- 01

- Jan

- 25

- 25

Mandatory compliances applicable to UAE companies at a Glance

General UAE taxation Rules, UAE Co. audit report requirements, UAE VAT Registration Thresholds, corporate tax return filing frequency, VAT return filing frequency. UAE Co. Bookkeeping & ...

Read More

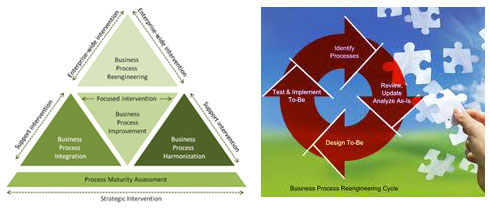

Business process re-engineering (BPR) originated as a private sector strategy to help companies radically reinvent how they conduct their job to significantly enhance client satisfaction, reduce running expenses and then become world-class rivals. Continuous creation and implementation of advanced information systems is the main catalyst for reengineering. The infrastructure for enabling creative enterprise methods is adopted by leading organisations.

Business process re-engineering (BPR) originated as a private sector strategy to help companies radically reinvent how they conduct their job to significantly enhance client satisfaction, reduce running expenses and then become world-class rivals. Continuous creation and implementation of advanced information systems is the main catalyst for reengineering. The infrastructure for enabling creative enterprise methods is adopted by leading organisations.