New Corporate & Professional Update 2021

Page Contents

New Corporate & Professional Update:

KEY PRACTICAL TAKEAWAYS:

CBDT has issued Circular No. 12/2020 dated 20.05.2020 in order to exempt B2B suppliers with 95% or more receipts through non-cash mode to not maintain prescribed payment modes as per Section 269SU such as POS, UPI, UPI-QR, etc.

Note-These assesses can disable these facilities if they are not in operation.

CBDT released Notification No. 25/2020 dated 20.05.2020 to ensure that the ‘Safe Harbor Principles’ applied in the case of Overseas Transactions shall extend to FY 2020-21 in the same manner as those applied in previous years.

In the case of a company that opts to pay tax under the “New 22% Scheme” under Section 115BAA, the MAT credit standing in the books must be written off because you will not be eligible to claim the same amount.

Note-Carefully opt for the scheme as the blind application of the 22% tax would eventually cause you a loss.

TDS The rates have been lowered by 25 percent of the current rates, e.g. 14.05.2020. Here are a few clarifications in this regard:

- Rate cut shall not extend to TDS for non-residents u / s 195.

- The rate cut does not occur in non-PAN cases (20 percent FLAT rate) or 206AA cases.

- Decrease in the TDS rate will apply to invoices due or payments made on or after 14.05.2020, even if the invoice date is before 14.05.2020. What you’ve got to do is “Due or Fee.” When all days occur on or after 14.05.2020, the reduced rate will apply.

The due dates of ITR for FY 2019-20 have been extended to 30.11.2020 for all assesses. In fact, the due date of the tax assessment in the case of ALL the assesses has been extended to 31.10.2020.

Note-In brief, we should assume that irrespective of whether or not the assessee is subject to a tax audit OR TP audit, the above due dates are valid.

For the calculation of depreciation under the Income Tax Act, 1961 for the year 2019-20, consider the following:

- Remember the effect of the “Leap Year” (i.e. 29.02.2020) on the estimate of 180 days. This period taking 100 percent depreciation for assets underuse after “04.10.2019” instead of 03.10 earlier and 50 percent depreciation for assets underuse after “04.10.2019.”

- In the case of a company, whether you take the “22% tax limit” or 115BAA, do not take the “additional depreciation” deduction.

Holding this in mind, let us begin by reflecting on our mission and dream, and let us ensure that we have made no mistake in complying with the organization. A few General Conformities referred to in the attached photo. The business and the industry that varies in their wise compliance.

DIRECT TAX: INCOME TAX:

# The due dates of ITR for FY 2019-20 have been extended to 30.11.2020 for all assesses. In addition, the due date of the tax assessment in the case of ALL the assesses has been extended to 31.10.2020.

Note-In brief, we can say that regardless of whether or not the assessee is subject to a tax audit OR TP audit, the above due dates are applicable.

# For the calculation of depreciation under the Income Tax Act , 1961 for the year 2019-20, know the following:

- Recognize the effect of the “Leap Year” (i.e. 29.02.2020) on the measurement of 180 days. This year taking 100 percent depreciation for assets underuse before “04.10.2019” instead of 03.10 earlier and 50 percent depreciation for assets underuse after “04.10.2019.”

- In the case of a company, if you take the “22% tax rate” or 115BAA, do not take the “additional depreciation” allowance.

# TDS The rates have been decreased by 25 percent of the current rates, e.g. 14.05.2020. Here are a few clarifications in this regard:

- The rate decrease shall not apply to TDS for non-residents u / s 195.

- The rate cut does not extend to non-PAN cases (20% FLAT Limit) u / s 206AA.

- The change in the TDS rate would refer on invoices due or purchases received on or after 14.05.2020, even though the invoice date is before 14.05.2020. What you’ve got to see is “Due or Payment.” If all dates occur on or after 14.05.2020, the reduced rate will apply.

INDIRECT TAX: GOODS & SERVICES TAX:

# Filing of GST Return is compulsory along with payment in case of opting for 15 days stress relief of GSTR-3B filing for taxpayers with a turnover of more than INR 5 crores.

