Micro Small and Medium Enterprises Compliance

Page Contents

micro small and medium enterprises

Overview on MSME’s Companies:

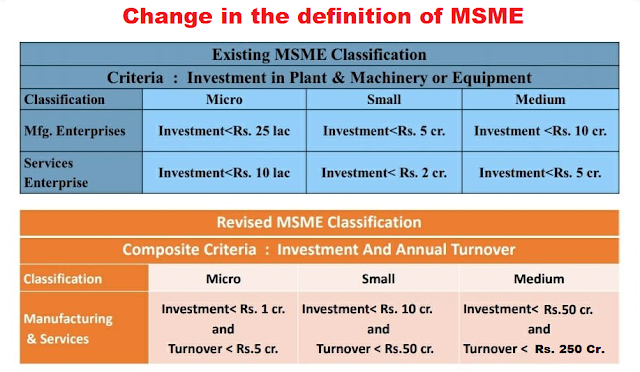

What is the definition of MSME?

The Micro Small & Medium Enterprises (MSMEs) are defined in India in the MSME Act 2006 according to the capital investment made in plant and machinery, excluding investments in land and building.

For multiple kind of industries which come under classification criteria, an MSME license is preferred since it has the below incentives scheme & benefits:

- Very Lower interest rate

- Priority in case of compliance & registration approvals by State & Central Govt.

- Availability of collateral free loans.

- Govt support in the form of incentives & subsidies.

- Many tax exemptions reduced rates for registrations and reduction in electricity charges (For Example: patent registrations, etc).

What kind of Entities Covered under MSME?

Below types of business entities covered under the MSME are:

- Hindu Undivided Family

- Co-operative Society

- Company

- Proprietorship

- Partnership Firm

- Association of Persons

Mandatory filing of MSME Companies:

According to the rules, every specified companys are required to file MSME Form I with Roc in the situation mentioned below:

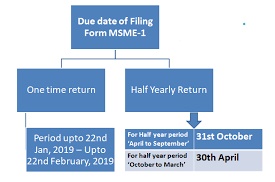

Two Types of Returns required filing by “Specified Companies” like:

- One Time Return.

- Half Yearly Return.

Every specified company shall file in MSME Form I details of all outstanding dues to Micro or small enterprises suppliers existing on the date of notification of this order within thirty days from the date of publication of this notification which is 22nd January.

All the specified MSME Company shall file a return as per MSME Form I annexed to this Order, by 31st October for the period from April to September and by 30th April for the period from October to March.

Specified Company means Every Company “Public or Private” who Received Goods or Services ‘from’ Micro or Small Enterprises ‘of which’ Payment Due or Not Paid till 45 days.

For more reading:

HALF-YEARLY RETURN BY MICRO OR SMALL ENTERPRISES WITH REGISTRAR OF OUTSTANDING PAYMENTS:

All companies having outstanding payments to MSME for more than 45 days from the date of acceptance or deemed acceptance of goods or/and services, who are not required to file the MSME Form I.

The Companies who have no outstanding payments to MSME or such outstanding payments are for not more than 45 days are not required to file this form.

DUE DATES FOR FILLING “MSME FORM 1”

Every Company within 30 days from the date of the notification i.e. 22nd February 2019 (22nd January 2019 + 30 days) is required to file this form as Initial Return.

All MSME Company within 30 days from the last day of half-year shall file the regular half-yearly return.

- October 31st for the period1st April to 30th September.

- April 30th for the period01st October to 31st March.

DETAILS AND DOCUMENTS TO BE ENCLOSED WITH THE FORM

INITIAL RETURN:

Total outstanding amount, Details of suppliers, and payments due (PAN of Suppliers)

REGULAR HALF YEARLY RETURN

Total outstanding due for the period and particulars of suppliers therein for the period, Reasons for delay in payment.

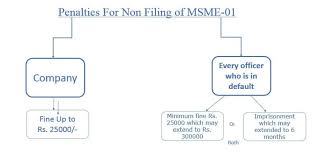

Penalty Provision as per Section 405 (4) of the Companies Act, 2013, if the said details are not submitted to MCA on or before 20/02/2019 or the information submitted is incorrect or incomplete.

Fine

- Company – up to Rs. 25,000

- Directors, CFO and CS

- Imprisonment – up to 6 months, or

- Fine – not less than Rs. 25,000 up to Rs. 3, 00,000 per person

NOTE: Non-compliance with such provisions will lead to punishment and penalty under the provision of the Act

https://youtu.be/PG48SK_4YQ8.

Popular Articles :

- Payment of Security to MSME according to LAW

- Micro Small and Medium Enterprises

- Top Taxation Relaxation to MSMS

- Cheer for SMEs and manufactures

- MSME CONSULTANCY & REGISTRATION SERVICE

- An emerging threat to small Enterprises (MSMEs)