ALL ABOUT SECTION 206C(1H)

Page Contents

ALL ABOUT SECTION 206C(1H)

| BASIS | SECTION 194Q | SECTION 206C(1H) |

| OBLIGATION | BUYER | SELLER |

| TURNOVER LIMIT TO DETERMINE APPLICABILITY | PREVIOUS YEAR TURNOVER/ GROSS RECEIPTS OF BUYER EXCEEDS 1 0CR | PREVIOUS YEAR TURNOVER/ GROSS RECEIPTS OF SELLER EXCEEDS 10CR |

| EFFECTIVE DATE | 1ST JULY, 2021 | 1ST OCTOBER 2020 |

| THRESHOLD LIMIT | PURCHASE IN EXCESS OF 50 LACS FROM EACH SELLER DURING THE YEAR | SALE IN EXCESS OF 50 LACS TO EACH BUYER DURING THE YEAR |

| TIME OF DEDUCTION/ COLLECTION | BILL OR PAYMENT WHICHEVER IS EARLIER | AT THE TIME OF RECEIPT |

| PRESCRIBED RATE | 0.10% | 0.10% |

| HIGHER RATE WHERE PAN IS NOT AVAILABLE | 5% | 5% |

| RETURN FORM | 26Q | 27EQ |

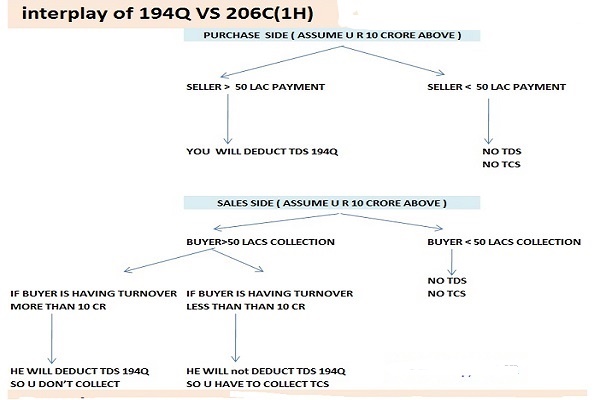

In case, a transaction falls within the ambit of both the sections- 194Q and 206C(1H), the following treatment be done –

| SITUATION | TDS/ TCS APPLICABLE PROVISION |

| TURNOVER IN PRECEDING FY BUYER >10 CR, SELLER<10CR | 194Q: BUYER TO DEDUCT TDS |

| TURNOVER IN PRECEDING FY BUYER <10 CR, SELLER>10CR | 206C(1H): SELLER TO COLLECT TCS |

| TURNOVER IN PRECEDING FY BUYER >10 CR, SELLER>10CR | 194Q: BUYER TO DEDUCT TDS |

| TURNOVER IN PRECEDING FY BUYER <10 CR, SELLER<10CR | NOTHING APPLICABLE |

| ADVANCE PAID BY BUYER ON OR AFTER 1ST JULY 2021 | 194Q WILL BE APPLICABLE AS TRIGGER POINT FOR 1 94Q IS EARLIER OF PAYMENT OR CREDIT OF SUCH SUM TO THE SELLER |

| ADVANCE PAID BY BUYER ON OR BEFORE 30TH JUNE 2021 | SELLER WILL COLLECT TCS ON SUCH TRANSACTION U/S 206C(1H), SINC THE TRIGGER POINT FOR DEDUCTION OF TDS IS PAYMENT OR CREDIT WHICHEVER IS EARLIER. THUS, TDS DEDUCTED U/S 194Q SHALL NOT BE APPLICABLE WHERE PAYMENTS ARE MADE BEFORE 30TH JUNE 2021. |

IMPORTANT OBSERVATIONS REGARDING 194Q

- Just in case the client is in non-compliance under section 194Q then the supplier is required to collect TCS under section 206C(1H) on such transactions.

- In respect of FY 20-21, the aggregate value of purchase shall be calculated with effect from 1st April, 2021, however, the provisions of the section shall be applicable with effect from 1st July, 2021.

- For the aim of section 194Q, purchase includes the purchase of capital goods as well.

NON-COMPLIANCE’S WITH SECTION 194Q

- Section 40a(ia): Just in case of default u/s 194Q, 30% of such purchase amount on which tax is deductible shall be disallowed under section 40a(ia).

- Section 201(1A): Just in case of default in deduction of tax or in depositing the tax after deduction, the assesses are going to be at risk of pay interest as per the following prescribed rate –

-

- @ 1% per month or a part of a month for default of non-deduction of TDS. The said period involves the period from the date from which such TDS be deductible, till the date on which such tax be actually deducted; and

- @ 1.5% per month or a part of a month for default of non-deposit of TDS deducted. The said period involves the period from the date from which such TDS has been deducted, till the date on which such tax be truly paid

- Section 271C: Penalty is levied under this section just in case of failure to deduct tax at source, akin to the number of taxes which the person, who failed to deduct or collect tax, shall be imposed by the Joint Commissioner.

AUDIT PROCEDURES

- Reconciliation of sales and purchases with Form 26 AS

Before the introduction of sections 194Q and 206C(1H), sales and purchases of products were out of the purview of TDS/ TCS. However, now Form 26 AS is further audit evidence to verify/ confirm the numerous revenues and buy of products transactions.

- Implications in tax audit

Under clause 34a of the shape 3CD, where auditor is required to investigate overall TDS/ TCS compliances by the assessee, detailed reconciliation may need to run for these newly added sections.

- Implication on calculation of income tax provision and interest thereon, if any

In case of non-compliances with the provisions of these sections, disallowances, interest and penalty will be welcomes by the taxpayer.

Auditors are required to diligently consider the identical for creation of provision for taxes within the books of account and also for the calculation of income tax liability and its consequent impacts in deferred taxes.