ITC Rules for Input Service Distributor

Page Contents

ITC Rules for Input Service Distributor

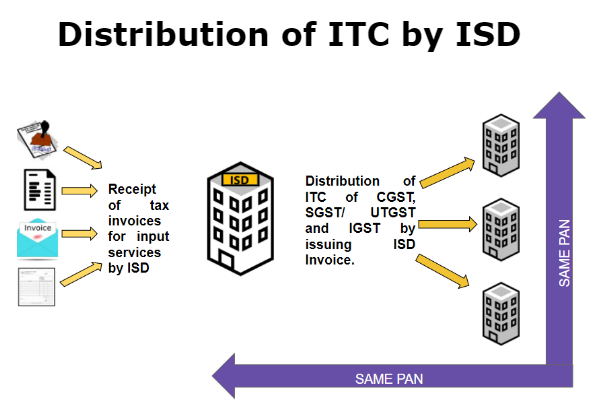

BRIEF INTRODUCTION

An Input Service Distributor (ISD), under the GST: An ISD, or input service producer, is a kind of taxpayer under the GST that has the need to split input tax credits, GST related to GSTIN, into your divisions or branches, with different GSTINS, but which will be registered in the same and YOU.

As described in Chapter 2 (61) of the CGST Act 2017, an Input Service Distributor means –

- It must be the office of a supplier of goods and/or services

- In the above-mentioned company, receiving tax receipts for receiving input services

- The aforementioned company, distributes CGST/SGST/IGST/UTGST credit to a supplier of goods and/or services, having the same PAN.

- The above office, provides for tax invoices or other documents, as required for distribution of credit.

MEANING UNDER GST ACT

- The concept of ISD under the GST was inherited from the service taxation regime. This is the unit that should be used for tax invoices in the direction of receiving input services and further distributing the CGST, SGST/UTGST, or IGST credit in the system of supplier units (using the same PAN) on pro-rata basis.

- CGST rules of 2017 define the procedure and conditions that must be met by the ISD, the quantum and manner of the Input Tax Credit (ITC) to be distributed by the Input Service Distributor, the customer’s invoice to be issued, the return must be filed by the ISD, as well as how to deal debit and credit notes issued by the ISD.

- As a distributor of goods and /or services they may have various corporate offices, including the headquarters, regional office, marketing, warehouse, sales office, etc., these departments avail various inputs such as security, communication costs, courier fees, cleaning fees, etc.

- With such units and buildings to obtain registration as a Distributor of Input services in order to receive credit on such input service and the allocation of credit to other units would lead to effective use of the funds collected.

MANNER OF DISTRIBUTION

In accordance with Article 20 (1), CGST Act 2017 The Distributor of input grants distributes the credit tax as central or integrated tax and integrated taxes as an integrated tax by issuing a document containing the amount of the input tax credit distributed in such a way as may be provided.

CONDITIONS

- Tax paid for services used in the course of business activity of the said entities, be distributed among them through the ISD.

- ITC that is available in a month must be distributed in the same month. Thus, the suspension of distribution payments is not allowed. It is important for the ISD, not to distribute any excess amount to any entity.

- ISD shall not accept any invoices in which tax is paid under the reverse charge mechanism. It should be noted that it is the recipient of the service who is subject, under the reverse charge mechanism, to discharge the liability of tax, and can claim the ITC.

This means that if they want to take input service under RCM, the entity shall be registered under GST.

- The credit of CGST, SGST/UTGST, or IGST should be distributed separately and consideration is given to eligible and ineligible credit.

- Credit attributable to a particular recipient unit shall be distributed to such entity, even though the same is unregistered or is making exempt supplies.

- The entity is required to take a separate registration as ISD even though the said entity is registered as a normal taxpayer in REG-01.

- Also, a company can have different registration for different places of businesses as ISD

- ISD shall issue an invoice regarded as an ISD invoice to the units to whom the ITC is distributed.

