Auto-Population in E-invoicing

Page Contents

Key features on Auto-population of e-invoice details in GSTR-1/2A/2B/4A/6A

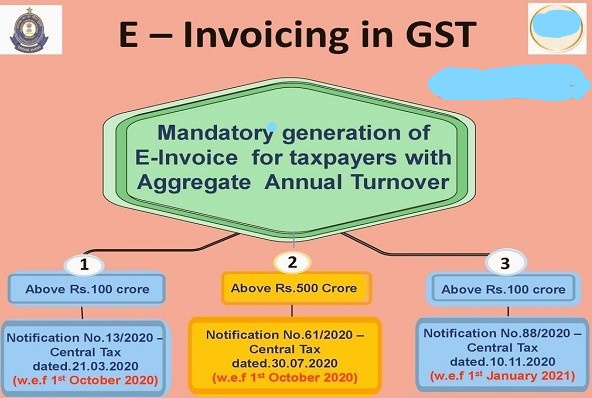

Who’s needed to create an E-invoice?

- Wide Notification No. 13/2020–Central Tax dated 21 March 2020, amended from time to time, any registered person with a cumulative turnover exceeding Rs 500 Cr in any previous FY from 2017 to 18 is needed to create an e-invoice w.e.f. 1 October 2020.

- In addition, every registered person with a total turnover in excess of Rs 100 Cr during any previous FY from 2017-18 onwards is required to generate an e-invoice w.e.f. 1 Jan 2021.

| E-invoice for Registered Person | Starting Timeline |

| The registered person having a total turnover in excess of Rs 500 Cr. | 1st Oct 2020 |

| The registered person having Total turnover in excess of Rs 100 Cr | 1st Jan 2021 |

GST E-Invoices – Advantage

- It is a reduction in price.

- GST E-Invoices Simplified GST compliance

- E-Invoices Improvement in business efficiency

- Precision

- E-Invoices abolition of paper

- Lesser reconciliation errors

- The effective functioning of capital performance

It is therefore not a soft copy of the GST invoices.

- The e-invoice is not just about the invoice shown in the soft copy as PDF, etc.

- E-invoice does not assume that the invoice is created through the govt portal.

More read: IMPACTS OF GST E-INVOICING SYSTEM

Business Exempted from creating an e-invoice:

E-invoicing shall not apply to specific categories of registered persons, whether or not their turnover exceeds the threshold as notified in CBIC Notification No. 13/2020-Central Tax:

- The registered person providing services by way of admission to the exhibition of cinematographic films in multiplex services.

- An insurer, a banking company, or a financial institution, including the NBFC.

- A registered person providing passenger transport services.

- Goods and Transport Agency (GTA).

- SEZ unit (excluded by CBIC Notification No. 61/2020 – Central Tax).

Auto-population of e-invoice details in GSTR-1/2A/2B/4A/6A

Invoices for which e-invoices have been created have also begun to auto-populate particulars of such e-invoice in the below processes:

- Return Form GSTR-2A (Auto-populated Inward Supply Details) of the recipient.

- Form GSTR-2B Return (Auto-drafted recipient’s ITC statement).

- Return Form GSTR-4A (Auto-populated Inward Delivery Details by Composition Dealer) of the recipient.

- Form GSRT-6A Return (Auto-populated details of inward supply by Input Service Distributor).

