What is FCTRS?

FCTRS stands for Foreign Currency Transfer of Shares. RBI has specified Form FCTRS for making

reporting of Transfer of Capital Instruments between a person resident in india and a person

resident outside India.

So, whenever there is a transfer of capital instruments between a resident india and a non

resident, then the Company needs to make the reporting of the same in Form FCTRS.

Who is required to file Form FCTRS?

Form FCTRS is required to be filed for reporting of Transfer of shares between a resident and

a Non-Resident Person.

Whenever there is a transfer of shares between the following then that needs to be reported

in Form FCTRS, The latest FIRMS e-reporting system at the moment allows the reporting of the

following transactions:

- Reporting of FDI to companies

- Reporting of FDI to LLP

- Transfer of share / capital to companies / LPL between residents and non-residents

- Issue or transition of convertible notes.

| Transferor |

Transferee |

| a person resident outside india holding capital instrument in an indian

company on a repatriable basis |

A person resident outside india holding capital instrument on a

Non-Repatriable basis |

| a person resident outside india holding capital instrument in an indian company

on a repatriable basis |

Person Resident in india Or vice-versa |

Cases where reporting in Form FCTRS is not required

- In case a person resident outside india holding capital instrument in indian company on

a Non Repatriable basis transfer his shares to a person resident in india

then in that case no reporting is required to be made in form FCTRS.

- Transfer of shares from a person resident outside india holding capital

instrument in an indian company on a repatriable basis to a person resident

outside india holding capital instrument in an indian company on a

repatriable basis

Time limit for filing Form FCTRS

Form FCTRS needs to be filed within 60 days of transfer of capital instrument or

receipt/remittance of funds, whichever is earlier.

Applicable regulations

Transfer of capital instruments between resident and Non-resident shall be regulated by

Foreign Exchange Management (Transfer or Issue of Security by a Person Resident Outside

India) Regulations, 2017

Documents required for Filing Form FCTRS

The individual transaction report in the FIRMS Single Master Form. An individual may only use

his or her login details for the agency that allowed the individual to record the

transactions. In the event that the person chooses to act as a Business Consumer for another

organisation, the person may register separately.

The individual transaction report in the FIRMS Single Master Form. An individual may only use

his or her login details for the agency that allowed the individual to record the

transactions. In the event that the person chooses to act as a Business Consumer for another

organisation, the person may register separately.

In case of Transfer by way of Gift

- Declaration by Non-Resident Transferor or Transferee in the prescribed Format

- Relevant Regulatory Approvals wherever applicable, in case of transfer by way of gift

- Consent Letter between both donor and done, in case of transfer by way of gift

- Pre and post Transaction shareholding pattern

- Board resolution for Transfer of Shares

- Reason for delay in submission, if any

In case of Transfer by way of sale

- Transfer Agreement along with Consent of both seller and buyer

- Valuation certificate

- Declaration by Non-Resident Transferor or Transferee in the prescribed Format

- In case the seller is a Non-Resident, then acknowledgement of FCGPR or FCTRS as the case

may be.

- Foreign Inward remittance certificate or Foreign outward remittance certificate from

Bank

- KYC of beneficiary from Bank

- Pre and post Transaction shareholding pattern

- Board resolution for Transfer of Shares

- Reason for delay in submission, if any

To register as a company customer, please visit the FIRMS website at https:/firms.rbi.org.in.

- The person must open the Registration or New Business User on the website.

- Then the business user must fill up the details in the form namely

- Name/User name (which must be unique)/E-mail address/Phone no./Address

- IFSC Code of the Bank branch towards whom the reporting shall be made.

- Authority letter

- CIN/LLPIN

- Copy of PAN Number

- Company/LLP Name

- When the specifics are finished, the Business User must submit the form.

- When the Business User submits an application form, the same shall be allowed to be

checked by the AD Bank Branch concerned. The acceptance or denial of the same shall be

conveyed to the Business User by means of an email alert.