DISTRIBUTION OF CREDIT

The taxes be distributed in the form SGST and IGST, and the same be provided under a document containing the amount of input tax credit to be distributed –

- ISD AND RECIPIENT IN THE SAME STATE –

| TYPE OF CREDIT | CREDIT DISTRIBUTED |

| CGST | CGST |

| IGST | CGST OR SGST |

| SGST | SGST |

- ISD AND RECIPIENT IN DIFFERENT STATE –

| TYPE OF CREDIT | CREDIT DISTRIBUTED |

| CGST | CGST OR IGST |

| IGST | IGST OR CGST |

| SGST | SGST OR IGST |

EXAMPLE:

- Suppose ISD is situated in Kolkata and receives an Invoice in respect of an intra state supply of input service on payment of CGST and SGST and such services were shared among another entity registered in Delhi. Thus, the CGST credit will be distributed to all the units of the ISD and such credit can also be used as CGST.

- However, in case of SGST credit the same can be utilized by the entity registered in Kolkata. Hence, such SGST can be used as IGST by the entities registered in states other than Kolkata.

RECEIPT OF CREDIT

- As per section 16 of the CGST/SGST Act,2017, the credit is going to be available to the taxable person in an electronic credit ledger maintained within the common portal. everybody making outward supply of products or services is required to declare the main points of outward supply by the 10th of the following month.

- Registered number of recipients is additionally declared by the supplier making outward supply. The credit gets auto-populated within the accounts of the recipient supported such declaration by person making outward supply.

- The recipient is eligible to take up multiple registrations under GST Law, which can be in the form of State-wise registration and ISD registration. The recipient should carefully specify the ISD registration number so as to avail of the credit.

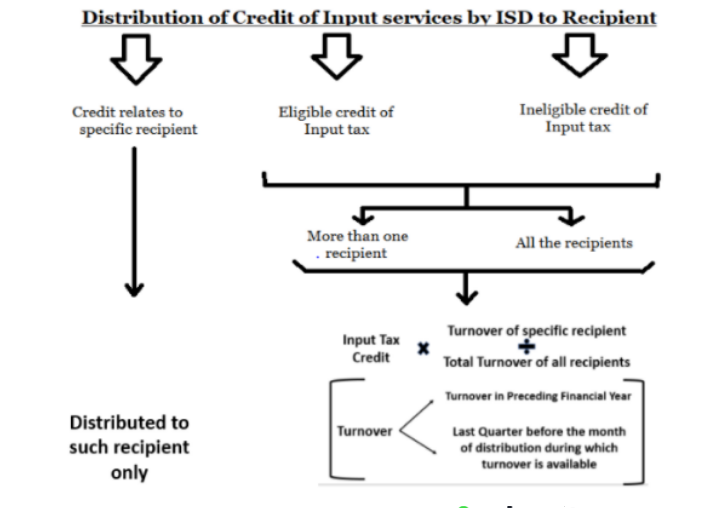

CONDITIONS FOR DISTRIBUTION

As per Sec.20(2) of the CGST Act,2017 specifies condition subject to which credit will be distributed by Input Service Distributor. These are: –

- The credit is often distributed to the recipients of credit against a document containing such details as is also prescribed.

- Quantity of the credit distributed shall not exceed the quantity of credit available for

- The credit of tax paid on input services owing to a recipient of credit shall be distributed only to it recipient.

EXAMPLE

ABC Limited has its corporate office in Mumbai and three manufacturing facilities in Jharkhand, Maharashtra, and West Bengal. Its Corporate Office is registered as an Input Service Distributor (ISD) under GST Law, 2017.

On the direction of ABC Limited, the Audit Committee it’s Corporate Office has appointed an audit firm to hold out the Management Audit of its plant in Jharkhand. during this case, because the service is exclusively for its unit in Jharkhand, the credit is distributed to the Jharkhand unit only and not Maharashtra or province unit.

- The credit of tax paid on input services attributed to over one recipient of credit shall be distributed amongst such recipients to whom the input service is attributable and such distribution shall be proportionately on the idea of the turnover in an exceedingly State or turnover in an exceedingly Union territory of such recipient, during the relevant period, to the combination of the turnover of all such recipients to whom such input service is attributable and which are operational within the current year, during the said relevant period.

