Important Dates for Company Annual Filing

Page Contents

Statutory due dates for Company annual filing

Important Dates for Annual Filing

- Every year, within 30 days and 60 days of the conclusion of the Annual General Meeting, every business registered in India must file its annual accounts and annual reports with the ROC.

- It is essential that you complete all of your ROC Compliance forms within the MCA’s timeframe. The penalty for not filing annual returns are severe. These fines are in additional to MCA’s normal fees, and there is no way to decrease the penalties.

Annual ROC Filing

- E-Form AOC-4:

- Within 180 days of the end of the fiscal year. [Refer to Section 137(1) of the Companies Act of 2013.]

- E-Form MGT-7:

- Within 60 days of the AGM date. [Refer to Section 92(4) of the Companies Act of 2013.]

If the deadline for holding the Annual General Meeting is extended,

E-Form AOC-4:

Within 30 days of the Annual General Meeting’s conclusion. [Refer to Section 137(1) of the Companies Act of 2013.]

E-Form MGT-7:

- Within 60 days of the AGM date. [Refer to Section 92(4) of the Companies Act of 2013.]

- Please keep in mind that the relevant ROCs have yet to issue orders for AGM Extensions specifying the exact date until the AGMs must be held.

AGM Extension provided by the MCA

- Annual General Meeting of company can be held 30.11.2021 as per AGM Extension provided by the MCA. Accordingly shorter notice agm can be done on 30.11.2021, so balance sheet can be signed lastly on 30.11.2021. UDIN is to be generated with 60 days of signing of balance sheet. Last date to generate UDIN is 28.01.2021 for signing the balance sheet.

Also, read the related Blogs: Process of obtaining fresh DIN

What is Due Dates of ROC Return Filing

| S. No. | E-form Name | E-form Purpose | Respective Due Date | Respective Due date of Filing |

| 1 | Form MGT-7A | Filing of Annual Return | 60 days from the conclusion of the Annual General Meeting

|

60 days from the conclusion of Annual General Meeting |

| 2 | Form MGT-14 | Filing of resolutions with MCA regarding Board Report and Annual Accounts | 30 days from the date of Board Meeting | 30 days from the date of financial statements and Board Report by Board of Directors |

| 3 | Form CRA-4 | Filing of Cost Audit Report | 30 days from the receipt of Cost Audit Report |

30 days from the receipt of Cost Audit Report |

| 4 | Form ADT-1 | Appointment of Auditor | Considering 30th Sept 2021 as Annual General Meeting

14th Oct 2021 |

15 days from the conclusion of Annual General Meeting |

| 5 | MSME Form 1 | Half yearly return with the registrar in respect of outstanding payments to Micro or Small Enterprise. | 31st August 2021 (Oct 2020 to March 2021) (Revised)

31st Oct 2021 (April to Sept 2021) |

For reporting dues to MSME exceeding 45 days, if any on half yearly basis |

| 6 | Form AOC-4 CFS and Form AOC-4 (in case of consolidated financial statements) | Filing of Annual Accounts | 29 Oct 2021 | 30 days from the conclusion of the Annual General Meeting (In case of OPC within 180 days from the close of the financial year) |

| 7 | Form MGT-7 | Filing of Annual Return | 60 days from the conclusion of the Annual General Meeting

|

60 days from the conclusion of Annual General Meeting |

Rajput Jain & Associates help in an easy and online E- Process for Company to file its Annual return & income tax return along with FS & BOD meeting along with documents preparation. Talk to a Expert of RJA Advisor to know more and file an Annual Return for your company easily.

Also, read the related Blogs: Are you a Director- then need to file E-KYC DIR-3 Form

What is Additional Fees or Penalty applicable?

We needed to pay Additional Fees for E-form AOC-4 (XBRL and Non-XBRL) & E-form MGT-7 after the due date is INR 100/- day w.e.f 1 July 2018

In case any other forms/docs etc. to be submitted with ROC .

| No of days Delays | Applicable Fees |

| Within 30 days | Two times of General fees applicable |

| In case more than 30 days & up to 60 days | Four times of General fees applicable |

| In case more than 60 days & up to 90 days | Six times of General fees applicable |

| In case more than 90 days & up to 180 days | Ten times of General fees applicable |

| In case more than 180 days & up to 270 days | Twelve times of General fees applicable |

New Update On LLP Compliance :

ONE PERSON COMPANY-ANNUAL FILING WITH MCA& AGM

- Due date for Annual Filing is 27.09.2021, Please File on or before 27.09.2021 to avoid late fee Rs. 100 per day on each form.

- Further AGM Provisions under Section 96 of CA, 2013 are not applicable on One Person Company (OPC). AGM Extension will not work for OPC because due date for filing Annual Returns is 180 days from closure of FY not from the date of AGM.

