Spend too much is Financial trouble fall when borrow without strategy

Debt Trap: spend too much is Financial trouble fall when borrow without strategy, borrow without strategy, Debt Trap, Financial trouble fall, How to Get Out ...

Read MoreCIBIL (Credit Information Bureau of India Limited) is the India's first credit information bureau. A credit bureau is a repository of credit information of all customers of its members, which comprises banks and financial institutions. CIBIL is one such organization that collates credit information contributed by its members and disseminates it to lenders, helping them in their credit-decision-making and lending process. In addition to above activities it also maintains account of settled loans and credit card for 7 years to come.

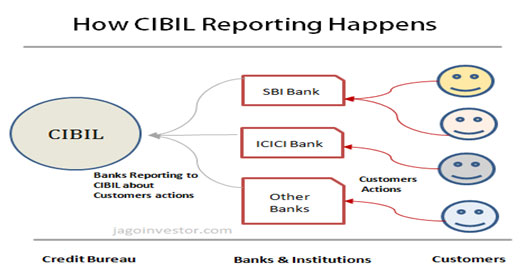

CIBIL is Credit Information Bureau of India Limited, which acts like a central repository of credit information in India. As many as 500 different banks and financial institutions are CIBIL’s clients and they report each of their customers (like me and you) actions to them. CIBIL is the India's first credit information bureau. A credit bureau is a repository of credit information of all customers of its members, which comprises banks and financial institutions.

So if you take a credit card from ICICI Bank, then ICICI bank reports to CIBIL about it. If you enquire about car loan to HDFC Bank, hold your breath! as even that enquiry is reported to CIBIL, if you can’t pay your EMI for home loan with SBI Bank for a particular month, that also gets reported to CIBIL.

Not just your bad actions, but even your good actions like paying EMI’s on time, paying credit card with punctuality also gets reported with CIBIL. You can see that this way, a history is maintained at CIBIL for each person, which can be good history or bad history depending on the case and this information is very useful for banks to decide if they want to give loan to you in future or not. All the banks are now looking at CIBIL report before taking the decision.

Credit Information Report (CIR) is a report card of factual records provided by member group to the CIBIL. Credit grantors are leading Banks, State Financial Corporations, Non-Banking Financial Companies, Financial Institutions, and Credit Card Companies, Housing Finance Companies, who are Members of CIBIL. Its purpose is to help credit grantors make informed lending decisions – accurately and speedily at better terms. Are you looking to check your credit score and want to know why your loan application was rejected? Yes, if you are misusing your credit taking capacity, you are being watched at like never before in this country. I am talking about CIBIL here and in this article let me show you how your current behaviour related to credit card, personal loan, home loans are going to affect you in future in a good and bad way. Also see 2 real life cases where a person’s loan application got rejected because of Bad CIBIL report and how they didn’t even knew about it.

CIBIL report is not always bad. It’s an extremely good concept which is now taking shape in India recently. If there are two people A and B and A is a good guy and B is a bad guy, obviously A should get better rates of interest, faster processing, first right to loan. Whereas, guy B should get loan at higher rate of interest (because he is risky) and may be banks can even deny entertaining him at all.

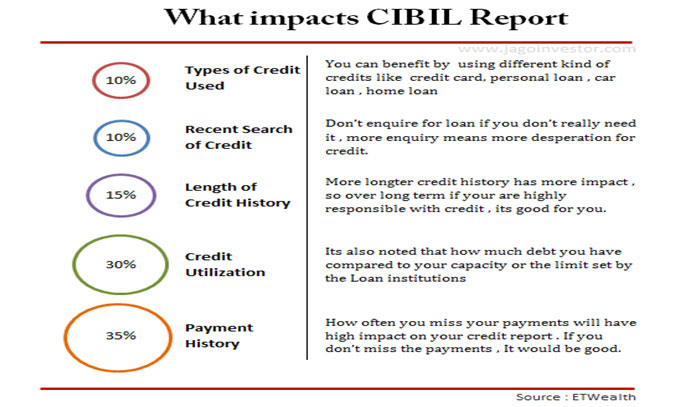

CIBIL gives us the power to build our credit report. So if you become responsible and use your credit effectively and with planning, you can build a good credit history with CIBIL, which will help you in long run. Also note that taking a lot of loans without having the capacity is also a negative thing and that can affect your credit report.

