FEMA Compliance for FDI in Equity share in India

Page Contents

FCGPR – FEMA Compliance for FDI in Equity share in India

OVERVIEW

FDI Stands for Foreign Direct Investment (FDI) Reserve Bank of India has made regulations and issued certain notifications in relation to the receipt of Foreign Direct Investment (FDI) in India.

RBI has allowed the receipt of Foreign Direct Investment (FDI) by the way of the issue of capital instruments in India.

Further, the company receiving Foreign Direct Investment (FDI) has to make reporting of receipt of FDI in form FCGPR.

Form FCGPR is required to be filed in case the company is issuing equity shares, Compulsorily Convertible Preference Shares (CCPS)/ Compulsorily Convertible Debentures (CCD) to a person resident outside India.

What is FCGPR?

FCGPR stands for the Foreign Collaboration general permission route. RBI has specified Form FCGPR for making reporting of Foreign Direct Investment (FDI).

Whenever a Company issues equity shares, Compulsorily Convertible Preference Shares (CCPS)/ Compulsorily Convertible Debentures (CCD) in consideration of money received from a person resident outside India by way of Foreign Direct Investment (FDI), then the company needs to file FORM FCGPR using FIRMS Portal.

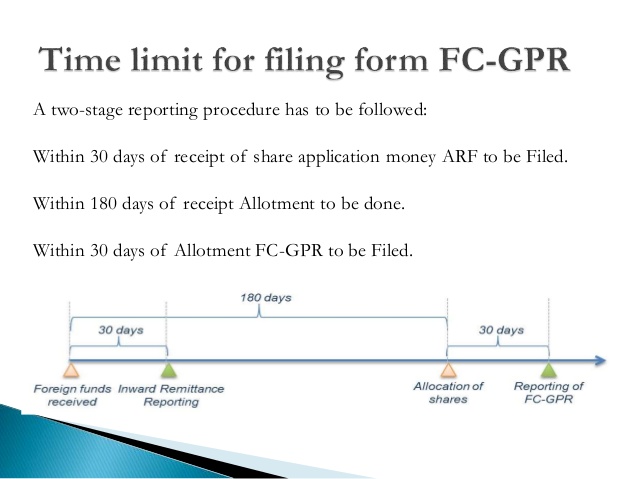

Time Limit for filing FORM FCGPR

Form FCGPR needs to be filed within 30days of allotment of shares / Compulsorily Convertible Preference Shares (CCPS)/ Compulsorily Convertible Debentures (CCD).

Applicable Regulation

Inward remittance of Foreign Direct Investment (FDI) by a person resident outside India is regulated by Foreign Exchange Management (Transfer or Issue of Security by a Person Resident Outside India) Regulations, 2017

Document Required for filing FORM FCGPR

The following documents shall be required for filing Form FCGPR:

1 Board Resolution for Allotment of Shares / Compulsorily Convertible Preference Shares (CCPS)/ Compulsorily Convertible Debentures (CCD)

2 Memorandum of Association of the company in case the shares are allotted for the subscription to the Memorandum of Association (MOA)

3 Foreign Inward remittance Certificate (FIRC) from AD Bank

4 KYC from AD Bank

5 Valuation certificate regarding the value of shares from the Chartered Accountant

6 CS Certificate in the prescribed format

7 Declaration by Authorised representative of the Company

8 Debit Authorisation for debiting charges from the Bank

9 Declaration regarding issue price by the directors of the Company

10 Reason for delay in submission, if any

Routes of Foreign Direct Investment(FDI)

FDI can be received by way of the following routes:

1 Automatic Route: where no approval is required for getting inward remittance from a person resident outside India.

2 Government Approval Route: There are certain sectors in which government approval is required for receiving inward remittance from a person resident outside India.

