FAQ on One Person Company (OPC)

Page Contents

FAQ on One Person Company(OPC)

Q1- is it mandatory for holding a meeting for one person company is f there is only one director?

No, it is not mandatory for holding a meeting for one person company if there is only one director.

Q2- what is the time limit for filing the annual return for the person’s company?

Annual return is filed by one person company before 30th September of the financial year.

Q3- is it compulsory to add a cash flow statement in the financial statements of one person company?

No, there is no need to file a cash flow statement in the financial statement of one person company.

Q4- Is One Person Company (OPC) preferred for small business?

- Yes, One Person Company (hereinafter referred to as OPC) is preferred for small business.

- The concept of OPC is basically to eradicate the limitation of sole proprietorship, which is actually the most popular form for small businesses, such as unlimited liability, no legal form etc.

In case, you are registered as OPC and if your

- Paid-up share capital exceeds 50 lakhs or;

- Average annual turnover exceeds 2 crores

Then it has to convert itself within 6 months from the date on which any of the above conditions is fulfilled. This requirement is as per rule 6 of Companies (incorporation) Rules, 2014.

The Ministry of Corporate Affairs notified the modifications to the one-person company’s, as released in Budget 2021. As regards the provisions introduced: 1. Thresholds of paid-up capital exceeding INR 50,00,000/- or turnover exceeding Rs 2 crores for mandatory transformation/conversation to non-one person company Public/Private Company shall be withdrawn.

- Form INC-6 can now be used for both – conversion from Private/Public to one person company or one person company to Private/Public.

- For transformation/conversation from a non-one person company (OPC) to one person company, the limits of paid-up capital INR 50,00,000/- or less and the turnover of INR 2 Cr or less are removed. Regardless of capital/turnover, a non- one-person company can transform itself into a one-person company.

- Indian Govt has changed the Companies (Incorporation) Rules, 2014 which shall come into force on the 1st day of April 2021 & it can be called the Companies (Incorporation) Second Amendment Rules, 2021. In the Current Amendment Now, Non-Resident Indians is also permitted to registered One Person Company in India. (a) shall be eligible to incorporate an OPC;

- One Person Company can be transformed into any kind of company at any time without any limit of paid-up capital and turnover with effect from 1 April 2021.

- OPC means a company incorporated with only 1 person as a member, unlike the traditional manner of having at least 2 members to form a company.

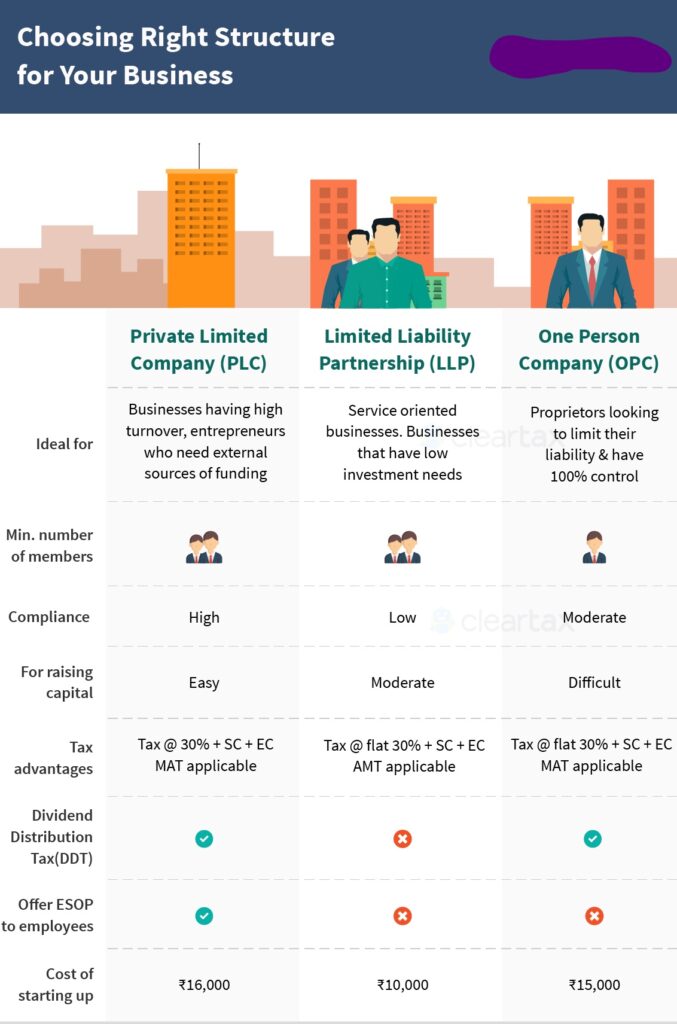

Q5- Why prefer one-person company (OPC) over other forms of companies?

The answer is simple; only one person is required in OPC. You don’t need another person. If you are independently want to commence your business without involving any other person then One Person Company (OPC) is the idle choice for you.

When the OPC concept wasn’t introduced in India, the above categories of people usually choose Proprietorship as their form of business. The proprietorship has many disadvantages like

- Cannot take investments

- No legal existence

- Unlimited liabilities

And many others as well. Further proprietorship as a form of business also not considered trustworthy. One Person Company (OPC) is a solution for all the above problems. Therefore, to make the above category of businesses more organised, OPC was introduced.

“Therefore, start-ups should use OPC as their form of business to make your business more organised and more valuable”.

Read More about : LLP Incorporation and Annual Compliances

Q6. Why Funding is it not a problem for One Person Company (OPC)?

Yes, it is true. Funding is not a problem for One Person Company (OPC) subject to if you have a good business idea and business plan.

Reserve Bank of India (RBI) has instructed banks to increase the funding made to priority sectors, viz agriculture and small-scale industries. Eligible priority sector lending:-

| Manufacturing Sector | |

| Enterprises | Investment in Plant & Machinery |

| Micro Enterprises | Do not exceed 25 lakhs rupees |

| Small Enterprises | More than 25 Lakhs but does not exceed 5 crores |

| Service Sector | |

| Enterprises | Investment in Plant & Machinery |

| Micro Enterprises | Do not exceed 10 lakhs rupees |

| Small Enterprises | More than 10 Lakhs but does not exceed 2 crores |

One Person Company coming under any of the above category may fall under priority sector lending. There is enormous scope for One Person Companies to leverage the benefits of priority sector lending.

Further, there are some additional benefits:-

- No ownership is transferred to the bank.

- Bank also lends without security up to a certain limit, subject to strong business plan and projections.

- In case of any default, the liability is limited only up to the share value in the company.

Therefore don’t worry about the funds, just concentrate on your core business idea & evolve it into a business plan, incorporate a One Person Company (OPC) with Carajput.com and start your business today!

Q7- Is it true that Public Limited Companies is valued higher than other forms of companies?

Yes, Public limited Companies are valued higher than every form of business. As per the statistics published by U.S. Chamber of commerce and Entrepreneur.com, private companies are valued at only four to six times, while public companies are typically valued at multiples greater than twenty times earnings.

There are many reasons for it, namely

- Market liquidity

- Risk Profile

- Capitalisation/capital structure

- Trust

- Operational reasons

The obvious result is an immediate and substantial increase in the net worth of its founders and shareholders.

Many companies that are about to be purchased, strategically converting themselves into the public company to be purchased at a much higher price.

Popular Blog:-