Note-If you pay tax under Cash Ledger and do not file GSTR-3B within the due date + 15 days period, you will have to pay interest at 9 per cent before 24.06.2020.

Transitional Forms-Review of Form GST TRAN-01:

- The facility to revise Form GST TRAN-01 has been enabled for taxpayers who have already filed it.

- If the revision results in downward credit, the taxpayer should only be able to file it if he has a sufficient balance in his credit note.

- Taxpayers who register it for the first time will not be able to update it instantly.

- The TRAN-01 revision functionality for those who do not meet the above criteria will soon be enabled.

# GST Portal has enabled the Input Service Distributor (ISD) facility to adjust negative ITC to its Units in case no ITC is to be distributed for a month and ISD has to distribute ITC reversal through CN.

CGST: establishes the date for the coming into force of the provisions of Section 128 of the Finance Act 2020 relating to the amendment of Section 140 of the CGST Act, which stipulates the manner and time limit for the taking of transitional loans. In our opinion, they are pushing for this amendment following the judgment of the Delhi High Court of Reliance Electric Works in which it was held that the restriction term (3 years) is to be extended as no time limit has been laid down in the CGST Act.

Popular article :Tax filing Changes are taken into account when filing ITR for FY-2019-20

How to e-file a return using EVC without sending a signed copy of ITR-V?

Delayed in payment of GST then Intt to be paid on net GST liability from Sep 1, 2020.

Effect of GST on Advertisement and Cinema Industry

CORPORATE & ALLIED LAWS:

# In the case of a company where up to 100 employees are working and out of which ninety percent are paying less than INR 15,000, no employer and employee contribution (24 percent) will be payable and the whole payment will be charged by the Government. Until August 2020.

# In the case of other PF organisations (not mentioned above), the Contractor and Employee share is expected to be charged at 10% each (means 20% instead of 24%) in June , July and August, 20.

# The government. Plans to extend the ESI Act to all businesses that have 10 or more employees and the region-wise provisions that have already been issued would expire.

# There is no need to file the ADT-1 form in the case of the first appointment of an auditor since the ADT-1 file is governed by Section 139(1) and the first auditor is appointed pursuant to Section 139(6) and not pursuant to Section 139(1) of the Companies Act 2013.

# In the event of the removal of the auditor, the new auditor appointed in place of the previous auditor may hold office only up to the next AGM date and not for a period of five years. You will name such an auditor again at the next meeting of the AGM.

# The government. Subsequently, the amendment to Section 140 of the CGST Act 2017 was notified in order to provide the legislative authority to have a time limit for the claim of transitional credit and the invalidation of Delhi HC ‘s decision to offer a time limit for the claim of transitional credit until 30.06.2020.

# whilst still trying to prepare GSTR-9 (Annual Return) for FY 2018-19, in scenario you have paid less tax in your GSTR-3B, you will have to pay the balance tax along with Interest by filing DRC-03 through the common portal.

Note-If paid in DRC-03, the auditor shall not recommend any responsibility in GSTR-9C.

# GST Portal has allowed the Input Service Distributor (ISD) facility to change negative ITC to its Units in the event that no ITC is to be delivered for a month and ISD is needed to distribute ITC reversal via CN.

# Filing of GST Return is compulsory along with payment in case of opting for 15 days relaxation of GSTR-3B filing for taxpayers with a revenue of more than INR 5 crores.

Note-If you pay tax under Cash Ledger and do not file GSTR-3B within the due date + 15 days period, you will have to pay interest at 9 percent before 24.06.2020.

Corporate & Allied law:

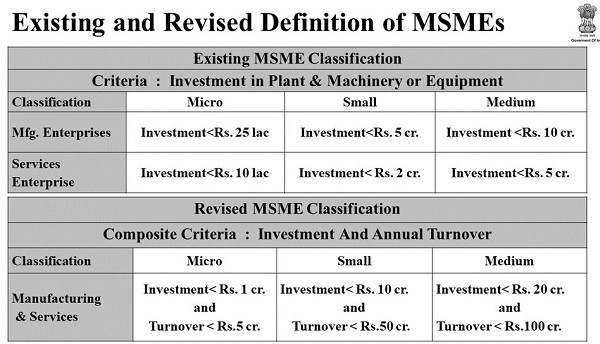

MSME Definition: MSME is divided into two main categories:

- Manufacturing enterprise; and

- Service enterprise.

