An emerging threat to small Enterprises (MSMEs)

Page Contents

–MSMEs face an identity threat due to economic recession in the FY 2021 in the midst of the Covid-19 pandemic.

- India was moving towards a 15-percent decline in revenue and a 25-percent decrease in earnings before interest, taxes. fortunately, for smaller firms, revenue will also fall by 17-21 percent, while the EBITDA margin would fall by 200-300 basis points ( bps) to 4-5 percent, with weak demand away from lower commodity prices.

- The downward trend at the operational level will also have an impact on creditworthiness. In the meantime, the average interest rate coverage ratio could fall to 1-1.5 times the 2.4-fold between the 2017 and 2020 fiscal years, “the study said.

More read:MSME REGISTRATION – ROLE OF CA COMMUNITY

As a summary to this issue, a three-pronged strategy is now crucial

- Improve job satisfaction with formal and informal employees to confident decisions.

- Speed up the execution of the Rs 3-Lakh Crore Aatmanirbhar scheme to ensure the continuous supply of liquidity to small and medium-sized enterprises.

- Lenders must go further than traditional credit processes because they have a key role to play in recovering.

Also Read : Overview of Medium and Small Entreprises

What is MSME

| Category of Micro/Small/Medium Enterprises – Type of Enterprises | Micro-Enterprise | Small Enterprise | Medium Enterprise |

| Manufacturing OR Services Sector, Both | Investment up to ₹ 1 Cr AND Turnover up to ₹ 5 Cr | Investment up to ₹ 10 Cr AND Turnover up to ₹ 50 Cr | Investment up to ₹ 50 Cr AND Turnover up to ₹ 250 Cr |