Prohibited Sector for Foreign Direct Investment(FDI)

A person resident outside India cannot make any Foreign Direct investment in any of the following sectors:

1 Lottery Business. It includes the Government / private lottery or online lotteries

2 Gambling and betting including casinos

3 Chit Fund (except for investment made by NRI’s and OCI’s on a Non – repatriation basis)

4 Nidhi Company

5 Trading in Transferable Development Rights (TDR’s)

6 Real Estate business or construction of Farmhouses

7 Manufacturing of Cigars, cheroots, cigarillos and cigarettes, tobacco or of tobacco substitutes.

Note: The prohibition is on the manufacturing of the products mentioned and foreign investment in other activities relating to these products including wholesale cash and carries, retail trading, etc. will be governed by the sectoral restrictions laid down in Regulation 16 of FEMA 20(R).

8 Activities/sectors not open to private sectors investment i.e Atomic energy and Railway operations

9 Foreign technology collaboration in any form including licensing for franchise, trademark, brand name, management contract is also prohibited for Lottery Business and Gambling and Betting activities.

For more reading: Advantages and know details about Startup India Scheme

Process for filing FORM FCGPR

The following process shall be followed for reporting of Foreign Direct Investment (FDI) in India:

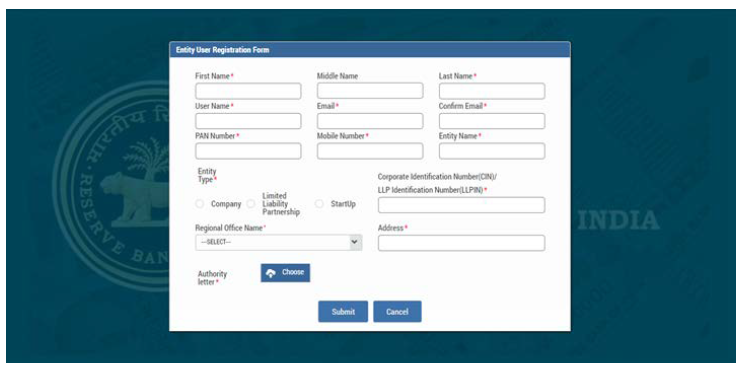

Step 1: Registration for Entity User on Firms Portal

The company has first of needs to get the registration of Entity user on the FIRM’s Portal in case the reporting of FDI is being made the first time for the Company.

In the case of subsequent reporting, the company does not need to make any registration for entity users.

Documents to be attached: Authority letter in signed Format, PAN of Entity, and PAN of Authorised Representative of the company.

After registering an entity user, the concerned authority will check and verify the details and documents filed and after being satisfied, a Password will be sent to the registered email ID which needs to change.

Step 2: Creation of Entity Master

After registration of entity user, there needs to create an entity master by logging into the FIRM’s Portal using the User ID and Password as created in the entity user process.

The Company needs to fill all the details as required in the entity master form in the FIRM’s Portal and then click on “Submit”.

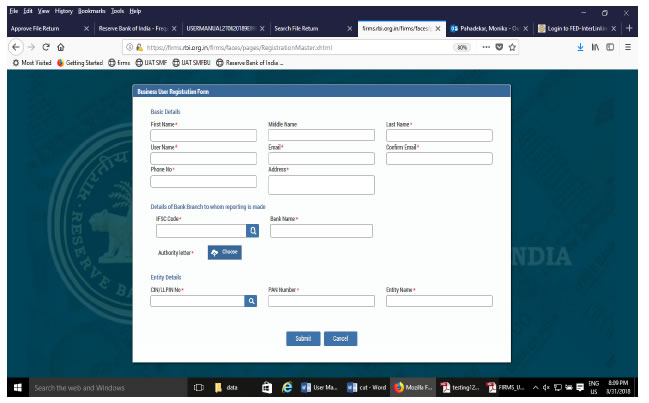

Step 3 Registration for Business User on Firms Portal

After the creation of Entity Master, the company needs to apply for business user registration.

One important point to be noted is that here in the business user form the company needs to select the IFSC Code of the AD Bank from the Drop Down. So, the company should confirm the IFSC Code to be chosen in the form in advance from the Concerned Bank.

Documents to be attached: Authority letter in signed Format, PAN of Entity, and PAN of Authorised Representative of the company.

