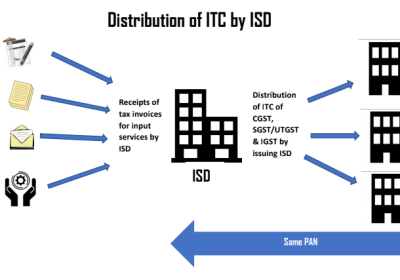

Changes in ISD Concept & Definition: Union budget 2024

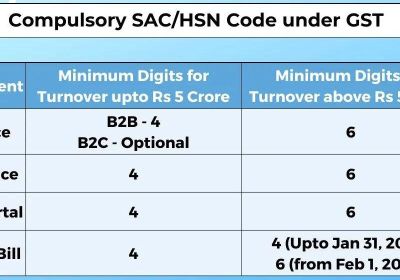

Reconciliation between input service distributer & input Tax credit receipt, ISD, Changes in Input Service Distributer (ISD), Union budget 2024, Registration as input service distributer (ISD), Distribution ...

Read More