Income Proof becomes Compulsory for INR 10 Lakhs Investment

Page Contents

Income Proof with KYC becomes Compulsory for INR 10,00,000/- investments in small savings schemes.

- Govt of India has now made it Compulsory for those investing over INR 10,00,000/- in post office schemes to provide proof of source of funds. It has also brought all investments in post office schemes under stricter Combating the Financing of Terrorism (CFT) / Anti Money Laundering (AML)/ Know Your Customer (KYC) norms compliance rules to prevent misuse for money laundering activities / terrorist financing.

- The Dept of Posts has directed post office officials to collect income proof from specified Class of small savings schemes’ investors. The Govt dept made this announcement though Income tax Dept circular issued on May 25, 2023. The circular has been issued due to the revision of Combating the Financing of Terrorism (CFT) / Anti Money Laundering (AML)/ Know Your Customer (KYC) norms, the department stated.

According to the circular, customers are grouped according to the level of risk they represent. In along with the standard KYC requirements, high-risk customers must produce proof of the money they are investing.

Clients on the basis of risk perception

According to the circular, We can divided clients on the basis of risk perception as below mention:

➡ High risk: Where the customer opens an account or applies for purchase of certificates or applies for prematurity value or credit of maturity of any existing savings instrument with an amount exceeding INR 10,00,000/- and balance in all accounts and certificates does not exceed INR 10,00,000/-.

➡ Medium risk: Where the customer opens account or applies for purchase of certificates or applies for prematurity value or credit of maturity/of any existing savings instrument with an amount exceeding INR 50,000/- However up to INR 10,00,000/- & balances in all accounts and savings certificates does not exceed INR 10,00,000/-

➡ Low risk: Where the customer opens an account or applies for purchase of certificates or applies for prematurity value or credit of maturity of any existing savings instruments with an amount of up to INR 50,000/- and balances in all accounts and savings certificates does not exceed INR 50,000/- .

Accounts relating to Politically Exposed Persons residing outside India shall fall under High-Risk Class. Politically Exposed Persons are those individuals who are or have been entrusted with prominent public functions by a foreign country, including judicial or senior politicians, or military officers or senior government, Heads of Govts or States, important political party officials & senior executives of state-owned corporations.

Source of funds can be verified with document:

According to the circular, the A copy of a document identifying the source of the cash received for investments must be submitted by the customer. The source of funds can be verified with any of the following document:

- Gift deed/Will/ Sale deed/Letter of Administration/succession certificate

- Post Office Account statement/ Bank, which reflects the source of funds

- Any one of the income tax returns filed during the last three financial years, which co-relates the investment in the gross income

- Any other document which reflects the income/source of fund

Apart from asking for proof of money source for certain investors, all categories of customers/investors (irrespective of their risk categories) are required to produce the following documents to do the investment:

- Address proof,

- Identification proof,

- Photo,

It is to be Noted that documents should be self-attested by investor. If joint account, ID & address proof of all joint depositors are needed. For basic savings accounts, document given that depositor is a beneficiary of any govt scheme is compulsory.

Above mention circular explain that Re KYC required to done depending on risk of customers. For low-risk customers and high-risk, medium risk, Re-KYC must be done every 2, 5 & 7 years respectively.

When any certificate holder or depositor or requests that the maturity value of an existing savings account be credited, this should only be done after confirming that the savings account in question was opened with the proper KYC documentation and applying the risk category in accordance with the balance in the account following the credit of the maturity value.

According to the circular, if a new savings account is opened to credit maturity value, it must be assured that the proper KYC documents are obtained depending on the maturity value being credited into the account.

