MSME Registration in India

Page Contents

MSME REGISTRATION – ROLE OF CA COMMUNITY

The Micro, Small, and Medium Enterprise Development Act, 2006 is an act of the Parliament of India. As per the Act, “any buyer who fails to make payment to MSME pursuant to agreed terms or up to a maximum of 45 days would be liable to pay compound interest on a monthly basis at 3 times the bank rate notified by RBI.

In full compliance with the (MSME) Act, enterprises are divided into two divisions:

- Manufacturing Enterprises – engaged in the manufacture or production of goods in any industry.

- Service Enterprises – engaged in the provision or rendering of services

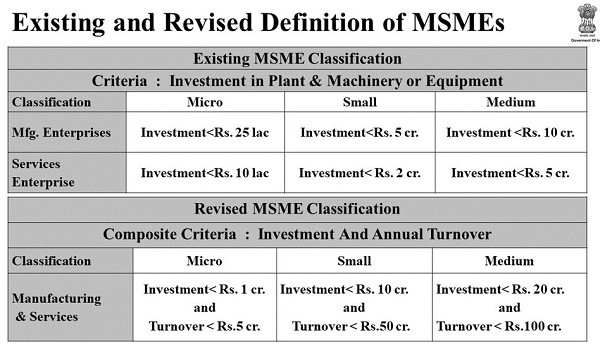

Definition of Micro, Small and Medium Enterprise (MSME) based on turnover and investment in plant & machinery:

Meaning of Service & Manufacturing Sector:

- Micro-enterprises… Investments in plant and machinery not greater than INR 1 crore and a turnover not going to exceed INR 5 Crores.

- Small enterprises.. Investments in plant and machinery not exceeding INR 10 crores and a turnover not going to exceed INR 50 Crores.

- Medium Enterprises— Investments in plant and machinery not exceeding INR 20 Crores & a turnover not exceeding INR 100 Crores.

Existing MSME Classification Sector Criteria

Micro Small Medium

Manufacturing Investment < Rs.25 lakh< Rs.5 crore< Rs.10 crore

Services Investment < Rs.10 lakh < Rs.2 crore< Rs.5 crore

With effect from 14.05.2020, Govt are defined in term of investment in Plant & Machinery/ Equipment “&” Turnover as following:

Revised Guidelines and Threshold limit for MSME

| Enterprises Classification | Investment Threshold Limit | Turnover Threshold Limit |

| Micro Enterprises | Less than Rs. 1 Crore | Less than Rs. 5 Crore |

| Small Enterprises | Rs 1 to 10 Crore | Rs. 1 to 25 Crore |

| Medium Enterprises | Rs. 10 to 50 Crore | Rs 25 to 250 Crore |

The Govt has facilitated the registration of micro, small & medium-sized enterprises to give them lots of much-needed benefits for their protection and growth.

Bearing in mind a far announcement made today by the Minister of Finance concerning the availability of MSMEs, the huge amount of INR 3 lakh crores with a moratorium of 0 to 2 months & no necessity for collateral security for filling the MSME sector, it is essential for MSMEs to register without fail for their own long-term advantages.

Frequently Asked question on MSME/SSI

What is the primary purpose of MSME/SSI registration?

- SSI registration can be used to obtain government concessions and rebates.

