XBRL Data Conversion Services

WHAT IS XBRL?

Extensible Business Reporting Language (XBRL) accounts to communication language for business and accounting data which has modified the structure of business reporting across the world. It is a part of computer language based on XML (Extensible Markup Language) which builds up the standard for data exchange between the businesses and on internet. The application of identified tags on the data items for efficient process of the computer have untangled the complications involved with the procedure.

BENEFITS OF XBRL REPORTING

Merits of XBRL Reporting are as follows:

- Interactive data is suitable for investors and other users for taking more productive decisions. In spite of wading through incomprehensible financial disclosure, investors can be accessible to meaningful information in a form which is more suitable for them.

- XBRL reporting will lead to error free accounts before being mapped under the respective taxonomy.

- Tagging of the financial data with the assistance of the application software may lead to detection of certain errors by the auditors. In this case, the XBRL will help cut down internal and external audit costs.

- The taxation system strictly adheres to accuracy and traceability in compliance with various rules and regulations. The values are used to calculate and report taxes and for that the compliance system is required to be effective for tracing accurate values. This procedure is necessary for atomic information. The straightforward and proper documentation and coding of the rules and formulas for assessing taxes helps in predicting the tax liability in case of any business transaction.

- Real time analysis helps the internal management in assembling reports for gamut of internal management decisions.

- XBRL technology is used as standard for analyzing and reporting financial information, accounting framework and Software Agnostic.

- Although XBRL can summarize the general ledger transaction but it cannot be treated as standardized chart of accounts. Standardized charts are a way of get the reporting of the prescribes information, a transactional activity.

- In the arena of business reporting and analysis, the XBRL works unparallel in all stages of automated business reporting, more reliable, more accurate handling of data which ultimately helps one fetch the useful information for resuming the decision-making process.

- XBRL have revolutionized the time taking assembling and re- entry data processes by shifting the gear from manual to automated process. The software validates and manipulates XBRL information for being able concentrate purely on analysis.

Steps involved in Implementing the XBRL process

- Stating requirements for future reporting platform

- Analyzing the requirements after the completion of XBRL process.

- List the driving processes of XBRL implementation

- Technical issues

- Modifications in legal regulations

- International Adoption

For the communication, analysis and preparation of business information, XBRL proves a major benefit. It assures greater efficiency, accuracy, low costs and reliability for the financial data users.

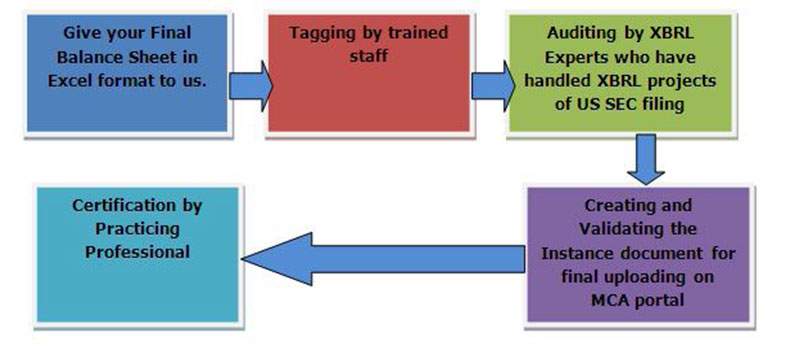

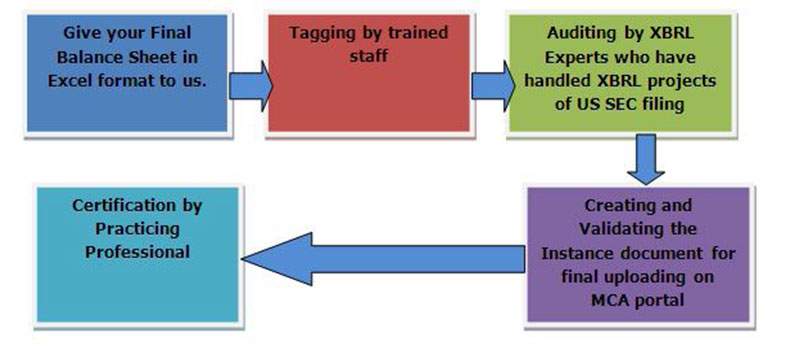

Steps Involved in Accounts Filling Process in XBRL:

- Mapping, Creation, Reviewing and Verification of XBRL document

- Download XBRL validation tool available on MCA Portal

- Validate the instance document through Validation tool’ s assistance

- Pre-scrutinize the validated instance tool

- Attach instant document along with Annual filling forms

The versatility in usability of the XBRL in financial analysis for the business and stakeholders has been confirmed and it has been declared as the useful tool for financial processes. In many companies, the XBRL as the reporting tool has been made compulsory while others are in the process. The accountants in India share huge potential for undertaking the challenges related to XBRL introduction.

What Rajput Jain & Associates Offers

Our XBRL services covers important industries like Corporations, financial printers, mutual funds and filing agents. We assure the benefit from our expert services of XBRL in preparations of accurate XBRL documents. Our well qualified, trained and experienced professionals along with technical experts are the strength of this organization. We undertake different measures for effective management of the XBRL functioning and adherence to procedures. We share specialization in XBRL, XML and document and through effective parsing of the roles we have achieved the independency of undertaking procedures.

Owing to the considerable years of experience in data tagging services and facilitation of XBRL tools we aim at curbing the pitfalls of XBRL implementation.

Below is the list of our XBRL services which we serve-

- Mapping up the financial statements with XBRL tags

- Validation services for tax and accurate calculations

- Preparation of XBRL document in XML format for e filling

- Creation of extended taxonomy as per the requirement

- Provision of “highlight” report for facilitating review and providing concurrence on tagging decisions requiring concurrence

- Added labels that require concurrence

- Converting XBRL instance document in the readable format

- E-filing XBRL data with respective authorities viz SEBI, MCA, RBI, Stock Exchange, Mutual Funds Associations.

OUR PROCESS

- We accept input data in any format be it PDF, Excel or Word without any requirement of changing the financial system model.

- Mapping of the financial data is conducted undertaking latest MCA approved Taxonomy

- Tagging of financial data

- Conversion of the reports into XBRL instance document. Our XBRL package includes Taxonomy and instance documents

- We deliver the validated XBRL package to you

WHY OUTSOURCE TO US?

- For simplifying your XBRL compliance, we leverage our years of experience in transforming the digital content and financial reporting.

- Our conversion services are priced per page or file.

- We have simple and transparent model of services

- Our services are ISO and ISMS certified and we assure quality along with turn around times.

- The minimum estimate for an Annual report is 20000-45000. You are required to submit the annual report of the previous year or in case of present year balance sheet you can submit the current annual report.

We effectively manage your XBRL elements by ridding you of high-end software and extensive manpower support. We aim at providing cost-effective, high-end technology, advanced and value-added business solutions to the companies.