Table of Contents

- Icai Now Allows Advertising: Big Update For Ca Firms

- Practical Do’s & Don’ts Checklist For Ca Firm Advertising Under The Icai Reform Effective 1 April 2026

- What Ca Firms Can Do Now

- What To Take Care Of While Doing Advertising, Branding & Promotion Of Ca Firms

- Don’ts – What Is Strictly Prohibited

- Why This Is A Game-changer For Indian Ca Firm's

ICAI NOW ALLOWS ADVERTISING: BIG UPDATE FOR CA FIRMS

In a landmark reform, the Institute of Chartered Accountants of India has issued a press release dated 12 December 2025, announcing a major relaxation in the Code of Ethics. The Institute of Chartered Accountants of India has issued a press release dated 12 December 2025, for chartered accountant firms as per the ICAI Code of Ethics, effective 1 April 2026. The following conclusion is drawn for chartered accountants & CA firms: advertising by CA firms is now permitted, subject to ethical safeguards.

- A strong digital brand is essential for chartered accountants in today’s globalized environment. Digital branding helps professionals Build trust and credibility, showcase expertise, reach wider audiences, & create new professional opportunities. A digital brand represents one’s online identity and how clients perceive chartered accountants’ values, expertise, behavior, and communication style.

- Chartered Accountants Firm proper brand values, such as integrity, honesty, and professionalism, as the foundation of a strong digital brand. It emphasizes that brand values should be consistent and authentic, visual identity (colors, fonts, photos) reinforces brand recognition, and emotional and internal elements of branding shape client perception. Through examples like Apple’s “Think Different” campaign, the guide illustrates how strong brand positioning builds long‑term loyalty.

- A CA firm must take an essential step for chartered accountants beginning their digital journey, like identifying strengths (USP), defining target audiences, understanding client needs, & aligning expertise with market expectations. It stresses combining digital competency with traditional chartered accountant skills to stay relevant.

Practical Do’s & Don’ts checklist for CA firm advertising under the ICAI reform effective 1 April 2026

Institute of Chartered Accountants of India has issued a Press Release dated 12 December 2025. Out of the press release, the following conclusion drawn for CA & CA firms:

What CA Firms CAN Do Now

- ICA I guidance on digital platforms CAs should use Search & Web Tools like websites, Google Business Profile (formerly Google My Business), and social media platforms like LinkedIn, Twitter, Instagram/Facebook, Quora, WhatsApp, etc. However, CA Form can make Content Creation Blogs, Articles, Journals, books, etc.

- CA Form also audio‑visual platforms like YouTube, webinars, podcasts, Twitter Spaces & Clubhouse. These tools help professionals reach diverse audiences, share knowledge, and build authority.

- Chartered Accountants Firm Advertise their services in a professional and ethical manner

- CA firm also Publicize non-assurance services, including Tax Advisory, Consulting, business advisory, & financial advisory.

- A major portion of the ICAI publication is dedicated to creating a professional website, which is described as a crucial digital asset. Key guidance includes choosing a domain name, setting up professional email, selecting beginner‑friendly website builders, designing mobile‑responsive pages, and creating essential sections (About, Services, Portfolio, Blog, and Contact also following ICAI’s website guidelines for members. They also stress investing in high‑quality professional photographs and maintaining a consistent visual theme

- Chartered Accountants Firm can use email, social media, and other push communication tools.

- Indian CAs can use social media to build visibility and trust. Tips include using professional profile photos, posting regularly, engaging with followers, sharing informative, ethical content, and using platform‑appropriate formats (images, videos, carousels, and Q&As). LinkedIn receives special attention as the most impactful platform for CA networking and professional visibility.

- CAs can promote services through websites and digital platforms. CAs can grow the popularity of podcasts, webinars, and live audio platforms (Twitter Spaces, Clubhouse) for presenting thought leadership. These audio‑visual formats help Cas like educate audiences, build communities, establish expertise, and reach wider networks.

- The CA firms can emerge from digital trends, such as the rise of new social platforms, preference for relatable, not overly polished content, demand for longer, deeper conversations (podcasts, audio rooms), multi‑sensory content (read + listen + watch), and authenticity and transparency as key branding differentiators. It encourages CAs to remain agile, adapt to new tools, and continually upskill to stay relevant.

What to take care of while doing advertising, branding & promotion of CA Firms

- Keep it professional & factual: Share accurate, verifiable information; clearly state the firm name & constitution, ICAI registration number, services offered, and years of experience/areas of expertise. Stick to facts, not hype.

- Promote Through Digital Platforms: Firm website, LinkedIn, X (Twitter), Instagram, Facebook, Google Business Profile, email newsletters & updates, educational posts, explainers, alerts & compliance updates are encouraged.

- Market Non-Assurance Services: Tax advisory & compliance, consulting & business advisory, valuation, due diligence, forensic services & GST, FEMA, and international taxation support. ICAI ensures independence is not compromised where audit clients are involved.

- Use Thought Leadership: Blogs, articles, white papers, webinars, seminars, podcasts, knowledge videos & FAQs, and case studies (without client identification). Position yourself as an expert, not a salesman.

- Maintain Ethical Tone: Dignified language, Informative & educative messaging, and the ICAI Code of Ethics always supreme

DON’Ts – What is STRICTLY PROHIBITED

What Is STILL Not Allowed during advertising, branding & promotion of CA Firms

- Misleading, exaggerated, or unverifiable claims: No misleading or exaggerated claims, like “Best CA Firm in India,” “Guaranteed Tax Refund,” “100% Success in Appeals,” or “Fastest GST Refund Experts.” No guarantees. No superlatives.

- Comparison with other CA firms or professionals: No Comparison or Criticism: Comparing fees, success rates or size, “Better than Big-4 / better than others,” Direct or indirect criticism of peers

- No Client Name-Dropping: Using client logos without permission, highlighting famous clients for promotion, Sharing testimonials that imply assurance success

- No Undue Influence or Solicitation: Cold calling with aggressive pitch, Pressure tactics, Commission-based client sourcing

- Ethics remain the non-negotiable backbone: Sensational ads, Humorous/viral content harming seriousness, Influencer-style promotions

- No Damage to Professional Dignity: Any content that compromises professional dignity, independence, or integrity

Why This Is a Game-Changer for Indian CA Firm's

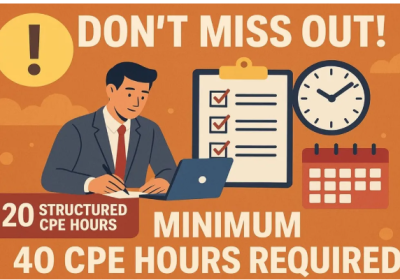

- Best Practices (Highly Recommended) : Add a disclaimer like “Information provided is for general guidance and does not constitute professional advice.” And CA firm maintains content approval & review process, Train staff handling social media, & Keep records of advertisements published

- The CA form has a chance to give a huge visibility boost for small & mid-size CA firms. ICAI Enables growth in the digital-first professional ecosystem Aligns the Indian CA profession with global best practices & shifts the focus from “silent excellence” to ethical visibility

- Advertising is allowed, but dignity, independence & ethics remain non-negotiable. Think visibility with credibility, not publicity at any cost.

- Chartered Accountants build a compelling digital presence, strengthen their professional reputation, connect authentically with clients, leverage modern digital tools, & stay future‑ready in a competitive global market.

- CA firms can now be visible without compromising values. This reform recognizes that professional competence deserves a platform, not just word-of-mouth. Digital branding is no longer optional. it is essential for growth, visibility, and long‑term professional success.

- Effective Date: 1 April 2026