Process for filing form FCGPR

The following process shall be followed for reporting of Foreign Direct Investment (FDI) in

india:

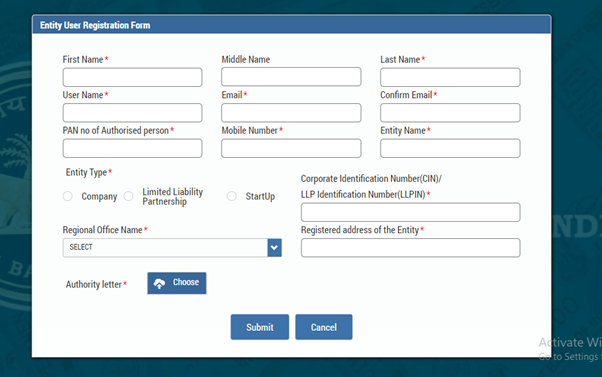

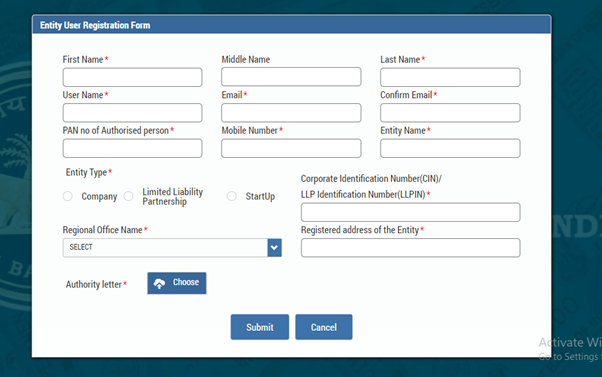

Step 1: Registration for Entity User on Firms Portal

The company has first of all needs to get the registration of Entity user on the FIRMS Portal

in case the reporting of FDI is being made first time for the Company.

In case of subsequent reporting the company does not need to make any registration for entity

user.

Documents to be attached : Authority letter in signed Format, PAN of Entity and PAN of

Authorised Representative of the company.

After registering of entity user, the concerned authority will check and verify the details

and documents filed and after being satisfied, a Password will be sent to the registered

email ID which needs to be change.

Step 2: Creation of Entity Master

After registration of entity user, there needs to create an entity master by logging into the

FIRMS Portal using the User ID and Password as created in the entity user process.

The Company needs to fill all the details as required in the entity master form in the FIRMS

Portal and then click on “Submit”.

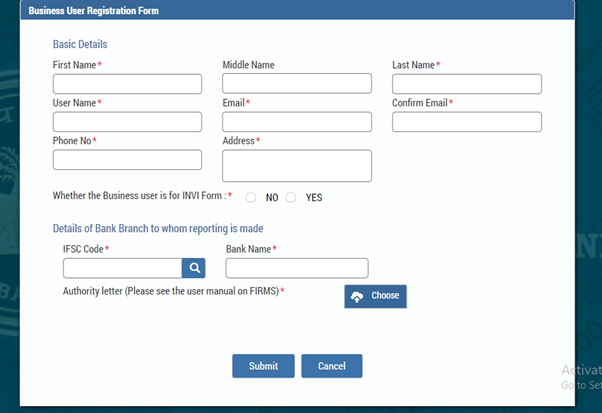

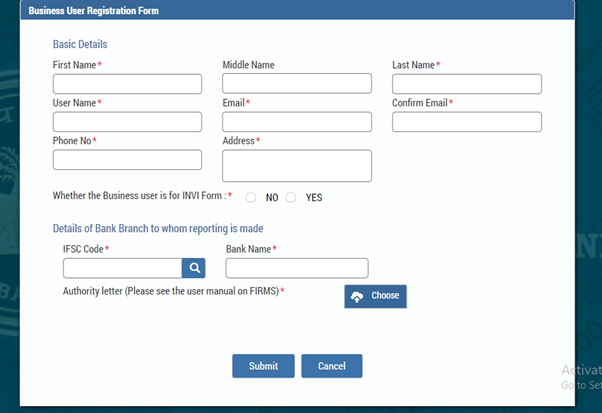

Step 3 Registration for Business User on Firms Portal

After creation of Entity Master, the company needs to apply for business user registration.

One important point to be noted is that, here in the business user form the company needs to

select the IFSC Code of the AD Bank from the Drop Down. So, the company should confirm the

IFSC Code to be chosen in the form in advance from the Concerned Bank.

Documents to be attached : Authority letter in signed Format, PAN of Entity and PAN of

Authorised Representative of the company.

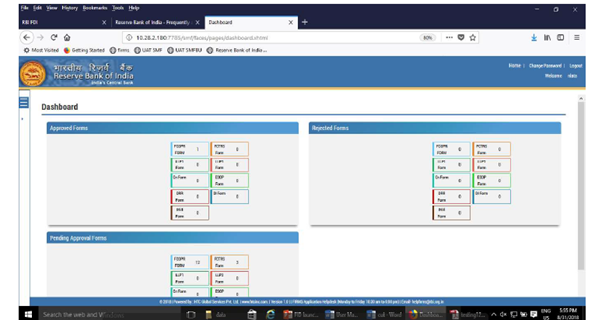

Step 4 Reporting of Transfer of shares

For making reporting in Form FCTRS the user needs to login to FIRMS Portal using his Business

user Credentials.

