Tax Audit Ceiling U/S 44ab From Rs.1 To Rs. 5 Cr

Page Contents

TAX AUDIT CEILING U/S 44AB FROM RS 1 TO RS 5 CRORE APPLIES WITH EFFECT FROM AY 2020-21

- There might be some uncertainty between specialists as to the assessment year from which the modification to raise the tax audit ceiling under section 44AB from Rs 1 crore to Rs 5 crore applies, i.e. whether the amendment means with effect from AY 2020-21 (for accounts for the financial year 2019-20) or from AY 2021-22 (The financial year 2020-21).

- Pursuant to paragraph (a) of Section 44AB, as it stood before the Finance Act of 2020, any person engaged in the company was required to have audited accounts if the overall sales, turnover or total receipt in business exceeds Rs.1 crore.

- The Finance Act, 2020 raised this ceiling to receive audited accounts from Rs.1 crore to Rs.5 crore in those situations where the sum of all collections in cash during the year and the sum of all payments rendered in cash over the year does not cross 5 % of total receipts and total payments, respectively.

Who is a binding and required Compulsory Tax audit?

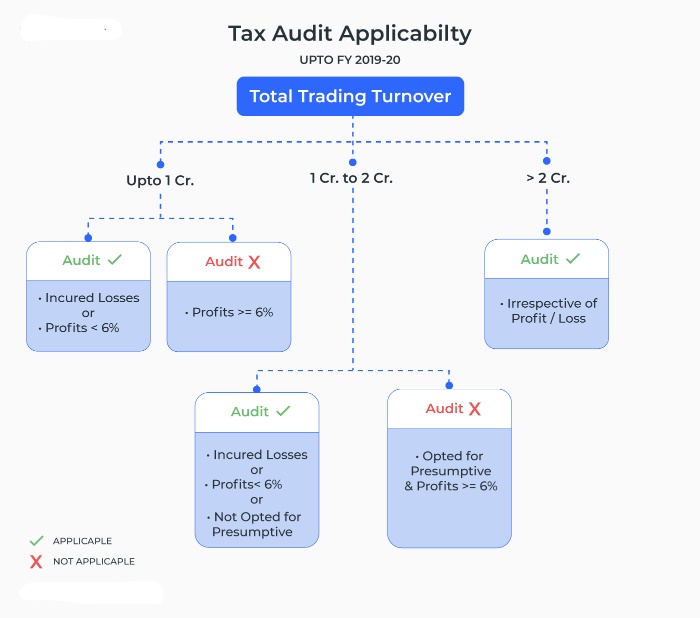

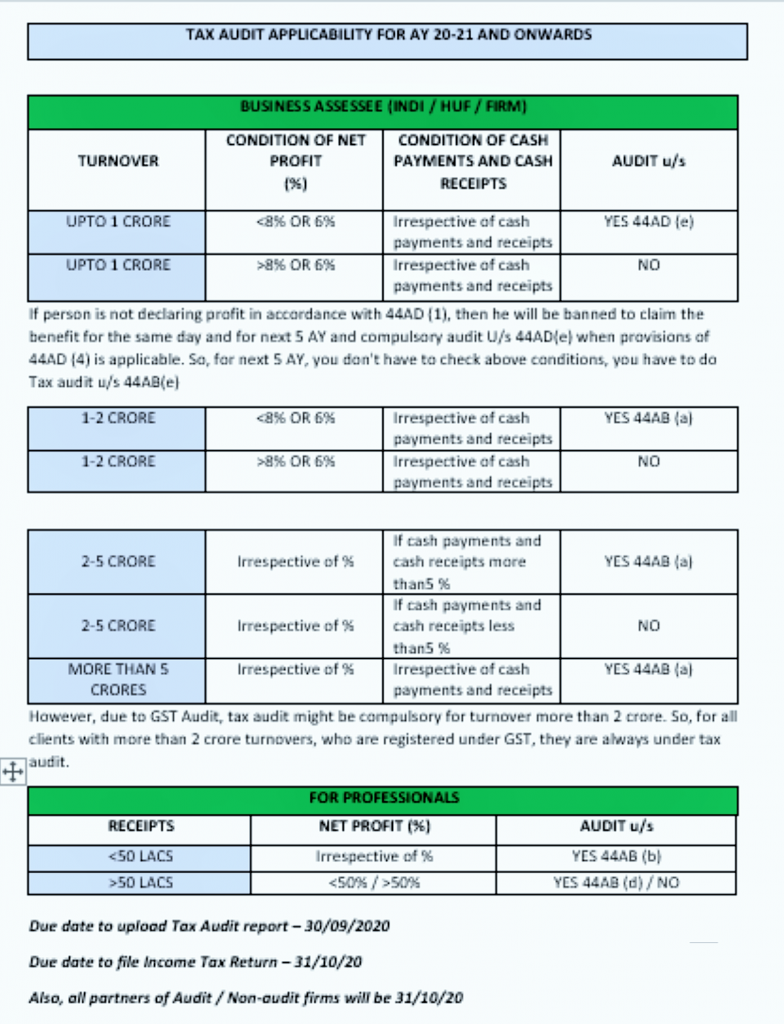

- A taxpayer is expected to carry out a tax audit if revenue, turnover, or gross business receipts surpass Rs 1 in the financial year. However, in some other cases, a taxpayer might be forced to have their accounts audited. In the tables below, we have classified the different circumstances:

