Overview of TDS Under Section 206AB & 206CCA

Page Contents

Overview of TDS Under Section 206AB & 206CCA

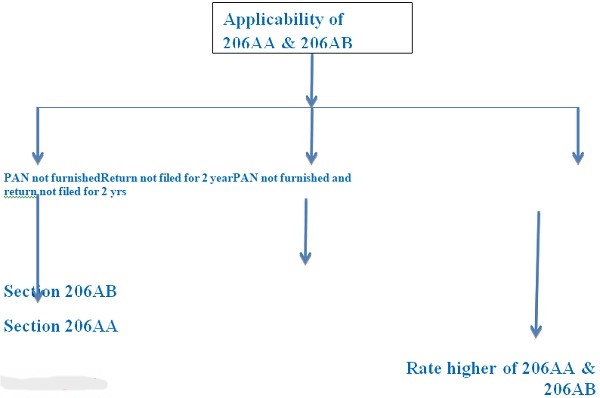

Section 206AB and 206CCA, effective from national holiday, 2021, primarily requires for deduction (TDS) and collection (TCS) of tax respectively at a higher rate* for the required person.

A specified person could be a person

- Who has not filed tax returns for two assessment years relevant to the previous years immediately before the previous year during which tax is required to be deducted/ collected?

- The date to file such return of income, as prescribed under Section 139(1), has expired

- The aggregate amount of tax deducted at source (TDS) amounts to Rs. 50,000 or more, for each of the previous 2 years.

NEW SECTION 206AB/ 206CCA

| HIGH RATE OF TDS ON NON-FILERS OF ITR UNDER SECTION 206AB | HIGH RATE OF TCS ON NON-FILERS OF ITR UNDER SECTION 206CCA |

| APPLIES WHERE THE DEDUCTEE FAILS TO FURNISH TO FURNISH THEIR ITR FOR 2 FINANCIAL YEARS, IMMEDIATELY PRECEDING THE FINANCIAL YEAR IN WHICH THE TDS IS REQUIRED TO BE DEDUCTED. | APPLIES WHERE THE DEDUCTEE FAILS TO FURNISH TO FURNISH THEIR ITR FOR 2 FINANCIAL YEARS, IMMEDIATELY PRECEDING THE FINANCIAL YEAR IN WHICH THE TCS IS REQUIRED TO BE COLLECTED. |

| SPECIFIED PERSON –

A PERSON IS SAID TO BE A SPECIFIED PERSON, WHERE ALL THE FOLLOWING CONDITIONS ARE FULFILLED –

|

|

| EXEMPTED

WHERE THE INCOME IS REQUIRED TO BE DEDUCTED UNDER THE FOLLOWING SECTIONS – · SECTION 192 · SECTION 192A · SECTION 194B, 194BB HOWEVER, THIS EXEMPTION SHALL NOT BE AVAILABLE TO A NON-RESIDENT, NOT HAVING A PERMANENT ESTABLISHMENT IN INDIA. |

EXEMPTED

WHERE INCOME IS RECEIVED BY ANY NON-RESIDENT NOT HAVING A PERMANENT ESTABLISHMENT IN INDIA |

| RATE WOULD BE HIGHER OF –

· AT TWICE THE RATE, BEING SPECIFIED IN RESPECTIVE PROVISION. · AT TWICE THE RATE OR RATES THAT ARE THERE IN FORCE.

|

RATE WOULD BE HIGHER OF –

· AT TWICE THE RATE, BEING SPECIFIED IN THE RESPECTIVE PROVISION.

|

| ALSO, WHERE THE DEDUCTEE FAILS TO FURNISH HIS PAN TO THE DEDUCTOR, TDS BE DEDUCTED @ PROVIDED IN THIS SECTION OR IN SECTION 206AA, HIGHER OF THE RATES

RATE UNDER SECTION 206AA: HIGHER OF: I) RATE BEING SPECIFIED IN THE RESPCETIVE PROVISION; II) RATE OR RATES THAT ARE THERE IN FORCE; OR III) 20%. CONCLUSION: WHERE THE DEDUCTEE FAILS TO FURNISH HIS PAN AS WELL AS ITR FOR 2 CONSECUTIVE PREVIOUS YEARS, TDS BE DEDCUTED AT HIGHER OF: 1) TWICE THE RATE, BEING SPECIFIED IN THE RESPECTIVE PROVISION OF THE ACT 2) TWICE THE RATE OR RATES THAT ARE THERE IN FORCE; OR 3) 20%. |