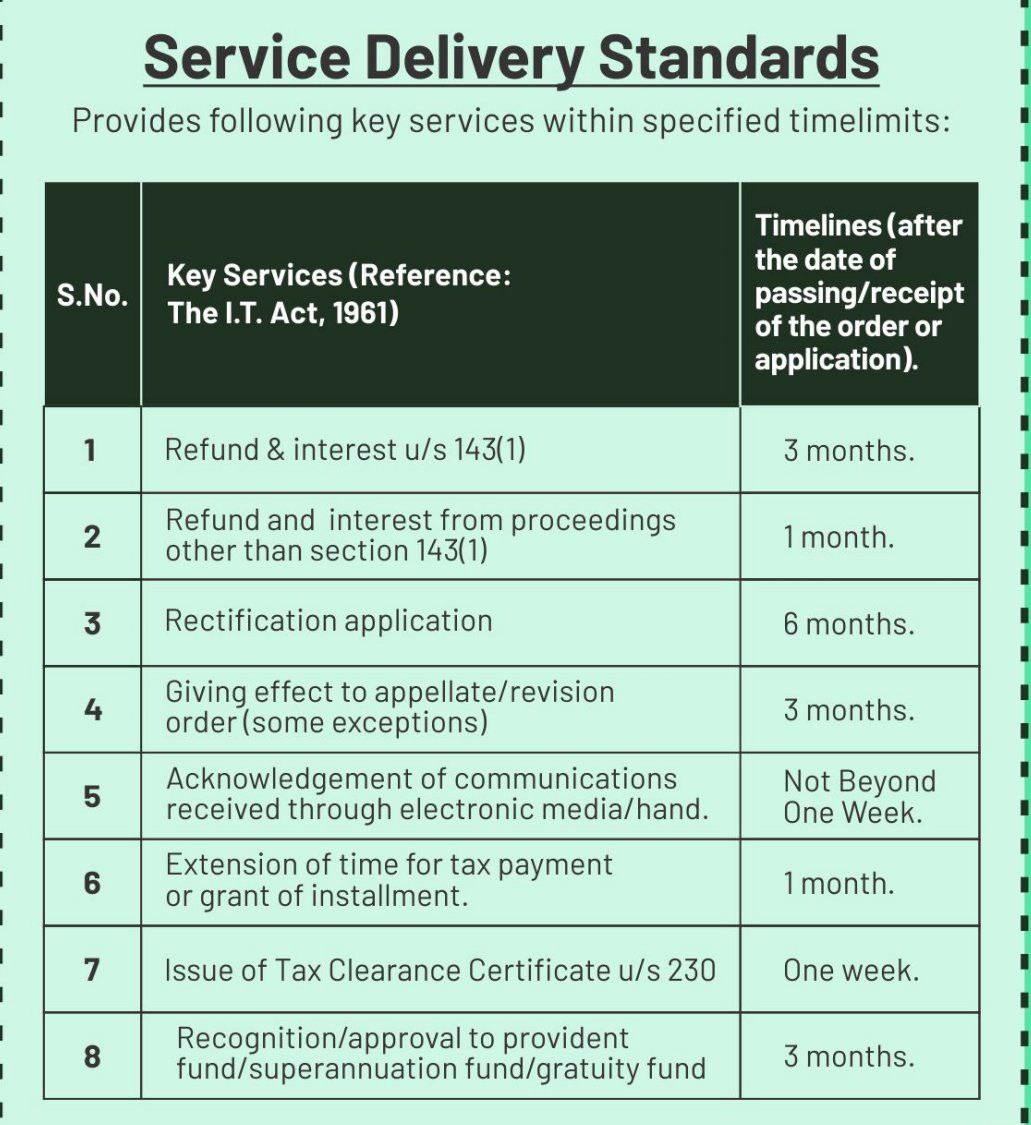

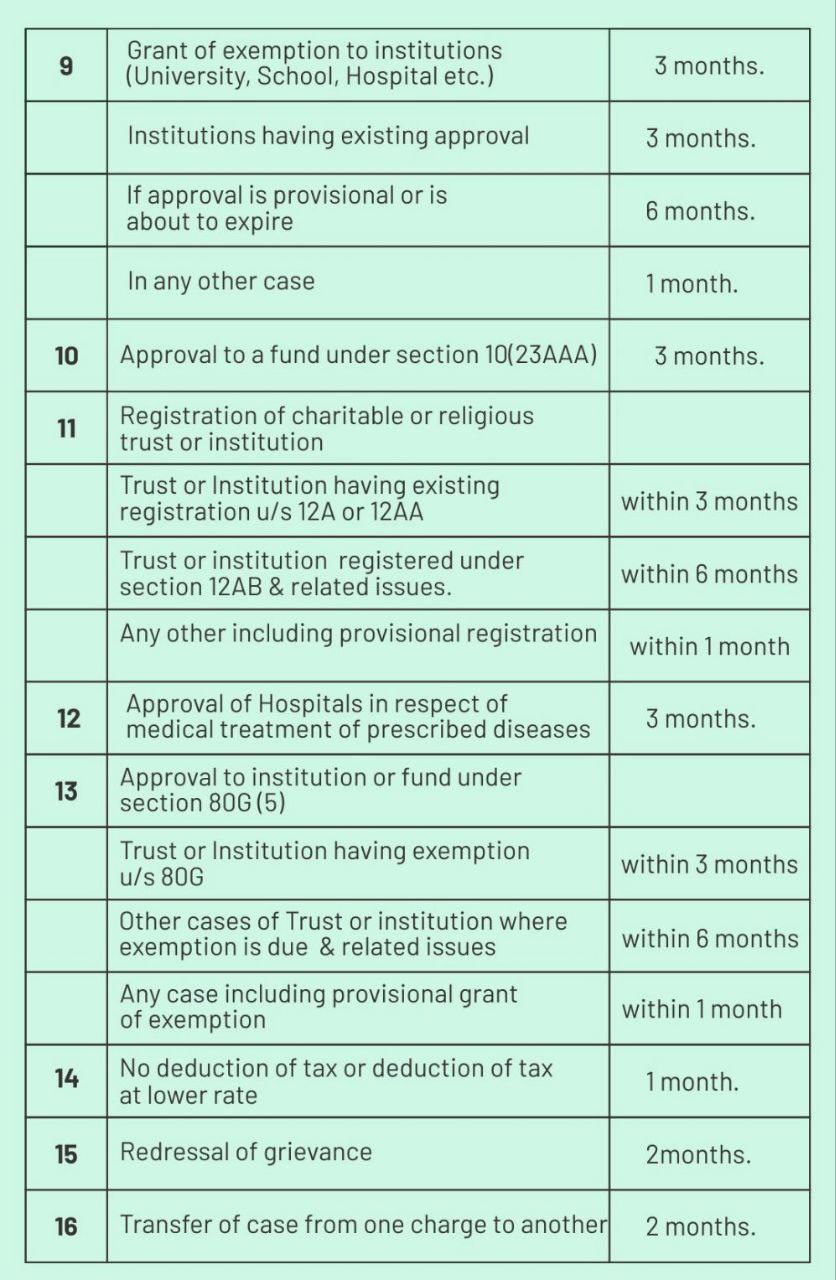

Income Tax Dept. Services Delivery Standards

Income Tax Dept given following key services within prescribed deadline given below.

Popular Article :More read for related blogs are:

- New TDS deduction No cash transactions exceeding 1 Crore -Section 194N

- Deduction u/s 80CCD of Income Tax Act, 1961

- New income tax portal

- All about the Income taxation on capital gain

- Provision-of-capital-gains-charts

- Govt needed to introduce changes in NSP Budget 2021

- All about the Income taxation on capital gain

- Deduction u/s 80CCD of Income Tax Act, 1961

- All about the Income taxation on capital gain

- Delay in the deposit of Employer provident fund during the lockdown

- Aware of the penalty of Section-234f for late filing of ITR

- What is the process of applying instant free pan through adhaar e-KYC

- Basic of aadhar card significance process aadhaar linking with PAN

- Tax Audit

- Implication of cash transaction under income tax Act

- How to file Revised Return of Income Tax E-Filing: Income Tax Department

- Prevent popular errors while filing an income tax return

- Needed to file Income Tax return of Bitcoin profit earned https://youtu.be/JPf9bPyv7bY

Contact Us

For query or help, You may find us via email at singh@carajput.com or by phone at +91 9555 555 480, Get in touch with us today to find out more about the services we offer! Call us at +91-9555 555 480. You can contact our NRI tax consultant in India or NRI tax filing services in India, We also offer Taxation compliance & Registration services!