POINT TO BE NOTED:

The requirement of Rs 1 crore for a tax audit is expected to be raised to Rs 5 crore with effect from AY 2020-21 (FY 2019-20) if the taxpayer’s cash receipts are restricted to 5 % of the gross receipts or turnover and if the taxpayer’s cash payments are restricted to 5 % of the aggregate payments. Below are different categories of taxpayers below:

| Category of person | Threshold |

| Business

|

|

| Carrying on business (not opting for presumptive taxation scheme*) | Total sales, turnover, or gross receipts exceed Rs 1 crore in the FY |

| Carrying on business eligible for presumptive taxation under Section 44AE, 44BB or 44BBB | Claims profits or gains lower than the prescribed limit under the presumptive taxation scheme |

| Carrying on business eligible for presumptive taxation under Section 44AD | Observe taxable income below the limits specified by the presumptive taxation system and has income that exceeds the basic limit. |

| Carrying on business and is not eligible for presumptive taxation under Section 44AD by opting for presumptive taxation in any one financial year of the lock-in period, i.e. 5 consecutive years from the date on which the presumed taxation system was implemented. | If the income reaches the permissible amount not to be paid for tax in the following five successive tax years from the financial year in which the assumption of tax was not introduced, |

| Carrying on business which is declaring profits as per presumptive taxation scheme under Section 44AD | If the overall revenue, turnover, or gross receipts for the financial year do not exceed Rs 2 crore, the tax audit would not apply to such entities. |

| Profession

|

|

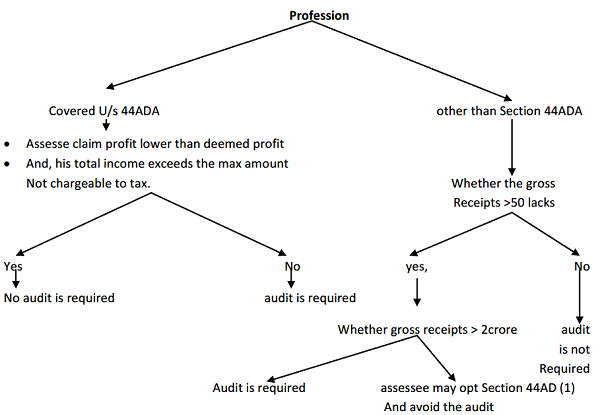

| Who Carrying on the profession | Total gross receipts exceed Rs 50 lakh in the FY |

| Who Carrying in the profession is eligible for presumptive taxation under Section 44ADA | 1. Claims for profit or gains below the permissible level under the presumptive taxation scheme

2. Profits increases the permissible sum not to be paid for taxation |

| In case of loss from carrying on of business and not opting for a presumptive taxation scheme | Total sales, turnover, or gross receipts exceed Rs 1 crore |

| If the gross income of the taxpayer exceeds the basic threshold but has suffered a loss from carrying on a business (not opting for a presumptive taxation system) | In case of loss from business when sales, turnover, or gross receipts exceed 1 crore, the taxpayer is subject to tax audit under 44AB |

| If continuing on business (opting a presumptive tax scheme under section 44AD) and making a business loss but with profits below the basic level | This Tax audit does not apply |

| If going on business (presumed tax scheme under section 44AD applicable) and making a business loss but with profits above the basic threshold | Declares taxable income far below limits specified by the presumed tax scheme and has income that exceeds the basic level. |

- It should be observed that there is no uncertainty in the amendment on this subject. It is explicitly mentioned in the amendment that it is valid from AY 2020-21 (FY 2019-20).

- In this regard, it is necessary to notice that the Memorandum of Understanding on the provisions of the Finance Bill 2020 and the Clauses Notes created as part of the Finance Bill 2020 clearly state that ‘These amendments will take effect from 1 April 2020 and will therefore apply in reference to the assessment year 2020-2021 and corresponding assessment years.’

- As a result, the amendment made to section 44AB will apply from AY 2020-21 (Financial Year 2019-20) itself and no individual engaged in business will be allowed to obtain the accounts audited for FY 2019-20.

- In case Revenue does not cross Rs 5 crore during that year given that the specified condition is met, i.e. the total of all cash receipts and the combination of all payments.

