NBFC Registration - Overview

NBFC Stands for Non Banking Financial Company. The basic business of a Non Banking Financial Company (NBFC) is to carry on the business of Loan and advances, leasing, hire purchase, insurance, etc.

An important point to be noted about Non Banking Financial Company (NBFC) is that it cannot carry on any agricultural activity, sale or purchase of any goods, industrial activity, or providing any services relating to sale / purchase / or construction of immovable property.

Registration of a Non Banking Financial Company (NBFC) is not an easy task, it requires various documentations to be completed including various compliances and criteria’s which are required to be fulfilled before issuance of certificate of registration from RBI.

So, it is advisable to appoint an expert consultant to make sure that you will be able to get the NBFC license and can run your NBFC Business.

Types of Non Banking Financial Company ( NBFC )

Based on Liabilities:

- (NBFC – D) Deposit Taking

- (NBFC – ND) Non - Deposit Taking

NBFC Based on the type of the Activity

- NBFC - Investment and credit Company(ICC)

- NBFC – Infrastructure Finance Company (IFC)

- NBFC – Asset Finance Company (AFC)

- NBFC – Core investment Company (CIC)

- NBFC – Infrastructure Debt Fund (IDF)

- NBFC – Micro Finance Institution (MFI)

- NBFC – Mortgage Guarantee Companies (MGC)

- NBFC – Non Operating Holding Finance Company (NOHFC)

Further, Non Deposit taking NBFC has been divided into the following:

- NBFC – ND Systematically Important

- NBFC - ND Non – Systematically important

Role and Functions of an NBFC

Documents required for Non Banking Financial Company ( NBFC ) Registration

The basic documents required for registering a Non Banking Financial company (NBFC) are as follows:

- Certified Copies of MOA, AOA, COI, PAN of the company

- Board Resolution in the specified format

- Copy of fixed deposit receipt

- Bankers report on Fixed deposit

- Banker report on Company account

- Banker report on Companies holding / subsidiary / associate holding substantial interest in the Non Banking Financial Company ( NBFC ).

- Banker report on Directors and shareholders of the Company

- Audited balance sheet and profit and loss account of the company for last three years or since incorporation whichever is less.

- Statutory Auditor certificate

Requirement of Non Banking Financial Company ( NBFC ) Registration

The basic requirements for registering a Non Banking Financial company (NBFC) is as follows:

- The entity must be a company incorporated under Companies Act 2013 / 1956

- The name of the company must include the words specifying the finance activities like finserv, finvest, capital, leasing, etc.

- At least two Directors must be having a good profile and experience in the Banking, Finance, Lending or NBFC sector

- The directors must fulfil the “fit and proper”

criteria as specified by RBI for NBFC

- Minimum Net owned Fund of at least 2 Cr.

- Fixed Deposit of at least 2 Cr.

- Every company shall prepare and submit a Proposed business plan of the NBFC for car

- The directors and shareholders must have a god credit history, there should not be any default from their end

- The shareholders of the company must have a good net worth, which must be certified by a Chartered Accountant.

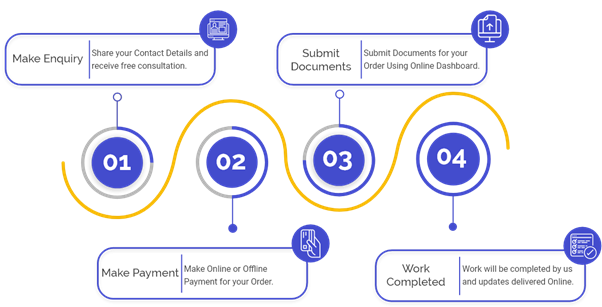

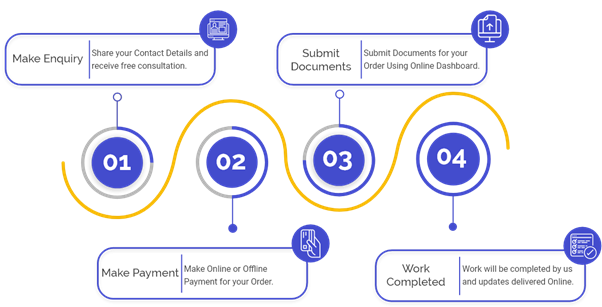

Registration Process for Non Banking Financial Company ( NBFC )

The registration process for registering a Non Banking Financial company (NBFC) is as follows :

- Company incorporation: The first step is to incorporate a company having the object to carry on the business of Non Banking Financial Company ( NBFC )

- Bank Account opening : Then the company needs to open a Bank account in its oen name.

- Fulfil Net owned fund requirement : After incorporation of the company, there needs to fulfil the minimum net owned fund requirement of at least 2 Cr.. for which the company needs to increase the paid up capital by more than 2 Cr.

- Preparation of business Plan : Then we need prepare the proposed business plan for the next five years of the NBFC

- Preparation of Draft documents : Then the consultant will prepare the draft documents for getting it signed by the directors / shareholders.

- Collection of signed documents : Then the signed draft documents along with other required documents shall be collected from the directors / shareholders for submission to Reserve Bank of India.

- Filing of Cosmos Form on RBI Website : After completing the File for submission, but before physical submission of file to RBI, the company needs to file COSMOS Form online on RBI COSMOS Portal.

- Submission of Physical documents : Then the Company needs to physically submit the Documents file to Department of Non Banking Regulation, RBI, Mumbai.

- Receipt of Queries from RBI : In case RBI found any discrepancy in the information and documents provided or if RBI requires any further information, then RBI will send the query to the company on the given email ID.

- Reply of RBI Queries : The company needs to revert to RBI Queries and provide the required details and documents

- Issuance of license : After satisfying the requirement, the RBI will issue the Certificate of registration (COR) of the NBFC.

How Rajput Jain and Associates can Assist in Non Banking Financial Company ( NBFC ) Registration

We offer all kinds of Consultancy, Compliances and Registration Services in relation to Non Banking Financial Companies (NBFC). We have empanelled various experts to provide the expert advisory, Registration and Compliances services for Non Banking Financial Companies (NBFC)

The services included in Non Banking Financial Companies (NBFC) registration are:

- Company incorporation

- Drafting and preparation of documents For Non

Banking Financial Company ( NBFC ) License

- Preparation of Business plan

- Preparation and Audit of financial statement

- Submitting Application with RBI for NBFC License

- Liaisoning with RBI for Certificate of registration (COR) of NBFC

- Follow up department and Approval

- Advisory relating to Non Banking Financial Companies (NBFC)