Basic Understanding on Tax Deducted at Source (TDS)

Page Contents

TAX Deducted at Source (TDS) has been adopted with the purpose of collecting tax from the source of earning of assesse. According to this concept, an individual (deductor) who is liable to make payment of specified nature to some other person (deductee) shall deduct tax at source and remit the same tax to the Central Government.

TDS has been introduced to collect taxes from the source of earning. As per the Income Tax Act, while someone making a payment is required to deduct tax if payment excessed such levels/limit as specified. Limits or rate of TDS is prescribed by the Tax Department. The TDS is administered by the CBDT, which is come in the preview of the Ministry of finance.

TDS is a Kind of advance tax that must be deducted regardless of the method of payment. Because Tax Deducted at Source is a part of the Income Tax Act, both the Deductee and Deductor the person permanent account number (PAN) are linked to it. In such a case the PAN of the deductee is not uploaded, the Deductor Tax Deducted at Source shall deduct at a rate greater than the following:

- at the rate prescribed in the Finance Act;

- at 20%.

- the rate prescribed in the income tax Act;

Tax Deducted at Source (TDS) IS APPLICABLE:

Below are expenditure & source of income falls under TDS-

- Technical or consultancy fees.

- Transfer of any immovable property other than agricultural land;

- Salary Payment ;

- Contractor payments

- Payment of Brokerage or commission

- Transfer of immovable property

- Compensation on acquiring immovable property

- Payment of interest by banks.

- Charge to the contractor/sub-contractor for the success of the work;

- Rent payment

- Payments to freelancers and lawyers

- Lottery etc

- Insurance Commission

- LIC maturity amount

- Interest-free

- The rise in demand (for TDS)

- Penalty tax

Tax Deducted at Source (TDS) IS NOT APPLICABLE :

In the following circumstances, TDS is not applicable as per the income tax Act:

- Where the person has a holder of a certificate of non-deduction u/s 192 of the Income Tax Act.

- When the sum is paid towards the State Government or Center and RBI.

- Payment made towards mutual funds specified U/s 10 (23D) income tax Act.

- Whenever a payment is made to Central Financial Corporations or State Financial Corporations.

- Interests paid or credited towards :

- National Savings Certificate

- Kisan Vikas Patra issued by the Government of India.

- Non-Resident External Account

- Banking Co-operative society as per defined under the income tax act

- Recurring deposits or Savings account of banks & Co-operative society

- Banking Company or Bank defined as per banking regulation

- Trust Unit of the Indian or any other insurance company;

- Notified body for non-deduction of tax

Benefit of TDS

- It expands the tax collection framework.

- This is a platform to transfer the accountability for the collection of taxes between the government and the deductors.

- It helps to stop tax evasion.

- As TDS deductions take place all throughout the financial year, this is an efficient method of revenue inflows to the government.

https://carajput.com/learn/compliances-of-tax-deducted-at-sources-tds-.html

Tax Deducted at Source Payment Due Dates

Month-wise TDS due date is as follows:

| Month | Due date |

| April | On or before the Seventh of May |

| May | On or before the Seventh of June |

| June | On or before the Seventh of July |

| July | On or before Seventh August |

| Aug | On or before Seventh September |

| Sept | On or before Seventh October |

| Oct | On or before the Seventh of November |

| Nov | On or before the Seventh December |

| Dec | On or before Seventh January |

| Jan | On or before Seventh February |

| Feb | On or before the Seventh March |

| Mar |

|

Normal Tax Deducted at Source Return Filing Due Dates

The Dead Line of Quarterly filing of Tax Deducted at Source Returns are as below:

| Quarter Period | Quarter | Due date to file TDS return |

| April to June | 1st Quarter | On 31st July of the same FY |

| July to September | 2nd Quarter | On 31st Oct of the same FY |

| October to December | 3rd Quarter | On 31st Jan of the same FY |

| January to March | 4th Quarter | On 31st May of the next FY |

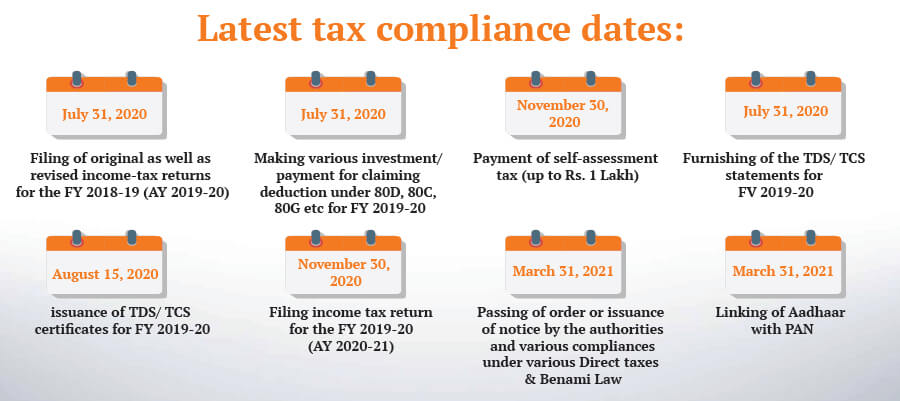

Govt made the New Deadline for TDS Returns Filing for FY 2020-21

| Quarter | Quarter Period | Quarter Ending | Due Date |

| First Quarter | April 2020 – June 2020 | 30 June 2020 | 31 March 2021 |

| Second Quarter | July 2020 – September 2020 | 30 September 2020 | 31 March 2021 |

| Third Quarter | October 2020 – December 2020 | 31 December 2020 | 31 January 2021 |

| Fourth Quarter | January 2020 – March 2020 | 31 March 2020 | 31 May 2021 |

How do I deposit TDS?

