New Revise TDS/TCS return filing & Payment due date

Page Contents

New Revise TDS / TCS return filing & Payment due date

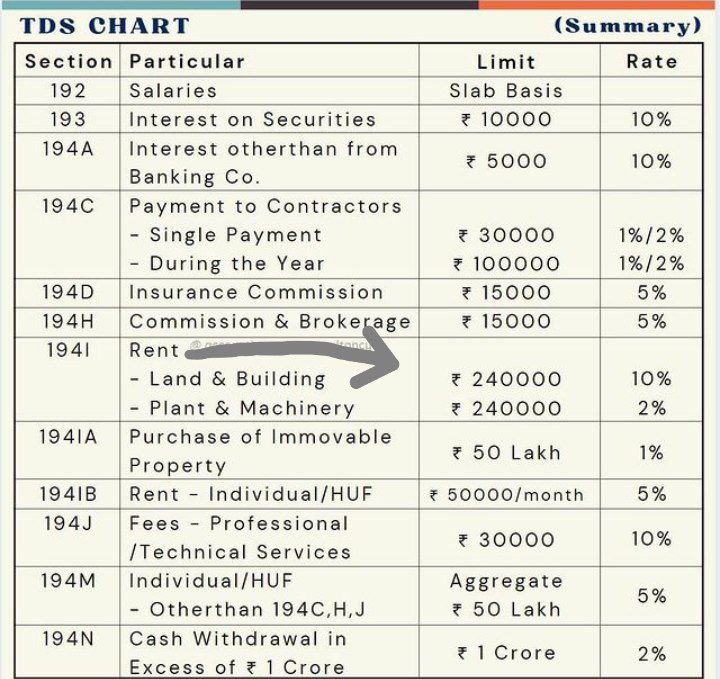

Rates of TDS

|

Section |

Nature of Income |

Rate of TDS applicable for the period | Threshold

Limit for deduction tax |

|

| 01-04-2020 to 13-05-2020 | 14-05-2020 to 31-03-

2021 |

|||

| 193 | Interest on Securities | 10% | 7.50% | – |

| 194 | Dividend | 10% | 7.50% | Rs. 5,000 in

case of Individual |

| 194A | Interest other than interest on Securities | 10% | 7.50% | Rs. 5,000 to

Rs. 50,000 |

| 194C | Payment to Contractors | – 1%: If deductee is an individual or HUF

– 2%: In any other case |

– 0.75%: If deductee is an individual or HUF

– 1.50%: In any other case |

– Single payment : Rs. 30,000

– Aggregate payment: Rs. 100,000 |

| 194D | Insurance Commission | – 10%: If deductee is a domestic Company

– 5%: In any other case |

– 7.50%: If deductee is a domestic Company

– 3.75%: In any other case |

15,000 |

| 194G | Commission and other payments on sale of lottery

tickets |

5% | 3.75% | 15,000 |

| 194H | Commission and

Brokerage |

5% | 3.75% | 15,000 |

| 194-I | Rent | – 10%: If rent pertains to the hiring of immovable property

– 2%: If rent pertains to the hiring of plant and machinery |

– 7.50%: If rent pertains to the hiring of immovable property

– 1.50%: If rent pertains to the hiring of plant and machinery |

2,40,000 |

| 194-IB | Payment of Rent by Certain Individuals or

HUF |

5% |

3.75% |

50,000 |

| 194J | Royalty and Fees for Professional or Technical Services | – TDs 2%: If royalty is payable towards sale, distribution or exhibition of cinematographic films

– 2%: If the recipient is engaged in the business of operation of call Centre – TDS 2%: If sum is payable towards fees for technical services (other than professional services) – 10%: In all other cases |

– 1.50%: If royalty is payable towards sale, distribution or exhibition of cinematographic films

– 1.50%: If the recipient is engaged in the business of operation of call Centre – 1.50%: If sum is payable towards fees for technical services (other than professional services) – 7.50%: In all other cases |

– Director’s fees: Nil

– Others: Rs. 30,000 |

| 194M | Payment to contractor, commission agent, broker or professional by certain Individuals

or HUF |

5% | 3.75% | 50 lakhs |

| 194N | Cash withdrawal | – 2%: In general if cash withdrawn exceeds Rs. 1 crore

– 2%: If the assessee has not furnished return for the last 3 assessment years and cash withdrawn exceeds Rs. 20 lakhs but does not exceed Rs. 1 crore – 5%: If the assessee has not furnished return for last 3 assessment years and cash withdrawn exceeds Rs. 1 crore |

