Form FCGPR – Filling of FDI Reporting with RBI

Overview

FDI Stands for Foreign Direct Investment (FDI) Reserve Bank of India has made regulations and

issued certain notifications in relation to the receipt of Foreign Direct Investment (FDI)

in india.

RBI has allowed the receipt of Foreign Direct Investment (FDI) by way if issue of capital

instruments in india.

Further, the company receiving Foreign Direct Investment (FDI) has to make reporting of

receipt of FDI in form FCGPR.

Form FCGPR is required to be filed in case the company is issuing equity shares, Compulsorily

Convertible Preference Shares (CCPS)/ Compulsorily Convertible Debentures (CCD) to a person

resident outside india.

What is Foreign currency Gross provisional Return (FC-GPR) ?

FCGPR stands for Foreign Collaboration general permission route. RBI has specified Form FCGPR

for making reporting of Foreign Direct Investment (FDI).

Whenever a Company issues equity shares, Compulsorily Convertible Preference Shares (CCPS)/

Compulsorily Convertible Debentures (CCD) in consideration of money received from a person

resident outside india by way of Foreign Direct Investment (FDI), then the company needs to

file FORM FCGPR using FIRMS Portal.

Time limit for filing Form FCGPR

Form FCGPR needs to be filed within 30 days of allotment of shares / Compulsorily Convertible

Preference Shares (CCPS)/ Compulsorily Convertible Debentures (CCD).

Applicable regulations

Inward remittance of Foreign Direct Investment (FDI) by a person resident outside india is

regulated by Foreign Exchange Management (Transfer or Issue of Security by a Person Resident

Outside India) Regulations, 2017

Documents required for Filing Form FCGPR

The following documents shall be required for filing Form FCGPR:

- Board Resolution for Allotment of Shares / Compulsorily Convertible Preference Shares

(CCPS)/ Compulsorily Convertible Debentures (CCD)

- Memorandum of Association of the company in case the shares are allotted for the

subscription to the Memorandum of Association (MOA)

- Foreign Inward remittance Certificate (FIRC) from AD Bank

- KYC from AD Bank

- Valuation certificate regarding value of shares from the Chartered Accountant

- CS Certificate in the prescribed format

- Declaration by Authorised representative of the Company

- Debit Authorisation for debiting charges from the Bank

- Declaration regarding issue price by the directors of the Company

- Reason for delay in submission, if any

Process for filing form FCGPR

The following process shall be followed for reporting of Foreign Direct Investment (FDI) in

india:

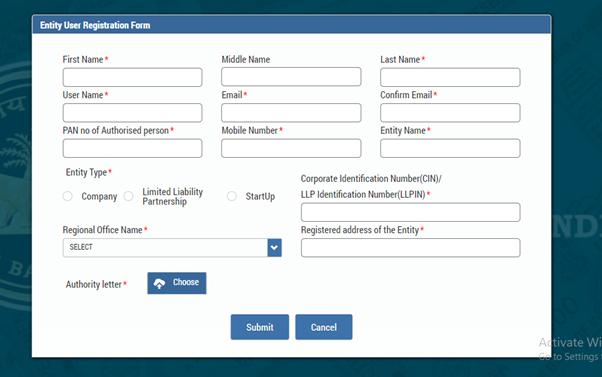

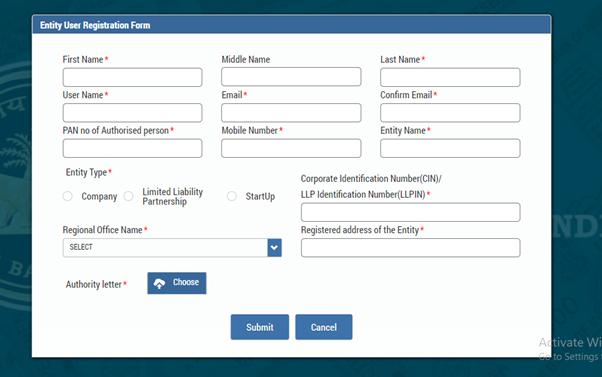

Step 1: Registration for Entity User on Firms Portal

The company has first of all needs to get the registration of Entity user on the FIRMS Portal

in case the reporting of FDI is being made first time for the Company.

In case of subsequent reporting the company does not need to make any registration for entity

user.

Documents to be attached : Authority letter in signed Format, PAN of Entity and PAN of

Authorised Representative of the company.

After registering of entity user, the concerned authority will check and verify the details

and documents filed and after being satisfied, a Password will be sent to the registered

email ID which needs to be change.