They are described as below in terms of investment in plant and machinery/equipment.

Illustration 1.

- Investment: 50 Lakhs

- Turnover: 4 Cr

As investment is less than 1 Cr and Turnover is less than 5 Cr. It fulfilled both conditions of the Micro category. Hence, it is a Micro-Enterprise.

Illustration 2.

- Investment: 2 Cr

- Turnover: 4 Cr

As investment is more than 1 Cr. Therefore, it is outside the purview of Micro Enterprise. As investment is less than 10 Cr and Turnover is less than 50 Cr. It fulfilled both conditions of the small category. Hence, it is a Small Enterprise.

Illustration 3.

- Investment: 2 Cr

- Turnover: 60 Cr

As turnover is more than 60 Cr. Therefore, it is outside the purview of Small Enterprise. As investment is less than 20 Cr and Turnover is less than 100 Cr. It fulfilled both conditions of the medium category. Hence, it is a Medium Enterprise.

# In the case of a corporation formed between 01.01.2020 and 31.03.2020, there is no annual compliance with FY 2019-20 except for the appointment of an auditor to the Board of Directors (no requirement for ADT-1) and the submission of an ITR. In other words, the following:

- There is no need to schedule FS for these three months and the first FS will be prepared as of 31.03.2021.

- There is no need to schedule the first AGM now and the due date of the First AGM will be 31.12.2021.

- There is no need to file MGT-7 (Annual Return), AOC-4 (FS Filing).

Note-For the tax audit of these firms for these three months, Form 3CB-3CD (not 3CA-3CD) must be used.

# MCA explained w.r.t. timelines and length of name allocation, name transition, and resubmissions as follows:

- Approved NEW Names from 15.03.2020 to 31.05.2020 will be held until 20.06.2020.

- Approved CHANGE in Names expiring between 15.03.2020 and 31.05.2020 will be reserved until 30.07.2020.

- Resubmission of any MCA type on which the last resubmission date expired between 15.03.2020 and 31.05.2020 has been extended until 15.06.2020.

# The government. Notified lowered PF prices (10 percent instead of 12 percent) for all workplaces for the months of May, June, and July 2020 for both employers and workers. If the employer contribution is still part of the CTC, you will take home 4 percent of the diminished contribution otherwise it will save 2 percent for the company and raise the employee ‘s profitability by 2 percent.

Note-You may also contribute more than 10%.

# In the case of an organisation where up to 100 workers are working and out of which 90 percent are paying less than INR 15,000, no employer and employee payment (24 percent) will be payable and the whole payment will be borne by the State. Before August 2020.

# In the case of other PF companies (not mentioned above), the Contractor and Employee share is expected to be charged at 10% each (means 20% instead of 24%) in June, July and August, 20.

# The government. Plans to extend the ESI Act to all businesses that have 10 or more employees and the region-wise provisions that have already been issued would expire.

# There is no need to file the ADT-1 form in the case of the first appointment of an auditor because the ADT-1 file is regulated by Section 139(1) and the first auditor is named pursuant to Section 139(6) and not pursuant to Section 139(1) of the Companies Act 2013.

# In the event of the termination of the auditor, the new auditor named in place of the previous auditor may hold office only up to the next AGM date and not for a term of five years. You will name such an auditor again at the next meeting of the AGM.

Read our articles:

New Online filing eForm DIR-3 eKYC Directors

Compliance for Foreign Subsidiary Companies in India

Insolvency (IBC)

- Debt accrued or sustained in a corona case shall not be included in the default.

- No current insolvency up to 1 year

- In the case of small and medium-sized companies, separate insolvency of 240A IBC and a minimum requirement of Rs . 1 Lakes to 1 Crore should be imposed.

Conveyance Deed Cancelled:

Flat owners must sign their names in the Land Tax Card / Municipal Registry. This was accepted by the Maharashtra State Cabinet in Principle at its meeting held yesterday.