– 1.50%: In general if cash withdrawn exceeds Rs. 1 crore

– 1.50%: If the assessee has not furnished return for the last 3 assessment years and cash withdrawn exceeds Rs. 20 lakhs but does not exceed Rs. 1 crore – 3.75%: If the assessee has not furnished return for last 3 assessment years and cash withdrawn exceeds Rs. 1 crore |

– If a person defaults in the filing of return: 20 lakhs

– If no default is made in the filing of return: Rs 1 crore |

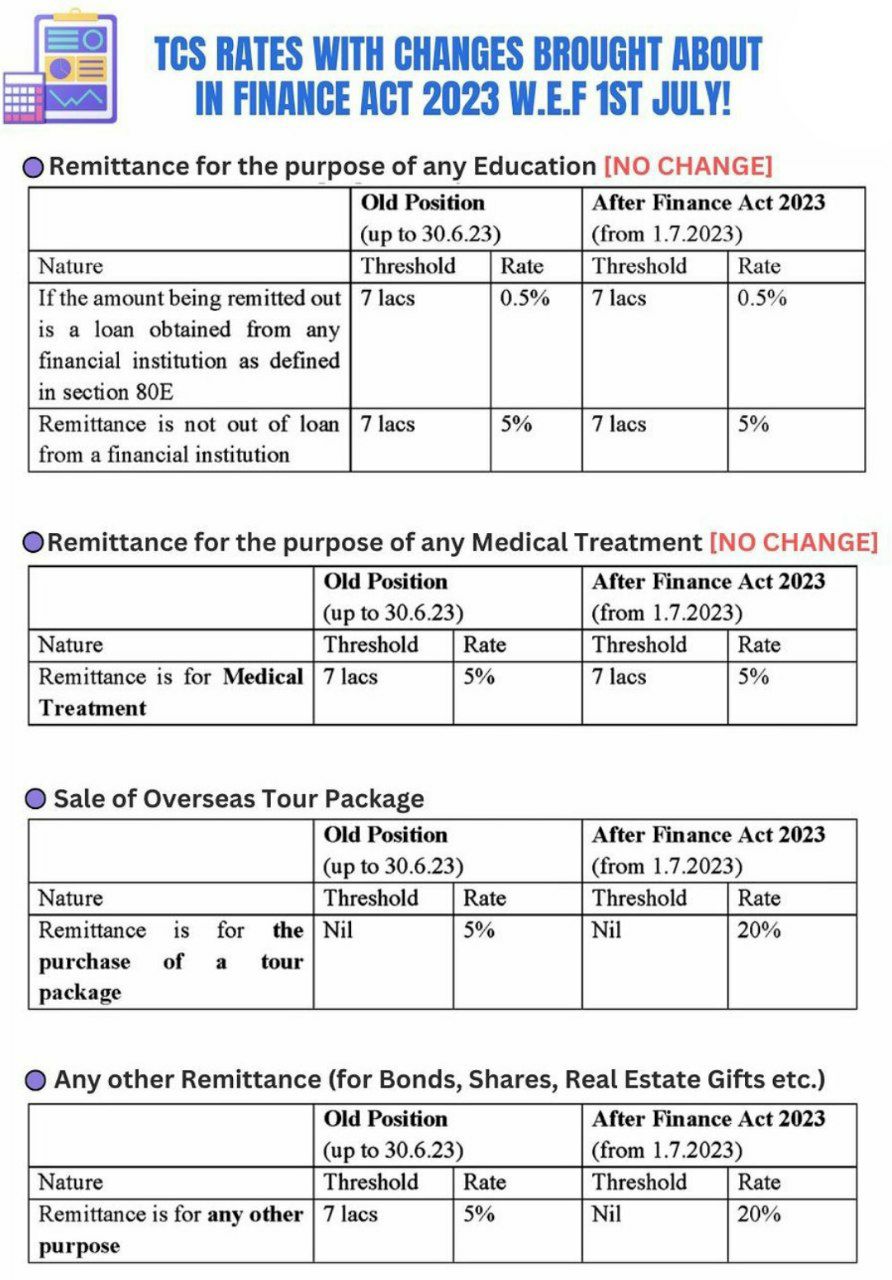

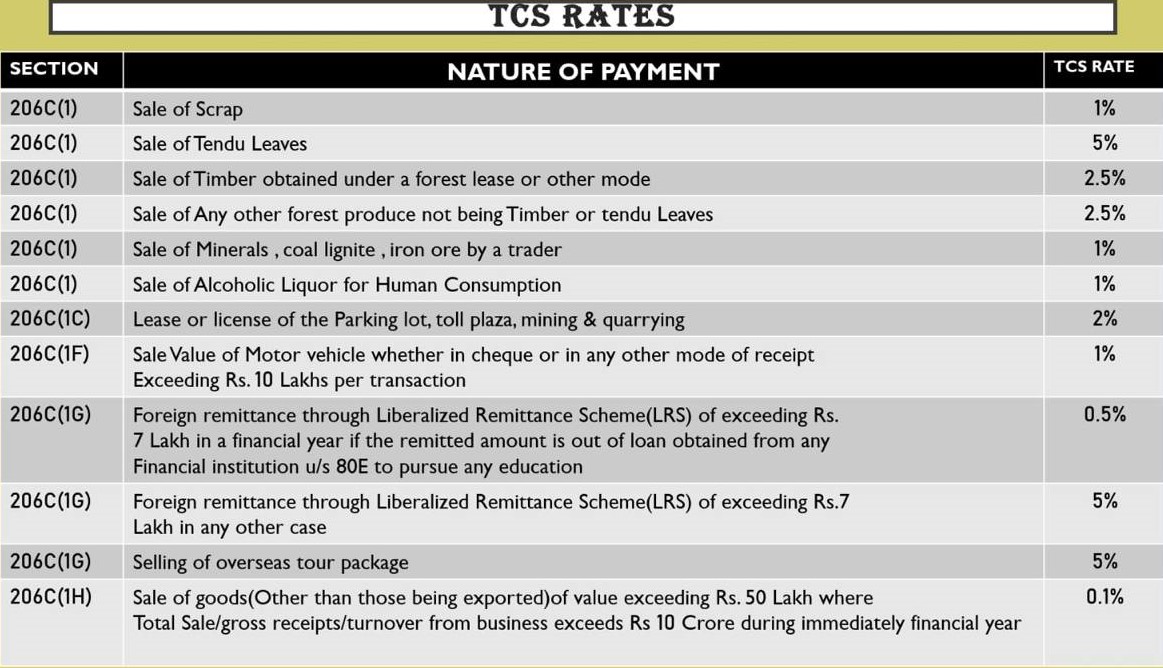

Rates of TCS

Attributable Due Date for TDS E-filing Returns

| Quarter | Quarter Period | Last Date of Filing |

| 1st Quarter | 1st April to 30th June | 31st July |

| 2nd Quarter | 1st July to 30th September | 31st Oct |

| 3rd Quarter | 1st October to 31st December | 31st Jan |

| 4rd Quarter | 1st January to 31st March | 30th June Read Rescript |

Due date for TDS & TCS Payment Deposit for Government & Non-Government Companies

- The due date for the submission of the TCS deposit is the 7th of the next month.

TDS Deposit Due Date:

- For non-governmental entities-7th of the next month (with the exception of March where the due date is scheduled for April 30th)

- Government departments

- If you pay via Challan-7th of next month

- If paid via book-entry, the same day on which the TDS is deducted.

TDS Deposit Due Date

As per section 201(1A) Interest at the rate of 1 % per month or part of the month on the amount of TDS deductible from the date of tax until the date of tax actually deducted shall be charged for the late deduction.

Also, interest for late payment at a rate of 1.5 percent per month or part of the month on the amount of the payment.

Interest in late payment of TCS or failure to collect TCS:

In the event that the collector responsible for collecting the tax at the source does not raise it or refuses to pay it to the Government,

then he shall be liable to pay basic interest at a rate of 1% a month or part thereof on the balance of that tax from the date on which the tax was collected to the date on which the tax was actually charged and that interest shall be paid until furnish.

Applicable Interest on late payment of Tax deducted at Souses

| SECTION | NATURE OF DEFAULT | INTEREST SUBJECT TO TDS/TCS AMOUNT | PERIOD FOR WHICH INTEREST IS TO BE PAID |

| 201A | Non deduction of TDS, either in whole or in part | INTEREST : 1% per month | From the date on which tax deductable to the date on which tax is actually deducted |

| After deduction of tax, non-payment of tax either in whole or in part | INTEREST : 1.5% per month | From the date of deduction to the date of payment |

Note: above said interest required to be paid before filing of TDS return.