TRC is the valid document for determining treaty advantages

Page Contents

Tax Residency Certificate is the valid document for determining treaty advantages.

- ITAT- Delhi – M/s Sarva Capital LLC (ITA No. 2073/Del/2023): Tax Residency Certificate is the valid document for determining treaty advantages.

Facts of the Case:

- M/s Sarva Capital LLC, a non-resident corporate entity that was established in accordance with Mauritiusan legislation and is involved in investments in India in a number of industries, including financial services, microfinance, healthcare, agriculture, & education services.

- M/s Sarva Capital LLC sold equity shares of 2 Indian companies, Sewa Gruh Rin Ltd. and Veritas Finance Pvt. Ltd., during the AY in question.

- In the original income tax return submitted, Sarva Capital LLC claimed that According to Article 13(4) of the India-Mauritius DTAA, capital gains from the sale of shares should be free from taxation in India since the seller was a resident of Mauritius.

- The issue before Income Tax Appellate Tribunal was whether, Sarva Capital LLC was entitled to exemption as per Article 13(4) of the DTAA or subject to taxation as per article 13(3A).

Income Tax Appellate Tribunal Delhi held as below:

-

Once a valid TRC has been issued by the competent Tax authority of another country, it serves as conclusive evidence of tax residency & eligibility for treaty benefits as per DTAA:

-

- Once a valid Tax Residency Certificate (TRC) has been issued by the competent authority of another country, it serves as conclusive evidence of tax residency and eligibility for treaty benefits as per the DTAA between the two countries involved.

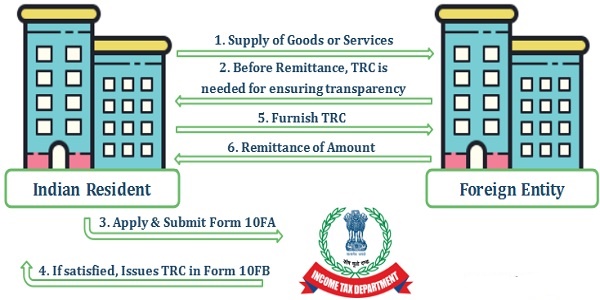

- Tax Residency Certificate is an official document issued by the tax authorities of a particular country to certify an individual or entity’s tax residency status in that country. When a taxpayer presents a valid TRC, it provides conclusive evidence that the taxpayer is a resident of the country specified in the certificate. As a result, the taxpayer becomes eligible to claim treaty benefits outlined in the Double Taxation Avoidance Agreement between that country and another country.

- So, Tax Residency Certificate is a critical document in international taxation, as it helps prevent double taxation and ensures that taxpayers can avail themselves of the benefits provided by tax treaties. Once issued, the Tax Residency Certificate carries significant weight and is generally accepted as conclusive proof of tax residency for the purposes of claiming treaty benefits.

-

For shares acquired before April 1, 2017, the the capital gains fall under Article 13(4) of the DTAA & were exempt from taxation in India.

-

- Article 13(4) of the DTAA typically pertains to capital gains from the sale of shares acquired before a specified date. In the case of India, for shares acquired before April 1, 2017, under many DTAA agreements, such Capital gains are often income tax exempt from taxation in India. The Capital gains arising out of alienation of shares of an Indian Company to a company who is a resident of Mauritius is liable to income tax only in Mauritiusin terms of Article 13(4) of the Double Taxation Avoidance Agreement.

- This provision is crucial for individuals or entities who have acquired shares prior to April 1, 2017, and subsequently sell them. The capital gains arising from the sale of such shares may be exempt from taxation in India, subject to the specific terms and conditions outlined in the Double Taxation Avoidance Agreement between India and the relevant country.

-

LLC’s appeal is allowed & Capital gains derived from sale of shares were not taxable under Article 13(4) of the India-Mauritius DTAA.

-

- Sarva Capital LLC’s LLC’s appeal was allowed, and it was determined that the capital gains derived from the sale of shares were not taxable under Article 13(4) of the India-Mauritius Double Taxation Avoidance Agreement (DTAA).

- Article 13(4) of the India-Mauritius DTAA typically deals with the taxation of capital gains arising from the sale of shares. Under this provision, capital gains derived by a resident of one contracting state (such as Mauritius) from the alienation of shares of a company resident in the other contracting state (such as India) may be taxable only in the resident state of the seller, subject to certain conditions.

- If an Sarva Capital LLC’s appeal was allowed and it was determined that the capital gains from the sale of shares were not taxable under Article 13(4) of the India-Mauritius DTAA, it likely means that the capital gains were exempt from taxation in India, & Sarva Capital LLC’s successfully demonstrated compliance with the conditions outlined in the DTAA.