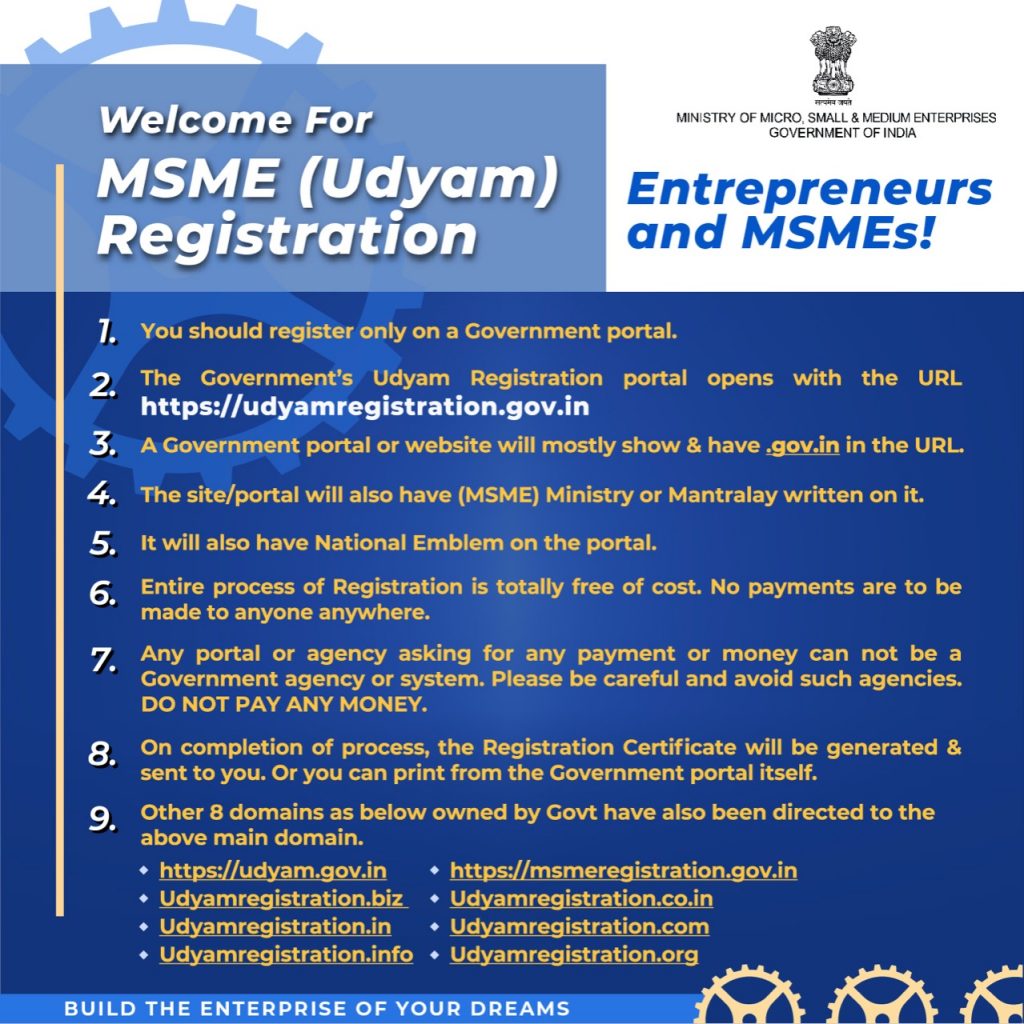

- We should take care of customers and make sure that they don’t have to go anywhere to get the registration done. Kindly notes the MSME registration could be done online on www.udyogaadhaar.gov.in & there is no fee for registration under the MSME. No fee for registration has been recommended.

- In addition, as per the latest Announcements/Decision of the Ethical Standard Board,

- ‘A Chartered Accountants may register on Udyog Aadhar, the MSME website.’

- Lets keep all information ready and visit the Udyog Aadhar website {Ministry of Micro, Small and Medium Enterprises.(MSME) Registration} to complete your registration.

What are the benefits of MSME Registration?

- Waiver of Stamp Duty & Registration Fees:

- 50% subsidy for patent registration

- Reduction in the rate of Interest from banks

- Direct Tax Laws Exemption

- Subsidy on NSIC Performance and Credit ratings

- Collateral free Bank Loan up to INR 5 Cr.

- Concession in electricity bills:

- Bar Code registration subsidy

- Eligible for IPS subsidy

- Waiver in Security Deposit in Govt

- Special consideration on international trade fairs:

- Octroi benefits

- Preference in procuring Govt Tenders

- Reimbursement of ISO Certification

- 1% exemption on the interest rate on OD

- Excise Exemption Scheme

- Counter Guarantee from Govt of India via CGSTI

- 15% weightage in price Preference:

- Protection against delay in payment

- Reservation policies to production sector/manufacturing

All the above benefits can only be made available to us if we have our proposed unit registered as an MSME.

Who has the power to issue the MSME Registration Certificate in India?

- MSME Registration is done online in India. Each state in India has a different division for small and medium-sized enterprises.

- The District Industries Center (DIC) is responsible for the registration of small and medium-sized enterprises in India.

- The Dept of District Industries Center (DIC) has the authority to issue an MSME Registration Certificate. The Dept also issues an MSME number with an MSME Registration Certificate in India.

- If a person wants to have his/her MSME registration completed, he/she must contact the neighboring District Industries Center (DIC) department.

What are the information/details required for Registration as an MSME?

- Name of organizations

- Business Activity & NIC Two-Digit Code of business activity of Business/Enterprise.

- Investment in Equipment/Equipment/Plant & Machinery etc. to start your business

- No of employees working in the Enterprises

- PAN No Copy,

- Turnover of Business/Enterprise

- Location of Plant with Address, provide office address if address other than plant location

- Type of Business/Enterprise with Business commencement of date

- Email id of Applicant & Mobile No of Applicant which is linked to Aadhar Card

- Aadhar Card of Applicant,

- Canceled Cheque of Organization

Is it possible to register for SSI/MSME online?

