How to file tds return online?

Page Contents

USUAL MANUAL PROCEDURE FOR FILING OF E-TDS QUARTERLY STATEMENT

ETDS QUARTERLY STATEMENT / RETURNS SHALL BE UPLOADED AT TRACES TDSCPC WEBSITE AND NOT ON TIN NSDL WEBSITE.

TDS STATEMENT UPLOAD: User Manual

- Pre-Requisites for Uploading TDS Statement

- To upload TDS, the user should hold valid TAN and should be registered in e-Filing

- The statement should be prepared using the Return Preparation Utility (RPU) and validated using the File Validation Utility (FVU). The utilities can be downloaded from the tin-nsdl website (https://www.tin-nsdl.com/).

- Valid DSC should be registered in e-Filing.

- Upload TDS/TCS Statement

STEPS in Uploading TDS Statement:

Step 1: In e-Filing Homepage, Click on “Login Here”

Step 2: Enter User ID (TAN), Password, and Captcha. Click Login.

Step 3: Post login, go to TDS Upload TDS.

Step 4: In the form provided, select the appropriate statement details from the drop-down boxes for:

- FVU Version

- Assessment Year

- Form Name

- Quarter

- Upload Type

Note:

- TDS can be uploaded from AY

- Only Regular Statements can be uploaded, the Correction statement can be uploaded only through the tin-NSDL portal.

Step 5: Click Validate to Validate Statement details.

Step 6: “Upload TDS ZIP file”: Upload the TDS/TCS statement (Prepared using the utility downloaded from tin-NSDL Website)

Step 7: “Attach the Signature file” Upload the signature file generated using DSC Management Utility for the uploaded TDS ZIP file. For further details on generating the Signature file click here. Navigate to Step by Step Guide for Uploading Zip File (Bulk Upload)

Step 8: Click on the “Upload” button.

Once the TDS is uploaded, a success message will be displayed on the screen. A confirmation mail is sent to the registered email id.

New Revise TDS/TCS due dates for filing Return and Payment

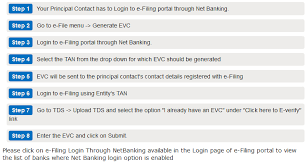

View Filed TDS Statement – the steps are as below:

Step 1: Log in to e-Filing, Go to TDS

Step 2: In the form provided, select the details from the drop-down boxes for Assessment Year, Form Name, and Quarter respectively for which the TDS was uploaded.

Step 3: Click on “View Details”.

Step 4: The status of the TDS uploaded is displayed.

- Once uploaded the status of the statement would be “Uploaded”. The uploaded file will be processed and validated. Upon validation, the status will be either be “Accepted” or “Rejected” and would be reflected within 24 hours from the time of upload. In case if “Rejected”, the rejection reason will be displayed.

- If the status is “Rejected”, click on the Token Number to view the error details.

- The reason for rejection would be displayed as below:

Step 6: If the status is “Accepted”, click on the Token Number to see the details of acknowledgment of the statement uploaded for all future reference.

Deadline for TDS Returns Filing

| Quarter | Quarter Period | Quarter Ending | Due Date |

| First Quarter | April – June | 30 June | 31 March 202X |

| Second Quarter | July – September | 30 September | 31 March 202X |

| Third Quarter | October – December | 31 December | 31 January 202X |

| Fourth Quarter | January – March | 31 March | 31 May 202X |

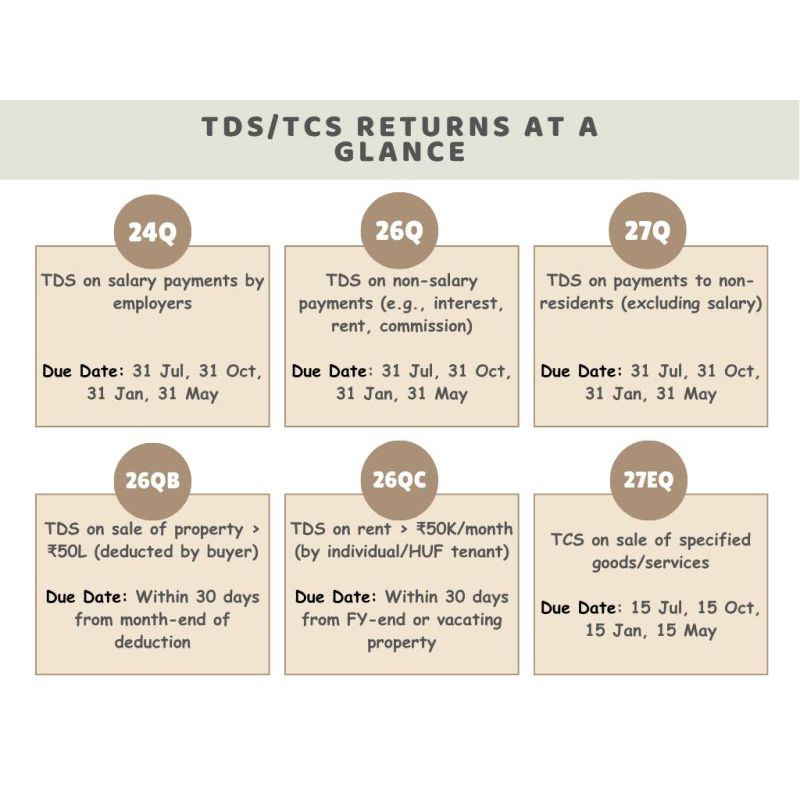

Relevant TDS Return filling Forms

The below are the TDS return filling forms & the object/purpose for which they are used:

