Reasons for the Movement of Goods under the GST

Page Contents

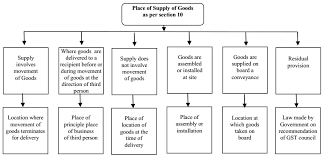

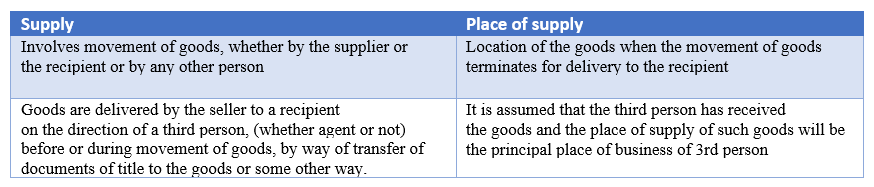

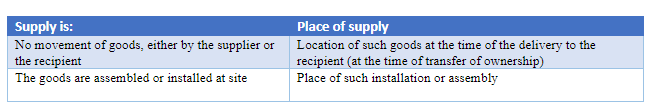

GST is a tax-based destination, i.e. goods/services would be taxed at the place where they are purchased and not at the point of origin. So, the state in which they are consumed would have the right to receive the GST.

This, in effect, makes the idea of the place of supply essential to GST, as all the regulations of GST revolve around this one.

The place of supply of goods under the GST determines if the transaction will be counted as intra-state or interstate, and the levy on SGST, CGST & IGST will be calculated and the results.

GST: Place of Supply In case There is a Movement of Goods

Reasons for the Movement of Goods under the GST

- Supply – In case of outward supply of goods, the supply liable to GST as per Schedule I or inward supply of goods liable to tax under reverse charge by a taxable person.

- Export or Import – In case of export of goods from or import of goods into the territory of India

SALIENT FEATURES OF NEW GST SYSTEM IN INDIA

-

Job Work –

When the principal and the job worker are registered persons the EWB will be generated by the principal when he occasions the movement of goods for job work and by the job worker when he occasions the movement after job work, and by the recipient, if the job worker is not a registered person.

- SKD or CKD –

The goods may be supplied on semi-knocked down (SKD) condition or the goods may be supplied in batches to be assembled at the place of the recipient in case of completely knocked down (CKD) conditions, the e-way bill is to be generated, based on the value of the product being transported

-

Line Sales–

When the goods are taken in the delivery van in a particular route to effect sale to all the retailers, the movement of goods is to be covered by an e-way bill. When the goods are moved under ‘Recipient not known’, they may not know the details of sales. However, the total value of the consignment e-way bill has to be generated.

-

Sales Return –

When the recipient rejects and sends back the goods they have to generate an e-way bill or the supplier will have to generate an e-way bill on the capacity of the recipient of such goods

-

Exhibition or Fairs –

When the registered person is going to participate in an exhibition or fair, and the goods are moved from the godown of such person, then the e-way bill is to be generated

-

For own use –

When goods are purchased for personal use, the supplier will generate EWB

-

Others –

For any item other than the above, such as the movement of goods for provision of supply of service or for any other purpose which involves movement of goods, EWB should be generated

GST: No Movement of Goods

Read our articles: