Auto-populated Details in into GSTR-1 & GSTR-3B

Page Contents

GSTN enable auto-populated in the E-invoice information into GST Return -1

GSTN made aware on 13 Nov 2020 that the details of the E-invoice would be auto-populated in GSTN-1. The document in its full is as follows:

- Some informed taxpayers must plan and file their invoices by receiving an Invoice Reference Number (IRN) from the Invoice Registration Portal (IRP) (commonly referred to as ‘e-invoices’).

- Upon the effective generation of IRN, the descriptions of such e-invoices will be auto-populated in the respective GSTR-1 tables. Information of available e-invoices for auto-population along with auto-population status can also be downloaded as an excel file.

- Certain tabs/labels are added to the GSTR-1 dashboard and screens (Those taxpayers for whom e-invoicing is not applicable may ignore these changes).

- For the duration in the month of October 2020, the details of the e-invoice will be issued on a gradual basis from 13 November 2020. The processing of the e-invoices/IRNs generated until 31 October 2020 is supposed to take up to 10 days.

- The processing of documents dated Oct 2020 has no effect on the filing of GSTR-1 for October. Taxpayers are suggested not to wait for self-population, but to file GSTR-1 for October, on their own (if it hasn’t already filed).

- But you may download the details of the October-dated documents via the excel file: ‘Download details from the e-invoice (Excel)’ button (available at the bottom of the GSTR-1 dashboard).

- Taxpayers are needed to check the below documents in excel & to share feedback on the GST Self Service Common Portal, below:

-

- All of the specifics of the document are correctly stored

- The status of each e-voucher/IRN is correct

- All documents reported to the IRP are in excel.

- For the period of November 2020, the produced e-invoices (i.e. memos dated the month of November) will be auto-populated into GSTR-1 on an incremental basis and the whole month process will be done by 2 Dec, 20 (i.e. on a T+2 basis).

The Below fields must be mandatory be declared in an e-invoice:

| Sl. no. | Name of the field | Particular | List of Choices/ Specifications/Sample Inputs |

| 1 | Document Type Code | Type of document must be specified | Enumerated List such as INV/CRN/DBN |

| 2 | Supplier_Legal Name | The legal name of the supplier must be as per the PAN card | String Max length: 100 |

| 3 | Supplier_GSTIN | GSTIN of the supplier raising the e-invoice | Max length: 15 Must be alphanumeric |

| 4 | Supplier_Address | Building/Flat no., Road/Street, Locality, etc. of the supplier raising the e-invoice | Max length: 100 |

| 5 | Supplier_Place | Supplier’s location such as city/town/village must be mentioned | Max length: 50 |

| 6 | Supplier_State_Code | The state must be selected from the latest list given by GSTN | The enumerated list of states |

| 7 | Supplier Pincode | The place (locality/district/state) of the supplier’s locality | Six digit code |

| 8 | Document Number | For unique identification of the invoice, a sequential number is required within the business context, time-frame, operating systems, and records of the supplier. No identification scheme is to be used | Max length: 16 Sample can be “ Sa/1/2019” |

| 9 | Preceeding_Invoice_Reference and date | Detail of original invoice which is being amended by a subsequent document such as a debit and credit note. It is required to keep future expansion of e-versions of credit notes, debit notes, and other documents required under GST | Max length:16 Sample input is “ Sa/1/2019” and “16/11/2020” |

| 10 | Document Date | The date when the invoice was issued. However, the format under explanatory notes refers to ‘YYYY-MM-DD’. Further clarity will be required. Document period start and end date must also be specified if selected. | String (DD/MM/YYYY) as per the technical field specification |

| 14 | Recipient’s State Code | The place of supply state code to be selected here | Enumerated list |

| 15 | Place_Of_Supply_State_ Code | The state must be selected from the latest list given by GSTN | An enumerated list of states |

| 20 | Shipping To_State, Pincode and State code | State pertaining to the place to which the goods and services invoiced were or are delivered | Max length: 100 for state, 6 digit Pincode and enumerated list for code |

| 21 | Dispatch From_ Name, Address, Place and Pincode | Entity’s details (name, and city/town/village) from where goods are dispatched | Max length: 100 each and 6 digit for Pincode |

| 25 | HSN Code | The applicable HSN code for particular goods/service must be entered | Max length: 8 |

| 26 | Item Price | The unit price, exclusive of GST, before subtracting item price discount, can not be negative | Decimal (12,3) Sample value is ‘50’ |

