CHEER FOR SMES AND MANUFACTURERS

Page Contents

CHEER FOR SMES AND MANUFACTURERS

More entities will be able to take advantage of the composition scheme now with the changes in the threshold. Jaitley said the council has attempted to keep a revenue-neutral rate as also ease the burden on smaller enterprises.

This should mean that a significant number of SME (small and medium enterprise) sector players should benefit from not having to meet with detailed compliances under GST and also having a less financial burden, on account of GST

For workers in industries such as textiles and, gems and jewellery, where they take work home, a GST rate of 5% will be charged instead of the 18% standard rate on outsourcing.

NEXT GST COUNCIL MEET ON JUNE 18

Jaitley said the council will now meet next Sunday in the Capital to finalise the remaining issues that include taxation of lotteries and eway bills, which relate to transport of goods across state lines. A committee of officials is also finalising the mechanism for the ant profiteering law.

Revenue secretary Hasmukh Adhia said the attempt would be to complete the drafting of rules and report to the council. “It can be any time, not necessarily linked to the rollout but we will try and expedite it as early as possible,” Adhia said.

GST, which seeks to replace multiple state and central taxes with a single levy, is proposed to be implemented from July 1. Some sections of industry have sought its deferral but the government is not keen to delay it any further.

“Irrespective of the date on which it starts, some people will say they are not ready, so they have no option but to get ready,” Jaitley said.

Adhia said industry had also begun stock planning so the levy can be rolled out as scheduled. “The transition rules have been made so relaxed that nobody will have any issue of stocking or destocking. So we don’t expect there will be any scarcity of any commodity in the market,” Adhia said.

The council has agreed to allow additional verification facilities to enrol taxpayers on the GST Network including the one-time password and banking verification. Some state finance ministers also want the rollout deferred.

“I have also added a caveat that July 1looks extremely difficult. It cannot be jugaad… Small business has to fill up a spreadsheet which then has to go through a software process to get uplinked,” said West Bengal finance minister Amit Mitra. “According to reports, end of the month, these spreadsheets would be available for uploading and you are going to start from July 1.” Tax experts also see difficulties in a July 1rollout.

“With potentially two more council meetings, we will be down to the wire for July 1 implementation,” said Harishanker Subramaniam, national leader, indirect tax, EY India.

The deferment of discussions to next Sunday around e-way bills is of concern to industry, as it would indeed be a tall task for industry to be prepared as on July 1, if the same were to be made fully applicable on the start date

The MCA raises the threshold for small and medium businesses- in new accounting standards guidelines,

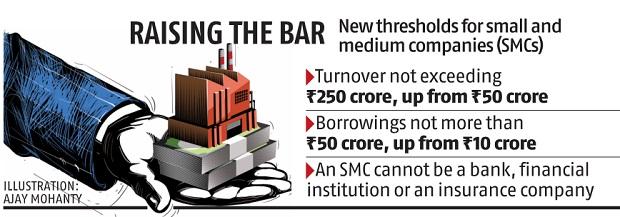

The ministry of corporate affairs (MCA) has enhanced the turnover and borrowing restrictions in its definition of small and medium corporations (SMCs) to harmonise the applicable accounting standards rules with the ministry of micro, small and medium enterprises’ most recent definition.

Revised Definition of “Small and medium companies” are defined as follows in the 388-page notification:

- whose equity or debt securities are not listed or in the process of being listed on any stock exchange in India or abroad;

- a corporation that isn’t a bank, a financial institution, or an insurance company;

- whose turnover (excluding other income) did not surpass Rs. 250 crore in the previous accounting year;

- which had no borrowings (including public deposits) in excess of Rs. Fifty crores at any point during the previous accounting year; and

- which isn’t a holding or subsidiary of a company that isn’t a small or medium-sized business

The general purpose accounting rules of the ICAI apply to enterprises with a turnover of less than Rs 500 crore and a net worth of less than Rs 250 crore. The rest of the businesses adhere to Indian accounting rules (IndAS).

Companies must disclose all major accounting policies used in the preparation and presentation of financial statements, according to the MCA notification. “Important accounting policies should be declared as such as part of the financial statements, and significant accounting policies should typically be published in one place.”

The limits are consistent with the ICAI’s rise in non-corporate entity thresholds. The updated standards will benefit a variety of businesses and improve ease of doing business.

The increase in the turnover and borrowing requirements for placement into the SMC category for some accounting standard exemptions in application and disclosure is a positive step.

We look forward for your valuable comment www.carajput.com

FOR FURTHER QUERIES CONTACT US:

W: www.carajput.com E: singh@carajput.com , 9-555-555-480