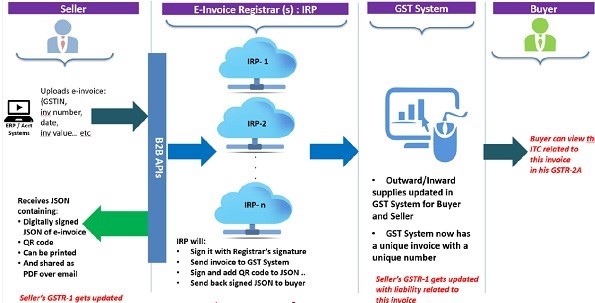

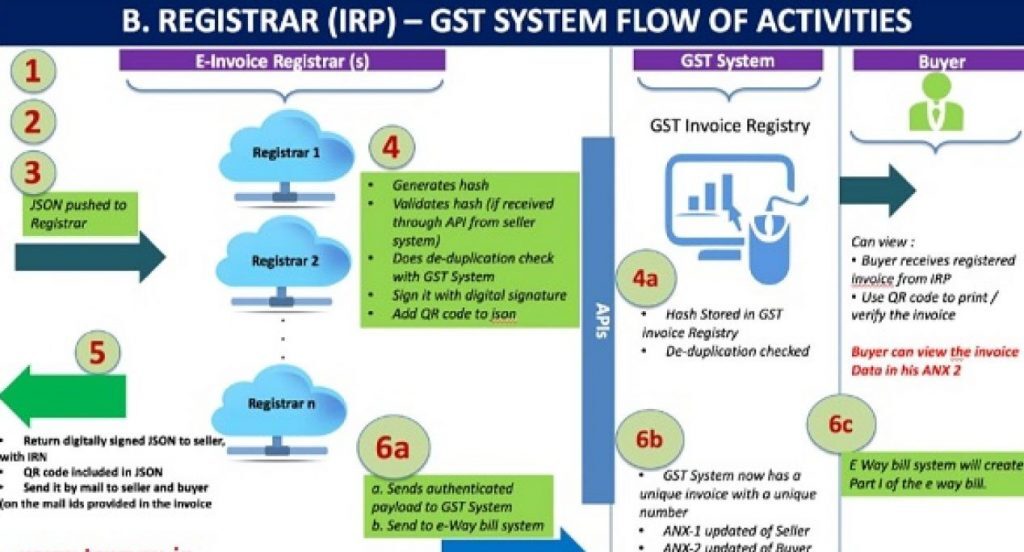

Few notified taxpayers issued invoices after acquiring the Invoice Reference Number (IRN) from the Invoice Registration Portal (IRP) (typically called ‘e-invoices’). The specifics of these e-invoices shall be auto-populated in the respective GSTR-1 tables. Here are all the key requirements that must be taken into consideration.

The time lag between E-invoices uploaded to the portal and updated to GSTR-1

- The data in GSTR-1 is now available on T+3 days, i.e. e-billing data uploaded on 18-12-2020 would’ve been visible in GSTR-1 on 21-12-2020.

- Consequent reflection of these e-invoice details in GSTR-2A/2B/4A/6A has also started.

Auto-population of E-invoice records to GSTR-1 based on Document Date

- Auto-population of e-invoice data in GSTR-1 is provided at the time of the document (as reported to IRP). For instance, a document dated December 30, 2020, is reported to IRP on January 3, 2021, with two situations possible;

- Situation 1:

If GSTR-1 is not filed for Dec 2020, the particulars of that document will be obtainable in the GSTR-1 tables for Dec 2020.

- Situation 2:

If the GSTR-1 has already been filed for Dec , the details of that document will be made accessible in the consolidated excel file that can be downloaded from the GSTR-1 dashboard (with an error description as ‘Return already filed).

An instance where Invoice details will not be auto-populated in the GSTR-1 Return

Due to the existing validations in GSTR-1, the e-invoices reported as below frequently reported issues are not auto-populated in the GSTR-1 tables but are made publicly available in the consolidated excel file that can be downloaded from the GSTR-1 dashboard (with based on the error description):

- The document date is after the date of cancellation of the registration by the supplier/recipient;

- Invoices reported as attracting “IGST on intrastate supply” but without reverse charge

- The supplier is found to be of type ISD/NRTP/TCS/TDS;

- Supplier is found to be a composition taxpayer for that tax period;

- The document date is before the date of registration of the Supplier/Recipient;

Commonly used data structure issues during E-invoice

Moreover, due to data structure issues, e-invoice details could not be processed (and were therefore not auto-populated) in some cases. These errors may be noted and avoided while reporting the data to the IRP.

- The serial number of the item shall not be reported as ‘0’

- White space found in POS (Place of Supply State Code), e.g. ‘8’ The expected values were 08 and 8.

Comprehensive advice on self-population methodology etc. has already been made available on the GSTR-1 dashboard (‘e-invoice advisory’) and has also been e-mailed to the appropriate taxpayers.

Auto-population of information in GSTR-1 is just a facility responsibility of the Supplier

- It is reiterated once again that the auto-population of details from e-invoices to GSTR-1 is only an opportunity for taxpayers. After viewing the auto-populated data,

- Taxpayer needs to verify the propriety and accuracy of the amounts and all other data in each field in particular from the viewpoint of GSTR-1, and file the very same information in the light of the relevant legal provisions.

- The Taxpayer has recommended authenticating the auto-populated documents in the GSTR-1 tables & excel on the below areas:

- All documents reported to the IRP are in excel.

- The position of each e-voucher/IRN is correct

- All the details of the document are correctly stored

Read our articles: