Establish Branch / Representative Office outside India

Indian vibrancy, entrepreneurship and creativity are searching around the world for new frontiers. Everyone who enters a foreign country must of necessity take note of the host country's policies , rules and regulations. Each region is different and it can also be a challenge to keep up with the laws of the countries.

Indian Reserve Bank manages and regulates investment in foreign companies by individuals who live in India. A individual may be an Indian citizen and resident outside India. A person who is not Indian resident will not be governed under Reserve Bank of India. An Indian citizen is eligible to invest in foreign assets from the revenue he/she obtained while living outside India. So, if a person residing in India wants to join the international market, they can either join outside India by setting up a branch office or liaison office or they can establish an independent business outside India. The Company formed outside India could be a subsidiary or joint venture.

It is necessary to note that the intention to remain outside or within India for an unknown time under section 2 of the FEMA Act is relevant. This is different from the provisions of section 6 the Income Tax Act, To be a resident under the Income Tax Act, an person must stay in India for a specified number of days only. Thus, an individual may be a non-resident for one year under the Income Tax Act and may be a resident for the same year under the FEMA Act.

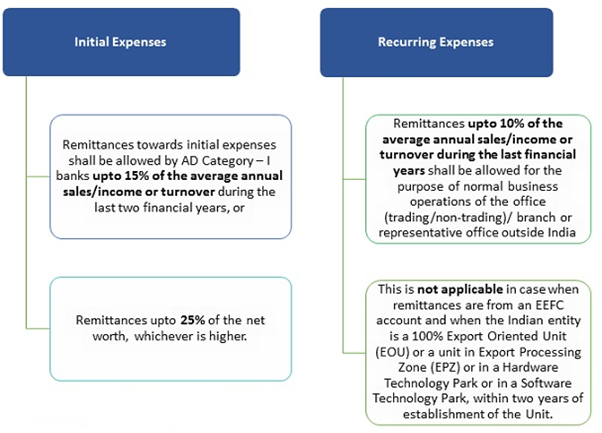

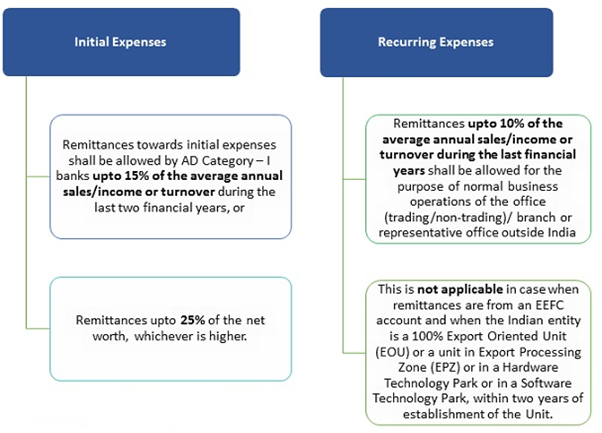

A party residing in India who is an incorporated company or business or corporate entity in India is eligible to create a branch outside India. For the purpose of meeting the Branch Expenses abroad, a general permission is required to open the Bank Account, subject to specific limits / conditions:

Common terms and conditions for abroad branch opening / representative:

- The branch / office was established abroad, or representative is posted overseas to conduct the Indian entity's usual business activities.

- The branch / office / representative of overseas countries shall not enter into any contract or arrangement in contravention of the statute, rules or regulations made thereunder;

- The foreign office (trading / non-trading)/branch / representative should not establish any financial obligations, contingent or otherwise, for the Indian headquarters and should not invest surplus funds overseas without the Reserve Bank's prior approval. Any surplus funds made should be repatriated to India.

- The exchange made available by the approved dealer must be used solely for the reason(s) for which it is published. The unused exchange could be repatriated to India upon the approved dealer 's advice.

- The information of bank accounts opened in the country overseas should be reported to AD Bank promptly.

- The account opened, kept or preserved in this manner is closed,

- Where the branch / office abroad is not established within 6 months of the account opening or

- Within one month of the Overseas branch / office being closed, or

- Where no representative is posted for a period of 6 years and the balance in the account is repatriated to India;

- Renewal of the remittance facilities after 2 years can be issued, given the designated dealer is provided with proper records of the usage of the issued foreign exchange.

- The applicant will forward the following statements to the approved dealer:

- A statement showing details of the original expenses incurred along with suitable documentary evidence, wherever possible, within 3 months from the date on which the exchange for that reason was made available.

- Annual trading / non-trading record overseas duly accredited by formal Auditors / Chartered Accountants.

Acquisition of Assets outside India

Branch / office / representative can purchase office supplies and other assets which are needed for normal business. Funds required for this may be remitted as a current account transaction by the Indian entity from India.

Nevertheless, the sale or purchase of immovable property outside India, other than by way of a lease not beyond 5 years, will be subjected to RBI regulators by the overseas branch / office / representative.

Particularly, above that the facility cannot be used by e-commerce companies which, for illustration, offer overseas sellers and buyers an e-commerce platform and wish to set up a collection account in a foreign country

Application to AD Banker

The Indian organization / companies will send applications in OBR form to their bankers (approved dealers) along with the details of their sales duly certified by their auditors and also a statement that they have not approached / would not approached any other approved dealer for the service for which they are applying. You need to fill in the OBR application form with the requisite information along with supporting documentation. After this the designated dealer (bank) releases the foreign exchange.

After receiving confirmation from the applicant that they have completed all legal and other formalities in India and abroad in connection with the opening of a trading / non-trading office or for posting a representative abroad, the recurring (expenditure) remittance facilities are permitted initially only for a period of 2 years.

After receiving confirmation from the applicant that they have completed all legal and other formalities in India and abroad in connection with the opening of a trading / non-trading office or for posting a representative abroad, the recurring (expenditure) remittance facilities are permitted initially only for a period of 2 years.

Some of the information that should be given in the application:

- Code number of exporters assigned by Reserve Bank;

- Nature of the business of the applicant in India;

- Applicant keeps specific foreign currency balances / securities, if any.

- Current arrangements for the representation of applicants in the country / territory in concern, if any. If there is any contract for an agency, the full information such as the amount & date of approval by Reserve Bank and commission paid over the past three years.

- Descriptions of past two years' export realizations.

- Commodity-wise/country-wise analysis of past two years' exports.

- Request is for the appointment of an agent (on a fixed remuneration basis) or the establishment of a trade branch or a representative liaison / non-trading branch.

- Place and country of posting of agent/representative office/branch.

- Territories / countries to which the new agent / representative office / branch relates

- Detailed description of the business to be carried out abroad by the office / branch agent / representative.

- Initial Setting Expenditures.

- The recurring monthly expenses.

Off-site and on-site contracts

The software exporter company / firm overseas office / branch may repatriate 100 percent of the contract value of each off-site contract to India.

In the case of businesses entering into 'on-site' contracts, they will repatriate the profits of these 'on-site' contracts after the contracts have been concluded.

An audited annual statement showing payments under 'off-site' and 'on-site' contracts conducted by the Foreign Office may be submitted to the AD Group - I banks.