You have to be super sensitive and careful with credit card and loan repayment, because one small mistake or being lazy in this area can cost you a lot. I would like to share some instances of readers who faced a lot of issues in area of getting loans and finally they checked their CIBIL report and found that they were having bad history

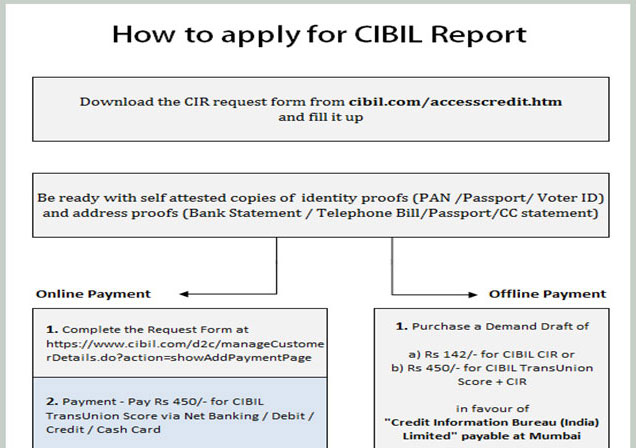

A borrower can now access his CIR directly from CIBIL. :- A CIR is a record of the credit payment history compiled from information received from credit institutions. The purpose is to help credit institutions make informed lending decisions - quickly and objectively - and enable faster processing of credit applications to help provide quicker access to credit at better terms. In order to get the report, one needs to fill up a requisition form available on CIBIL's website (www.cibil.com). After filling the form, you have to provide self-attested copies of some documents to CIBIL. The documents needed with the application are identity proof and address proof.

There are two kinds of reports which you can get from CIBIL. The basic one is called CIR Report which is nothing but a basic information on how is your credit history and what kind of information is there with CIBIL . The fee for obtaining the CIR is Rs 142.It must be paid through a demand draft favouring 'Credit Information Bureau (India) Ltd.', payable at Mumbai and sent to CIBIL. The documents can be sent either through email, post or fax. On receiving the documents and fees, CIBIL will process the request and send a copy of the CIR. This is good enough if you just want to check your status with CIBIL. You can also apply for your CIBIL Report Online

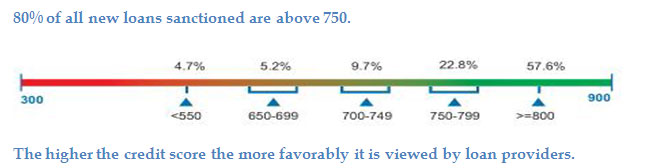

The second thing which you can get from CIBIL is your Credit Score which is called as CIBIL Trans Union Score and ranges from 300 – 900. This is number which scores your credit ranking. A lower number means your credit score is bad and you will be considered as Risky! If it is 900, you are doing great, Higher the better. The cost of CIBIL Trans Union Score along with your CIR report would be Rs 450. I would say this is not at all expensive if you can get this vital information at such a cost. If you are facing any rejection for loans or if you fear that your past history can haunt you, then it’s a good idea to check the CIBIL report each year and find out how it looks like. I have created a step by step procedure for you on how to apply for CIBIL report. Have a look

With the new base rate system of interest rates coming into effect, it would be all the more beneficial for home loan borrowers. The interest rates will henceforth be based on the base rate plus a premium depending on the credit rating of the borrower. A good credit rating helps in getting a loan at a lower interest rate as compared to a loan based on a bad credit rating.

Your credit score plays a critical role in the loan approval process. Your credit score gives loan providers an indication of your capability to pay back a loan, based on your Credit Information Report (CIR). However, it is important to note that every loan provider, that uses the CIBIL TransUnion Score, has its own benchmark of what constitutes a "good" score. For example, a score of 670 may be an adequate score for some loan providers, but reason enough to reject a loan application for some others.

Your CIBIL CIR is provided to you along with your score purchase, because it is the basis on which your credit score is generated. It's a record of your credit history, compiled from information received from loan providers, who are members of CIBIL.

How to get your CIBIL TransUnion Score

Documents Required along with the online payment confirmation in cases of unsuccessful authentications:

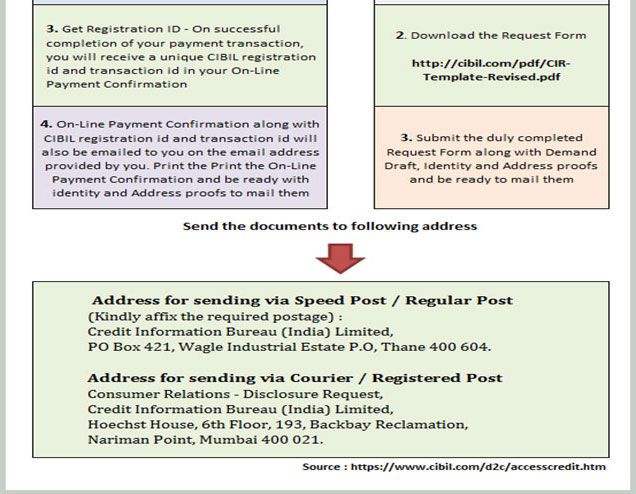

Notes :- Address: Consumer Relations - Disclosure Request, Credit Information Bureau (India) Limited, Hoechst House, 6th Floor, 193, Backbay Reclamation, Nariman Point, Mumbai 400 021

Submit the duly completed CIR Request Form along with demand draft, identity and address proofs and send it to the address mentioned in the site http://www.cibil.com/accesscredit.htm. Remember CIBIL has no authorised agents. Please do not contact anyone other than CIBIL in order to gain access to a copy of your Credit Information report.