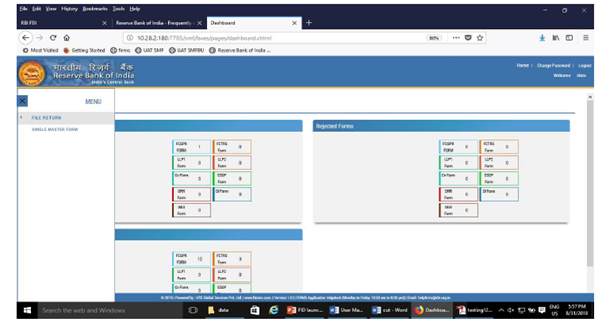

Step 2: Creation of Entity Master

After registration of entity user, there needs to create an entity master by logging into the

FIRMS Portal using the User ID and Password as created in the entity user process.

The Company needs to fill all the details as required in the entity master form in the FIRMS

Portal and then click on “Submit”.

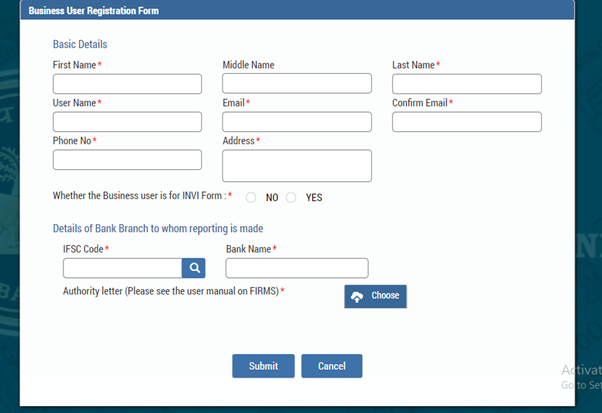

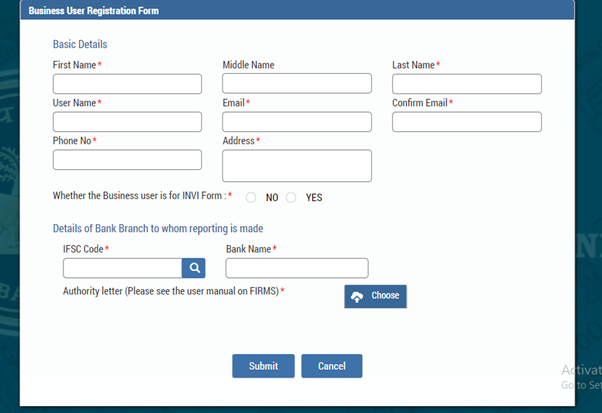

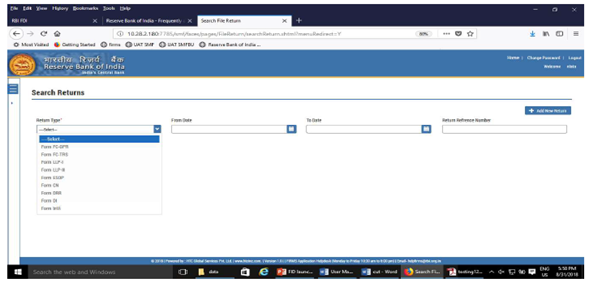

Step 3 Registration for Business User on Firms Portal

After creation of Entity Master, the company needs to apply for business user registration.

One important point to be noted is that, here in the business user form the company needs to

select the IFSC Code of the AD Bank from the Drop Down. So, the company should confirm the

IFSC Code to be chosen in the form in advance from the Concerned Bank.

Documents to be attached : Authority letter in signed Format, PAN of Entity and PAN of

Authorised Representative of the company.