EXAMPLE

A Ld. has its corporate office in Mumbai and three manufacturing facilities in Jharkhand, Maharashtra and state. Its corporate office is registered as an Input Service Distributor (ISD). Turnover of the three units in its states for the last year and current year (Quarter-1 and Quarter -2) is as follows:

| UNIT | FINANCIAL YEAR 2019-20 (RS CRORES) | Q-1 F.Y 2019-20 (RS CRORES) | Q-2 F.Y.2019-20 (RS CRORES) |

| JHARKHAND | 400 | 60 | 80 |

| MAHARASHTRA | 300 | 50 | 25 |

| WEST BENGAL | 500 | 75 | 75 |

Input Service Distributor (ISD) has obtained certain services for its units in Jharkhand ad province on which CGST and SGST of Rs.20 Lakhs were paid. ISD wanted to distribute the credit within the month of July 2019 (Financial Year 2019-20). The credit is distributed as under: –

Jharkhand =Rs.20 Lakhs × (400crores/ (Rs.400 crores. +Rs.500 crores.) =Rs.8.89 Lakhs

West Bengal =Rs.20 Lakhs × (500crores/ (400crores+Rs.500 crores) = Rs.11.11 lakhs

Maharashtra = Nil (because the services were just for Jharkhand and state)

- The credit of tax paid on input services thanks to all recipients of credit shall be distributed amongst such recipients and such distribution shall be proportionately on the idea of the Turnover in a very State or turnover in a very Union Territory of such recipient, during the relevant period, to the mixture of the turnover of all recipients and which are operational within the current year, during the said relevant period.

EXAMPLE

XYZ Limited has its corporate office in Mumbai and three manufacturing facilities in Jharkhand, Maharashtra and state. The company’s Corporate Office is registered as an Input Service Distributor. Turnover of the three units in its states for the last year and current year (Q-1 and Q-2) are as follows.

| UNIT | FINANCIAL YEAR 2019-20 (RS IN CRORES) | Q-1 F.Y.2019-20 (RS IN CRORES) | Q-2. F. Y 2019-20 (RS IN CRORES) |

| JHARKHAND | 400 | 60 | 80 |

| MAHARASHTRA | NIL | 50 | 25 |

| WEST BENGAL | 500 | 75 | 75 |

ISD is in receipt of services that is commonly shared by all its units on which IGST of Rs.40 lakhs was paid.

ISD wanted to distribute the credit within the month of Juy,2019 (Financial Year 2019-20). The credit is going to be distributed as under: –

Jharkhand = Rs.40 lakhs × (Rs.60 crores / (Rs.60 crores+ Rs.50 crores.) = Rs.12.97 Lakhs

West Bengal= Rs. 40 Lakhs × (Rs.50 crores/ (Rs.60crores + 50 crores +75 crores) = 10.81 lakhs

Maharashtra= Rs. 40 Lakhs× (Rs.75 crores/ (Rs.60 crores+Rs.50crores+Rs.75 crores) = 16.22. lakhs.

Bottom of Form

WHAT IS MEANING OF RELEVANT PERIOD ?

Meaning of “Relevant Period” as per Explanation -1:

The Relevant Period” shall be: –

-

- If the recipients of the credit have turnover within their State or Union territory in the fiscal year preceding the year during which credit is to be distributed, the said twelvemonth, or

- In case some or all recipients of the credit don’t have any turnover within their State or Union Territory in the year preceding the year during which the credit is to be distributed, the half-moon that details of such turnover of all the recipients are available, previous to the month during which credit is to be distributed.

TURNOVER IN AN EXCEEDINGLY STATE/UT

Meaning of Turnover in a very State or Turnover in an exceedingly Union Territory as per Section 2(112) of CGST Act,2017:

“ Turnover in State” or Turnover in Union territory “ means the combined value of all taxable supplies (excluding the worth of inward supplies on which tax is payable by an individual on reverse charge basis) and exempt supplies made within a State or Union Territory by a taxable person, exports of products or services or both and inter-State supplies of products/services or both made by the said taxable person but excludes central tax, State-Tax, Union territory tax, Integrated tax, and cess.

RECIPIENT OF CREDIT

The expression “recipient of credit “means the supplier of products or services or both having the identical PAN as that of the Input Service Distributor.

