Functions & Features of Wholly Owned Subsidiary in India.

Functions & Features of Wholly Owned Subsidiary in India, Minimum criteria Pre-Conditions of 100% Wholly Owned subsidiary, Incorporate Wholly Owned Subsidiary in India,

Read MoreNidhi companies are just like Public Limited Companies but having the word Nidhi before Limited. Nidhi companies are allowed to borrow from its members and lend to its members.

Therefore, the funds contributed for a Nidhi company is only from its members (shareholders).They are created primarily for the motive of cultivating the habit of thrift and savings among their members.

People desirous of carrying on the finance business cannot do so, until they are having the ppropriate license from Reserve Bank of india.

A Person cannot lend or borrow money unless it has the license of NBFC from Reserve Bank India. But getting a license of NBFC from Reserve Bank of India is a very lengthy process and it involves various regulatory requirements that needs to be fulfilled alongwith Minimum Capital requirement of 2 Crore.

But the Government has allowed Nidhi Companies to carry on the business of lending and borrowing within its members.

So, if a person wants to carry on the business of borrowing and lending within its members then he should incorporate a Nidhi Company.

Nidhi Companies are registered as Public Limited Companies involved in taking deposits and lending money to its member. Nidhi Companies only deal with its members money. RBI has exempted Nidhi Companies from the core provisions of the RBI and other regulations applicable to a NBFC.

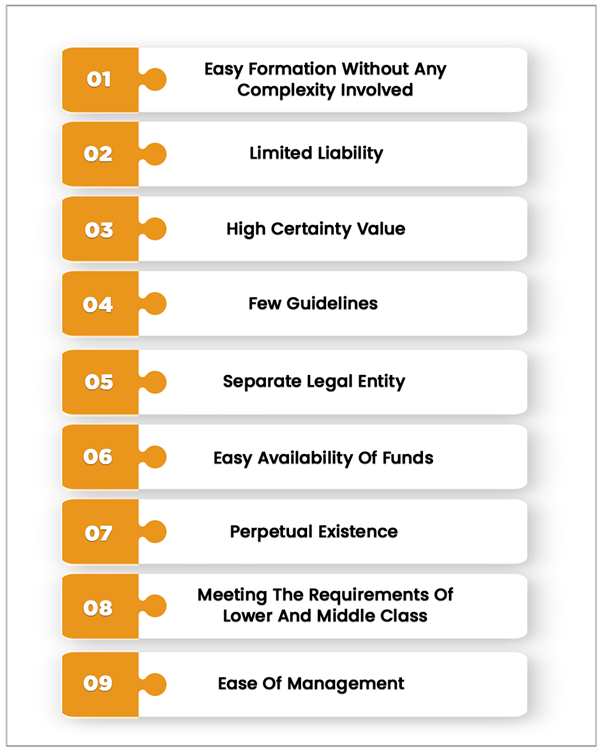

The following are the advantages of Nidhi Company:

Ministry of Corporate affairs regulates all the Nidhi Companies. Further, all the Nidhi Companies must need to Comply with Companies Act 2013.

An important point to be noted is that Reserve Bank of India does not regulate Nidhi Companies.

There is no approval required from RBI for registration of Nidhi Company. One can get Nidhi Company incorporated by making an application of the same with MCA.

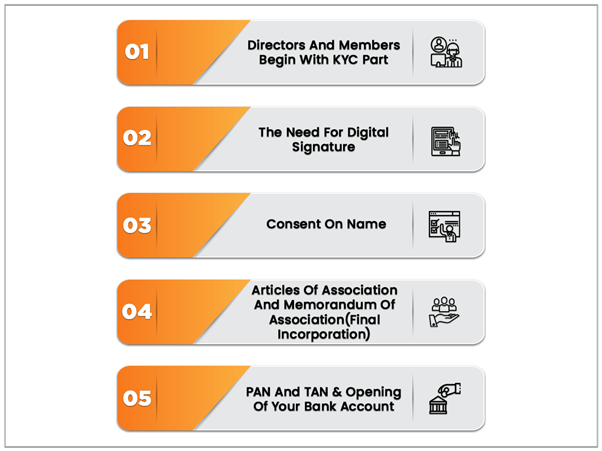

Ministry of Corporate Affairs regulates the Nidhi Companies. For incorporating a Nidhi Company, the following process needs to be followed:

The process for Nidhi company registration is not much time consuming. A Nidhi Company can be incorporated within a week time.

We offer all kinds of Consultancy, Compliances and Registration Services in relation to Nidhi Companies. We have empanelled various experts to provide the expert advisory, Registration and Compliances services for Nidhi Companies.

The services included in Nidhi Company registration are:

Pick your Company Name

Pay the Registration Fees

Upload Documents

Rajput Jain & Associates offers the following Cost effective & Easy Company Registration Services packages for its Clients with in schedule days from Anywhere in India:

200+

550+

2009

700+

All the information related to any client is considered confidential and never be disclosed to anyone.

Having years of experience in respective areas and backed by skilled and experienced workforce keep us ahead.

We believe in the building the good relationship with the clients that ensures the great impression.

If you are not happy with our services then you can request a refund within 30 days.

We provide 24*7 supports through phone, email and live chat.

You can pay online through EMIs, PayPal, net banking, debit card, credit card and more.