ALSO, WHERE THE COLLECTEE FAILS TO FURNISH HIS PAN TO THE COLLECTOR, TCS COLLECTED AT THE RATES PROVIDED IN THIS SECTION OR IN SECTION 206CC, HIGHER OF THE RATES

RATES UNDER SECTION 206CC: HIGHER OF: I) TWICE THE RATE, BEING SPECIFIED IN SECTION 206C; II) 5%. CONCLUSION: WHERE THE COLLECTEE FAILS TO FURNISH HIS PAN AS WELL AS ITR FOR 2 CONSECUTIVE PREVIOUS YEARS, TCS BE COLLECTED AT HIGHER OF: 1) TWICE THE RATE, BEING SPECIFIED IN SECTION 206C; 2) 5%. |

|

IN CASE, THE PROVISION OF SECTION 206AA IS ALSO APPLICABLE TO SPECIFIED PERSON APART FROM THIS SECTION, TDS BE DEDUCTED AT THE RATE HIGHER OF RATES DETERMINED U/S 206AA & 206AB.

|

WHERE THE PROVISION OF SECTION 206CC IS ALSO APPLICABLE TO A SPECIFIED PERSON, APART FROM THIS SECTION, TCS BE COLLECTED AT THE RATE HIGHER OF RATES DETERMINED U/S 206CC & 206CCA |

| THE SECTIONS SHALL BE EFFECTIVE FROM 1st JULY 2021. | |

IMPORTANT INTERPRETATIONS

- As mentioned above, the definition of a specified person includes those who have not filed the ITR for both the applicable assessment years. Hence if the person has filed a return for even one among the 2 applicable assessment years, provision of this section wouldn’t apply.

- This section doesn’t give any exception to the persons who don’t seem to be required to file ITR. Hence, this section is going to be applicable if the person has not filed ITR for the relevant applicable two assessment years, although he might not be prone to file the ITR under the provisions of tax Act, 1961.

Our Comments

- With the introduction of two new sections, namely section 206AB and 206CCA, there has been an additional compliance burden being imposed on the taxpayers/assessee.

- Earlier, the assessee wont to only enkindle PAN of the deductee/ collectee. If PAN wasn’t available TDS/TCS was made at a better rate.

- But now from 1st July 2021, the assessee also will have to check whether such person has filed its ITR or not for last 2 financial years. Further, he also must check whether the TDS/TCS amount in such 2 years was Rs. 50,000 or more.

- With the introduction of these sections, the taxpayer is ought to be quite careful in deducting TDS or collecting TCS. They are required to be prepared, in order to gather the copy of their client’s ITR and also Form 26AS to comply sections 206AB & 206CCA.

- There’s no rationale behind these sections. the govt is simply casting additional responsibility upon the assessee which was undoubtedly an obligation of the govt to confirm that the ITR is filed by the person who is liable for deduction/collection of TDS/TCS.

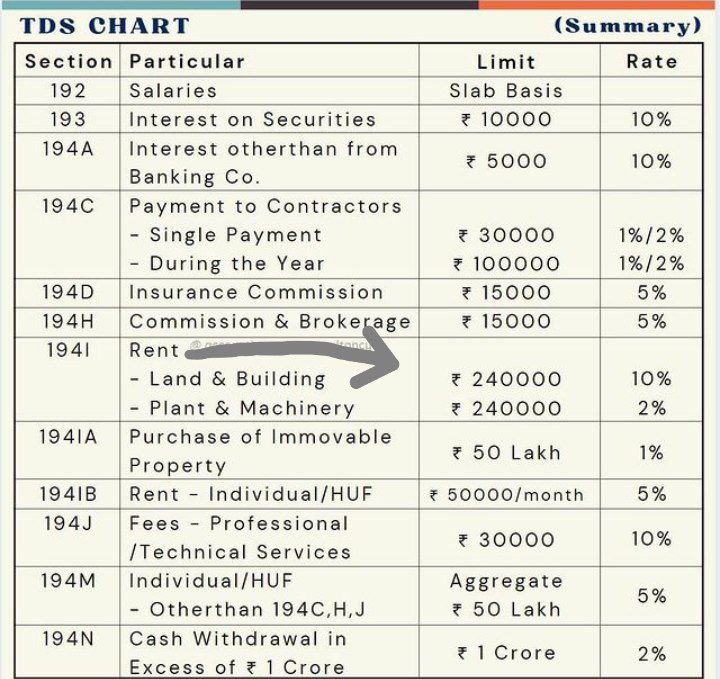

What is the TDS limit for 2023?