TURNOVER

The term “turnover”, in relevancy any registered person engaged within the supply of taxable goods likewise as goods not taxable under this Act, means the worth of turnover, reduced by the quantity of any duty or tax levied under entry 84 of List I of the Seventh Schedule to the Constitution and entry 51 and 54 of List II of the said schedule.

PROCEDURE FOR DISTRIBUTION

As per Rule 39 of CGST Rules,2017 these following procedure we’ve to follow:

- An Input Service Distributor shall distribute input step-down within the manner and subject to the conditions, namely: –

- The input diminution available for distribution in a very month shall be distributed within the same month and therefore the details thereof shall be furnished in FORM GSTR-6 in accordance with the provisions of Chapter VIII of those rules.

- Input Service Distributor shall, in accordance with the provisions of clause (d), separately distribute the number ineligible as input reduction (ineligible under the provisions of sub-section (5) of section 17 or otherwise) and therefore the amount eligible as input step-down.

- The Input decrease on account of central tax, State tax, Union territory tax, and integrated tax shall be distributed separately in accordance with the provisions of clause (d).

- Input reduction that’s required to be distributed in accordance with the provisions of clause (d) and € of sub-section (2) of section 20 to at least one of the recipients” R1”, whether registered or not, from amongst the entire of all the recipients to whom input decrease is attributable, including the recipient(s) who are engaged in making exempt supply, or not registered for any other reason, shall be the termed as quantity,” C1”, and be calculated by applying the subsequent formula: –

Formula :

C1=(t1÷T) ×C, where, “C” is that the amount of credit to be distributed,

”t1” is that the turnover, as mentioned in section 20, of person R1 during the relevant period, and

“T” refers to the aggregate turnover of all the recipient entities, to whom such input service is attributable in accordance with the provisions of section 20.

- The input decrease on account of integrated tax shall be distributed as input diminution of tax to each recipient.

- ITC on account of central tax and state tax or any other tax leviable in union territory shall –

- In respect of a recipient located within the same State or Union territory within which the Input Service Distributor is found, be distributed as input decrease of central tax and State tax or Union Territory Tax respectively.

- In respect of a recipient located in a very State or Union territory aside from that of the Input Service Distributor, be distributed as integrated tax and therefore the amount to be so distributed shall be adequate to the mixture of the quantity of input step-down of central tax and State tax or Union territory tax that qualifies for being distributed as ITC, to the eligible recipient as per the clause (d).

- The Input Tax Distributor shall issue an ISD invoice, as prescribed in sub rule (1) of rule 54 clearly indicating in such invoice that it’s issued just for distribution of input step-down.

- Input Service Distributor shall issue an ISD credit note, as prescribed in sub-rule (1) of rule 54, for reduction of credit just in case the input decrease already distributed gets reduced for any reason.

- Additional amount of input step-down on account of issuance of a debit note to an Input Service Distributor by the supplier shall be distributed within the manner and subject to the conditions per clauses (a) to (f)and the number owing to any recipient shall be calculated within the manner provided I clause (d) above and such credit shall be distributed within the moth within which the debit note has been including within the return in FORM GSTR-6.

- Any input step-down required to be reduced on account of issuance of a credit note to the Input Service Distributor by the supplier shall be apportioned to every recipient within the same ratio within which input diminution contained within the original invoice was distributed in terms of clause (d) above, and also the amount so apportioned shall be: –

- Reduced from the quantity to be distributed within the month within which the credit note is included within the return in FORM GSTR-6.

- Added to the output liabilities of the recipient and where the quantity so apportioned is within the negative by virtue of the number of credits under distribution being but the quantity to be adjusted.

- If the number of input diminution distributed by an Input Service Distributor is reduced afterward for the other reason for any of the recipients, including that it absolutely was distributed to a wrong recipient by the Input Service Distributor, the method prescribed in clause (j) of sub-rule (1) shall, mutatis mutandis applies for reduction of credit.

- Subject to sub-rue (2), the Input Service Distributor shall, on the premise of the ISD credit note laid out in clause (h) of sub-rule (1), issue an ISD Invoice to the recipient entitled to such credit and include the ISD credit note and also the ISD Invoice within the return in FORM GSTR-6 for the month during which such credit notes and invoice was issued.