- In case you want to conduct AGM voluntary for OPC, you are required to conduct the same before due date of return i.e. 27.09.2021.

- AGM extension orders not applicable on OPC and hence OPC can’t conduct their AGM (Voluntary) beyond 27.09.2021.

MCA On LLP form 8

1. The due date for filing LLP Form 8-Statement of Account & Solvency is 30th October 2021. which is now extended – The last date of filing form-8 LLP is now – 30.12.2021.

2. Failure to file LLP Form 8 can incur a late fee of Rs. 100 per day.

3. In addition to filing LLP Form 8, all LLPs must all file LLP Form 11 before 30th May of each financial year.

Cost Audit Report – Due date extended

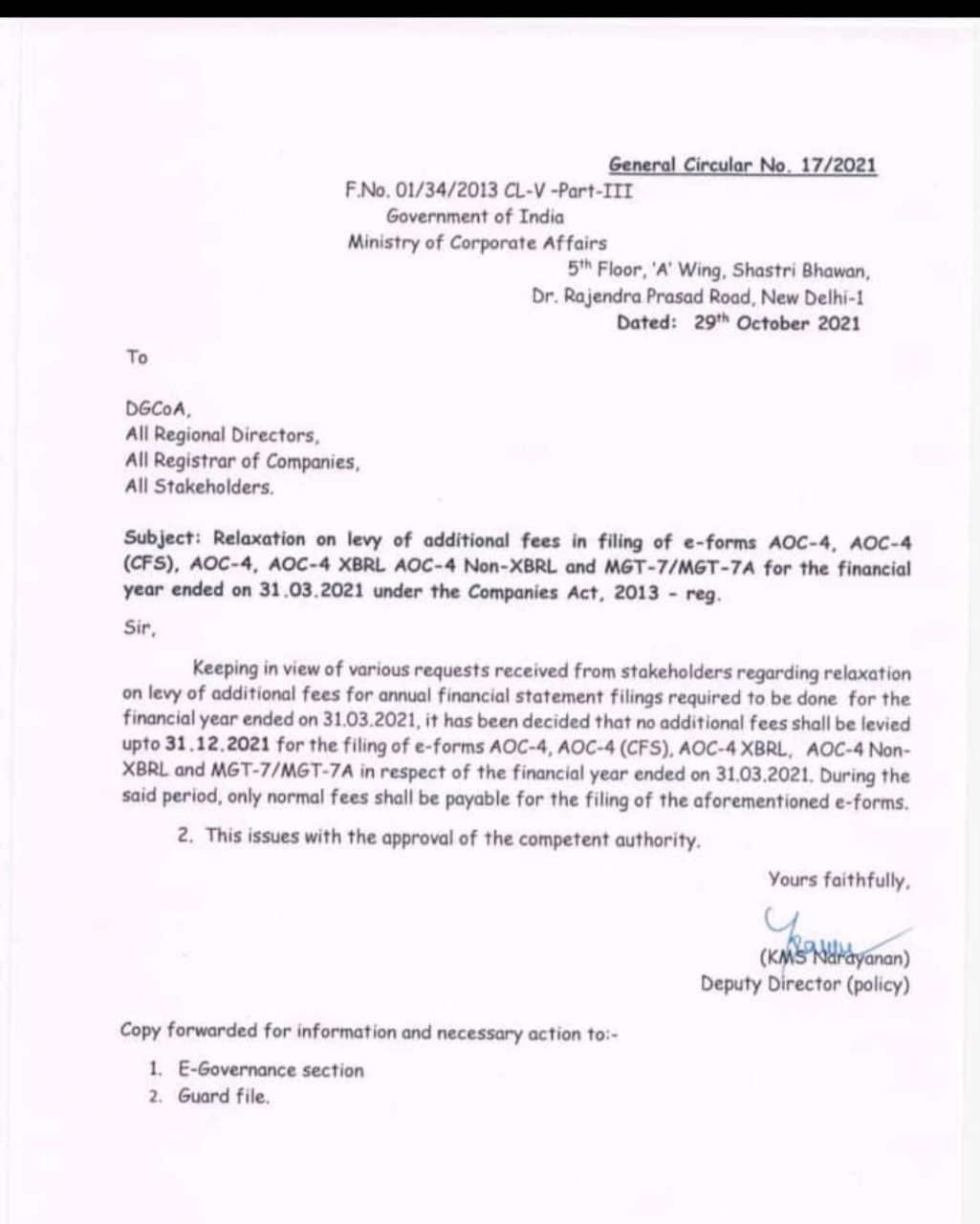

Please find the link- AOC-4, AOC-4(CFS), AOC-4 XBRL, AOC-4 Non-XBRL and MGT-7/MGT-7A

RELAXATION NO LEVY OF ADDITION FEES .