The New Legislation will be passed to Surpass The Continuation of the Conveyance Contract. Draft New Law will be Available in Few Weeks and the Law will be approved at the Budget Session or Monsoon session of the Maharashtra Legislative Assembly. Now experience Land Ownership along with Flat.

Supreme Court Decision on the transition of Flat to Nominee. Land Mark Judgment

- Deceased Member Nominee is entirely entitled to Ownership through the transition to the Co-op Society.

- Society Can’t Challenge the Right to Nominate a Land Law.

- No legitimate inheritance, no court order or certificate of succession is required.

- Please Circulate, Essential to Members of the Society and Office Bearers.

- After the nomination is registered with the organization You Don’t Need

-

- To Prove Legal Heirship.

- No Further Court Order Required.

- No Succession Certification

Thus, Transfer to Registered Nominee is Automatic.

KEY DUE DATE:

Tax on income:

30.06.2020 is the due date for filing Form 61A (SFT Compliance) in the event that you have such substantial financial transactions as the issue of shares worth more than INR 10 lakhs.

Note-In the case of no such SFT activity, the tax audit assesses are required to file the “Preliminary SFT Reponse” on the e-filing platform by the said due date.

07.06.2020 is the due date for payment of TDS / TCS for the month of May 2020.

30.06.2020 is the due date for the TDS / TCS returns file for Q4 (F.Y. 2019-20).

30.06.2020 is the due date for the ITR / Revised ITR register for the 2018-19 fiscal year.

Note-The ITR for FY 2017-18 can not now be submitted as the due date for the paper lapsed.

31.05.2020 is the due date for filing Form 61A (SFT Compliance) in the event that you have such substantial financial transactions as the issue of shares worth more than INR 10 lakhs.

AS on the 20 may 2021 Update

- Income tax Returns for Assessment year 2021-22 (Other Than Tax Audit & of Corporations) can be filed until September 30th, 2021.

- The deadline for submitting an income tax audit report for the FY 2021-22 is October 31, 2021.

- Tax Deducted at Source (TDS) Returns for the fourth quarter of the fiscal year 2020-21 can be filed without any additional fees until June 30, 2021.

- Income tax returns for the Assessment year 2021-22 can be filed up to the 30th of November 2021 in the case of a tax audit and for companies.

- The FY 2020-21 Statement of Financial Transactions (SFT) can now be filed until June 30, 2021.

Key DUE DATE:

07.06.2020 is the due date for payment of TDS / TCS for the month of May 2020.

30.06.2020 is the due date for the TDS / TCS returns file for Q4 (F.Y. 2019-20).

30.06.2020 is the due date for the ITR / Revised ITR file for the financial year 2018-19. Note-The ITR for FY 2017-18 cannot now be filed as the due date for the file lapsed.

04.06.2020 is the due date for filing GSTR-3B for the month of April 2020 in the case of taxpayers with a gross turnover of more than INR 5 cores in the previous year.

Note-You can delay filing beyond GSTR-3B until 24.06.2020 without any late fees but with 9 percent p.a. Responsibility for value.

31.05.2020 is the due date for filing Form 61A (SFT Compliance) in the event that you have such significant financial transactions as the issuance of shares of more than INR 10 lakhs. Note-In the event of no such SFT transaction, the tax audit assesses are required to file the “Preliminary SFT Response” on the e-filing portal by the said due date.