MANNER OF RECOVERY

As per sec.21 of the CGST Act,2017, Where the Input Service Distributor distributes the credit in contravention of the provisions contained in section 20 leading to excess distribution of credit to 1 or more recipients of credit, the surplus credit so distributed shall be recovered from such recipients together with interest, and therefore the provisions of section 73 or section 74 shall apply, since the same is mutatis mutandis, and applies for determination of the amount to be recovered.

EXAMPLE

If ABC company has one unit in Rajasthan and another unit in the province and as per the provisions contained in Section 21, Rs.1 Lakh was to be distributed to the unit in Rajasthan and Rs.2 Lakhs to the unit in the state. However, because of some calculation error credit of Rs.1.2 Lakh was issued to the Rajasthan unit and Rs.1.8 lakh to the unit in West Bengal. Thus, excess credit of Rs.20,000/- issued to the unit in Rajasthan shall be recovered from the unit in Rajasthan, and show cause notice shall be issued by the jurisdictional officer of Rajasthan

RECOVERY PROCEDURE FOR WRONG DISTRIBUTION

GST Act provides that the subsequent shall be deemed to be an inappropriate distribution of reduction by Input Service Distributor:

- Credit distributed to any or all or any recipient in far more than the quantity available for distribution.

- Distributed in an inappropriate ratio to all or any or any recipient.

- The Distributed in excess to what a supplier is entitled to and shall be recovered from such recipient(s) together with interest and therefore the provisions of ‘Demand and Recovery’ shall apply for effecting such recovery.

MANNER OF DISTRIBUTION OF ITC BY ISD

ITC accumulated can be of two sorts:

- ELIGIBLE: that which may be utilized for setting off against output liabilities

- INELIGIBLE: that which cannot be utilized for setting off against output liabilities

Note: To read more on the distribution of ITC by ISD. Both the types have to be distributed in the same manner. Input Tax Credit on any goods or services or both utilized by the taxable person for the development of immovable property (other than machinery or plant) on his own account including any goods or services or both employed in the course or expansion of business has got to be distributed separately for the ineligible ITC and eligible ITC.

ITC on account of IGST must be distributed as IGST only ITC of CGST and SGST/UTGST in respect of recipient located within the same State/Union territory is distributed because it is respectively. ITC of CGST, SGST/UTGST in respect of recipient located in several states is to be distributed as IGST i.e., CGST+SGST/UTGST=IGST

AMOUNT OF DISTRIBUTION OF ITC BY INPUT TAX DISTRIBUTOR (ISD)

For instance, some services are billed on Head office but employed by its units. There are three scenarios:

SCENARIO 1

Service billed is employed entirely by one recipient unit: Here, the services are used only by one among its units and none other. So, ITC of such bills that are specifically thanks to one unit must be allocated thereto unit entirely.

SCENARIO 2

Service billed is employed by over one recipient unit but not all Here, the services are utilized by two or more units but not all. Credit needs to be distributed to those units that were operational and generated revenue during the relevant month.

Tax credit shall be distributed as follows: Total credit of tax is apportioned on a pro-rata basis supported the turnover of the recipient within the state/ union territory to the full turnover of all the recipients that are operational and to whom the input service relates.

Formula

C1 = C*(T1/T)

C1 =ITC to be distributed to the recipient

C =Total ITC available for distribution

T1 =Turnover of the particular recipient

T =Total Turnover of all recipients to which ITC relates

SCENARIO 3

- Service billed is employed by all the recipient units: Here, the services are employed by all the units. Credit should be distributed to those units that were operational and generated revenue during the relevant month.

- Tax credit shall be distributed as follows: Total credit of tax is apportioned on a pro-rata basis supported by the turnover of the recipient within the state/ union territory to the full turnover of all the recipients that are operational and to whom the input service is relates.

- The proportion of ITC shall be determined, in respect of procedures laid down in scenario 2.

KEY POINTS TO CONSIDER

- Suppose there is quite one location in a very state or union territory, the sum of their turnover therein state/ union territory is to be considered in situ of turnover of the recipient (within the numerator).

- Credit owing to a recipient has distributed whether or not such recipient is unregistered or making exempt supplies.

- Where both taxable and non-taxable supplies are made, the “turnover” shall exclude Central excise duty, State excise duty, and VAT.

