PROCESS FOR ACQUIRE PAN CARD

Page Contents

www.carajput.com; PAN Online

PROCESS FOR ACQUIRE PERMANENT ACCOUNT NUMBER CARD

There is 2 way to get PAN Card.i.e.

- National Securities depository Limited (NSDL): www.tin-nsdl.com

- UTI infrastructure technology & services ltd. (UTIITSL)::www.utiitsl.com

OFFLINE PROCESS OF PAN APPLICATION

- Download the application form from the NSDL/UTIITSL website.

- Complete the form, and attach the supporting documents for POI/POA.

- Submit the duly filled form with NSDL/UTIITSL.

- You will receive your PAN Card within 15 working days.

ONLINE PROCESS

- Visit the website .i.e.: NSDL / UTIITSL.

- Fill out the online application form.

- Processing fees to be paid by using Net Banking/Debit credit card/Demand draft.

- After processing fees are paid then the final page contains a 15 digit Acknowledgment number.

- After receiving the acknowledgment number, one should send them to NSDL along with form 49A within 15 working days.

- When verification is done PAN Card number is generated by NSDL.

Import Things to considered

- When a person who is engaged in any of the above transactions is a MINOR & has no taxable income, he/she should state the father/mother/guardian PAN Card information.

- Anyone not holding a PAN Card and entering into transactions in which PAN is mandatory shall fill out Form No. 60 according to Rule 114B of Income Tax Act, 1962.

Note: PAN Card details are required for source tax deduction i.e. The aggregation of TDS or Tax at source i.e. TCS, as described in section 139 [5b & 5c].

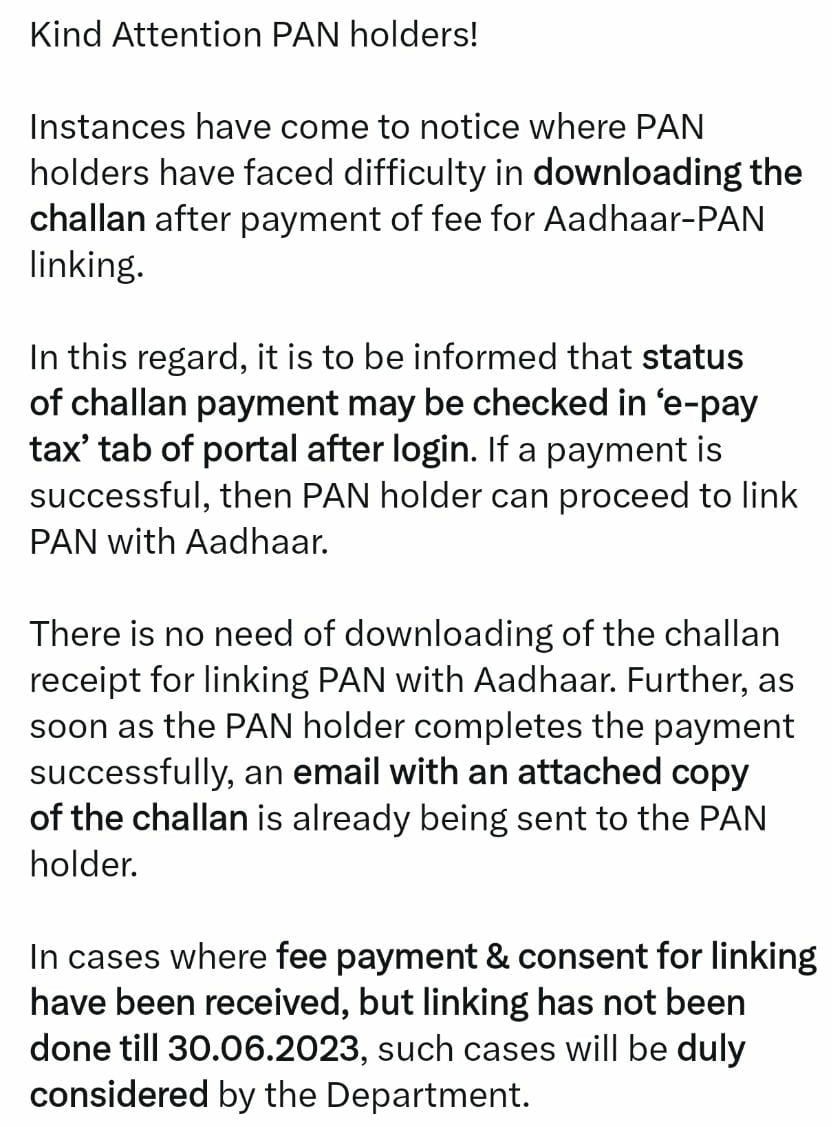

The penalty of Rs. 10K for not linking Pan with Aadhar

- If you do not link your Permanent Account Number to your Aadhaar card within the March 31 deadline, the income tax department may impose a penalty of as much as Rs. 10K for using an inoperative Permanent Account Number.

- The income tax department had previously stated that all unlinked PAN cards would be considered “inoperative” and now a new notice has been released stating that certain Permanent Account Number cardholders would face consequences for failure to supply PAN under the Income Tax Act.

- As per Section 272B of the Income Tax Act, when a Permanent Account Number becomes inoperative, it would be presumed that PAN has not been furnished/quoted as prescribed by law and that a penalty of Rs. 10K will apply.

- Using the PAN card as ID proof for non-tax-related reasons such as opening a bank account or applying for a driving license does not incur a penalty,

- In the case of individual transactions, the liability would be imposed on all other instances, i.e. the assessee will have to pay the penalty on any possible non-compliance with the actual transaction.

- An Issue may emerge if the bank account opened with an inoperative PAN has activities that put it under income tax jurisdiction. For eg, whether you need to deposit or withdraw cash over Rs.50K Pan is necessary.

- Rajput Jain & Associates, Chartered Accountant, said that in view of the penalty provisions laid down in Section 272B.

- Inoperative Permanent Account Number would relate to the non-furnishing and non-quotation of PAN, which is mandatory pursuant to section 139A of the Act. Section 272B(1), for non-compliance, carries a penalty of Rs. 10K.

Important Update

- if you link your Permanent Account Number and Aadhaar, the PAN will become active and there will be no fines applied after the linking date.

- Many with inoperative PAN cards must bear in mind that they do not need to reapply for a new PAN card as once the transfer is completed the Permanent Account Number card becomes usable again.

Central Board of Direct Taxes has made Instant PAN allotment in near to real-time available at free of cost. Individuals (other than minors) with a valid Aadhaar number (with an updated Mobile No) can avail of the PAN allotment facility.

More read for related blogs are:

- All about the Income taxation on capital gain

- Provision-of-capital-gains-charts

- Govt needed to introduce changes in NSP Budget 2021

- All about the Income taxation on capital gain

- Deduction u/s 80CCD of Income Tax Act, 1961

- All about the Income taxation on capital gain

- Delay in the deposit of Employer provident fund during the lockdown

- Aware of the penalty of Section-234f for late filing of ITR

- What is the process of applying instant free pan through adhaar e-KYC

- Basic of aadhar card significance process aadhaar linking with PAN

Contact Us

For query or help, contact: singh@carajput.com or call at 9555555480 Get in touch with us today to find out more about the services we offer! Call us at +91-9555 555 480. We also offer Taxation compliance & Registration services!