Essential key concepts Gift Taxation: Income Tax

Page Contents

Essential Key concepts Taxation on gifts

Gifts up to Rs 50,000 per year are exempt from tax in India. In addition, donations from particular relatives, such as parents, spouses, and siblings, are also exempt from tax. Gifts are taxable in other cases. The gift tax in India falls under the Income Tax Act as there is no specific gift tax after the Gift Tax Act of 1958 was enacted in 1998.

In India, gifts are given on a number of occasions, such as celebrations such as Diwali, Holi, or the occasion of marriage, to express love for our loved ones.

Nevertheless, gifts are now also used for tax planning reasons as, in multiple given to a specific, any amount of gifts received is exempt from tax. Some people whose gifts they got in their ITR claim that they’re still gifts obtained out of love and affection.

Even so, it’s not the right way, since donations are tax-exempt only in such specific circumstances or where they are obtained by particular persons. Non-disclosure of gifts could result in penalties of between 50 and 200 percent of the tax payable on the income attempted to be avoided.

-

Gifts received from the employer

There are occasions when employers give the employee a present on a special occasion or to boost their productivity, or because they do well. An employee shall be liable for gifts received from the employer only if the value of such gift is equal to or greater than Rs. 5,000. Gifts below Rs. 5,000 in value within the financial year shall be excluded from the vat. These gifts shall be taxable as perquisites under the Head of Salary Income.

-

Gifts received from any other person;

Section 56(2)x) of the Income Tax Act, 1961 deals with the taxability of gifts received by a person, except the employer, throughout the year. This provision shall apply regardless of the status of the resident or of the class of assessee.

The donor or donor can be an individual, a partnership business, LLP, a corporation, AOP, BOI, a cooperative society, or an artificial legal body, whether resident or non-resident.

Previous gifts from a resident to a non-resident are, even then, claimed to be non-taxable in India as the recipient used to claim that income does not accrue or arise in India.

In order to make sure that the receipt of gifts is also taxed in the hands of non-residents, Section 9 has been amended by the Finance Act (No. 2), 2019, to provide that income is considered to have accrued or to have arisen in India as a result of the payment of gifts (exceeding Rs. 50,000) without adequate consideration by a resident to a non-resident.

It does not provide proof of the taxability of the gift of the estate as referred to in Section 56(2)(x), inter-alias, immovable property, gold, securities, etc.

Therefore, after the amendment, it may be inferred that gifts in the nature of money in the hands of non-residents provided by resident persons would be paid in their hands, even though gifts of any other manner are also beyond the control of the Income Tax Act.

2.1. Gifts received in cash form

Where even a person receives any amount of money without consideration and the total value of that sum exceeds Rs. 50,000, the total aggregate value of that sum shall be taxed on the basis of capital income from other sources. For the determination of the threshold, the aggregate amount of receipt from different sources and persons throughout the year shall be considered.

2.2. Gifts obtained in the form of real estate

Immovable property received by the assessee for the year, either without consideration or for lack of consideration, shall be deemed to have been income in his hands and to have been taxable in that year if the receipt is within a period of time.

- If the immovable property is received without consideration as well as the stamp duty value of the property reaches Rs. 50,000, the stamp duty value of the immovable property shall be liable to tax.

- If an immovable property is obtained for payment far less than the stamp duty value, the discrepancy between the stamp duty value and the compensation shall be taxable if the difference meets the above two limits: Rs. 50,000; or 10% of the consideration

For all cases, the cap of Rs. 50,000 shall be reviewed for each transaction and not for all transactions as a whole.

2.3. Gifts received in the form of Movable Goods

Movable property as described in the Act shall include any property in the form of shares and stocks, jewels, historical artifacts, sketches, portraits, sculptures, any work of art, or bullion.

In which the transaction includes any other movable property, such as car furniture, the excess consideration for the fair market value shall not be taxed. In this case, the deemed income shall be calculated as follows given way :

If any property is obtained without regard and the total fair market value of it reaches Rs. 50,000, the entire fair market value of such property shall be paid.

3. Gifts Exempt

I Upon the occurrence of a specified incident

- On the occasion of the marriage of an individual

- By will or by means of inheritance

- Considering the death of the payer or of the donor.

II Due to the status of the Doner

- The gift is to be accepted from any specified relative;

- Gifts obtained by any local authority;

- Gifts earned from any fund or foundation or university or other educational institution or hospital or medical institution or from any trust or institution referred to in Section 10(23C);

- Gift received from any trust or institution registered under section 12A/12AA/12AB[2];

- Gift obtained by a person from a trust formed or established exclusively for the benefit of the relative of the recipient.

III. Owing to the position of the Donee

- Gifts shall be handled by any trust or institution registered under section 12A/12AA/12AB2;

- a certain fund or trust or institution, or any university or other educational institution, or any hospital or medical institution referred to in Section 10(23C)(iv)/(v)/(vi)/(via).

IV Due to transactions not considered to be a transfer

- Any distribution of capital assets to the full or partial division of the HUF[Section 47(i)]

- the transfer of capital assets by an Indian parent company to its subsidiary company;

- Transfer of a capital asset to a merger, demerger, or company reorganization scheme such that the requirements laid down in Section 47(vi) to Section 47(vii) are fulfilled.

