CBDT Notifies ITR Forms 1-6 for AY 2024-25 in advance

Page Contents

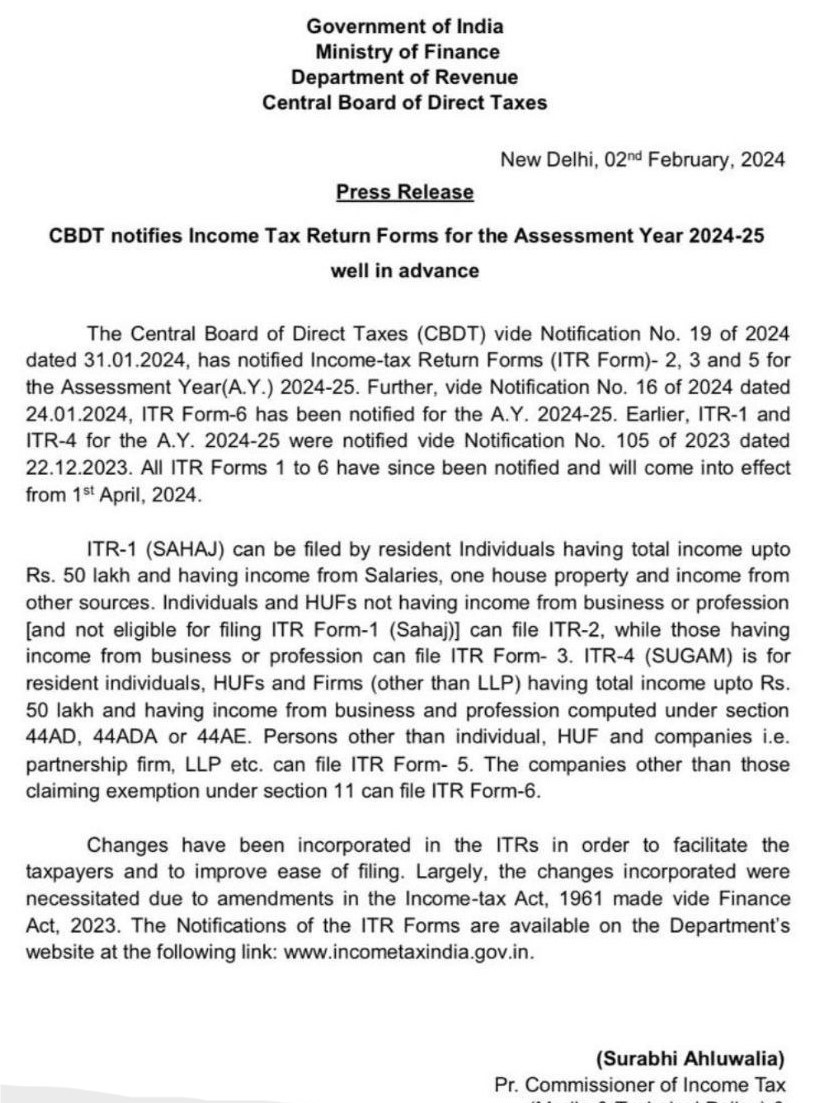

CBDT Notifies ITR Forms 1-6 for AY 2024-25 in advance, to facilitate taxpayers & improve ease of filing

CBDT Notified income tax return forms 1-6 for AY 2024-2025 well in advance is a significant step towards facilitating taxpayers and enhancing the ease of filing. Providing taxpayers with timely access to these forms enables them to prepare and submit their returns with greater efficiency and accuracy. It also reflects the Central Board of Direct Taxes’s commitment to simplifying the tax filing process and improving overall taxpayer experience. Such proactive measures contribute to promoting compliance and ensuring a smoother tax administration system.

- The early notification of income tax return forms by the CBDT for AY 2024-2025 demonstrates a commitment to streamlining the tax filing process and providing taxpayers with ample time to prepare and submit their returns.

- This proactive approach contributes to enhancing the ease of income tax filing and promotes compliance among taxpayers. It also allows individuals and businesses to plan their financial affairs more effectively. Such initiatives are crucial for promoting transparency and efficiency in the taxation system.

- The Central Board of Direct Taxes notifies Income tax return Forms 1-6 for AY 2024-2025, well in advance, to facilitate income tax taxpayers & improve ease of Income tax filing!

👉ITR Forms – 2, 3 and 5 were notified vide Notification No. 19/2024 dtd 31.01.2024.

- Specific Income Tax Return Forms 2, 3, and 5 have been notified via Notification No. 19/2024 dated 31.01.2024. This information will be helpful for taxpayers to identify which form they need to use based on their income sources and other relevant factors. Early notification of these forms allows taxpayers to familiarize themselves with the requirements and ensures a smoother filing process.

👉ITR Form-6 was notified vide Notification No. 16/2024 dtd 24.01.2024.

- Income Tax Return Form-6 was notified via Notification No. 16/2024 dated 24.01.2024. This Notification No. 16/2024 provides taxpayers with specific guidance on which form to use for their tax filing needs, depending on their individual circumstances. Early notification of the forms ensures that taxpayers have adequate time to prepare and submit their returns, contributing to a smoother and more efficient tax filing process overall.

👉ITR Forms-1 & 4 were notified earlier vide Notification No.105/2023 dtd 22.12.2023.

- Income Tax Return Forms 1 and 4 were notified earlier via Notification No. 105/2023 dated 22.12.2023. This notification No. 105/2023 ensures that taxpayers are informed well in advance about the forms applicable to them for filing their ITR. Having these forms notified in advance allows taxpayers to plan and prepare their documentation, accordingly, contributing to a smoother and more organized tax filing process.

👉In effect, all ITR Forms 1-6 have been notified and will come into effect from 1st April, 2024.

- All ITR Forms 1-6 have been notified and will come into effect from 1st April, 2024. This early notification provides taxpayers with ample time to familiarize themselves with the forms and gather the necessary information for filing their income tax returns for the Assessment Year 2024-2025. Having all the forms in place well before the start of the assessment year ensures a smoother and more efficient tax filing process for taxpayers.

👉Changes incorporated were necessitated due to amendments in the Income-tax Act, 1961 made vide Finance Act, 2023.

- The changes incorporated in the notified ITR Forms were necessitated due to amendments in the Income-tax Act, 1961, made via the Finance Act, 2023. These amendments likely include updates to tax laws, provisions, exemptions, deductions, and other relevant aspects that impact the computation and reporting of taxable income. Ensuring that the ITR Forms reflect these legislative changes enables taxpayers to accurately report their income and fulfill their tax obligations in compliance with the updated legal framework.

More read for related blogs are:

- All about the Income taxation on capital gain

- Provision-of-capital-gains-charts

- Govt needed to introduce changes in NSP Budget 2021

- All about the Income taxation on capital gain

- Deduction u/s 80CCD of Income Tax Act, 1961

- All about the Income taxation on capital gain

- Delay in the deposit of Employer provident fund during the lockdown

- Aware of the penalty of Section-234f for late filing of ITR

For query or help, contact: singh@carajput.com or call at 9555555480