| Form No | Purpose of TDS return form |

|---|---|

| Form 24Q | salary TDS from |

| Form 26Q | All payments apart from salaries |

| Form 27Q | Subtraction of tax from dividend, interest or any other amount payable to non-residents |

| Form 27EQ | Collection of tax at source |

Tax Deducted at Source (TDS) Forms

TDS Certificate Form

| Sr. No | Form Number | Description |

| 1. | FORM- 16 | TDS Certificate of Salary |

| 2. | FORM- 16 A | TDS Certificate for Income other than Salary |

| 3. | FORM- 24Q | Quarterly statement of deduction of tax under sub-section(3) of section 200 of income tax act in respect of salary |

| 4. | FORM- 26Q | Quarterly statement of deduction of tax under sub-section(3) of section 200 of income tax act in respect of payments other than salary |

| 5. | FORM- 27Q | Quarterly statement of deduction of tax under sub-section(3) of section 200 of income tax act in respect of payments other than salary made to non-residents |

TDS Return Forms

| Sr. No | Form Name | Description |

| 1. | TDS Return Form 24Q | Statement for tax deducted at source from salaries |

| 2. | TDS Return Form 26Q | Statement for tax deducted at source on all payments other than salaries. |

| 3. | TDS Return Form 27Q | Statement for tax deduction on income received from interest, dividends, or any other sum payable to non residents. |

| 4. | TDS Return Form 27EQ | Statement of collection of tax at source. |

| 5. | TDS Return Form 27A | Form 27A is a control chart of quarterly TDS/TCS statements to be filed by deductors/collectors along with quarterly statements |

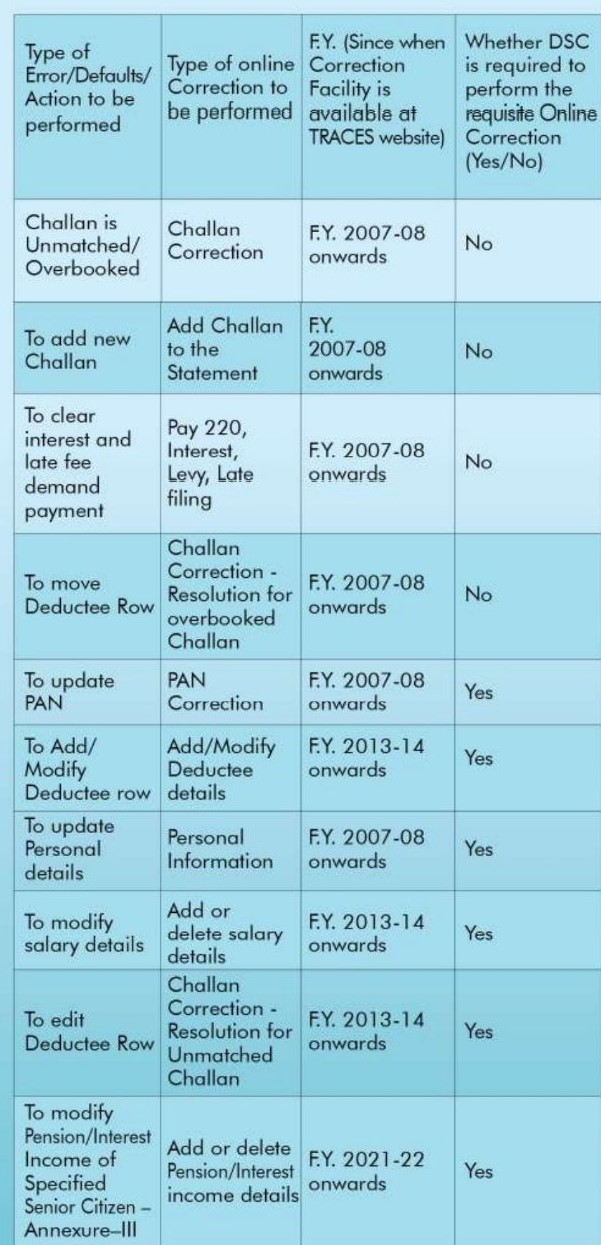

Guidelines for Online Corrections in TDS/TCS Statements

RELEVANT LATE FILLING FEES

NOW Failure to submit TDS returns within the deadline will mean that we needed to an applicable late filing fee of INR 200 per day. That fee will be charged for every day after the deadline until the date on which your TDS return is submitted. However, the max fees that you will have to pay are only limited to Tax deducted as sources amount.

