INCOME TAX

TAXABILITY OF VIRTUAL DIGITAL ASSETS U/S 115 BBH

RJA 01 Jun, 2022

TAXABILITY OF VIRTUAL DIGITAL ASSETS/ CRYPTOCURRENCY U/S 115 BBH Applicability of TDS & Tax Rate on Virtual Digital assets/ cryptocurrency Any Kind of Income received from the transfer of any Virtual Digital Assets/ cryptocurrency will be taxed @ 30%. Slab rate 1% tax deducted at source will be deducted on such transfers of ...

IBC

CBIC issues SOPs for recovering GST dues from liquidation- IBC companies

RJA 28 May, 2022

SOP of the CBIC issued for recovering GST dues from companies in liquidation under IBC. SOP of the CBIC for recovering GST dues from entities that are in the process of being liquidated under the Insolvency and Bankruptcy Code (IBC). GST and Customs authorities have been designated as operational creditors, ...

GST Compliance

LATE FEE FOR DELAY IN GST FILING FORM GSTR-4 FOR FY 2021-22 WAIVED

RJA 28 May, 2022

New E-Advance Rulings Scheme 2022 - CBDT Notification No. 07/2022 The Ministry of Finance announced the E-Advance Rulings Scheme 2022 in a notification dated January 18, 2022. Taxpayers can now ask for advance rulings by e-mail under the new e-advance rulings scheme. Notably, the case's personal hearing will be held via video conference as ...

INCOME TAX

Benefits & Drawbacks of Tax saving by Formation of HUF

RJA 16 May, 2022

Benefits & Drawbacks of Tax saving by Formation of HUF. What is a Hindu Undivided Family (HUF)? HUF stands for Hindu Undivided Family. This is a legal practice of reduction of taxes and assets pooling by forming HUF which comes under the Hindu Undivided Family Act. All the members of ...

FEMA

Legitimate Foreign Currency while Person Travelling Foreign

RJA 14 May, 2022

What is legitimate Foreign Currency while person travelling foreign. Manny countries have slowly & steadily opened their doors to foreign tourists after a long period of closure. The last two years have been particular worst for domestic and international travel, whether for education or business. But now that restriction is ...

IBC

IBC - INSOLVENCY CODE ON MCA MENU

RJA 08 May, 2022

INSOLVENCY CODE ON MCA MENU Bid to confirm errant promoters don’t regain control, usher in simpler framework for individual insolvencies. The Ministry corporate affairsis proposing to undertake multiple changes under the IBC 2016, and the same is expected to include the ways of ensuring ...

OTHERS

CA's can check C&AG Provisional Empanelment Status for FY 2022-2023

RJA 06 May, 2022

CA Empanelment with the Office of the C&AG for FY 2022-23 From 06.05.2022 to 17.05.2022, the status of provisional Empanelment, as well as provisional score points, for LLPs and Chartered Accountant firms that have applied for empanelment with the Office of the C&AG of India for the FY 2022...

COMPANY LAW

Tax Compliance & Statutory Calendar for May 2022

RJA 02 May, 2022

Statutory and Tax Compliance Calendar for May 2022 S. No. Statue Purpose Compliance Period Due Date Compliance Details 1 Labour Law PF/ ESI Apr-22 15-May-22 Timeline for payment of PF & ESI contribution for the previous month. 2 Goods and Services Tax GSTR -7 TDS return under GST Apr-22 11-May-22 GSTR 7 is a ...

IBC

Is IBC 2016 is a the right step ?

RJA 02 May, 2022

Is IBC 2016 is a the right step ? Before this IBC legislation, the debt recovery system in our country took an average of four years to resolve insolvency. That's far too long and inexcusable, especially given the Prime Minister's and our country's efforts to improve the ease ...

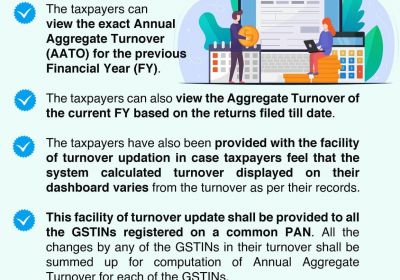

GST Consultancy

How to compute AATO (annual Aggregate Turnover) computation for FY 2021-22.

RJA 01 May, 2022

GSTN Enables Functionality Of AATO (annual Aggregate Turnover) For The FY 2021-22 On GST Taxpayers' Dashboards Functionality of Annual Aggregate Turnover for the Financial Year 2021-22 has now been made live on GST Taxpayers’ GST Dashboards with the below characteristic mentioned here under: The GST taxpayers can view the ...

INCOME TAX

CBDT Notifies Manner & Form for filing Updated ITR Returns U/s 139(8A)

RJA 30 Apr, 2022

CBDT through Notification No. 48/2022 Dated 29th April 2022 notifies Form and Manner for filing Updated ITR Returns under section 139(8A). On April 29, 2022, the CBDT has issued the New income tax rules i.e Income-tax (Eleventh Amendment) Rules, 2022 to amend the OLD income rule i.e Income-tax Rules, 1962 & introduces manner for ...

Goods and Services Tax

Modification/Change to GSTR 1 & GSTR Filling Process

RJA 30 Apr, 2022

Change to GSTR 1 and GSTR Filling Process GSTR 1 is a monthly return form for regular taxpayers who have a yearly turnover of more than 1.5 crores and must provide information of outward supply on the 11th of the next month. Taxpayers with income under 1.5 crores will be required to submit ...