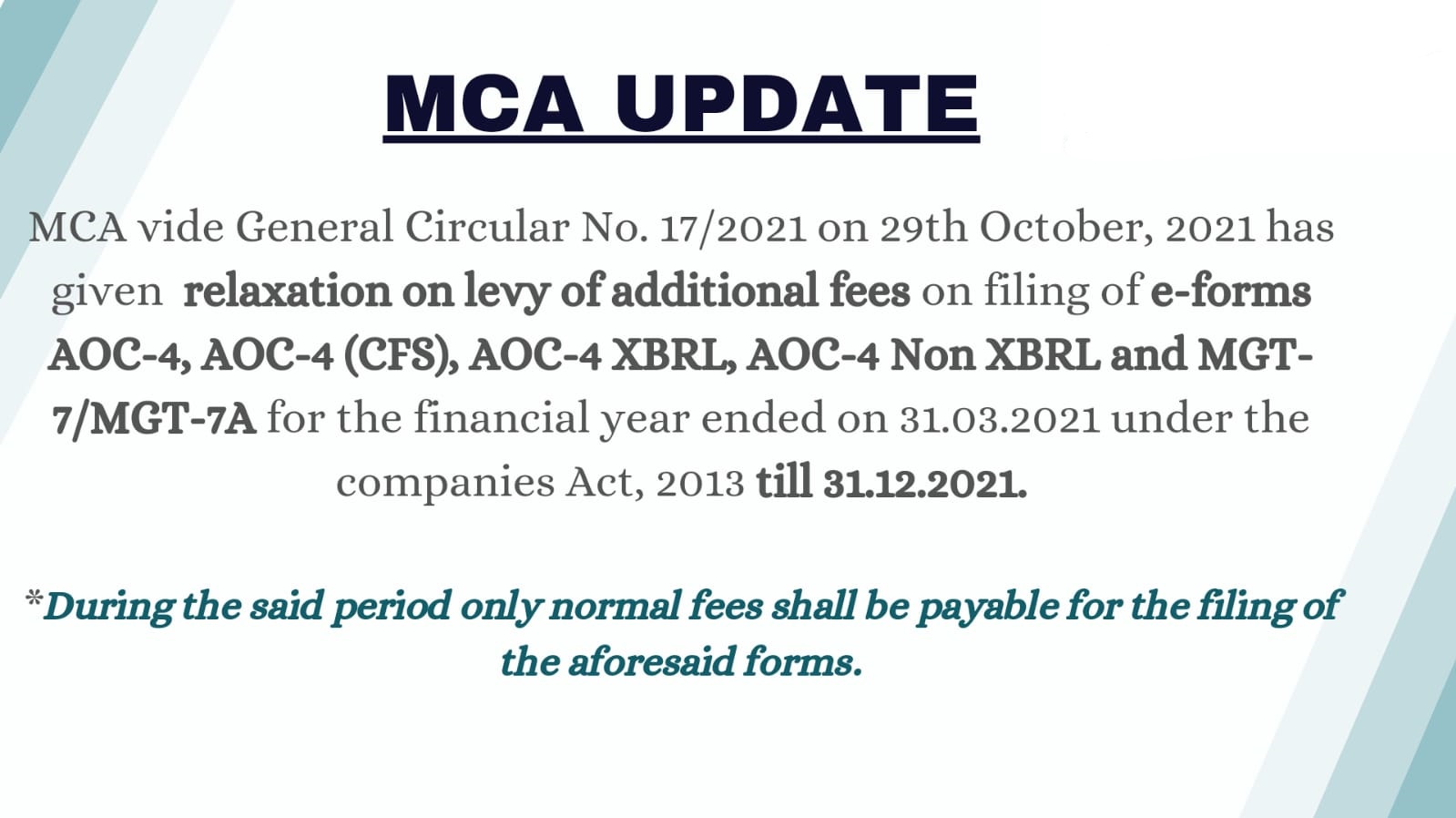

MCA has revealed a “Moratorium Period” from 01.04.2020 to 30.09.2020 for the filing of ROC Forms and no additional fees will be charged for that period due to the late filing of any form due within that period

Goods and Services Tax

04.06.2020 is the due date for filing GSTR-3B for the month of April 2020 in the case of taxpayers with a gross turnover of more than INR 5 crores in the previous year.

Note-You can delay filing above GSTR-3B until 24.06.2020 without any late fees but with 9 percent p.a. Responsibility for interest.

Corporate & Allied law:

# MCA has declared a “Moratorium Period” from 01.04.2020 to 30.09.2020 for the filing of ROC Forms and no further penalties will be paid during this time due to the late submission of any form submitted during this time.

We hope that no deadline will be skipped because of COVID-19.

Please feel free to return should you have any questions or uncertainty.

“Ups and downs are part of life, but to change this time of crisis into a time of opportunity is what gives us a special identity”

Post by Rajput Jain & Associates