Three-tier TP Documentation & threshold Requirement

Page Contents

Three-tier Transfer Pricing Documentation & threshold Requirement

Taxpayers are expected to maintain, on a yearly basis, a collection of detailed information and documentation relating to international transactions performed with AEs or specified domestic transactions.

Rule 10D of the Income Tax Rules of 1962 provides for accurate records and documents to be kept by the taxpayer. These specifications may generally be divided into two sections.

The very first part of the rule sets out required documents/data which must also be preserved by a taxpayer; the second part of the rule specifies that sufficient documentation is kept to support the data/analysis/studies recorded below the first part of the law. The second part also includes a suggested list of such supporting documentation, like government papers, reports, surveys, technical papers/market research studies performed by credible organizations, price publications, relevant agreements, agreements, and communications.

Taxpayers with cumulative foreign transactions just below the defined INR 10 million threshold and specified domestic transactions below the INR 50 million thresholds are exempted from keeping the defined documents. However, even in these situations, it is crucial that the documents preserved should be sufficient to sustain the price of the arms-length of international transactions or defined domestic transactions.

Both required records and details must be preserved at the same time (to the extent possible) and must be in order by the due date of the filing of the tax return. Businesses subject to the regulations are usually expected to file their tax returns on or before 30 November following the conclusion of the tax year in question.

The required records must be retained for a period of nine years from the end of the applicable tax year and must be revised on a continual basis an annual basis. Supporting document provisions also extend to multinational companies whose income is subject to Indian tax liability.

|

|||||||||||||||||||||||||||||

Structure of three-tier transfer pricing documentation:

Local File-This must be recorded by the Organization itself. · Master File-Requires to be filed with the IT department. · Nation by Nation Study – Requires to be sent to the IT Department. Applicability of CbCR

Note: Turnover to be taken for Master File is the Accounting Year (i.e., for F.Y 2019-20, accounting Year will be 2019-20) Compliance applicable on Transfer PricingMaster File– Forms and Timelines |

|||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

|

Transfer pricing rules wouldn’t really apply if the arms-length price results in a downward revision of the income taxed in India. Burden of proof The responsibility of establishing the arm’s length existence of the transaction rests mainly with the taxpayer. If during the audit process on the basis of content, details, or records in their possession, the tax authorities are of the opinion that the arm’s-length price did not apply to the transaction or that the taxpayer did not maintain / Produce sufficient and accurate documentation / Details/information, the overall taxable income of the taxpayers may be computed as follows after the hearing right has been provided. Compliance Under CBCRCbCR – Forms and Timelines : |

|||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

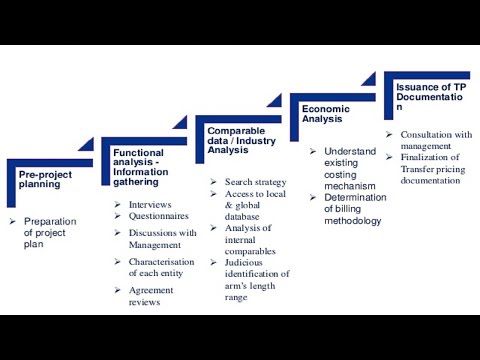

Time-Time for Creating Transfer Pricing Documents

Regrettably, the timeline for processing the report varies from country to country. Many countries need details to be ready when a tax return is filed. Other countries want to see something ready at the time of the audit.

Even so, the whole rationale of the transfer pricing legislation is to consciously enforce the Arm’s Length concept. You do this by determining the right transfer price before the actual transaction takes place. What this means is that you build up the transfer pricing paperwork over the year when you’re doing the business. Not at end of each year, like that.

Summarizing

The latest events have given rise to a renewed emphasis on transfer pricing practices. Standard reporting standards are now in place to address (assumed) abusive tax practices.

The aims of such provisions are, first of all, to increase awareness of the transfer pricing legislation and the environment of adherence. In addition, the report provides policymakers with an analysis of possible threats. In the end, it makes the future audit much simpler.

There are many three reports to be given. Master File, Local File, Country-by-Country Chart. The Country-by-Country report is for major Multi-National Companies with a turnover of Dollars 750 million or more.

Popular Blog:-