A lot of times Banks makes mistakes in CIBIL Report and it is mostly manual mistakes or lot of times delay in communicating the details. If you check your CIBIL report and find out any problems, please ask your bank to communicate it to CIBIL as soon as possible. Also if based on your CIBIL report, if you clear some loans , make sure you ask your bank to communicate to CIBIL that you have cleared the liabilities , so that it can get updated in CIBIL report. CIBIL report is your lifeline for future, don’t do anything which makes its dirty, else that will affect you in long run.

You can access your Credit Information Report (CIR) directly from CIBIL. As you may be aware, your CIBIL CIR is a factual record of your credit payment history compiled from information received from credit grantors. The purpose is to help credit grantors make informed lending decisions - quickly and objectively, and enable faster processing of your credit applications to help provide you speedier access to credit at better terms.

Name and address of borrower Identification and PAN numbers Passport details Date of birth Records of all the credit facilities availed by the borrower Past payment history Amounts overdue Number of inquiries made on that borrower by different members Suits filed and their status The CIR does not contain Income and revenue details Amounts deposited with banks Details of assets Details of investment. Now, individuals can access their credit information as analyzed by CIBIL. In case of any mistakes, they can be rectified.

Previously, a borrower used to get credit information from the bank where he applied for the home loan. A home loan application was liable to be rejected on account of negative or poor scoring by CIBIL. Lenders never provided the CIR to borrowers. Once a borrower found out that the credit information was incorrect, on his request, the lender would provide him a nine digit unique borrower control number. With the control number, the borrower was supposed to contact CIBIL to get the exact details related to the negative or poor scoring details. Many times, due to wrong reporting by member organizations, it was found that the CIBIL report was incorrect. In order to get the mistakes rectified, the borrower had to go through a long process.

As of September 2008, CIBIL is the only credit bureau in India. But some other credit bureaus are planning to set up in India soon.

All leading banks and financial institutions are members of CIBIL. CIBIL collects information from these Members, collates and disseminates it in order to create a truly comprehensive snapshot of a borrower's credit history.

CIBIL IS not FOR classifying any accounts as default accounts or any borrowers as defaulters. It merely reflects this information after the Member has classified. The Number of Days Past Due and / or Asset Classification as per RBI definition as submitted by Members is reflected in the CIBIL Credit Report.

The CIBIL Credit Report only submitted by CIBIL members and does not provide any indication or comment pertaining, to whether credit should or should not be granted. The credit grantors who have received an application for credit will make their own credit decision depending on their risk management policies. CIBIL does not grant or deny credit.

CIBIL is a repository of credit information and in the consumer ground it provides information on the various loans availed of and cards held by an individual from a member bank. Its commercial report covers the credit availed of by non-individuals.

The credit report shows account information such as repayment record, defaults, type of loan, amount of loan, etc. of the customer. This information facilitates prudent decision-making when the credit underwriter processes the loan/credit-card application.

A customer’s name cannot be removed from CIBIL’s database because member banks contribute to CIBIL on a monthly basis data of all their customers who maintain a loan/credit-card account with them.

Approval or rejection of a credit application depends on the bank’s policies. Rejection by one bank on the grounds of the CIBIL report might not imply rejection by another bank.

The CIBIL report has information of loan/credit details of the borrower only. Therefore, for a retail customer, it would not matter if someone in his/her family has defaulted. If the customer’s repayment track record is okay, his/her credit score will not be affected by that of his/her family members.

A lot of times Banks makes mistakes in CIBIL Report and it is mostly manual mistakes or lot of times delay in communicating the details. If you check your CIBIL report and find out any problems, please ask your bank to communicate it to CIBIL as soon as possible. Also if based on your CIBIL report, if you clear some loans , make sure you ask your bank to communicate to CIBIL that you have cleared the liabilities , so that it can get updated in CIBIL report. CIBIL report is your lifeline for future, don’t do anything which makes its dirty, else that will affect you in long run.

Yes. CIBIL rating affects your loan application in different ways. CIBIL report will show the details of all the loans taken by you. It will also show details such as your regularity in paying back the loan -details of installments due but not cleared on time etc Applicants who have defaulted earlier in paying back their loan installments will be easily caught and their loan application will be rejected.

Of course yes. All lending institutions will check CIBIL reports so that they can take firsthand information about your credit history. Not only banks, anybody interested in checking your credit history can access your information from CIBIL by paying a small fee.

You can improve your credit score by repaying your loan EMI’s on time and always pay the minimum payment on your credit card to avert from the bad credit score. Remember Below Points to Maintain Good Credit History

You can request CIBIL for the Credit Information report (CIR). This report will show the complete details of your credit history.

What Rajput Jain & Associates Offers

We provide a start to end solution with regard to CIBIL Report.

200+

550+

2009

700+

All the information related to any client is considered confidential and never be disclosed to anyone.

Having years of experience in respective areas and backed by skilled and experienced workforce keep us ahead.

We believe in the building the good relationship with the clients that ensures the great impression.

If you are not happy with our services then you can request a refund within 30 days.

We provide 24*7 supports through phone, email and live chat.

You can pay online through EMIs, PayPal, net banking, debit card, credit card and more.