Functions & Features of Wholly Owned Subsidiary in India.

Functions & Features of Wholly Owned Subsidiary in India, Minimum criteria Pre-Conditions of 100% Wholly Owned subsidiary, Incorporate Wholly Owned Subsidiary in India,

Read MoreThe Limited Liability Partnerships are prominent and popular form of doing businesses in countries across the world. These LLPs are elegant and easy means of combining entrepreneurial initiative with requisite capital and other resources, the professional expertise, and creative knowledge about the business concerned. The taxation liabilities of LLP are different, and generally less than that of the business corporations. Other benefits of limited liability partnerships are outlined in the section below. A LLP is an optional corporate business form that offers advantages of limited liability of an enterprise and the adaptability of a partnership.

The outstanding salient features or benefits of the limited liability partnerships are:

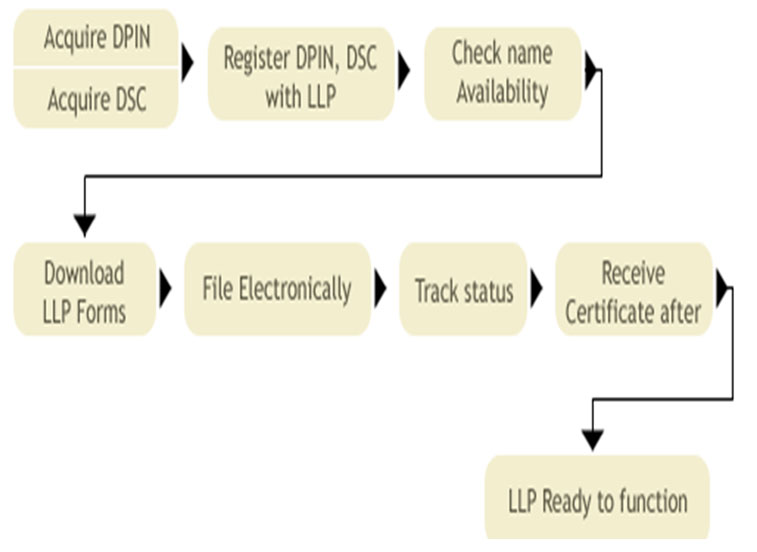

Steps involves in LLp registration

We offer LLP registration services which are highly renowned as a one-window-solution provider for LLP registration services in Delhi/NCR. We offer professional assistance in getting your LLP Registration at competitive rates and in a short span of time. We area of our with regards to LLP is as follows:

200+

550+

2009

700+

All the information related to any client is considered confidential and never be disclosed to anyone.

Having years of experience in respective areas and backed by skilled and experienced workforce keep us ahead.

We believe in the building the good relationship with the clients that ensures the great impression.

If you are not happy with our services then you can request a refund within 30 days.

We provide 24*7 supports through phone, email and live chat.

You can pay online through EMIs, PayPal, net banking, debit card, credit card and more.