Establishment of a subsidiary outside India

Since the rise of globalisation, Indian companies are increasingly involved in doing business

outside India. We would like to set up a regional office or an overseas franchise. There are

many advantages in doing so, such as reducing prices as they save on import duties, making

business simpler, creating an international brand etc.

Foreign investment in wholly owned companies or joint - venture has been regarded by Indian

businessmen as significant avenues for promoting global business.

There are essentially two pathways in which one can set up a WOS worldwide, namely automatic

route and path approval. Under the automatic path, no prior approval from the regulatory

authority is needed of a company to set up a WOS abroad.

While other plans / operations not covered by automatic route conditions would require prior

Reserve Bank approval.

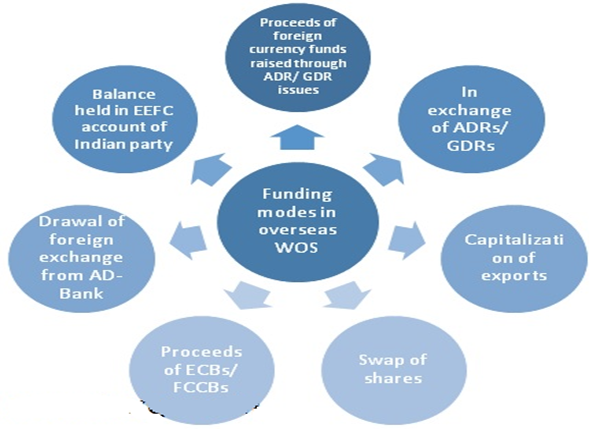

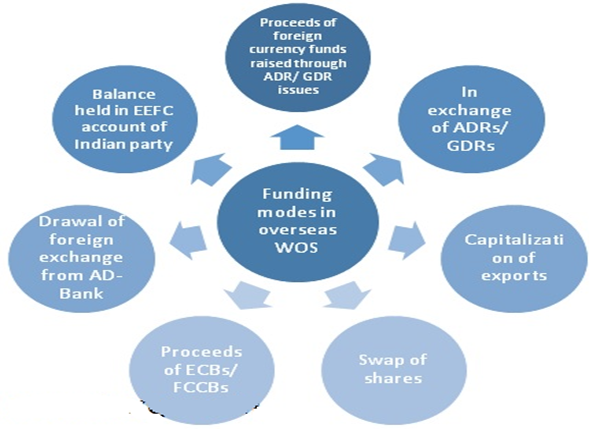

Permissible ODI Funding Sources:

Under the Automatic Route an Indian Group does not need the Reserve Bank’s prior approval to

make direct overseas investments in a wholly owned subsidiary (WOS) abroad. The Indian Party

should reach a category of Authorized Dealer – I bank for making the transfer payments to

such investments.

"Indian Group" means either of the following or hybrid of:

- An organization incorporated in India

- A body created under an Act of Parliament

- A partnership company registered under the Indian Partnership Act 1932;

- A limited liability partnership formed under the Limited Liability Partnership Act 2008

and including any other entity in India as the Reserve Bank may notify;

(this should be remembered that under the Automatic Route, individuals are not permitted to

invest)

Activities allowed for investments overseas

An Indian business can create investments overseas in any operation in which it has

experience and expertise (except those that are expressly banned). Even so, specific extra

requirements set out in Regulation 7 may be conformed to for the arrangement of operations

in the financial sector.

Real estate and banking are the banned sectors for investing overseas. Indian banks operating

in India can therefore set up JV / WOS abroad as long as they receive permission under the

1949 Banking Regulation Act.

Just an Indian company involved in activities in the finance market may make investments in

the financial services industry unless it meets the following requirements:

- Has gained net income from the financial services operations over the preceding 3

financial years;

- Is required to register for the acts of banking and finance activities with the suitable

regulatory authority in India;

- Has acquired authorisation from the regulatory authorities involved in both India and

abroad to engage in such operating in the financial sector;

- Has met prudential capital adequacy requirements as defined by the regulatory authority

involved in India.