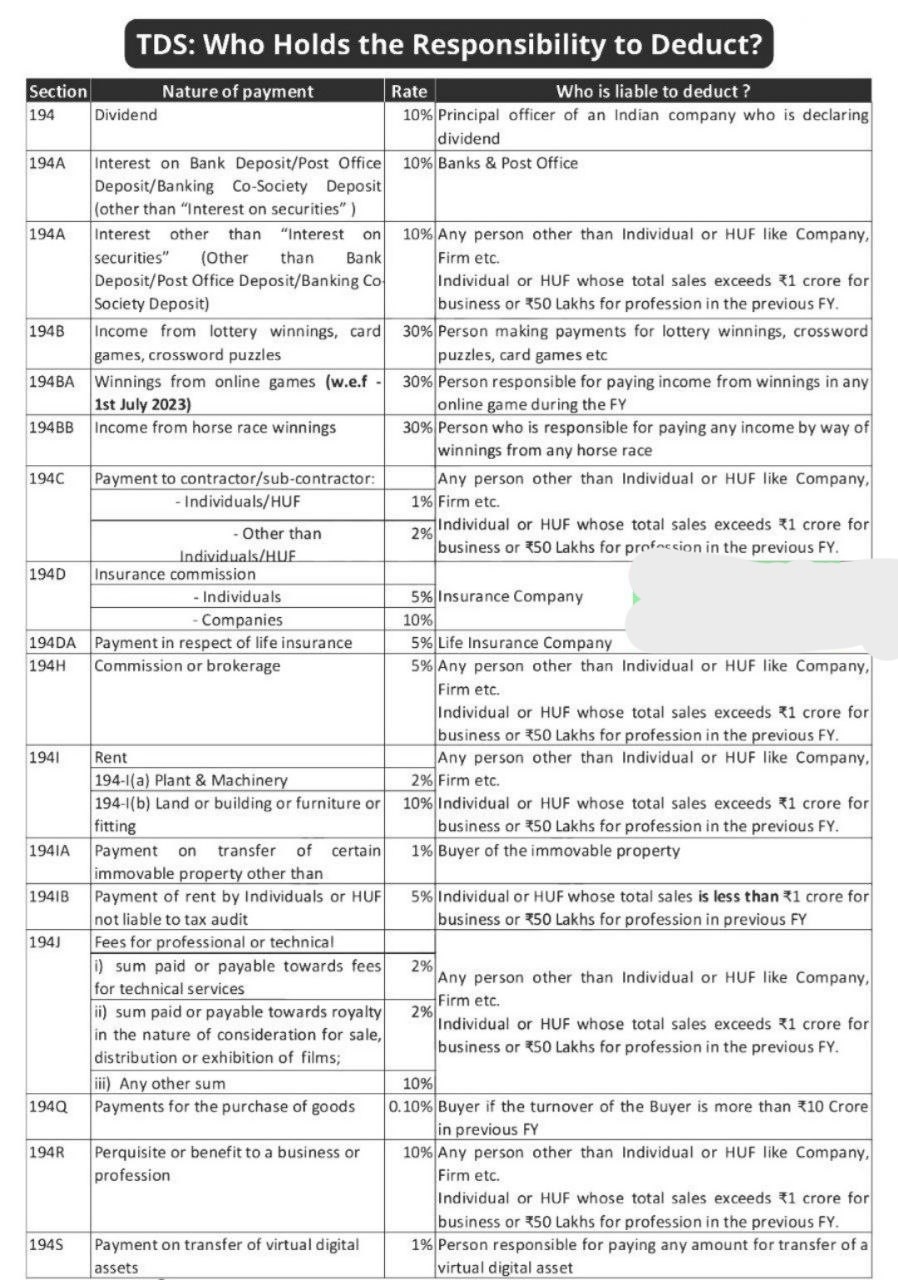

Who is liable to deduct TDS ?

Read More about: