SEBI Investment Advisors’ Amendment Regulations 2020

Page Contents

The Securities Exchange Board of India recently issued a notice under PR No. 37/2020 providing for the amendments to the SEBI (Investment Advisors) Regulations, 2013. The Investment advisor’s amendment is aimed to strengthen the regulatory framework for investment advisors.

OVERVIEW ON SEBI INVESTMENT ADVISORS’ AMENDMENT

- In India, the investment advisers are regulated and monitored by the Securities and Exchange Board of India (Investment Advisers) Regulations, 2013.

- These regulations specify conditions related to the registration, certification, capital adequacy, risk profiling and suitability, disclosures to be made, code of conduct, records to be maintained, manner of conducting inspection etc. with relevance IAs. Vide its gazette notification of July 03, 2020, the Securities and Exchange Board of India (SEBI) has notified amendments to those Principal Regulations.

- Earlier, in January, the Securities and Exchange Board of India had floated a consultation paper on review of the regulatory framework for investment advisors and asked for public comments thereon. The consultation paper had created speculations among the RIA community concerning the very fact of how this new regulatory regime would come forth, considering the challenging and competitive environment.

- In January 2020, SEBI had issued a consultation paper on review of regulatory framework for IAs and sought comments from the general public and stakeholders on the proposed changes. Such a paper was issued, in order to provide a clear segregation between advisory, distribution and execution services provided to a client by IAs.

- On 3rd July, the speculations were put to rest when the market regulator (SEBI) came out with the ultimate version of the amendment to SEBI Investment Advisors Regulations, 2013.

- The notification states that the amendments are slated to come back into force on the nineteenth day from the date of publication within the official gazette. The amendments are expected to further strengthen the regulatory framework for Investment advisors.

- In the past, it was seen that the distribution and execution services were being used interchangeably, without any significant differentiation. After considering these issues in its consultation paper, SEBI has approved the proposals on regulatory changes and accordingly notified the SEBI (Investment Advisers) (Amendment) Regulations, 2020 (“Amendment Regulations “).

- Thus, these amendments thereby provide for greater clarity on the segregation of advisory services from distribution services and distinguish between distribution and execution services.

- The Amendment Regulations shall inherit force on the ninetieth day from the day of their publication within the official gazette (i.e., July 03, 2020). this text aims to briefly summarize the key regulatory changes, which are introduced by way of the Amendment Regulations.

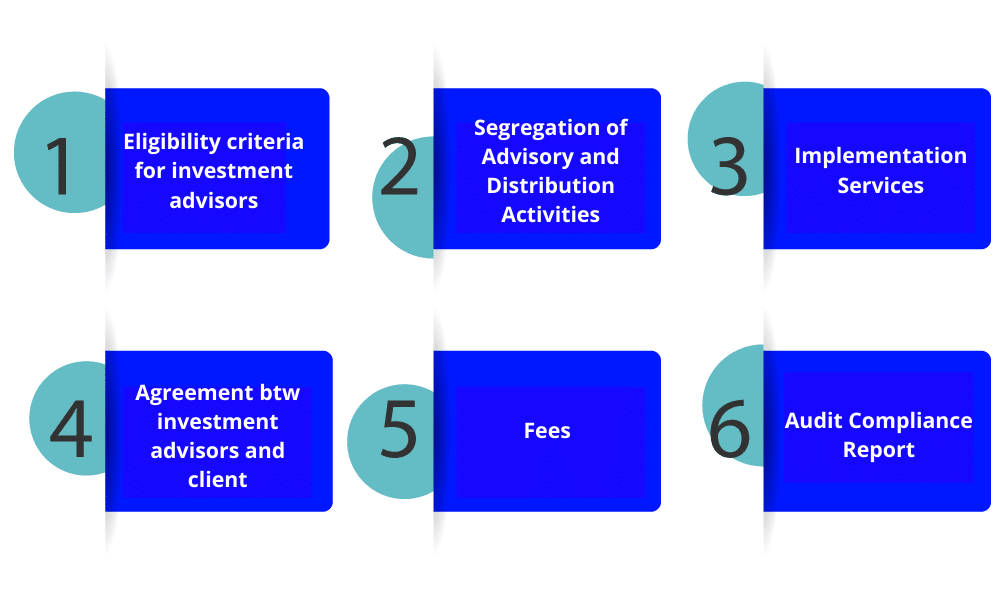

HIGHLIGHTS OF THE SEBI INVESTMENT ADVISORS’ AMENDMENT

The main points as provided in the amendments to SEBI (Investment Advisors) Regulations are as follows:

ELIGIBILITY CRITERIA SEBI INVESTMENT ADVISORS’

- Enhanced eligibility criteria for registration as a consultant including net worth of Rs.50 lakhs for non-individuals and Rs. 5 lakhs for people.

- Individual adviser or a principal officer of a non-individual consultant to possess enhanced professional or post-graduate qualification in relevant subjects and relevant experience of 5 years while grandfathering existing Individual Investment Advisers from complying with the improved qualification and knowledge as specified by SEBI.

- Individuals registered as investment advisers whose number of clients exceed 150 in total, shall apply for registration with SEBI as non-individual consultant.

-

- The investment advisors’ eligibility criteria consist of the qualification along with the net worth requirements. SEBI has amended the qualification and net worth requirement with the Investment advisor’s amendment.

- Eligibility criteria for registering as adviser has been enhanced with a net worth of fifty lakh rupees for non-individuals and 5 lakh rupees for people.

- The individual consultants or principal officers of a non-individual investment advisor to own enhanced professional or postgraduate qualification in relevant subjects.