What is the applicable Penalty as per the income tax act for TDS Return?

In case of TDS returns are submitted after the deadline or there are details in the TDS return forms, the below penalties shall have become applicable:

- The penalty under Section 234E: as per the section, the deductor will be charged Rs.200 per day until TDS is paid, but the penalty amount cannot be more than the TDS amount.

- The penalty under Section 271H: A penalty which may range between a minimum of INR 10k & a max of INR 1,00,000/- shall be applicable in case wrong details have been submitted, such as incorrect PAN, incorrect tax amount, etc.

A penalty would not be charged U/s 271H of the Tax law in case TCS / TDS returns are not filed within the deadline, provided that the appliable below requirements are applicable:

- The TCS/TDS is paid to the Govt’s credit.

- The submitting of the TDS/TCS return is done prior to the expiry of one year from the deadline.

- The interest & fee applicable on late filing (if any) have been paid to the govt’s credit.

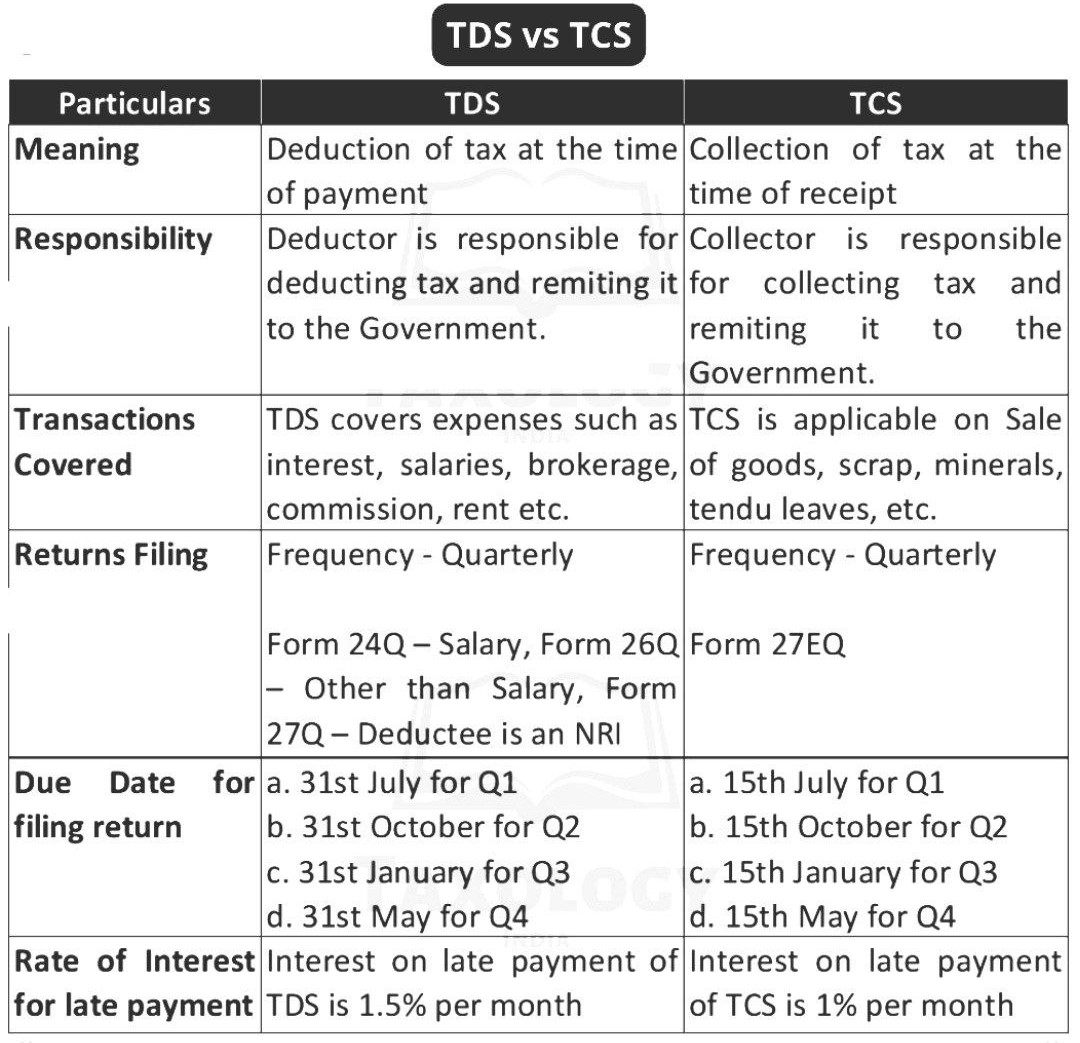

TDS VS TCS

FOR FURTHER QUERIES CONTACT US:

W: www.carajput.com E: singh@carajput.com T: 9-555-555-480\