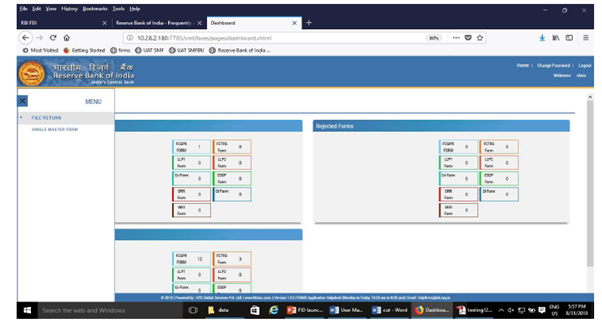

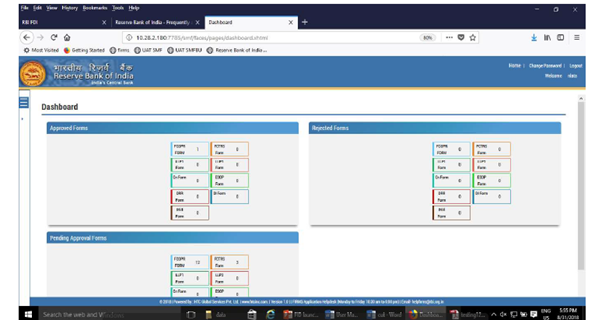

The user will be landed to the Home page

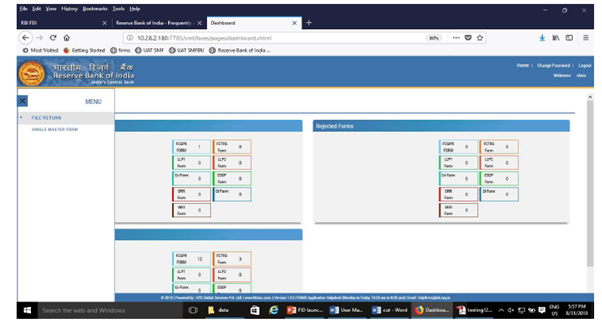

Then on the left navigation button the user needs to select “Single master Form”

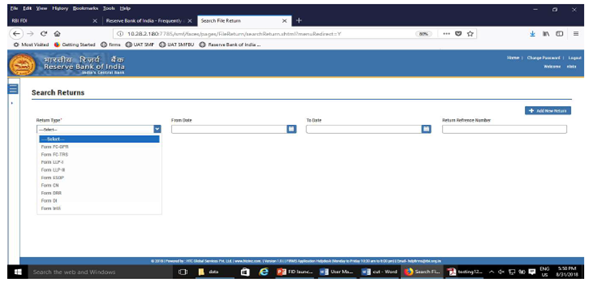

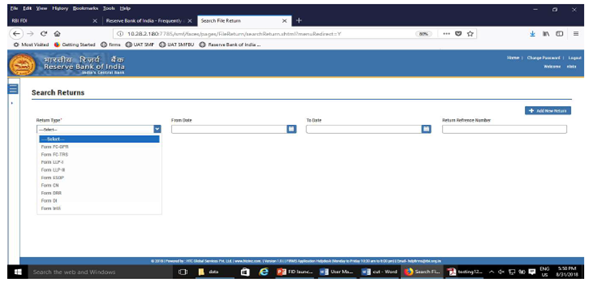

Then the user Needs to select Form FCTRS from the dropdown in the Return Type list.

