panic; simply contact us and you will receive full support from our team of Share recovery experts.

-

In case of Unclaimed Dividend

Unclaimed Dividends Explained:

Companies declare dividends on their shares on an annual basis, and if these dividends go unclaimed for seven years in a row, they are transferred to the IEPF account. You can claim unclaimed dividends as an investor even after the shares have been transferred to the IEPF account.

When and How Can we can Assist You?

Even after the government's constant efforts to ensure the security of unclaimed dividends, deposits, debentures, split shares, bonuses, and so on, there are numerous affected investors. You should not be concerned if you are also experiencing issues with unclaimed dividends. RJA are always available to help you in any way they can. We will assist you in reclaiming unclaimed dividends and shares, as well as any other bonus or fund. Here are some potential issues you may encounter while attempting to recover unclaimed dividends.

Records That Have Expired:

The most common reason for unclaimed dividends is that shareholder information is out of date or incorrect. Mismatches in any private details, such as name, age, father's/name, husband's date of birth, and address, can result in unclaimed dividends on one's shares.

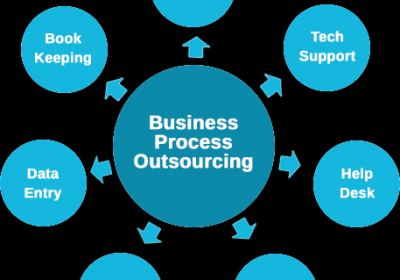

RJA can help you reclaim your unclaimed shares. RJA's emphasized services include the following. RJA is assist with below ….

- Registration of nomination

- Unclaimed dividends, bonuses, split shares

- Procedure to appl y for issue of Duplicate Share Certificate

- Recover shares and dividends from IEPF

- Change in name of the shareholders, company, merger of companies

- Procedure for transfer of shares

- Procedure to record change of address

- Transposition of names i.e. changing the order of names of registered holders

- Non-receipt of dividend

- Deletion of names of deceased shareholder, Transmission of shares

It all comes down to the three services provided by Rajput Jain & Associates Kindly do not hesitate to contact us if you encounter any difficulties.

Lost dividends & Lost shares -Recovery service

RJA have help in recovered shares from different company for clients in India or out of India

Email us: In case you are interested in our services than

- copies of bank statements showing dividend receipts, if any

- Scan copies of dividend warrants, if any

- copies of correspondence from the company / registrar, if any

- your email and telephone number

- copies of (old?) certificates, if any

Inadequate or non-execution of a transfer or transmission of share :

Due to improper or non-execution of the transfer: shares of the buyer may remain in the name of the seller. It is common in the case of physical shares.

In the case of share transmission: if a legal successor or heir fails to properly transmit shares in the investor's name after the investor's death.

Above situation can happen for a variety of reasons, including the successor's negligence for whatever reason, fraud from the concerned company, a lack of effort, or improper legal consultation.

What is the Process for claiming back shares from IEPF Suspense Account?

Shareholder can claim from Investor Education and Protection Fund (IEPF) Authority both unclaimed dividend amount and the shares transferred to Investor Education and Protection Fund Demat Account.

1. It is happened By making an proper online application in Form IEPF-5 on website www.iepf.gov.in along with applicable fees and

2.Next step is sending hard copy such online application duly signed by all joint holders which is as per registered specimen signature along with needed documents enumerated in the said Form IEPF-5 to Company at its registered office or to Karvy Computershare Pvt. Ltd. for verification of your unclaimed dividend amount & the shares transferred claim.

Investor Education and Protection Fund Authority shall decide to pay the amount of unclaimed dividend amount & transfer shares back to credit of your account after verification report submitted by the Company.

Investor Education and Protection Fund Authority Rules & the Form IEPF-5 are available online on website of the MCA at www.iepf.gov.in.

Rajput Jain & Associates is help for claiming these unclaimed shares, and we do it in a new different way for you. At RJA, you will receive thorough answers to all of your questions and concerns about shares, stock transfers, duplicate stock issues, stock transpositions, and name deletion, among other things. In a pinch, his isn't just about our consulting and services. Other legal procedures that you can seek our assistance with include micro-financing, litigation, compliance, incorporation, NBFCs, insolvency, and much more. We are always delighted to welcome you.