GST on Interest Income applicability Business Owner Must Know

GST on Interest Income applicability Business Owner Must Know, What is "interest" under GST? Is interest on delayed payment taxable/exempt? GST on Interest Income, ...

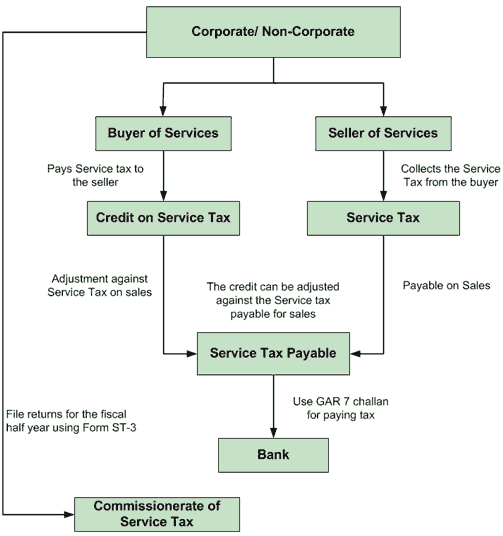

Read MoreService tax is an indirect tax which is levied upon the taxable services defined u/s 66B of finance act 1994. Generally the service provider is liable to collect the service tax from service receiver and deposit the same to the central govt. account this account is administered by the Central Excise Department. Generally service provider is liable to deposit service tax to central govt. but in some circumstances service receiver is liable to deposit such tax to central govt. which is popularly known as reverse charge mechanism.

What does service means?

'Service' has been defined and means -any activity for consideration carried out by a person for another excluding services under negative list but includes a declared service. The said definition further provides that 'Service' does not include

To determine whether you are a “service” provider or not ask following question to yourself

Once a person indulges in providing taxable services and his turnover exceeds Rs. One million during any financial year he must have to register himself under service tax department.

Rate of service tax:

At present, the effective rate of Service tax is 15%. The above rate comprises of Service tax @ 14% inclusive of ESHC, Swacch Bharat Abhiyan @ 0.5% and Krishi Kalyan Cess @ 0.5%.

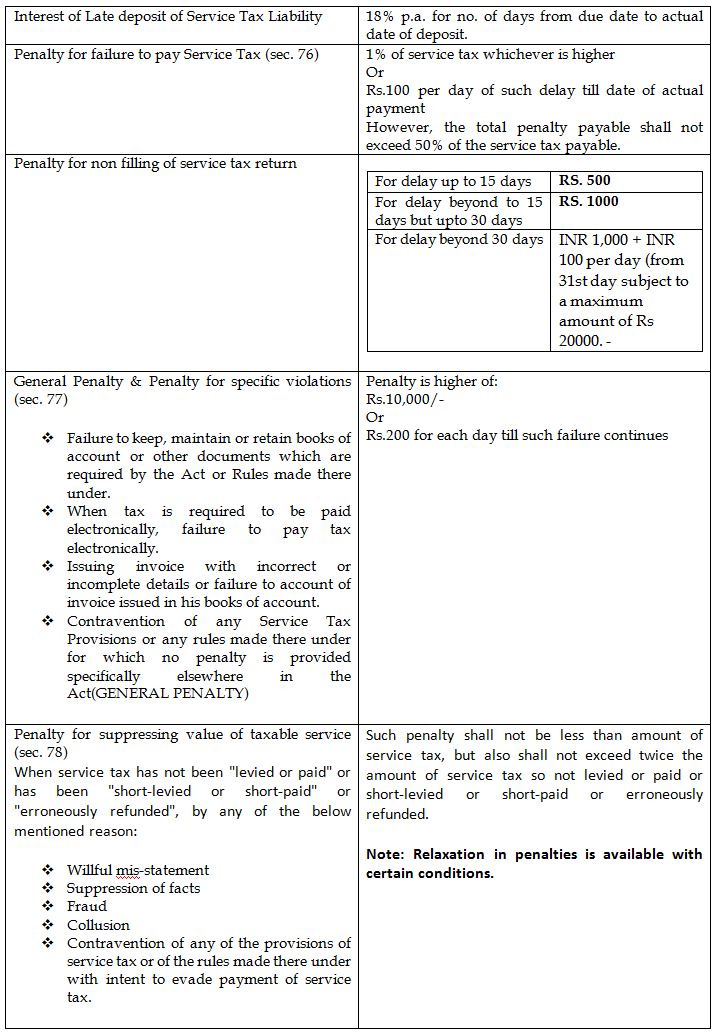

Interest and penalties for non compliance of service tax rules and regulations:

With a very extensive experience in service tax online services, we are adept in this field. We have been rendering our services in the following area:

200+

550+

2009

700+

All the information related to any client is considered confidential and never be disclosed to anyone.

Having years of experience in respective areas and backed by skilled and experienced workforce keep us ahead.

We believe in the building the good relationship with the clients that ensures the great impression.

If you are not happy with our services then you can request a refund within 30 days.

We provide 24*7 supports through phone, email and live chat.

You can pay online through EMIs, PayPal, net banking, debit card, credit card and more.