| 27 | Assessable Value | The price of an item, exclusive of GST, after subtracting item price discount. Hence, Gross price (-) Discount = Net price item, if any cash discount is provided at the time of sale | Decimal (13,2) Sample value is ‘5000’ |

| 28 | GST Rate | The GST rate represented as a percentage that is applicable to the item being invoiced | Decimal (3,2) Sample value is ‘5’ |

| 29 | IGST Value, CGST Value, and SGST Value Separately | For each individual item, IGST, CGST and SGST amounts have to be specified | Decimal (11,2) Sample value is ‘650.00’ |

| 30 | Total Invoice Value | The total amount of the Invoice with GST. Must be rounded to a maximum of 2 decimals | Decimal (11,2) |

| 16 | Pincode | The place (locality/district/state) of the buyer on whom the invoice is raised/ billed to must be declared here if any | Six digit code |

| 17 | Recipient Place | Recipient’s location (City/Town/Village) | Max length: 100 |

| 18 | IRN- Invoice Reference Number | At the time of the registration request, this field is left empty by the supplier. Later on, a unique number will be generated by GSTN after uploading of the e-invoice on the GSTN portal. An acknowledgment will be sent back to the supplier after the successful acceptance of the e-invoice by the portal. IRN should then be displayed on the e-invoice before use. | Max length: 64 Sample is ‘a5c12dca8 0e7433217…ba4013 750f2046f229’ |

| 19 | ShippingTo_GSTIN | GSTIN of the buyer himself or the person to whom the particular item is being delivered to | Max length: 15 |

| 11 | Recipient_ Legal Name | The name of the buyer as per the PAN | Max length: 100 |

| 12 | Recipient’s GSTIN | The GSTIN of the buyer to be declared here | Max length: 15 |

| 13 | Recipient’s Address | Building/Flat no., Road/Street, Locality, etc. of the supplier raising the e-invoice | Max length: 100 |

| 22 | Is_Service | Whether or not the supply of service must be mentioned | String (Length: 1) by selecting Y/N |

| 23 | Supply Type Code | Code will be used to identify types of supply such as business to business, business to consumer, supply to SEZ/Exports with or without payment, and deemed export. | The enumerated list of codes Sample values can be either of B2B/B2C/ SEZWP/S EZWOP/E XP WP/EXP WOP/DE XP |

| 24 | Item Description | Simply put, the relevant description generally used for the item in the trade. However, more clarity is needed on how it needs to be described for every two or more items belonging to the same HSN code | Max length: 300 The sample value is ‘Mobile’ The schema document refers to this as the ‘identification scheme identifier of the Item classification identifier’ |

- Comprehensive advice on self-population methodology etc is made available on the GSTR-1 dashboard (‘e-invoice advisory’) and e-mailed to the relevant taxpayers.

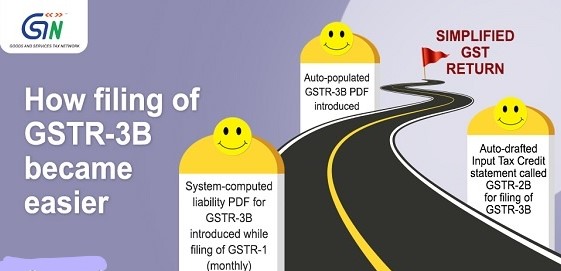

WHY AUTO-GENERATED GSTR-3B -TAXPAYERS LIFE GET EASIER

- In recent times, the Auto-Population of System-Computed Details in Form GSTR-3B has been enabled for taxpayers (filing their Form GSTR-1 on a monthly basis) from November 2020 onwards. The auto-population is characterized by the following:

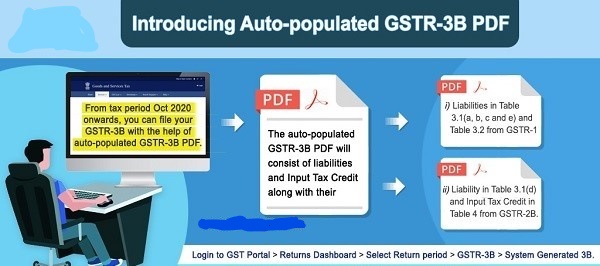

- Liabilities in Tables3.1 (External Supplies Tax) & 3.2 (Inter-State Supplies) of Form GSTR-3B (with the exception of Table-3.1(d) on inward supplies subject to reverse charges) are calculated by the system on the basis of outward supply information as filed in Form GSTR-1 for the tax period.