- If there are two or more locations of a recipient in a very state/ Union Territory, the sum of their turnover is to be considered in understanding the proportion of the credit that may be distributed thereto registration.

SOME EXAMPLES OF INPUT TAX DISTRIBUTOR (ISD) WORKING

EXAMPLE 1

XYZ Ltd. has its head office located in Mumbai (Maharashtra) which could be a registered ISD. it’s four units in numerous cities: one in Bangalore (Karnataka), one in Delhi, one in Chennai, and one in Pune (Maharashtra)Bangalore unit operates from another location in Karnataka at Belgaum. Delhi unit wasn’t operational during the year. Turnover generated at different locations is as follows:

- Bangalore: Rs. 50,00,000

- Belgaum: Rs. 30,00,000

- Pune: Rs. 80,00,000

- Chennai: Rs. 40,00,000

Total turnover for the year is Rs. 200,00,000. We’ve got three situations –

- XYZ Ltd. Is in receipt of an invoice issued by the supplier ‘A’ involving an Input tax credit-IGST of Rs. 1,80,000 for December 2017, services employed by all units.

- Also, XYZ Ltd received an invoice from supplier ‘B’ with an input reduction -CGST and SGST Rs. 10,000 each that’s used entirely by the Pune unit.

- Also, XYZ Ltd received an invoice from supplier ‘C’ with an input step-down

CGST and SGST both amounting to Rs. 2,40,000 that’s used entirely by all units except the Chennai unit. The distribution of step-down is as follows –

- The Head office of XYZ Ltd., is required to distribute the amount of Rs. 1,80,000 among all units except Delhi because it isn’t operational within the ratio in 2:1:2 as follows –

- Pune: within the kind of IGST Rs. 72,000 i.e. (1,80,000/200,00,000) x 80,00,000

- Chennai: within the type of IGST Rs. 36,000 i.e. (1,80,000/200,00,000) x 40,00,000

- Bangalore: within the sort of IGST Rs. 72,000 i.e. (1,80,000/200,00,000) x 80,00,000 .

Being a ratio of turnover is – 80,00,000: 40,00,000: 80,00,000 i.e., 2:1:2 Inclusive of the turnover at Belgaum because the turnover because it isn’t a separate unit but an extension of Bangalore unit within the identical state.

XYZ Ltd Head office (ISD) shall distribute Rs. 10,000 to Pune only within the variety of CGST and SGST of Rs. 5,000 each because the supply from supplier ‘B’ was exclusively for Pune Unit.

XYZ Ltd Head office (ISD) shall distribute Rs. 2,40,000 among all units except –

- Delhi because it isn’t operational.

- Chennai as Input services isn’t employed by this unit.

Thus, Pune will get CGST and SGST Rs. 60,000 each i.e. [(2,40,000/160,00,000) x 80,00,000]/2 Chennai: NIL Bangalore: within the type of IGST Rs. 1,20,000 i.e. (2,40,000/160,00,000) x 80,00,000 (*) (*) Inclusive of the turnover at Belgaum because the turnover because it isn’t a separate unit but extension of Bangalore unit within the identical state.

EXAMPLE 2

XYZ Ltd. received a credit note from the supplier ‘A’ in January 2018 in respect of supplies made in December for ITC Rs 80,000/-Now, this ITC mentioned in the credit note are going to be reduced from January month total ITC distributed, within the same ratio during which the initial ITC was distributed i.e., 2:1:2 (to be furnished partially 6B of the GSTR-6 of January 2018)

- Pune: in variety of IGST of Rs. 32,000

- Chennai: in sort of IGST of Rs. 16,000

- Bangalore: in type of IGST of Rs. 32,000

EXAMPLE 3

XYZ Ltd. received a credit note from the supplier ‘C’ in February 2018 in respect of supplies made in December for ITC Rs 50,000/-Now, this ITC mentioned in debit note are added to January month total ITC distributed, within the same ratio within which the initial ITC was distributed i.e., 1:1 between Pune and Bangalore (to be furnished partly 6B of the GSTR-6 of February 2018)