COMPANY LAW

Strict Compliance - Documents Related to formation of Company or LLP

RJA 28 Apr, 2022

Strict Compliance - about the Verification/ Clarification of Documents Related to the Incorporation of a Company or an LLP by Practicing Professionals. - ICAI made and warn for Strict Compliance - about the Verification/ Clarification of Documents Related to the Incorporation of a Company or an LLP by Practicing Professionals ...

COMPANY LAW

Compulsory audit trail in company accounting postponed to FY on 01.04.2023.onwards

RJA 28 Apr, 2022

The requirement for a compulsory audit trail in company accounting software has been postponed to the financial year commencing April 1, 2023. The requirement for a mandatory audit trail in corporate accounting system has been postponed until the fiscal year that begins on or after April 1, 2023. MCA Notifications should be read. The ...

INCOME TAX

ICAI issue FAQs.: CAs are not allowed to certify an ITR as a true copy

RJA 28 Apr, 2022

CAs are not allowed to certify an ITR as a true copy: ICAI provides Frequently Asked Questions. In a set of FAQs about issuing the UDIN, the ICAI said that "Chartered Accountants have no authority to qualify an Income Tax Return as a valid document." Chartered ...

COMPANY LAW

4 more CA, CS & directors have been fraud charged under Co. Act

RJA 26 Apr, 2022

FOUR MORE CHARTERED ACCOUNTANTS, COMPANY SECRETARIES, AND DIRECTORS HAVE BEEN CHARGED WITH ALLEGED FRAUD UNDER THE COMPANIES ACT. MUMBAI: The Economic Offences Wing has filed four new FIRs for alleged fraud under the Companies Act against seven Chinese nationals, several chartered accountants, company secretaries, and directors of Indian companies. ...

INCOME TAX

CBDT has notified additional conditions u/s 139(1) for compulsory return filing

RJA 23 Apr, 2022

CBDT inserts Rule 12AB to provide further conditions, where filing of ITR is mandatory as per clause (iv) of 7th Proviso to section 139(1) CBDT via Notification No. 37/2022 dated 21.04.2022 via Income-tax (Ninth Amendment) Rules, 2022 notified conditions for furnishing a ITR n terms of clause (iv) of the seventh proviso section 139(1) ...

Goods and Services Tax

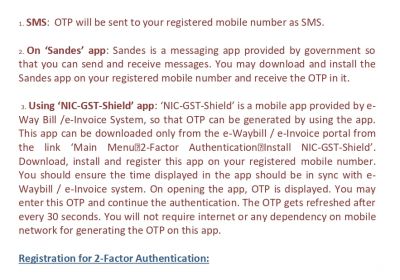

NIC implemented 2-factor authentication to login into e-invoice system.& e-way bill

RJA 19 Apr, 2022

NIC implemented two-factor authentication. To accessing the e-way bill and e-invoice systems, NIC is deploying 2-Factor Authentication for logging in to the e-Way Bill/e-Invoice System to improve the security of the system. OTP will be used to authenticate login in addition to username and password. The OTP can be ...

INCOME TAX

How to Check your PAN card status in minutes

RJA 07 Apr, 2022

How to Check your PAN card status in minutes by your self PAN cards are used to file Income Tax Returns (ITRs) and perform transactions. This is the reason why so many people pay such close attention to this document. PAN Card fraud has been all too common in recent ...

NBFC

Report: RBI may allow NBFCs to issue credit cards

RJA 07 Apr, 2022

Report: RBI may allow NBFCs to issue credit cards As per the latest reports it is believed that the RBI might allow the issue of credit card by NBFC. Till Now, the NBFC are only allowed to issue co branded credit cards. But New updates suggests that NBFC now will ...

COMPANY LAW

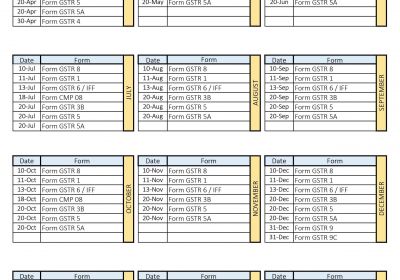

Statutory & Tax Compliance Calendar for April 2022

RJA 01 Apr, 2022

Taxation & Statutory Compliance for April 2022 S. No. Statue Purpose Compliance Period Timeline Compliance Details 1 Labour Law Compliance PF / ESI Return March-2022 15- April-2022 Timeline for payment of PF & ESI contribution for the Last month. 2 Goods and services Tax Compliance GSTR -7 TDS return under GST March-2022 10- ...

NBFC

Non-banking financial companies(NBFC) Business Model

RJA 29 Mar, 2022

NBFC BUSINESS MODEL The New NBFC regulatory rules has a goal to build a well-informed cadre population, that has abilities and is able to attain credit and a rating which better elucidates the repayment capabilities. The Economy calls for the NBFC’s to grasp the importance of alternate data ...

OTHERS

ICAI Clarification with reference to CA in Practice/ CA Firms Registering on GeM Portal

RJA 08 Mar, 2022

ICAI issue the Guidance & issue clarification with reference to Chartered Accountants in Practice/Firms of Chartered Accountants registering themselves on GeM Portal As members are aware, the Government of India has mandated that government departments and organisations purchase products and services through the GeM (Government e-marketplace) platform. ...

INCOME TAX

Top Unconventional Tax Planning ways Save Income Tax

RJA 01 Mar, 2022

Top Unconventional Tax Planning ways Save Income Tax Paying income tax at the conclusion of a financial year is a time-consuming process for most people. The majority of the strain is spent figuring out how to submit insurance, rent, and other expenses in such a way that the tax burden ...