What is the system of E-Invoice?

Page Contents

What is the system of E-Invoice?

- There was a lack of a standard invoicing system on the market and the GST Council, in discussion with the ICAI (Institute of Chartered Accountants of India),

- the statutory body regulating the practice and profession of chartered accountants in India introduced a new requirement with this invoicing system.

- This norm has been chosen as it takes into account the specifications of the statutory tax legislation and is also compliant with global business practices.

- The standard also enables the generation of multiple data fields that are not required to be reported under the GST regime. Businesses are free not to create and report such data if they choose or do not produce such data.

Benefits of E-Invoice System for Businesses

There are many benefits of the E-Invoice System for Business are as follows:

-

Better service is provided to the taxpayer

-

- The process of generating invoices for GST will be self-regulated by E-Invoices. This will significantly speed up the task, cut prices, eliminate human error due to the need for manual data entry at every step.

- Elimination of multiple formats by automating the reporting of B2B invoice data (purchase, sale, etc.) in the unified and native format in which it is generated. There is no need for different formats for the generation of GSTR 1 and e-way bills.

- Sales and Purchase registered data are automatically generated from this so that the Return (RET 1) is pre-prepared and kept ready for filling. These details may also be used to initiate an e-way bill.

-

Enhancing the business process

-

- The format would become part of the company’s business process and practice.

- For companies who are already using accounting software, a single framework format across the industry can help the relationship between businesses and banks, auditors, and investors, who can now access the data without first having to translate it to the format they use.

- In the case of small businesses that do not use computerized accounting software, the GST Council is courtesy of the Government. Provides free ERP and Accounting software to GST-registered companies to boost the Digital India Initiative.

-

Save time & Cost control

-

- With e-invoicing, the invoicing process is cut off by several unnecessary steps. Using online e-invoicing tools, both you and your client can save time.

- You may not have to pay for paper or for postage costs for paperless invoicing. In addition, you save work time by saving time with e-invoicing instead of using templates and emailing PDFs.

- Concentrate more on other things that add value and can save both time and cost.

- Reduction in input tax verification issues:

-

- The input tax is the amount of tax already charged on the raw materials in the product (input) that must be deducted from the output product taxable amount. By-hand estimates in the filing of GST returns often lead to errors in the under or over-claiming of input tax credits.

- This results in the amount of deduction which an undertaking is entitled to in respect of the tax already paid on the commodity.

- Inadequate Input Tax Credit claims may lead to a significant loss for the company, as well as extra costs and difficulty fixing mistakes. An automated system can remove human mistakes and ensure that accurate input tax data is always entered.

- Reduction in input tax verification issues:

-

- The input tax is the amount of tax already charged on the raw materials in the product (input) that must be deducted from the output product taxable amount. By-hand estimates in the filing of GST returns often lead to errors in the under or over-claiming of input tax credits.

- This results in the amount of deduction which an undertaking is entitled to in respect of the tax already paid on the commodity.

- Inadequate Input Tax Credit claims may lead to a significant loss for the company, as well as extra costs and difficulty fixing mistakes. An automated system can remove human mistakes and ensure that accurate input tax data is always entered.

- Administrative Efficiency

- Before the e-Invoice system, several fake invoices were made, which will now be reviewed as the system is automated.

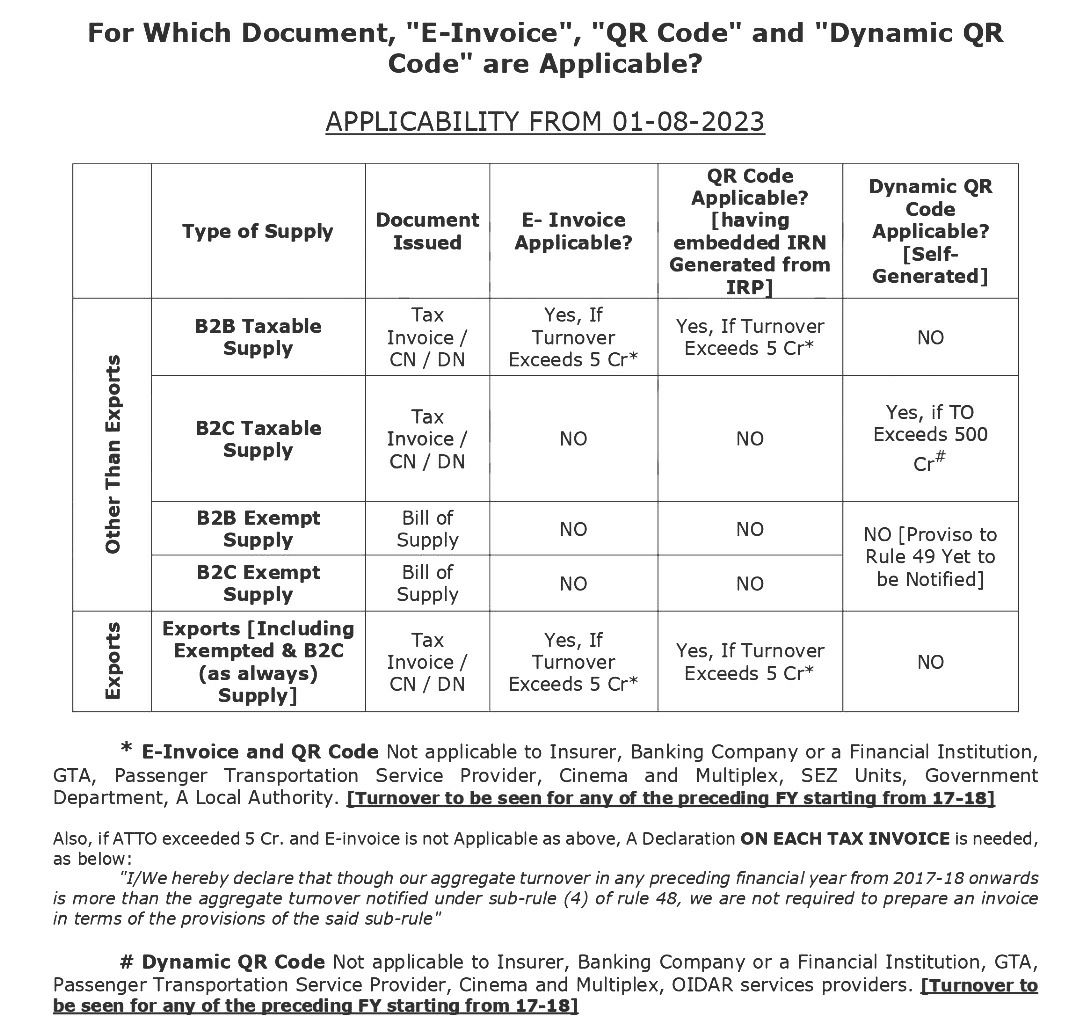

E-invoice limit reduced from INR 5 Cr applicable from 1 Jan 2023,

E-invoices GST Rules Changing From 1 August 2023, May Impact Lakhs Of Co. in India

- Finance Ministry has issued a GST circular with regard to the GST System beginning that Company with sale of More than 5 Cr will be needed to e-invoices generate from 1 August 2023.

Popular blog:-

- E-Invoice Mechanism under the GST

- Blocking/Unblocking the E-Way Bill creation system if fails to file GSTR-3B: GSTN

- Reasons for the Movement of Goods under the GST

- Overview of Invoice Furnishing Facility (IFF) Under QRMP Scheme

- Key characteristics for Auto-population of e-invoice