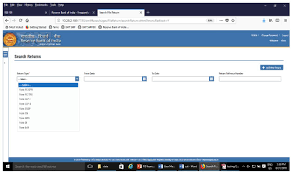

Step 4 Reporting of FDI Received

The Last step is to make the reporting of remittance received from a person resident outside India. The company needs to fill in all the required details and attach the relevant documents as mentioned above while making reporting in this form and then submit the Form.

After filing Form FCGPR, the AD Bank or both AD Bank and RBI as the case may be will check the form and in case any discrepancy is found in the Form, then they will reject the Form giving the appropriate reasoning or otherwise they will approve the Form.

In case the form got rejected, then the company needs to file the Form again after removing all the discrepancies.

For more reading: Legal documents required for running Business

Also read more: Advantages and know details about Startup India Scheme

Consequences of late filing of FORM FCGPR

If the Company makes reporting of Foreign Direct Investment (FDI) after the period of 30 days of allotment of shares / CCPS / CCDs, then the Form will first be checked by the DA Bank and then AD Bank will send the form further to the Respective regional Reserve Bank of India.

Further, the Reserve Bank of India will either charge late submission Fees (LSF) or ask the Company to go for compounding for approval of Form FCGPR.

How Rajput Jain & Associates can Assist

We offer all kinds of Consultancy, Compliances, and Registration Services in relation to Foreign Direct Investment (FDI) in India. We have impaneled various experts to provide the expert advisory, Registration, and Compliances services for Foreign Direct Investment (FDI) in India.

The services that we offer include in Foreign Direct Investment (FDI) in India are:

- FEMA Compliances related to Foreign Direct Investment (FDI)

- Reporting to RBI in relation to Foreign Direct Investment (FDI)

- Drafting of documents for reporting to RBI

- Valuation of shares

- Advising various routes for remitting the money in India

- ROC Compliances in relation to Foreign Direct Investment (FDI)

- Liaisoning with AD Bank and RBI in relation to compliances and FDI matters

Frequently Ask Question(FAQ)

Q 1 Where we can make reporting of Foreign Direct Investment (FDI)?

Ans Reporting of Foreign Direct Investment (FDI) can be made online using FIRMS Portal.

Q 2 What is the Time limit for allotment of shares for FDI received in India?

AnsThe shares need to be allotted within 60 days of receipt of Foreign Direct Investment (FDI) in India.

Q 3 Do we require to file form FCGPR for issuance of Preference shares or debentures?

Ans Form FCGPR is required to be filed if the Preference shares or debentures issued are fully and compulsorily convertible in shares, otherwise, it would be treated as ECB.

Q 4 Do we require to file form FCGPR for partly paid equity shares?

Ans Yes, Form FCGPR is also required to be filed for issuance of partly paid shares.

FEMA, DGFT & other related Compliances:

- Online Reporting of FDI to RBI through AD banker in ARF form. ·

- Filing of online FCGPR with RBI ·

- Filing of Foreign Liabilities & Assets return (FLA) with RBI ·

- Compliances related to Downstream Investment

- Application and online modification of IEC with DGFT, also done some compliances related to the application of EPCG license.

- Liaoning with various Banks for the documents like KYC, UIN, FCGPR registration no. & other acknowledgements related to FDI.

- Application of Registration Cum Membership Certificate (RCMC) from Federation of Indian Export Organization (FIEO).

- Liaoning with NIC.

- Registration of Trust under FCRA (Foreign Contribution Regulation Act)

- Registration of Societies and Trusts.

ALSO Popular Articles :

CS Akshay Gupta is a diligent and innovative qualified Company Secretary, striving in matters related to Corporate Law. Akshay takes a deep interest in corporate, NBFC and FDI matters and his specialization includes corporate Compliance, FEMA Compliances, and NBFC Registration. As a Company Secretary, Akshay is passionate about matters relating to corporate funding, NBFC, and its compliances.

Don’t Worry! Our experts are here to help you. Get in Touch with our team for easy filing of SMF Form FCGPR.