Table of Contents

CHARTERED ACCOUNTS 'BENEVOLENT FUND (CABF):

Financial support to Covid-19 for Chartered Accountants, Parents, Children & Dependents.

ICAI provides medical support for members and their CORONA dependants The Management Committee of the Benevolent Chartered Accountants Fund (CABF), ICAI, considered the difficulty facing members during a pandemic and decided to provide medical support to CORONA members and their dependents.

-

Financial assistance up to Rs. 1.5 Lakes will be given if the net taxable income is less than Rs. 10 lac p.a.

- ICAI is India's national accounting professional body. It was constituted on 1 July 1949 as a statutory body under the Chartered Accountants Act of 1949, enacted by the Parliament (acting as the provisional Parliament of India) to govern the profession of Chartered Accountants in India. ICAI is the second-largest specialist accounting and finance entity in the world.

- Regular Covid-19 cases in India passed 50,000 for the first time on Sunday, July 26, 2020, as the overall caseload surpassed 14 lakhs, capturing the deadliest week of the pandemic so far, with total cases rising by 28 percent and death tolls rising by 19 percent.

- CABF of ICAI found the challenges faced by Members during the period of the outbreak and agreed to offer medical financial support to Members and their dependents suffering from CORONA.

This is an extremely critical time for your safety and happiness, I pray to God and to your family. ICAI share financial assistance from the Fund. Forms of financial support from the Chartered Accountant's Benevolent Fund are attached via the link here.

The Fund gives the necessary assistance:

The only person to whom the monthly family income is Rs 25,000/- will be financially supported will be the Widows/relatives.

That funding is only granted to members/widows/relatives whose monthly family income is only Rs. 25,000/-.

Following is the ICAI Member Corona Grant Application Process

The committee of the CA Benevolent Fund (CABF) ICAI considered the difficulties faced by Members at the time of the pandemic and agreed to provide medical financial assistance to Members and their dependents suffering from CORONA.

Financial Assistance procedure :

- Financial assistance requests should be made in prescribed format and all relevant documents referred to in these documents may also be submitted on cabf.icai.org. Any Central Council Member, President/Vice-President/Ex-President/Vice-Chairman, and Member of the Management Committee of the CABF/Member of the Managing Committee of the Regional Council shall recommend that application.

This support will be available to Members and their dependents who are in need and need financial assistance in the care of coronary disease. To make use of this support, members/dependents can send a request in the specified Application Form-cum-Undertaking hosted on the ICAI website at the CABF Portal under the https:/cabf.icai.org/link. The application must be followed by a positive CORONA report and is only available in cases of hospitalization.

Link of form to be submitted- Link

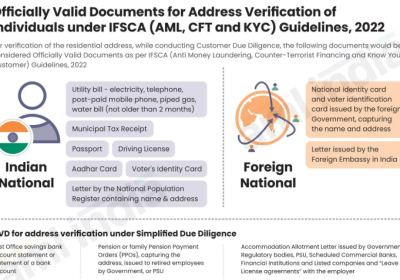

In consideration of the application for the granting of medical assistance, the additional records are to be included.

- Copy of the diagnosis, in the original form

- Health Reports & Hospital bills, in original [if available]

- Hospital calculation of the cost of treatment

- Copy of the ITR for the last two years

- Copy of the applicant's PAN number, if any

- Copy of the applicant's Aadhar Card, if any

- Canceled cheque

The financial assistance will be up to INR 1.5 Lakhs & it will be required to return to CA Benevolent Fund (CABF) in full if it is not utilized for the treatment of CORONA. For detailed information please mail to covidassistance@icai.in.

Member Secretary

Chartered Accountants Benevolent Fund

M&C-MSS Directorate

The Institute of Chartered Accountants of India

ICAI Bhawan

Plot No. A-29, Sector-62 NOIDA

Phone – 0120-3045997/98

Help give to help members in need of assistance # ca # accountants # share # icastudents

Start posting with members # IndiaFightsCoronavirus # icaifightscoronavirus #