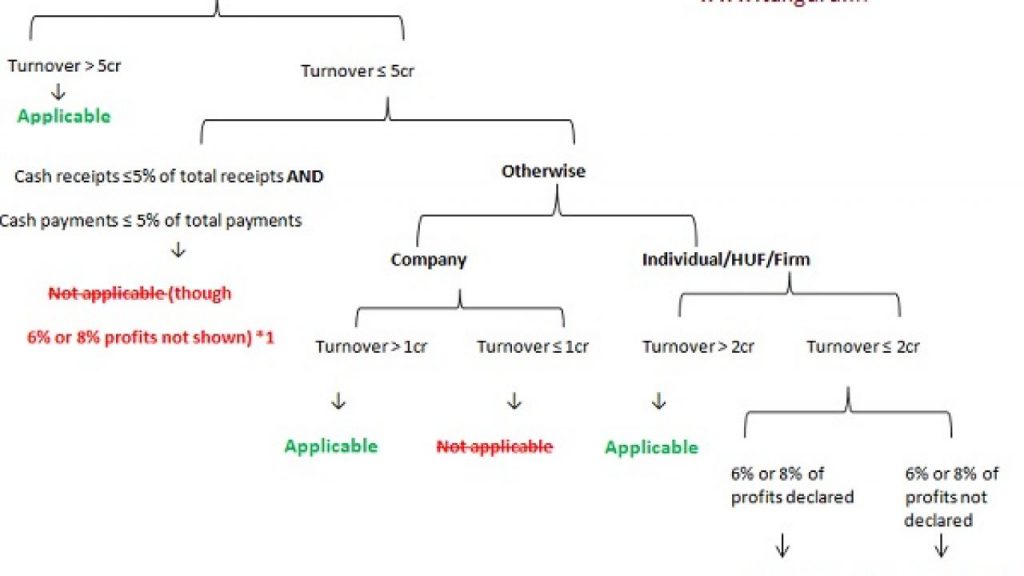

For effective from 01/04/2020, that is to say from the assessment year 2020-21, this requirement is changed as follows:

The threshold limit has been updated in order to increase it for an individual engaged in business from Rs . 1 crore to Rs . 5 crores if the following criteria are satisfied.

-

- The sum of all receipts in cash in the preceding year shall not exceed 5 percent of such revenues.

- The sum of all payments in cash during the previous year does not exceed 5 percent of all expenditures.

- Through AY 20-21, the stated date shall be one month before the due date for the income tax return referred to Section 139(1). Thus, I inform you that the 44AB limit is still 1 crore (except as indicated above) and the 44AD limit is Rs . 2 crores. Also,

- there is NO Improvement IN FINANCE BILL 2020 in Section – 44AD, which deals with a special provision for calculating the income and earnings of the industry on a presumptive basis.

- As a result of such an amendment, some strange situations could arise which CBDT should explain.

- It should be noted that the modification of the increased threshold extends to any ‘person’ engaged in business and, thus, the value of the modification is available to all individuals, corporations, LLP, Firms, etc. engaged in business.

- However, it should be explained that the amendment made is only applicable to an individual engaged in ’employment’ and thus an individual engaged in ‘profession’ would continue to be allowed to have audited accounts if the gross receipt in the profession exceeds Rs.50 lakh in the year.

Due to the planned amendment under the 2020 budget,

The scenario is as follows:

– In case Assess who have TO>2 crores (but less than 5 crores and have cash receipts and cash payments not exceeding 5 percent), they are NOT liable for a tax audit. This holds true regardless of whether the assessee shows income of up to 6 percent or 8 percent in 44AD or not.

– For assesse who have TO<2 crores (but have cash receipts and cash payments not exceeding 5 percent), they are liable for tax audit if they do not have an income of up to 6 percent or 8 percent as per 44AD.

Mandatory validation of UDIN in all Income Tax Forms

- The Central Board of Direct Taxes will validate the UDIN created from the ICAI portal while uploading the Tax Audit and other Income Tax Reports as per their press release. Tax audit reports/forms submitted to the e-filing portal from 27 Nov 2020 and beyond.

- Tax Audit Reports/forms will only be accurate if their Unique Document Identification Numbers have been checked by the CBDT E-filing portal. In order to do so, Charted Accountants would have a buffer time of fifteen days to update their UDIN on the e-filing portal in addition to providing the same immediately.

- The income tax department will validate the ICAI Unique Identification Number of the CA/auditors when they submit the tax audit reports to the e-filing server.

- It has been noted that the financial documents/certificates attested to by a third party misinterpreting itself as chartered accountants Representatives are deceptive to the Authorities and Stakeholders.

- ICAI also receives a variety of concerns about non-chartered accountants’ signatures forged by chartered accountants. In order to curb malpractice,

- the ICAI professional Development Committee has phased out a groundbreaking UDIN concept, i.e. Unique Identification Number of Documents.

- The Direct Taxes Committee of ICAI has asked for an extension of the different due dates under the Income Tax Act, in particular, the Tax Audit Reports & related returns, including that of the ITR Forms for AY 2020-2021 to the CBDT.

Popular blog:-

Amendment in Tax Audit u/s 44AB

Deduction u/s 80CCD of Income Tax Act, 1961