Other classes of persons who have been notified

- Immovable property acquired by a citizen of an illegitimate colony in the NCT of Delhi, pursuant to the requirement that such transaction must be regularized by the Central Government on the basis of the most current power of attorney, the selling document, the will, etc.

-

The first and only manner to save the tax via a gift

The alternative tax can be saved is by offering gifts to your parents or legitimate guardians or to a kid who is a major. Nonetheless, when you contribute the sum, your taxable income stays the same. However, the interest they earn from other products by continuing to invest these funds becomes their own income. So, presuming that their income is lower, you can rest in peace knowing that the money is not going to be taxed.

Previously, so when long-term capital gains (LTCG) tax was effective, gift money can also be invested in a mutual fund or stock for 1 year and used as tax-free income. However, it is not feasible now as the LTCG tax has been reintroduced with effect from 1 April 2018.

- Are gifts, both in cash and kind, taxable?

Actually, all sorts of donations, including dollars, jewelry, real estate, paintings, or some other valuables, are taxable. However, if the amount of cash or the value of the gift in kind is less than Rs 50,000, the same amount would not be taxable.

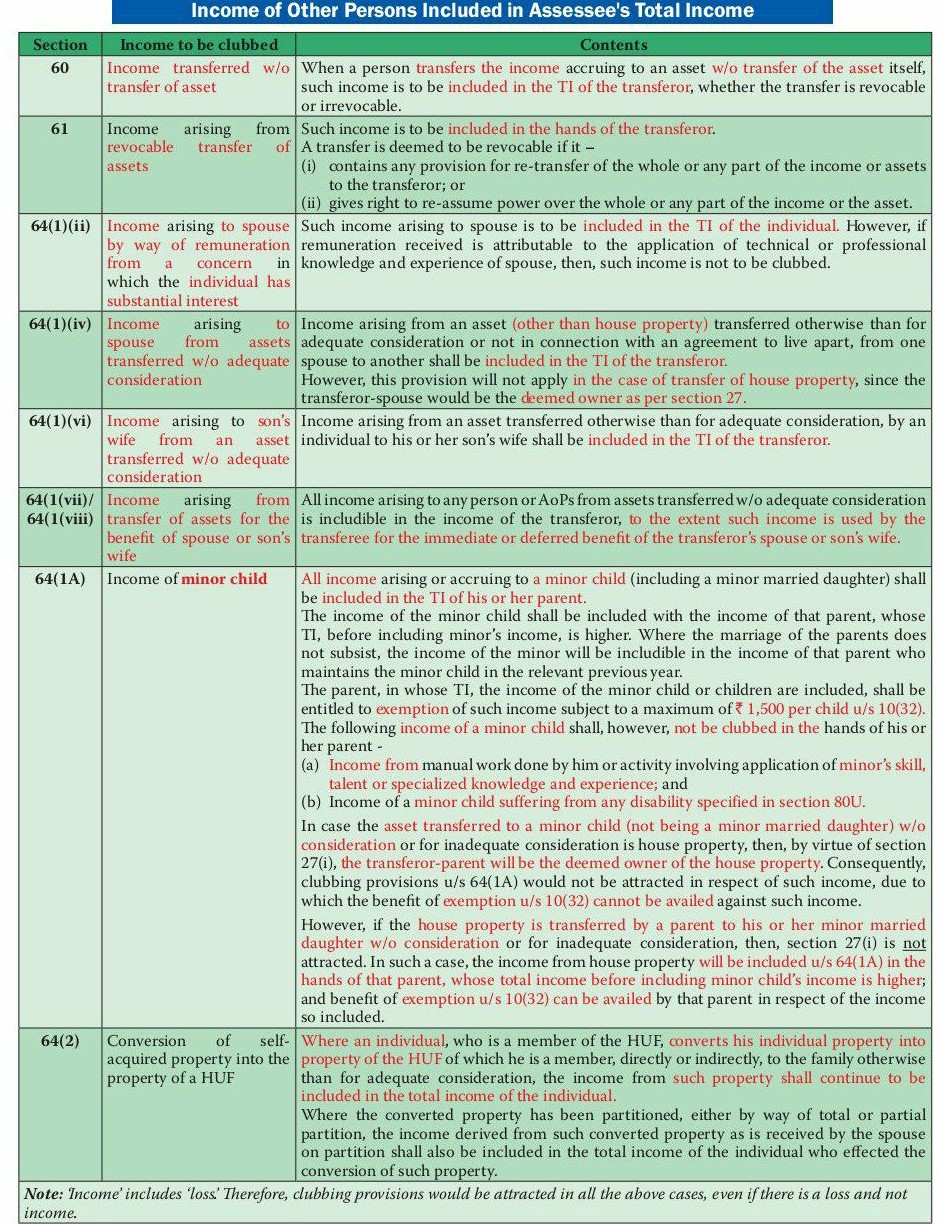

Income of Other Person included in Assessee Total Income

Popular blog:-