Under the Automatic Route the conditions for overseas direct investment / financial

commitment are as follows:

- The Indian Party may invest up to 400 per cent of its net worth (as per the last audited

Balance Sheet) in WOS for any bonafide operation authorized under host country law

subject to prior RBI approval for a cap of more than USD 1 trillion per FY;

- The Indian entity is not on the cautionary list / list of defaulting exporters of the

Reserve Bank to the banking system published / circulated by the Credit Information

Bureau of India Ltd. (CIBIL)/RBI or any other credit information company as approved by

the Reserve Bank or under inquiry by the Enforcement Directorate or any investigative

agency or regulatory authority;

- The Indian Party shall route all transactions concerning the investment in a WOS through

only one branch of an authorized dealer (bank) to be designated by the Indian Party.

"Financial commitment" means an Indian Party's made direct investment outside India, and

includes

- By way of contribution to WOS 's overseas equity shares;

- As loans to its overseas WOS;

- 100% of the value of the business guarantee given on behalf of its WOS overseas;

- 100% Sum of Bank guarantees; and

- 50 percent of the execution guarantee issued on behalf of its overseas WOS.

Process to adopt within the Automatic Route

The Indian Party planning to make direct investment abroad under the automatic route is

required to fill out the ODI online form via AD bankduly assisted by the documentation

specified therein, i.e. certified copy of the Board Resolution, statutory auditors

certificate and valuation report (if an established company is acquired) as per the

valuation standards and approach an Authorized Dealer (desdealer)

Abroad Investment under RBI approval route

Initiatives not provided by automatic route requirements require prior approval by the

Reserve Bank for which a detailed application in Form ODI with the specified documents is

required to be made via the Approved Dealer Category-I banks.

The following considerations shall be taken into account by Reserve Bank when considering

these requests:

- WOS viability outside India

- Contribution to foreign trade as well as other benefits accruing to India by these

investment;

- An Indian Group and a global entity's financial status and business document; and

- Indian Party experience and knowledge with the same or associated area of activity as

WOS outside India.

With a vision to allowing recognized star export industries with an excellent track record

and consistently strong export performance to realise the rewards of globalization and

liberalization, proprietorship considerations and unregistered partnership firms are

permitted to set up WOS outside India with the Reserve Bank's prior approval subject to

fulfilling some eligibility requirements.

An application in form ODI may be apply to the Chief General Manager, Reserve Bank of India,

Foreign Exchange Department, Overseas Investment Division, Central Office, Amar Building,

5th Floor, Fort, Mumbai 400 001, through their bank.

Registered trusts and societies working in the manufacturing / educational / hospital sector

are permitted to invest in same sector(s) in a WOS outside India, with prior permission from

the Reserve Bank.

Compliances by Indian Party

- On Investment/ Financial Commitment:

- Filing Form ODI along with:

- Certified copy of Board Resolution for investment

- Statutory Auditor’s Certificate

- Valuation report for the value of shares

- Acquire UIN via AD bank – necessary for all investments

- Post-investment, make sure that share certificates or any other document are

received as proof and submit to AD bank within 6 weeks.

- Report details of the decisions made by a WOS with regard to diversification of

its operations / setting up of step-down subsidiaries / modification of its

shareholding pattern within 30 days of the approval of such decisions by the

competent authority concerned of such WOS with regard to the host country's

local legislation.

- During Investment:

- On changes in investment report to RBI through AD bank within 30 days of

approval by competent authority of WOS

- Repatriate to India all dues viz. dividends, royalty, technical fees, etc.

within 60 days of falling due.

- Annual Filing:

- Annual Performance Report (APR) in Part II of Form ODI by 31st December every

year

- Annual Return on Foreign Assets & Liabilities (FLA) by 15th July every year

Where host nation legislation does not compulsory conducting an audit of WOS accounting

records, the Indian Party may obtain the Annual Performance Report (APR) on the basis of the

unaudited audited reports provided by the WOS:

- Statutory auditors of the Indian Party certify that the law of the host country does not

automatically involve auditing of the WOS accounting records and that the estimates in

the APR are in line with the unaudited statements of the WOS and

- That the unaudited annual accounts of the WOS were approved and confirmed by the Indian

Party Board.