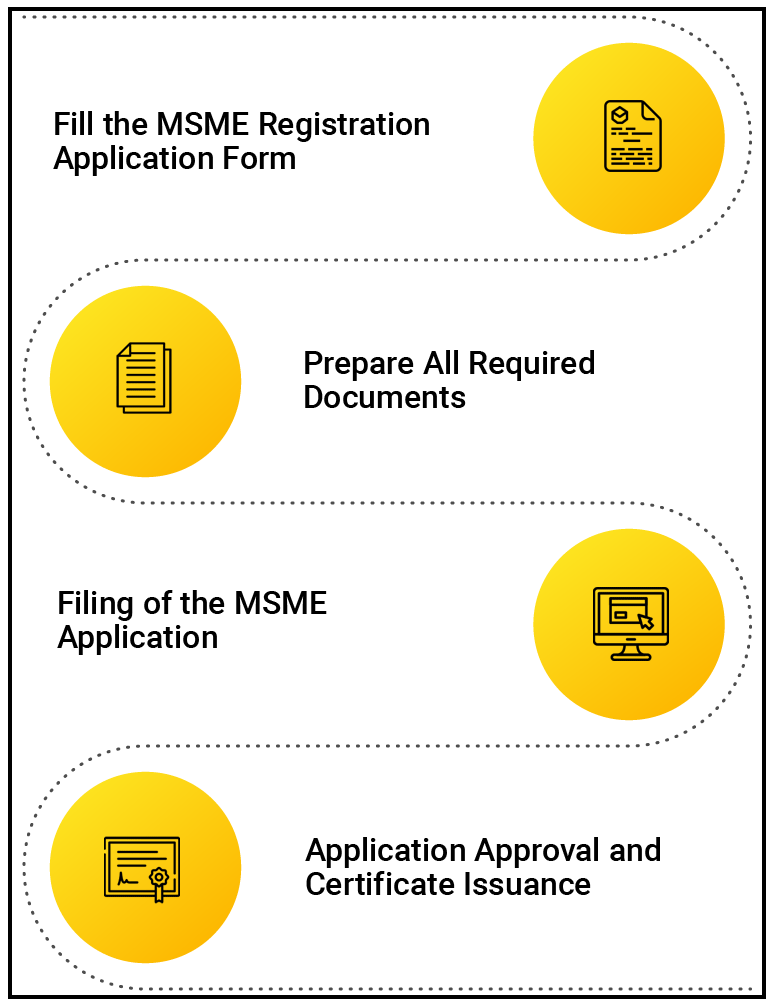

Yes, by visiting their official website and filling out and submitting the application form, you can SSI/MSME register online in india.

How long will it take to register after submitting the form?

As soon as you submit the application form, you will receive an email with your registration certificate.

What is the distinction between SSI and MSME registration?

There are no distinctions between SSI and MSME registration. Previously, MSME registration was known as SSI registration.

Whether the registration is mandatory SSI?

- A Medium enterprise engaged in the manufacture or production of goods has to compulsorily register under the MSMED Act. For other Enterprises, the registration is discretionary or optional.

- Taking into consideration the benefits available under the Act, it is recommended that every enterprise shall opt for registration.

- Registration of Micro, Small, and Medium (MSM) Enterprises under MSMED Act is a very powerful medium to enjoy the benefits available to such firms.

Which are the classes of enterprises that may qualify for registration?

All classes of enterprises, whether Proprietorship, Hindu undivided family, Association of persons, Cooperative society, Partnership firm, Company, or Undertaking, by whatever name called can apply for the registration and get qualified for the benefits provided under the Act.

What are some examples of small-scale manufacturing?

- Following are some example of small-scale manufacturing:

- Beverages

- Tobacco & Tobacco Products,

- Chemical & Chemical Products,

- Cotton Textiles,

- Electrical Machinery & Parts,

- Food Products

- Hosiery & Garments,

- Wood Products

- Metal Products,

- Leather and Leather Products etc

How does Rajput Jain & Associates help you get MSME registration in India?

- Our experienced professionals will understand your needs and make suggestions to you appropriately.

- We will hand over the registration task to one of our qualified and professional Experts, & you will receive support and assistance throughout the registration process.

- For MSME Registration, we will assist you in collecting and bringing together all the information and data required for MSME Registration.

- Call us if any issue then raises a question with us.

How to cancelled the Udyog Adhar Registration ?

Link are mention below for details

Why trust Rajput Jain & Associates to register for MSME?

- Best services are provided at a reasonable price

- Customer satisfaction is our primary goal.

- There are no hidden charges

- End to end assistance & support.

- We have a team of qualified & experienced staff.

Popular Articles :

- Payment of Security to MSME according to LAW

- Micro Small and Medium Enterprises

- Top Taxation Relaxation to MSMS

- Cheer for SMEs and manufactures

- MSME CONSULTANCY & REGISTRATION SERVICE

- An Emerging Threat to Small Enterprises MSMEs

- An emerging threat to small Enterprises (MSMEs)