- Input Tax Credit (ITC) particulars and details of inward supplies subject to a reverse charge to be reported in Tables-4 and 3.1(d) are calculated as per the system-generated form GSTR-2B for the tax period.

- Auto-generated GSTR-3B Available in PDF: The table-wise value computation, which is auto-populated in GSTR-3B form, is granted access in PDF format on the GST platform. The same can be downloaded by having to click on the “GSTR-3B Generated System” tab.

The system-generated PDF will be made now available on the GSTR-3B portal. Taxpayers will be able to access their Form GSTR-3B (PDF) through:

Login to GST Portal > Returns Dashboard > Select Return period > GSTR-3B> System Generated 3B.

Measure Specifications:

- These values are calculated from the system as self-populated values, which are intended solely to help the assessee to provide its form GSTR-3B. The assessee needs to ensure that the facts and figures presented in the form GSTR-3B are correct.

- The assessor may modify the auto-populated values in the form of GSTR-3B. The alert message will be sent to the assessor on a system where the deviation of the corrected data via the auto-populated data is more than just a set threshold.

- If the taxpayer does not provide the GSTR-1 form for the period, the system-generated synopsis will constitute the respective values as ‘Not filed.’ If Form GSTR-2B is not created for the time frame then ‘Not created’ will be prompted for the system to create a summary

- In the form GSTR-3B, if the taxpayer inserted and saved the data before auto-population by the system, the saved data will not be revised by the system.

- Tables 5 and 6.2 of the GSTR-3B Form is not part of the PDF and do not auto-populate through the framework.

Be careful:

- In view of the above, and since there is no facility for submitting modified GST returns, the taxpayer should take particular precautions when there is any mistakes or losing outs while e-filing Form GSTR-1, as these particulars will be auto-populated to GSTR-3B. Taxpayers need to identify and rectify each table while filing the GSTR-3B form.

- It is also important to check the ITC auto-populated from GSTR-2B and to take credit only if the other requirements laid down in the GST legislation for the use of GST Credit are met, such as accessibility of a tax invoice, payment to the vendor within the specified time period, block credits, etc.

- Now because of this self-population facility with a view to simplifying of business and enhancing the taxpayer with regard to the output liability mapped out in GSTR 1 duly filled by it, hoping that the history of technical problems will not be conducted and the required clarifications/updates will be provided by the GST authorities.

Know Facts about incorrect filing GSTR 3B!

- The GST department has made a series of operational changes and new ways of evaluating businesses.

- We are here with the GSTR 3B Facts series, and discusses all these modifications, to make you aware of all these changes.

We will discuss the first fact/consequence of not filing a return on time.

- Registration Notice of suspension on Mismatch grounds

Rule 21(2A) of CGST Rules 2017

- The outward supply shown in GSTR 1 and the Input Tax Credit as shown in GSTR 2A is contrasted by the Govt. Using EDW-ADVAIT Mechanism software with the value reflected in GSTR 3B.

- The GST officer has the power to suspend your registration certificate if there is a substantial mismatch between the two figures and then give you a notice to understand the reasons according to Rule 21(2A) in Form REG 31.

Click here to find FORM REG 31

- The worst element is that the GST law allows officers to punish businesses with suspension before allowing them a chance to justify the mistakes, unlike all other laws where the accused is given a chance to explain his/her case before getting the punishment.

- Sophisticated systems that are capable of identifying pattern disturbances with the power of AI and BI are also on track to improve further by Govt.

With the late filing of returns, the same kind of problems will happen

What should I do?

- With regulations getting stricter by the day, enhancing the way you treat your tax data and business is also essential for you.

- At all times, you must use GST software that reconciles GSTR 2A, GSTR 1, and GSTR 3B and notify you of issues just as they arise. Your software must define key ratios and recognize red flags to enable the Department to take action and correct mistakes.

If you still have doubts about filing GSTR 3B or do not confidence reconciliation and want to strengthen your understanding of business and data.

You are always welcome, we the Rajput Jain and Associates will help you get a realistic understanding of how your company is treated by the Department and avoid all sorts of potential problems!!!

You may like a few other posts

- GST Return compliances calendar- Nov 2020

- SALIENT FEATURES OF NEW GST SYSTEM IN INDIA

- Key points of 42nd GST council Meeting headed By FM N. Sitharaman

- GSTN enable auto-populated in the E-invoice information into GST Return -1

- Delayed in payment of GST then Intt to be paid on net GST liability from Sep 1, 2020.