How to Calculate Income Tax Liability in India

Page Contents

How to Calculate Income Tax Liability in India: A Comprehensive Guide

Introduction

If you are filing ITR for the first time, it can be really overwhelming to understand the ITR form and the different terms used. As simple as it may get, you can get jumbled if you do not know which field to use and how to do calculations. Therefore, here is a guide to understanding everything about calculating your income tax liability. Read on to know the details.

Different Income Sources for ITR Filing

Before you learn how to calculate your tax liabilities during ITR filing, it is imperative to understand the different sources of income. If you think your income source is only limited to your salary, it is much more than that. You will need to include all your income sources for calculating the liability. Here are the different income sources for your reference:

- Income from your salary

- Income from your property

- Any income from capital gains

- If you have additional income in the form of business or profession

- Any other income source

Formula For Calculating Tax Liability

Since you know the different income sources that need to be included during ITR tax filing, you should look at the formula for calculating your liability. Let’s look at the simple formula that can assist you.

First, calculate your total earnings by adding your income from all the above sources. Then, follow the simple calculations:

Taxable Income = Total Income – Total Deductions

Now, let’s understand each income and what all components are added in detail, along with the deductions that need to be included.

1. Income From Salary

When calculating income from salary, you should include all allowances that include HRA, DA, TA, Medical, etc. It will also include the reimbursements you may have received and any bonuses. Additionally, if you have any HRA or TA/DA exemptions, you can deduct them first and then add the balance to your salary income.

2. Income from Property

Here you will need to include all your rental income that you may have. It could be from your residential property or commercial unit. It is where people make the most mistakes and miss on adding their rental income.

3. Capital Gain Income

If you have sold any bonds, stocks, or properties in the assessment year, it will be considered capital gains. When calculating your income, you should include all the capital gains as a part of it. Remember, these capital gains are irrespective of whether long-term or short-term.

4. Business or Any Other Professional Income

These days it’s common for people to indulge in secondary sources of income to manage their expenses. If you also have some different businesses running along with your primary source of income, consider that while doing your ITR calculations. To calculate your income, you must add all profits and deduct all expenditures and other applicable deductions.

5. Other Sources Income

Again a point that most people miss. All other sources of income will include your dividends, interest received on savings or fixed deposits, family pension, monetary gifts, lottery, etc. Add all these together and then reach your total other sources of income.

6. Deductions

Once you have the total earnings, you must calculate your total deductions. All the investments you may have done under sections 80 C to 80 U, such as provident funds, LIC, Life Insurance, etc., will be a part of the deductions. You can also include tuition fees for children and any ULIPs, NPS, and other saving instruments here.