- Relevant experience of 5 years is additionally required while grandfathering exiting individual investment advisors from complying with the improved qualification and skill as prescribed by the SEBI.

- The necessity of certification in financial planning remains the identical.

- In case where a personal registered as a personal consultant has over 150 clients, then he’s required to choose non-individual adviser registration.

- It is also to be noted, that the Securities and Exchange Board of India inserted regulation 3(3), prohibiting anyone except investment advisors registered with SEBI dealing within the distribution of securities, to use “Independent Financial Advisor” or wealth advisor or such other name.

SEGREGATION OF ADVISORY AND DISTRIBUTION ACTIVITIES

- As per the regulation 15 (5) of the Investment Regulations, all the Investment advisors are required to disclose all conflict of interest that pops up while advising its clients.

- There are often instances where the investment advisors would advise to take a position in products that fetch maximum commission. So so as to beat such a situation, investment advisors are required to disclose conflict of interests.

- Segregation of Advisory and Distribution Activities to be at the client level with a view to avoiding conflict of interest.

- The individual adviser to possess a choice to register as an adviser or has the choice to supply distribution services as a distributor.

- In case where a non-individual investment adviser contains a clear mechanism, and he also maintains an arm’s length relationship between advisory and distribution services, he can continue with both.

INVESTMENT ADVISORS OFFER IMPLEMENTATION SERVICES

- Investment advisors offer implementation services to their clients, which implies the execution of recommendation provided to the client by charging reasonable consideration.

- SEBI has emphasized the very fact that whether to avail implementation services are going to be supported the selection of the client, and therefore the investment advisors cannot force its clients to avail the services.

- As per the Investment advisor’s amendment, Investment advisors are permitted to produce implementation services (Execution) through direct schemes or products within the stock market. However, it should be noted that no consideration will be received either directly or indirectly at the investment advisor’s group or family for these services.

- Investment advisors or group or family of investment advisors cannot charge any consideration, including commission or referral fees for giving implementation services.

- SEBI has mandated the investment advisors to supply a declaration that no consideration shall be charged for implementation services.

AGREEMENT BETWEEN INVESTMENT ADVISORS AND CLIENT

Under regulation 19, a consultant is required to keep up a duplicate of the agreement with the client with other records prescribed under the regulation. the necessity of the agreement wasn’t mandatory under the erstwhile regulations; therefore, many consumers weren’t attentive to the terms and conditions of the advisory services that they received from investment advisors.

SEBI also received numerous complaints against investment advisors regarding their unfair practices like charging high advisory fees, promising false returns, non-disclosure of fees, etc. Moreover, within the case where there’s no agreement between advisor and clients, the client might not be able to prove his claim.

Hence, now there’s a requirement for mandatory agreement between investment advisors and clients. it’ll help in ensuring greater transparency in advisory activities. A circular concerning minimum mandatory term to be incorporated within the agreement is awaited.

For details refer to the circular:

SEBI has extended the date from 30 June to 15 Sept 2020 for the filing of financial results

Amendments in SEBI -Listing Obligations and Disclosure Requirements Regulations 2015

FEES TO BE CHARGED BY THE ADVISER

The fee to be charged by the adviser shall be as per the way prescribed by the Securities Exchange Board of India. The circular regarding the identical is awaited.

AUDIT COMPLIANCE REPORT

- It is provided that the required audit compliance will be required to be submitted with the Securities and Exchange Board of India.

- A circular concerning the timeline of the identical is awaited. this alteration within the annual compliance audit requirement was essential as this can be the sole report submission of which has been made necessary for an RIA.

SUMMARY ON INVESTMENT ADVISERS AMENDMENT

Following are the key highlights:

- Eligibility criteria for registration as an investment advisor including net worth of Rs. 50 lakhs for non-individuals and Rs. 5 lakhs for people

- Segregation of Advisory & Distribution Activities at client level to avoid conflict of interest.

- For individual investment adviser there’s a choice to register as an investment advisor or provide distribution services as a distributor.

- If a non-individual adviser incorporates a clear mechanism and also, he maintains an arm’s length relationship between advisory and distribution services, he can continue with both.

- Investment Advisers are allowed to supply implementation services (Execution) through direct schemes/ products within the stock exchange. However, no consideration is received directly or indirectly, at investment adviser’s group or family level for these services.

Client agreement & Annual Compliance

- Mandatory Client agreement between the Advisor and client

- Annual Compliance Audit to be mandatorily submitted to SEBI

- Fee charge by investor advisor shall be as per the way prescribed by SEBI

- If a private registered as a private adviser has over 150 clients, then he will must go for non-individual adviser registration

- Individual adviser or a principal officer of a non-individual investment advisor to own enhanced professional or post-graduate qualification in relevant subjects and relevant experience of 5 years while grandfathering existing Individual Investment Advisers from complying with the improved qualification and skill as specified by SEBI

CONCLUSION

- The SEBI Investment Advisors Amendment is anticipated to control the role of Investment advisors, and therefore the glaring gaps that were visible earlier are expected to be full of these amendments.

- Apart from the key regulatory changes as described above, Regulation 7 has been amended to produce for enhanced professional or post-graduate qualifications of the IA or a principal officer of a non-individual IA, being registered as an IA under the relevant subjects along with relevant experience. However, these qualification requirements shall not apply to such existing IAs as is also specified by SEBI.

- The Amended Regulations also make further amendments to create A in First Schedule of the Principal Regulations, which handle application for grant of certificate of registration/renewal as an IA. Vide its release dated July 03, 2020,

- SEBI has clarified that the rules coping with various other issues like key terms and conditions of investment advisory services agreement, modes of charging fee, periodicity etc. are separately specified through a circular.

Also Read