• Pune: in kind of CGST and SGST of Rs. 12,500 each

- Chennai: NIL

- Bangalore: in kind of IGST of Rs. 25,000, Being ratio of turnover as – 80,00,000: 80,00,000 (*) Inclusive of the turnover at Belgaum because the turnover because it isn’t a separate unit but extension of Bangalore unit within the identical state

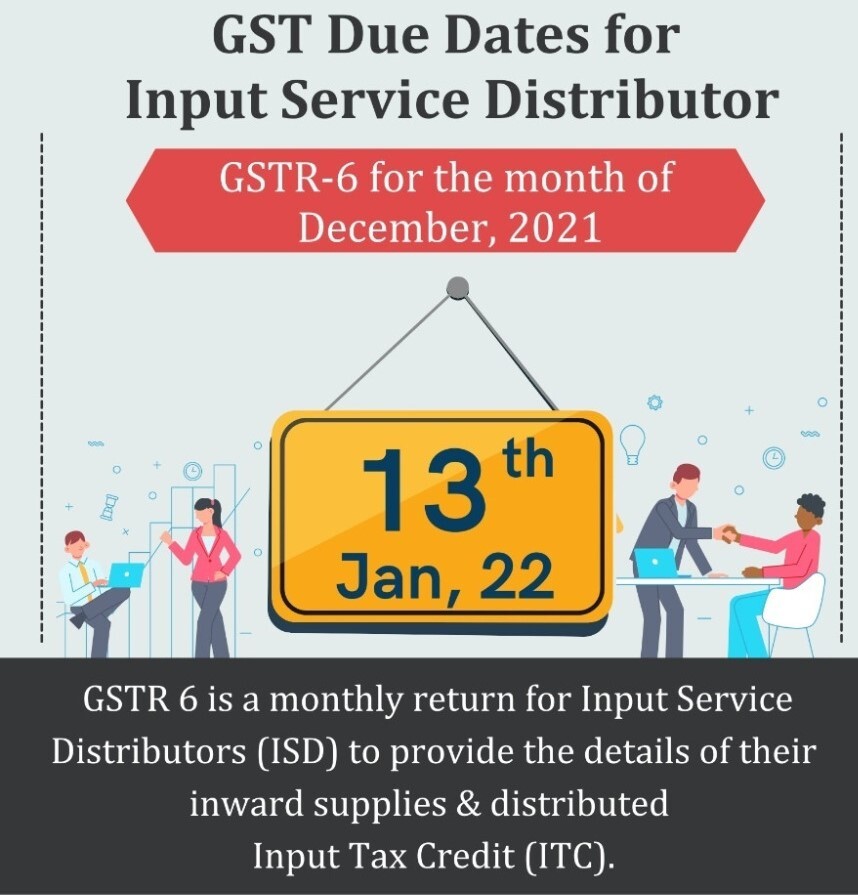

FILLING OF RETURNS

According to section 34 (4) of the CGST Act,2017, states that each taxable person registered as an Input Service Distributor shall, forever time period or part thereof, furnish, in such form and in such manner as is also prescribed, a return, electronically, within thirteen days after the top of such month.

Provision of Rue 65 of the GST Rules,2017 states that each input service distributor shall, on the premise of details contained in FORM GSTR-6A, and where required, after adding, correcting or deleting the main points, furnish electronically the return in FORM GSTR-6, containing the main points of tax invoices on which credit has been received and issued under section 20, on the common portal of GST.

As per Rule 60(5) of the GST Rules,2017 states that the small print of invoices furnished by an Input Service Distributor in his return in FORM GSTR-6 under rule 65 shall be made available to the recipient of credit partially B of Form GSTR-2A electronically through the Common Portal and therefore the said recipient may include the identical in FORM GSTR-2.

RECENT UPDATES ON GSTR-6

- 28th May 2021 – The due date for filing of GSTR-6 for April and the same has been extended up to 30th June 2021.

- 1st May 2021: The date to furnish GSTR-6 for April 2021 has been extended up to 31st May 2021.

- 3rd April 2020: CBIC has notified that the maturity date to furnish GSTR-6 for the months of March 2020, April 2020 and will 2020 (falling due between 20th March 2020 to 29th June 2020) shall stand extended till 30th June 2020.

Popular Article :