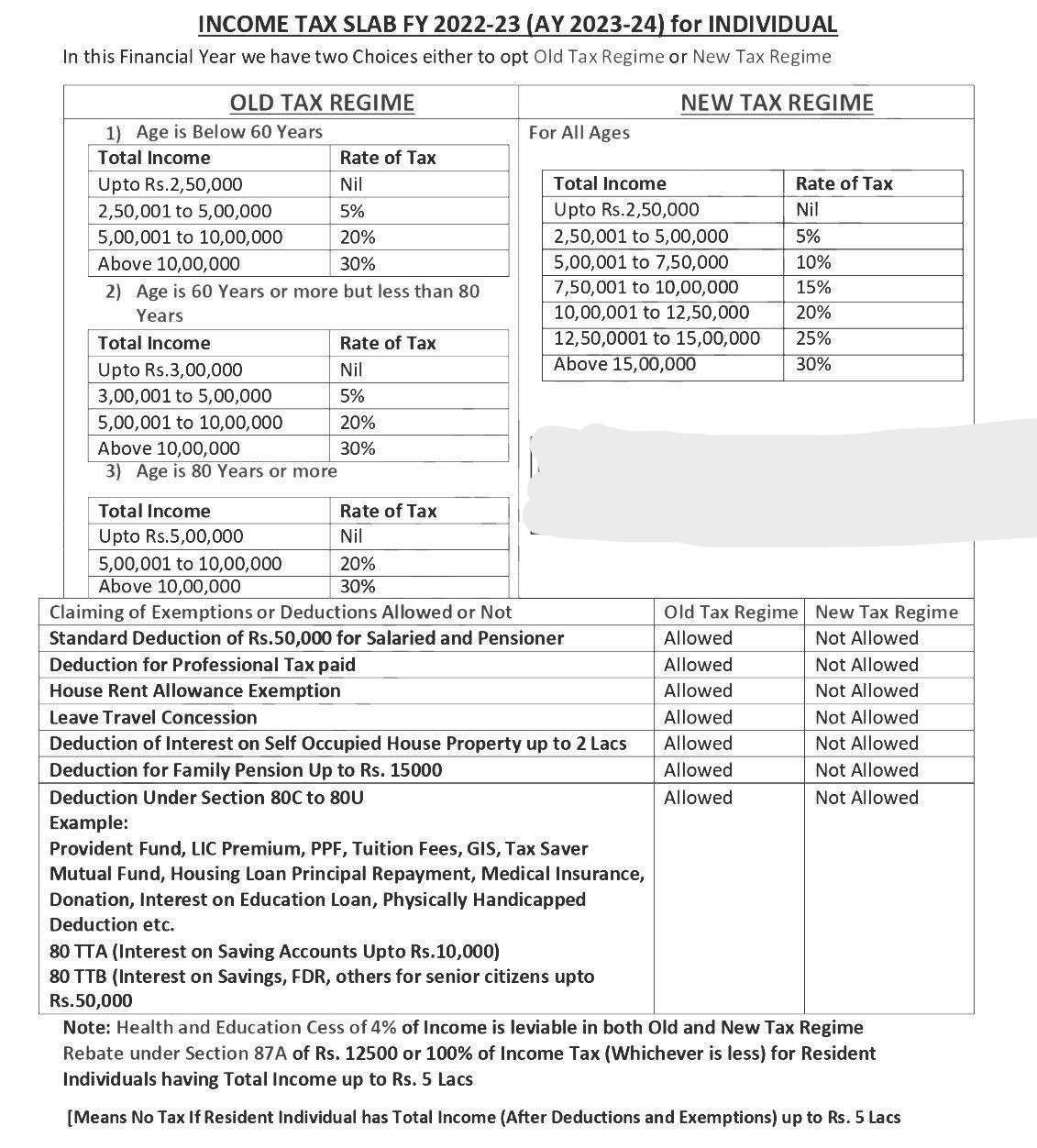

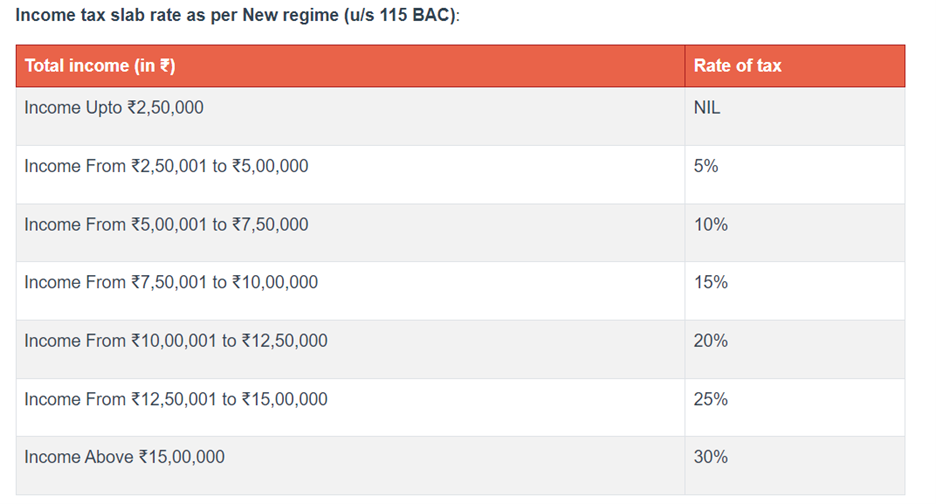

Now, you will get your total earnings and total deductions. As per the formula mentioned above, you can calculate your taxable income. It is the income on which you will need to pay the tax, either through the old or new tax regime.

Bottom Line

Managing tax-related work is often daunting and exhausting since a single mistake can result in a significant problem. Therefore, referring to a guide or checklist is important to ensure you follow the steps properly. You can keep this article as your guide for knowing the different income sources to include when calculating your tax liability.

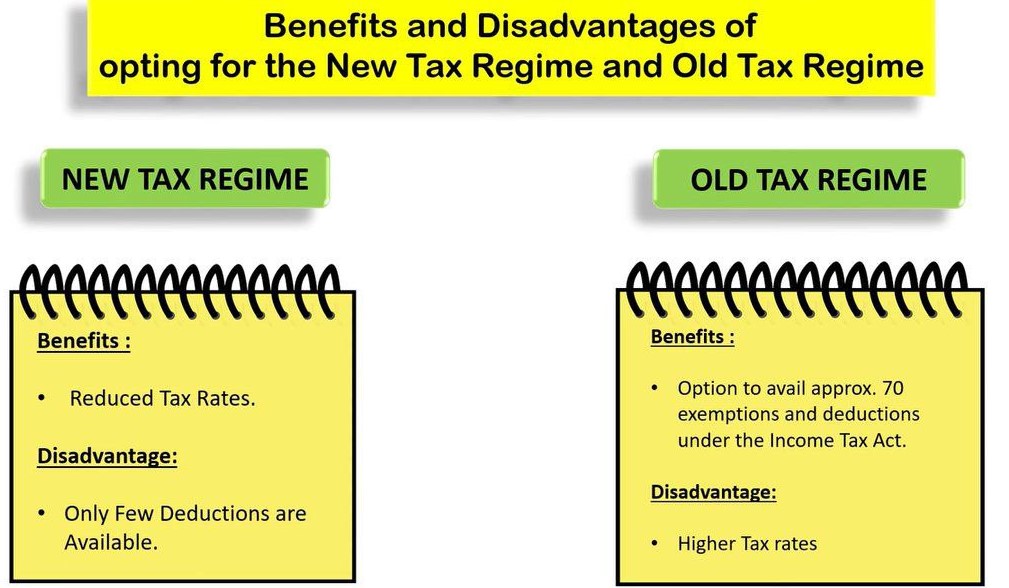

New Tax Regime Vs Old Tax Regime