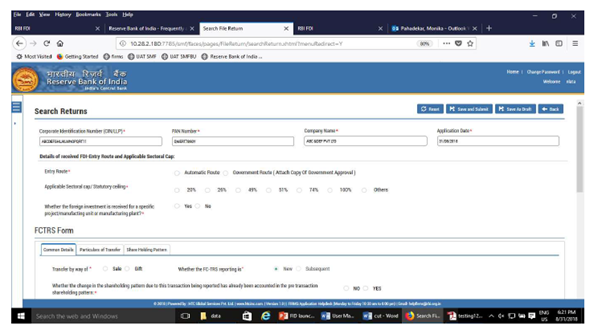

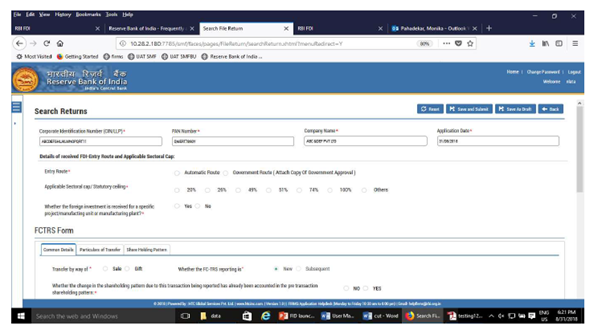

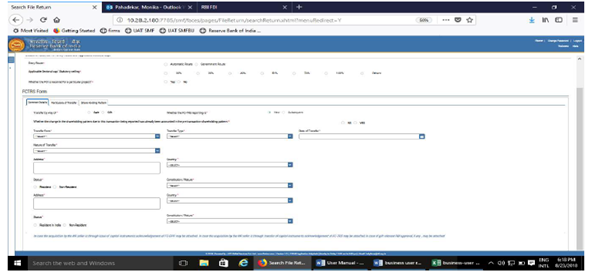

Then the user needs to fill the Common investment details

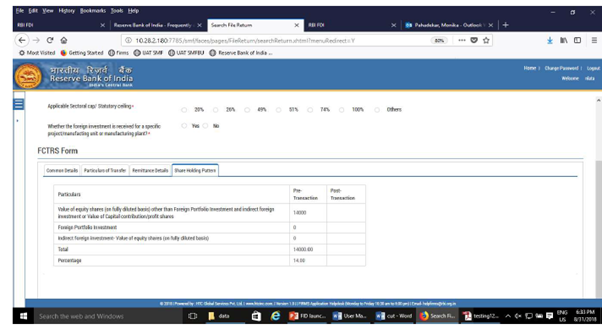

The details like entry route, Applicable sectoral cap etc. is required to be filled here.

Further, some details like “Company Name”, “CIN” shall be Auto-Populated.

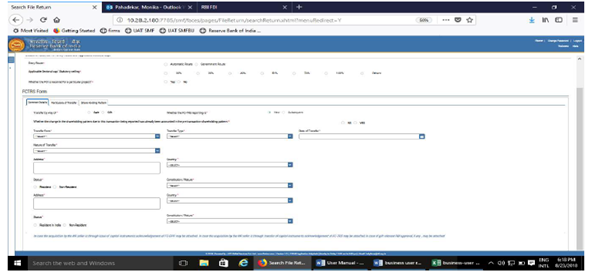

Then the user needs to fill up the common details in Tab-1 Like whether the transfer is by

way of sale or gift, Transfer Type, Buyer and seller details, etc.

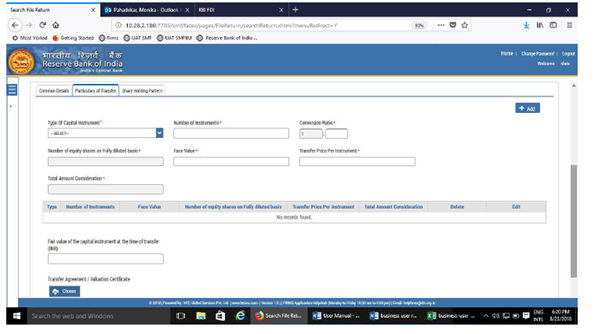

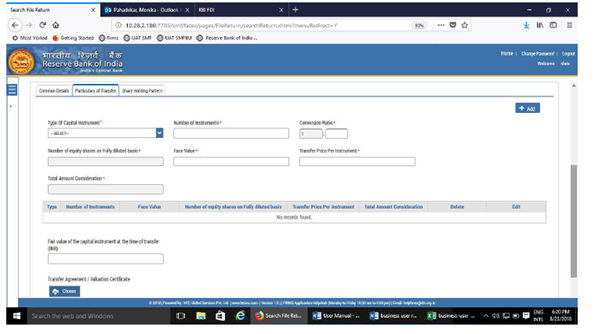

Then in Tab-2, Particulars of transfer

The user needs to fill the information like Type of Capital Instrument, Number of

instruments, Conversion Ratio, etc.

After entering all the information, the user needs to Click on “ADD” button.