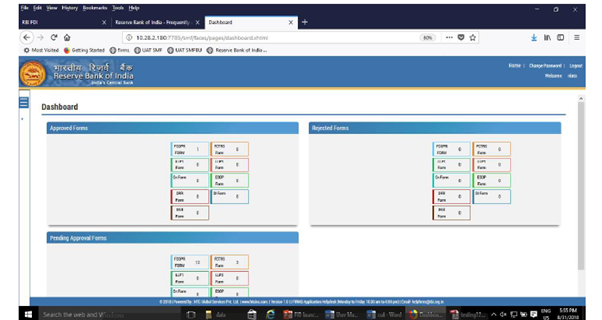

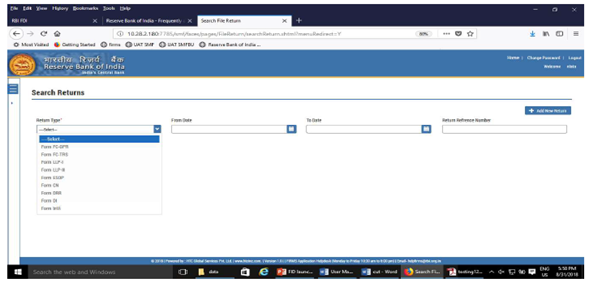

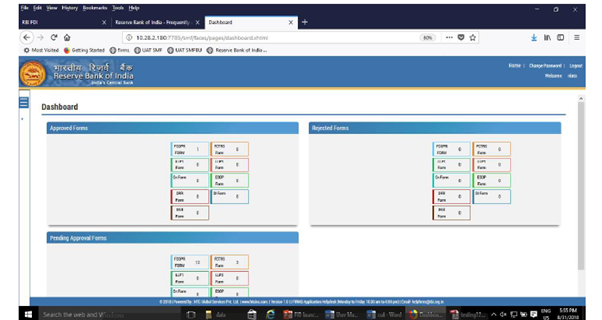

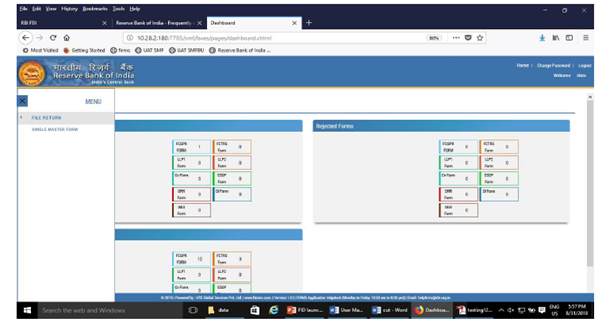

Step 4 Reporting of FDI Received

The Last step is to make the reporting of remittance received from person resident outside

india. The company needs to fill all the required details and attach the relevant documents

as mentioned above, while making reporting in this form and then submit the Form.

After filing of Form FCGPR, the AD Bank or both AD Bank and RBI as the case may be will check

the form and in case any discrepancy is found in the Form, then they will reject the Form

giving the appropriate reasoning or otherwise they will approve the Form.

In case the form got rejected, then the company need to file the Form again after removing

all the discrepancies.

Consequences of late filing of Form FCGPR

If the Company makes reporting of Foreign Direct Investment (FDI) after the period of 30 days

of allotment of shares / CCPS / CCDs, then the Form will first be checked by the DA Bank and

then AD Bank will send the form further to the Respective regional Reserve Bank of India.

Further, Reserve Bank of India will either charge Late submission Fees (LSF) or ask the

Company to go for compounding for approval of Form FCGPR.

Routes of Foreign Direct Investments (FDI)

FDI can be received by way of the following routes:

Automatic Route: where no approval is required for getting inward remittance from a

person resident outside india.

Government Approval Route: There are certain sectors in which government approval is

required for receiving inward remittance from a person resident outside india.

Prohibited Sectors for Foreign Direct Investments (FDI)

A person resident outside india cannot make any Foreign Direct investment in any of the

following sectors:

- Lottery Business. It includes the Government / private lottery or online lotteries

- Gambling and betting including casinos

- Chit Fund (except for investment made by NRI’s and OCI’s on a Non – repatriation basis)

- Nidhi Company

- Trading in Transferable Development Rights (TDR’s)

- Real Estate business or construction of Farm houses

- Manufacturing of Cigars, cheroots, cigarillos and cigarettes, tobacco or of tobacco

substitutes.

Note: The prohibition is on manufacturing of the products

mentioned and foreign investment in other activities relating to these products

including wholesale cash and carry, retail trading etc. will be governed by the sectoral

restrictions laid down in Regulation 16 of FEMA 20(R).

- Activities / sectors not open to private sectors investment i.e Atomic energy and

Railway operations

- Foreign technology collaboration in any form including licensing for franchise,

trademark, brand name, management contract is also prohibited for Lottery Business and

Gambling and Betting activities

How Rajput Jain and Associates can Assist

We offer all kinds of Consultancy, Compliances and Registration Services in relation to

Foreign Direct Investment (FDI) in india. We have empanelled various experts to provide the

expert advisory, Registration and Compliances services for Foreign Direct Investment (FDI)

in india.

The services that we offer includes in Foreign Direct Investment (FDI) in india are:

- FEMA Compliances related to Foreign Direct Investment (FDI)

- Reporting to RBI in relation to Foreign Direct Investment (FDI)

- Drafting of documents for reporting to RBI

- Valuation of shares

- Advising various routes for remitting money in india

- ROC Compliances in relation to Foreign Direct Investment (FDI)

- Liaisoning with AD Bank and RBI in relation to compliances and FDI matters