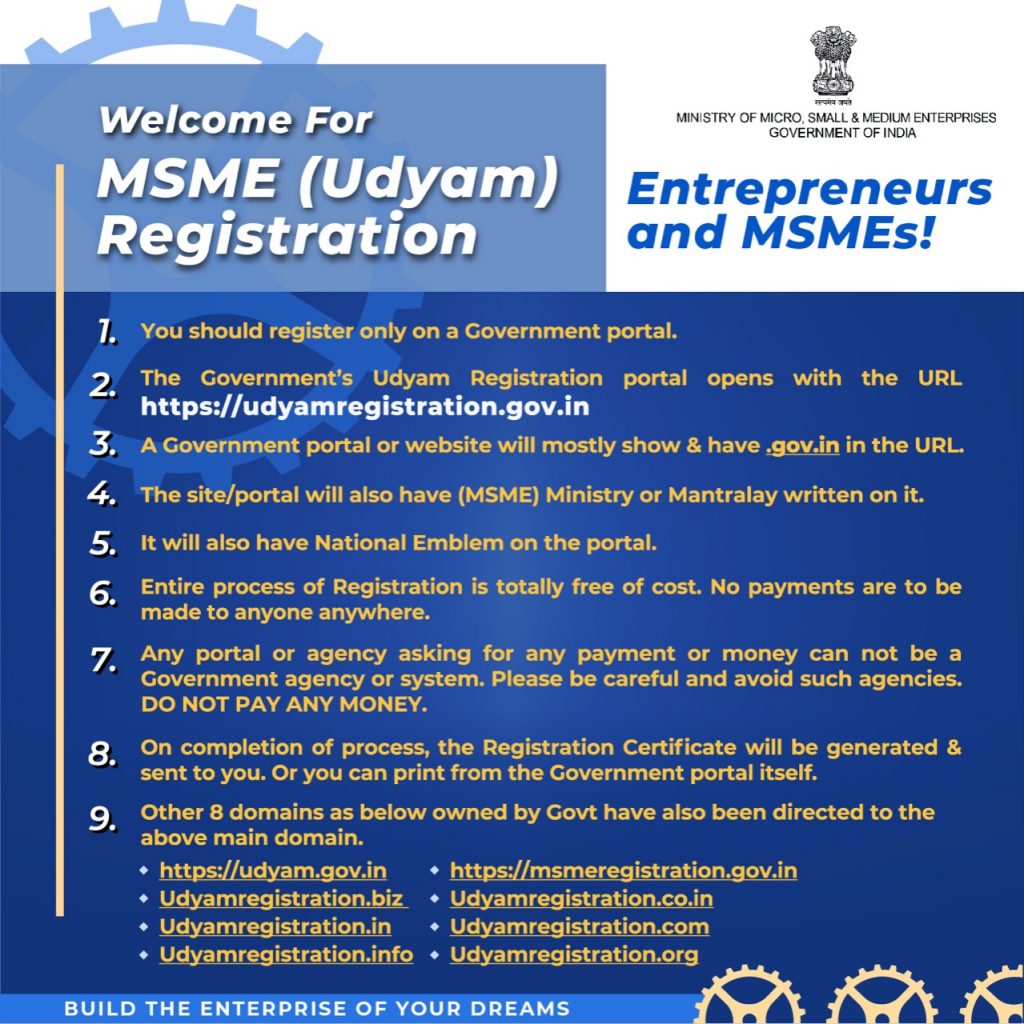

Documents for Udyam Registration MSME

- Adhaar Card – of the prop. (in case of the prop.)

- Of Managing Director/Partner(in case of company/partnership firm)

- Must be linked with mobile no. and pan.

- GSTIN and Pan Card.(RC copy of GST no.)

- Annual Turnover as per Income Tax and GST.

- Plant and Machinery details as per Income Tax Return.

- Self-declared if Income Tax Return not filed.

- Date of Incorporation of business (RC copy of company)

- Income Tax Return Copy with the Balance sheet and Profit and Loss.

- Email id/ Mobile No.

Benefits of Udyam Registration MSME –

– Collateral Free Borrowings

– Subsidized Loan from banks with a low-interest rate

– Participate in the International Trade Fairs

– Benefits from Central Government Schemes

– Preference in the Government Tenders

– Get Subsidy on the Patent Registration

– Protection against delayed payment

– Get Subsidy on Trademark Registration

– Concession in electricity bills

– Easy to get licenses, approvals, and registrations

– Reimbursement of Foreign Exhibition Charges

Govt of India schemes to promote MSMEs

- MSME Samadhaan– The MSME Delayed Payment Portal would allow Micro and Small Businesses (MSMEs) across the country to file their complaints about delayed payments from Central Ministries/Departments/CPSEs/State Governments.

- Digital MSME SchemeIt entails the use of Cloud Computing, in which MSMEs use the internet to access both standard and customised IT infrastructure.

- Micro & Small Enterprises Cluster Development Programme (MSE-CDP)– adopts cluster development approach for enhancing the productivity and competitiveness as well as capacity building of MSEs.

- Credit Linked Capital Subsidy Scheme (CLCSS) is operational for upgradation of technology for MSMEs.

- MSME Sambandh : To monitor the implementation of the public procurement from MSMEs by Central Public Sector Enterprises.

- Revamped Scheme of Fund for Regeneration Of Traditional Industries (SFURTI) : Traditional industries and artisans are grouped together to make them more competitive by increasing their marketability and providing them with better skills.

- Prime Minister Employment Generation Programme: It is a credit linked subsidy program under Ministry of MSME.

- National Manufacturing Competitiveness Programme (NMCP): The National Manufacturing Competitiveness Programme (NMCP) aims to improve Indian MSMEs’ global competitiveness by enhancing their processes, designs, technology, and market access.

- A Scheme for Promoting Innovation, Rural Industry & Entrepreneurship (ASPIRE): Creates new jobs and lowers unemployment, encourages entrepreneurship, and facilitates innovative business solutions, among other things.

- Udyami Mitra Portal :SIDBI initiated this initiative to make lending and handholding services more accessible to MSMEs.

Popular Articles :