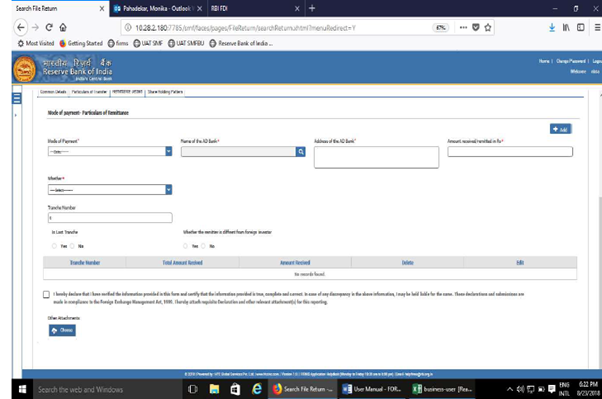

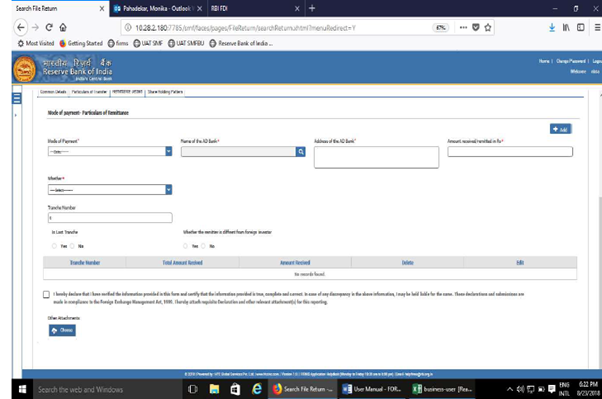

Then in Tab-3 Remittance Details

The user needs to fill the details like Mode of Payment, Name and Address of the AD Bank,

Amount Remitted, etc.

And after filling all the details the user needs to Check the Declaration box.

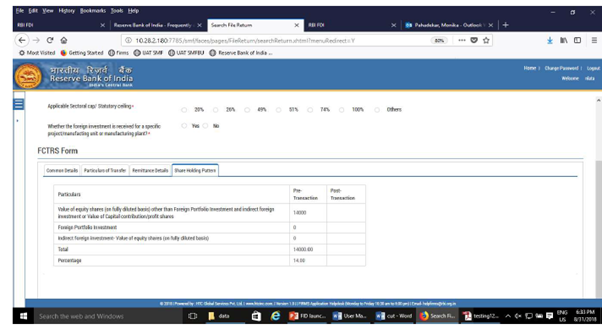

Shareholding Pattern

This includes the pre and post transaction shareholding pattern which will be auto populated

After filing all the details, the user needs to click on “Save and Submit Button” or the user

can click on “Save as Draft” button to submit the form late.

After filing of Form FCTRS, the AD Bank or both AD Bank and RBI as the case may be will check

the form and in case any discrepancy is found in the Form, then they will reject the Form

giving the appropriate reasoning or otherwise they will approve the Form.

In case the form got rejected, then the company need to file the Form again after removing

all the discrepancies.

Consequences of late filing of Form FCTRS

If the Company makes reporting of Transfer of capital instrument after the period of 60 days

of transfer of capital instrument or receipt/remittance of funds whichever is earlier, then

the Company shall be liable to late submission fees as decided by Reserve bank of india in

consultation with Central Government. Following LSF prescribed by RBI for delay reporting

FOLLOWING LSF PRESCRIBED BY RBI FOR DELAY REPORTING

| The amount involved in reporting (in Rs.) |

Late Submission Fee (LSF) as % of the amount involved * |

The maximum amount of LSF applicable |

| Up to Rs 10 million |

0.05 % |

Rs.1 million or 300 % of the amount involved, whichever is Less |

| More than Rs 10 million |

0.15 % |

Rs.10 million or 300% of the amount involved, whichever is less |

| * Percentage of LSF will be doubled every 12 months. The floor

(minimum necessary amount) for LSF will be Rs. 100. |

How Rajput Jain and Associates can Assist

We offer all kinds of Consultancy and Compliances Services in relation to Filing of for

FCTRS. We have empanelled various experts to provide the expert advisory and Compliances

services for Filing of Form FCTRS.

The services that we offer includes the following:

- Filing of Transfer of shares in Form FCTRS

- Drafting of documents for reporting to RBI

- Valuation of shares

- Advising on matters relating to Transfer of capital instruments

- ROC Compliances in relation to Transfer of capital instruments

- Liaisoning with AD Bank and RBI in relation to compliances for transfer of capital

instruments