TDS must be deposited on the government portal using Challan ITNS-281.

What’s a TDS certificate?

Form 16, Form 16A, Form 16 B, Form 16 C are all TDS certificates. TDS certificates must be issued by an individual who deducts TDS from an assessee whose TDS income was deducted at the time of payment.

For example, banks issue Form 16A to the depositor when TDS is deducted from interest on fixed deposits. Form 16 shall be given to the employee by the employer.

| Frequency of TDS certificate | Form Type | Certificate issued for | Dead Line |

| Yearly | Form 16 | TDS on salary payment | 31st May |

| Quarterly | Form 16 A | TDS on non-salary payments | 15 days from due date of filing return |

| Every transaction | Form 16 B | TDS on sale of property | 15 days from due date of filing return |

| Every transaction | Form 16 C | TDS on rent | 15 days from due date of filing return |

Key Point to be remembered while deducting TDS

- According to Sections 192 to 194L of the Income Tax Act provide a complete list of Tax Deducted at Source expenditures and sources of income.

- If the person does not fall within the scope of the income tax slab, he or she may apply Form 15G or Form 15H to the deductor in advance for non-deduction of tax at source.

- The Tax Deducted at Source refers to each kind of income that reaches a certain threshold.

- TDS shall be deducted as per the rate of income tax imposed on employees.

- For many other deductees, the Tax Deducted at Source shall be deducted at the specified percentage at each type of income.

- Form 15H is intended for senior citizens.

- Form 15G is intended for all other persons.

Points to be understood for TDS

- Any person who deducts TDS must have a TAN as provided for in Section 203 A of the Income Tax Act 1961.

- Tax Deduction and Collection Account Number is a required condition for TDS returns to be filed. In addition, it should be included in the tax deduction certificate issued.

- Deductions for TDS are connected to your Permanent Account Number. It is, therefore, necessary to have Permanent Account Number information of the deductee in order to deduct tax at source.

- Any deductee must request a Tax Deducted at Source certificate to change the amount of tax deducted against the total amount of tax payable.

- Tax Deducted at Source information can be reviewed using the Tax Credit Form 26AS, which is open to all PAN holders.

- This consolidated tax statement gives you specific details of the Tax Deducted at Source withheld for the different forms of payments.

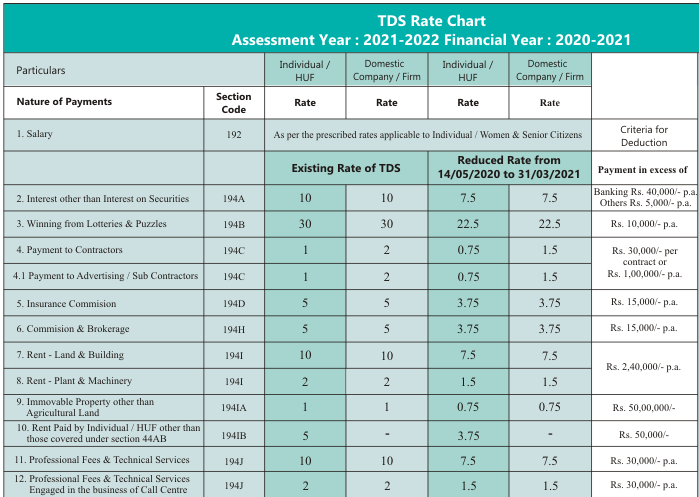

Decrease in TDS rates i.e. 25% TDS cut to benefit individuals – Effects and results

As part of a Special and Detailed Economic Package of COVID-19 Pandemic – Aatmanirbhar Bharat Abhiyaan, the following steps have been taken with regard to TDS and TCS: W.e.f. Fourteen May 2020, the Government has decreased the rate of TDS, dividends, professional fees, rent payments and other non-salary payments (TDS) and the rate of tax collection (TCS) by 25%. These rates shall be effective from 14 May 2020 and shall remain effective until the end of the financial year, i.e. March 2021, please. This action taken by the government would certainly increase the liquidity in the hands of a person who is already struggling with the financial distress caused by this pandemic. Deduction and collection of tax at a lower rate would leave further discretionary income in the hands of the recipient and would have the desired impact of increased cash flows and liquidity in the market. The effect and benefits of the reduction of TDS rates can be understood as follows:

- NO subsequent reduction of the tax liability:- TDS rates for non-salary payments rendered to residents and TCS rates for defined receipts have been decreased by 25% of current rates.

- The new rates would only apply to payments other than wages, such as contract payment, professional fees, rent, interest, dividend, commission, brokerage, etc.

- The TDS, TCS cut does not minimize the tax burden of taxpayers but allows more money in their pockets.

- Better management of the Fund:

- Benefits for a particular section of taxpayers:

- No TDS relief for expenditure booked before 14 May 2020:, The reduced rates will apply to the remaining portion of the 2020-21 fiscal year, i.e. from 14 May 2020 to 31 March 2021.

- Lower Operational TDS and TCS rates would also benefit those who usually earn tax refunds.

- Higher prices for non-furnishing of PAN:

- The step is anticipated to occur in a liquidity increase of Rs. 50,000 crore.

Related Articles/pieces of information

-

Tax Deducted at Source (TDS) for Financial Year 2020-21

-

How to file a return of TDS online

-

New revise TDS/TCS due date for filing Return and Payment for the year 2020

-

key features of TCS on goods sale section-206c

-

New TDS deduction No cash transactions exceeding 1 Crore -Section 194N

-

Extention of TDS/TCS statement filing Date