All About the procedure for Import Export Code

Importer-Exporter Code in India, Validity of Import and export Code, procedure for import export code, Benefits of Importer-Exporter Code in India, Exemption from the IE ...

Read MoreFor facilitating the process of the promotion and for increasing the competitiveness of Micro Small and Medium enterprises the registration in accordance with Small and Medium Enterprises Development (MSMED) Act 2006 is conducted.

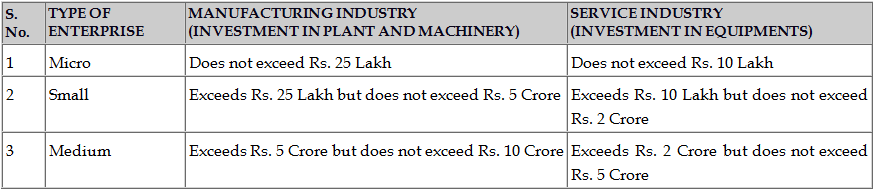

The following slabs comes under the MSMED Act for determining the status of the Enterprise:

All the enterprise classes, Association of persons, Proprietorship, Partnership firm, Hindu undivided family, Company or Undertaking can apply for the registration and relish the privileges under the Act.

We are well aware with the process of SSI/ MSI/LSI registration. If you are looking forward to relevant guidance in this regard then you can contact us.

200+

550+

2009

700+

All the information related to any client is considered confidential and never be disclosed to anyone.

Having years of experience in respective areas and backed by skilled and experienced workforce keep us ahead.

We believe in the building the good relationship with the clients that ensures the great impression.

If you are not happy with our services then you can request a refund within 30 days.

We provide 24*7 supports through phone, email and live chat.

You can pay online through EMIs, PayPal, net banking, debit card, credit card and more.